This is a fun chart that I actually made into an NFT on the Enjin chain. The idea is simple. As you can see, ENJ is trapped in a certain zone. The future direction depends on where it breaks off towards. If ENJ breaks above the descending curve, then my prediction is at least 16k Satoshi by August 2022. It could take one of two paths up there. On the other hand,...

Decred is currently in a downtrend, made clear by the recent failure to breach and stay above the .065 BTC resistance line in early November 2018. We are currently completing the right shoulder shown in the chart down to the support zone of mid 2016 and early 2017 of 0.0030 BTC to 0.0036 BTC. That is my first target. From there on, I expect a reversal that...

Today, I analyze the BINANCE:ADABTC Weekly chart, Logarithmic scale. Observe where price is sitting at the time of writing. It is sitting at the crossing of two trendlines and the 0.5 Fibonacci line. This conjunction may serve as a good support for price, meaning that price would not go below 1500 Satoshi ever again. However, that's the extent of bullish factors...

BITFINEX:WAXBTC is in a descending triangle as seen in the chart. Breaking the triangle downward will take us back to the year-long support at 540 Satoshis, a 42% drop.

There are 81 Russian Rubles in one USD today. This is not the first time the RUB has devalued this much against the Dollar. We have an ascending triangle in the FOREXCOM:USDRUB chart that has spanned six years of price action. Once that triangle breaks upwards, we have a price target of 135. Let us keep watching this triangle to see if it will indeed break...

BINANCE:ALGOBTC has found support on the 0.5 Fib line and a rising trend line on the logarithmic scale. In this chart, I argue why these two signals are not strong enough and conclude that we should wait longer for a trade setup to emerge. You can follow this chart here . I hope you learn something from this video and if you like it, then please leave a like....

The SPROTT Physical Uranium Trust TSX:U.U is showing a triangle formation on the daily chart. There is a number of reasons why I am inclined towards higher Uranium prices: 1. Rising inflation. 2. Rising commodity prices. 3. Supply chain problems (although doesn't apply to Uranium that much). 4. Energy Crisis! 5. The world starting to see that Nuclear energy...

LiteCoin ( BINANCE:LTCBTC ) is at or slightly below its all-time-low, sitting at a historical support line at 3000 Satoshi. The great thing about this is we're seeing a consistent RSI divergence that has been playing ever since the first time it hit 3000 Satoshi in Feb/March 2017. Every new bottom since then has has higher RSI low. Most importantly, the latest and...

Gold ( OANDA:XAUUSD ) is forming an immature cup and handle on the monthly with a price target of $2600. On the weekly, we see it has broken above this triangle as you see in the chart below. That move is not confirmed yet either, but if next week, gold trades above this week's close, then we set a price target of $2060 and set a stop loss below the recent...

BINANCE:LINKBTC has lost the gains it has made on the first half of January. We are now retesting the 4-year long trendline that has held as strong support after reversing off of the 0.236 Fib line above. We did anticipate such a move in preparation for higher highs. However, we haven't yet gotten confirmation that LINK will not break below the strong support....

BINANCE:FTMBTC is one of the most beautiful charts I've seen in a while. Fantom is a smart contracts network that has grown about 100x in the past year. In this video, we analyse the charts and give our future outlook. You can view this chart here . If you like this video, then please leave a like. If you would like to see more, then please follow me. Thank you.

BINANCE:FLUXUSDT is another hype crypto that is probably another scam. Regardless, the chart shows a technical setup that can return 28% once confirmed by breaking above the ascending triangle reaching a target of $2.168. At the same time, we see a unique RSI pattern. There are three lows in price aligning with three lows in RSI which I have marked with vertical...

BINANCE:FLUXBTC has broken above a long descending trend line on the hourly. Watch the video for the details of this easy trade. We are awaiting confirmation. The trade is not on yet. So keep watching this idea by giving me a follow. Also see my previous idea on Flux in Related Ideas below. You can view this chart here .

TSX:U.U is showing an ascending triangle on the hourly that spans the past eight trading days. This is a simple trade with the stop loss below the swing low and the target at the height of the triangle. Gives us a 6.83% potential profit to 3.1% potential loss, a reward-risk ratio of 2.22. Of course that depends on whether the triangle breaks upwards in the first...

NYSE:PLTR was in a rising wedge before it made the recent 43% drop. Now, on the weekly, it appears to be forming a falling wedge . What this means is that we see at least one lower low, before we can break the top of the falling wedge , and eventually reach all time high. Currently, the falling wedge is not confirmed because we have only two touches on its bottom...

If you look at the S&P500 index ( TVC:SPX ) chart, you find that it has reached, and even surpassed, the previous high at 3393.5 which occurred just before the CV19 drop in March 2020. The last close on 31 December 2020 was at 3760. However, many attribute the recent V-shaped recovery to the Quantitative Easing scheme by the Federal Reserve, which makes a lot of...

In this stream, I revisit the trades I set up in the previous weeks on DOGE, LINK, ETH, and other crypto as well as stocks. The markets are crazy and volatile. Let's take a look.

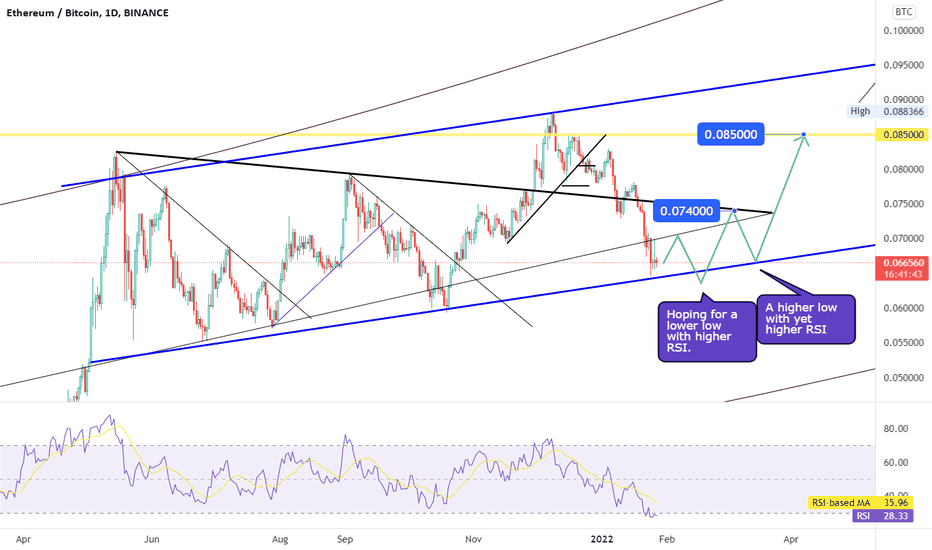

BINANCE:ETHBTC is one of my favorite charts. I made the prediction during 2021 that we would go from 0.030 BTC to 0.085 and we did (See related idea below). Now, we are at 0.066 BTC and nearing a significant support line. The line is not very well-defined, so I expect price to hover around it for a while. What I would like to see is dipping below the line while...