Hello Traders Investors And Community,

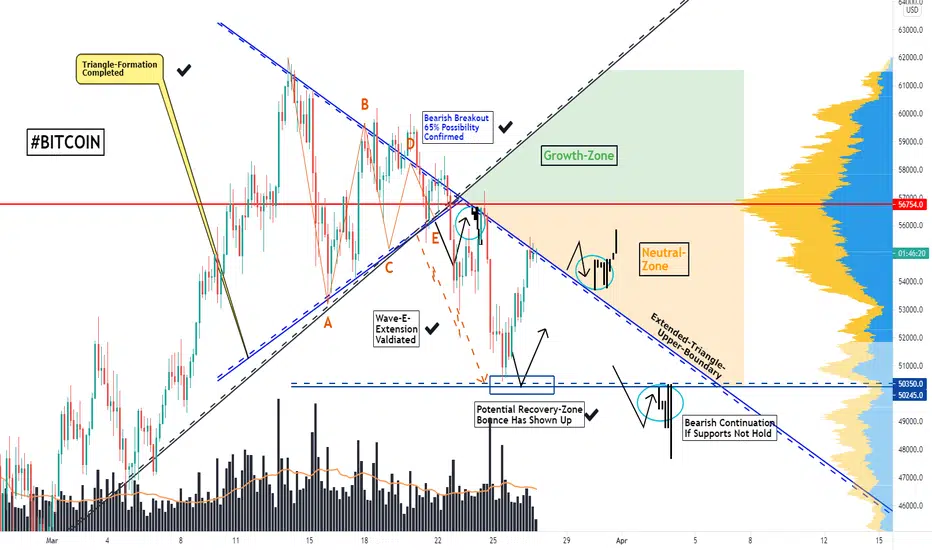

Welcome to this analysis about Bitcoin, we are looking at the 4-hour timeframe perspective, the recent events, the established formational structure, and what we can expect in the upcoming times. Since the former analysis Bitcoin has developed the more likely bearish triangle-breakout to the downside, has shown up with the wave-E-extension since then, and reached the downside-targets with the potential recovery-zone from where Bitcoin managed to bounce initially to the upside, if you did not see this analysis already I highly recommend it to watch to have a full-depth-overview, now since these events, I discovered the further signs Bitcoin developed and where the journey will move, important is now to look for the proper confirmations.

Structural Developments:

As when looking at my chart now we can watch there how Bitcoin just bounced from the potential recovery-zone bullishly to the upside confirming it as support, now Bitcoin moved on and what is meaningful now is that Bitcoin is testing this extended-upper-boundary of the previously established triangle-formation marked in blue. Currently, Bitcoin is about to test this resistance-line and the next time it will be important to elevate on if Bitcoin manages to move above this resistance right away or it firstly reverses and tests lower levels in the structure, when this happens it can also indicate the further bearish pressure to continue.

Upcoming Determinations:

Taking all these factors into consideration Bitcoin is trading in a situation in which it needs to decide how it continues its way further in the next times, when Bitcoin then manages to break out above this main descending-resistance-line it can initially lie the ground for further continuations. The main resistance than will be the point-of-control of the volume-profile that Bitcoin needs to test and it is more likely that a pullback shows up firstly. Otherwise, when Bitcoin does not move above the descending-resistance-line it will test lower levels, it has to be elevated then if Bitcoin manages to hold these levels or the bearish pressure increases, when this happens Bitcoin can also continue bearishly firstly, these are the scenarios important to assess next times.

Thank you everybody for watching the analysis, great contentment for everybody supporting, have a good day and good trading, all the best!

"There are many roads to prosperity, but one must be taken."

Information provided is only educational and should not be used to take action in the market.

Welcome to this analysis about Bitcoin, we are looking at the 4-hour timeframe perspective, the recent events, the established formational structure, and what we can expect in the upcoming times. Since the former analysis Bitcoin has developed the more likely bearish triangle-breakout to the downside, has shown up with the wave-E-extension since then, and reached the downside-targets with the potential recovery-zone from where Bitcoin managed to bounce initially to the upside, if you did not see this analysis already I highly recommend it to watch to have a full-depth-overview, now since these events, I discovered the further signs Bitcoin developed and where the journey will move, important is now to look for the proper confirmations.

Structural Developments:

As when looking at my chart now we can watch there how Bitcoin just bounced from the potential recovery-zone bullishly to the upside confirming it as support, now Bitcoin moved on and what is meaningful now is that Bitcoin is testing this extended-upper-boundary of the previously established triangle-formation marked in blue. Currently, Bitcoin is about to test this resistance-line and the next time it will be important to elevate on if Bitcoin manages to move above this resistance right away or it firstly reverses and tests lower levels in the structure, when this happens it can also indicate the further bearish pressure to continue.

Upcoming Determinations:

Taking all these factors into consideration Bitcoin is trading in a situation in which it needs to decide how it continues its way further in the next times, when Bitcoin then manages to break out above this main descending-resistance-line it can initially lie the ground for further continuations. The main resistance than will be the point-of-control of the volume-profile that Bitcoin needs to test and it is more likely that a pullback shows up firstly. Otherwise, when Bitcoin does not move above the descending-resistance-line it will test lower levels, it has to be elevated then if Bitcoin manages to hold these levels or the bearish pressure increases, when this happens Bitcoin can also continue bearishly firstly, these are the scenarios important to assess next times.

Thank you everybody for watching the analysis, great contentment for everybody supporting, have a good day and good trading, all the best!

"There are many roads to prosperity, but one must be taken."

Information provided is only educational and should not be used to take action in the market.

►✅JOIN THE BEST+ TOP TELEGRAM TRADING CHANNEL: t.me/VincePrinceForexGoldStocks

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

►✅JOIN THE BEST+ TOP TELEGRAM TRADING CHANNEL: t.me/VincePrinceForexGoldStocks

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

►🚀Write To Join the Elite VIP Signal Channels: @Vince_Prince

►🔥JOIN BYBIT TOP EXCHANGE►🎁 UP TO $30,000 BONUS NOW: partner.bybit.com/b/VinceByBit

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.