Bearish potential detected for XYZEntry conditions:

(i) lower share price for ASX:XYZ along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $111.02 (open of 24th February).

Depending on risk tolerance, the stop loss for the trade would be:

(i) above t

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.80 USD

2.90 B USD

24.12 B USD

531.05 M

About Block, Inc.

Sector

CEO

Jack Patrick Dorsey

Website

Headquarters

Oakland

Founded

2021

ISIN

US8522341036

FIGI

BBG0018SLC07

Block, Inc. engages in creating ecosystems for distinct customer audiences. It operates through the Square and Cash App segments. The Square segment provides payment services, software solutions, hardware, and financial services to sellers. The Cash App segment includes the financial tools available to individuals within the mobile Cash App, including peer-to-peer payments, bitcoin and stock investments. It also includes Cash App Card, which is linked to customer stored balances that customers can use to pay for purchases or withdraw funds from an ATM. The company was founded by Jack Patrick Dorsey and James Morgan McKelvey in February 2009 and is headquartered in Oakland, CA.

Related stocks

Bullish trendline keeps beeing rock solid 📈 We can clearly see a bullish trendline confirming the trend since mid-May.

✅ The trendline has been tested and confirmed on multiple occasions, especially over the last two weeks.

🔥 The candles that broke through ended up attracting a huge amount of buyers, turning them into extremely bullish ca

XYZ Bullish Setup: Pending Entry & Target Strategy!📌 Asset & Plan

XYZ (Block, Inc.) NYSE | Swing/Day Trade

Plan: Bullish 💹 (Pending Order Setup)

Breakout Entry: Near $83.00 ⚡ (Set alerts to catch the breakout!)

🧩 Thief-Style Layer Strategy

Multiple limit layer entries after breakout: $82.00 / $80.00 / $78.00

Scale your positions according to your r

Block Inc XYZ is a buy for meThe stock decline appears to stem from a combination of recent earnings results, slightly softened guidance, and general fintech sector caution.

Investor sentiment toward fintech remains cautious. Other POS and payments firms, even when posting decent earnings, have seen significant stock swings du

Stock Of The Day / 08.08.25 / XYZ08.08.2025 / NYSE:XYZ

Fundamentals. The earnings report did not meet expectations.

Technical analysis.

Daily chart: Uptrend. Local maximum 82.18 ahead.

After-hours/Premarket: Gap Up on increased volume. At the same time, the price was unable to update the after-hours high. We mark the af

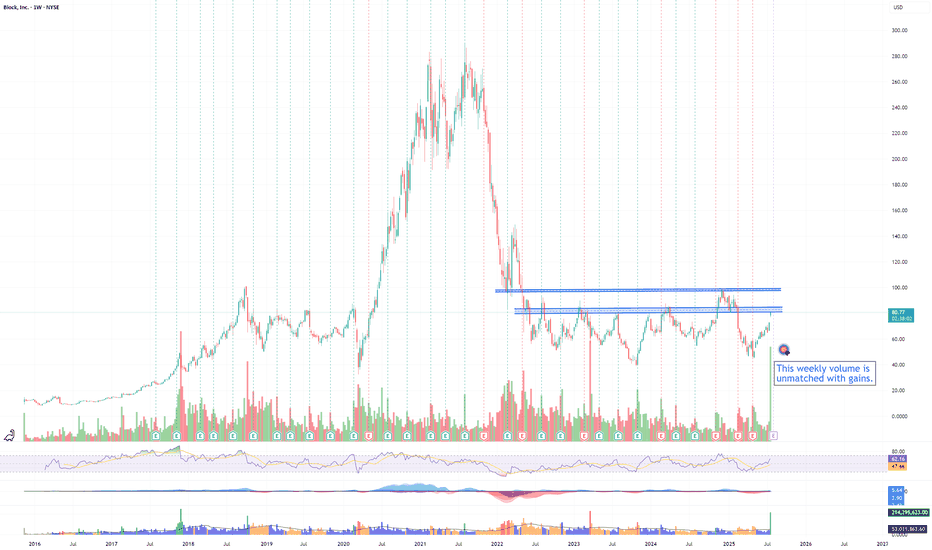

XYZ momentum is buildingXYZ positive weekly volume this week is a first in its history! Even though it has never had this much 'green' volume in its weekly history, there is plenty of resistance to be overcome for this stock

$81-85 will be challenging as sellers all the way from 2022 will begin dumping shares, especially

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SQ6150163

Block, Inc. 6.0% 15-AUG-2033Yield to maturity

5.38%

Maturity date

Aug 15, 2033

SQ6150161

Block, Inc. 5.625% 15-AUG-2030Yield to maturity

5.15%

Maturity date

Aug 15, 2030

SQ5449301

Block, Inc. 2.75% 01-JUN-2026Yield to maturity

4.93%

Maturity date

Jun 1, 2026

SQ5449300

Block, Inc. 3.5% 01-JUN-2031Yield to maturity

4.88%

Maturity date

Jun 1, 2031

SQ5307444

Block, Inc. 0.0% 01-MAY-2026Yield to maturity

—

Maturity date

May 1, 2026

SQ5307445

Block, Inc. 0.25% 01-NOV-2027Yield to maturity

—

Maturity date

Nov 1, 2027

See all XYZ bonds

Frequently Asked Questions

The current price of XYZ is 76.49 USD — it has decreased by −0.07% in the past 24 hours. Watch Block, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Block, Inc. stocks are traded under the ticker XYZ.

XYZ stock has risen by 0.80% compared to the previous week, the month change is a −2.42% fall, over the last year Block, Inc. has showed a 11.75% increase.

We've gathered analysts' opinions on Block, Inc. future price: according to them, XYZ price has a max estimate of 105.00 USD and a min estimate of 58.00 USD. Watch XYZ chart and read a more detailed Block, Inc. stock forecast: see what analysts think of Block, Inc. and suggest that you do with its stocks.

XYZ stock is 3.18% volatile and has beta coefficient of 1.37. Track Block, Inc. stock price on the chart and check out the list of the most volatile stocks — is Block, Inc. there?

Today Block, Inc. has the market capitalization of 46.66 B, it has increased by 1.99% over the last week.

Yes, you can track Block, Inc. financials in yearly and quarterly reports right on TradingView.

Block, Inc. is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

XYZ earnings for the last quarter are 0.62 USD per share, whereas the estimation was 0.63 USD resulting in a −1.11% surprise. The estimated earnings for the next quarter are 0.64 USD per share. See more details about Block, Inc. earnings.

Block, Inc. revenue for the last quarter amounts to 6.05 B USD, despite the estimated figure of 6.30 B USD. In the next quarter, revenue is expected to reach 6.33 B USD.

XYZ net income for the last quarter is 538.46 M USD, while the quarter before that showed 189.87 M USD of net income which accounts for 183.59% change. Track more Block, Inc. financial stats to get the full picture.

No, XYZ doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 25, 2025, the company has 11.37 K employees. See our rating of the largest employees — is Block, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Block, Inc. EBITDA is 2.62 B USD, and current EBITDA margin is 10.01%. See more stats in Block, Inc. financial statements.

Like other stocks, XYZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Block, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Block, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Block, Inc. stock shows the neutral signal. See more of Block, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.