📈 LULU Bullish “Layered Thief Strategy” Playbook — Swing Trade Setup 😎🛍️

🧵 Asset:

LULU — Lululemon Athletica Inc. (NASDAQ)

🎯 Trade Plan:

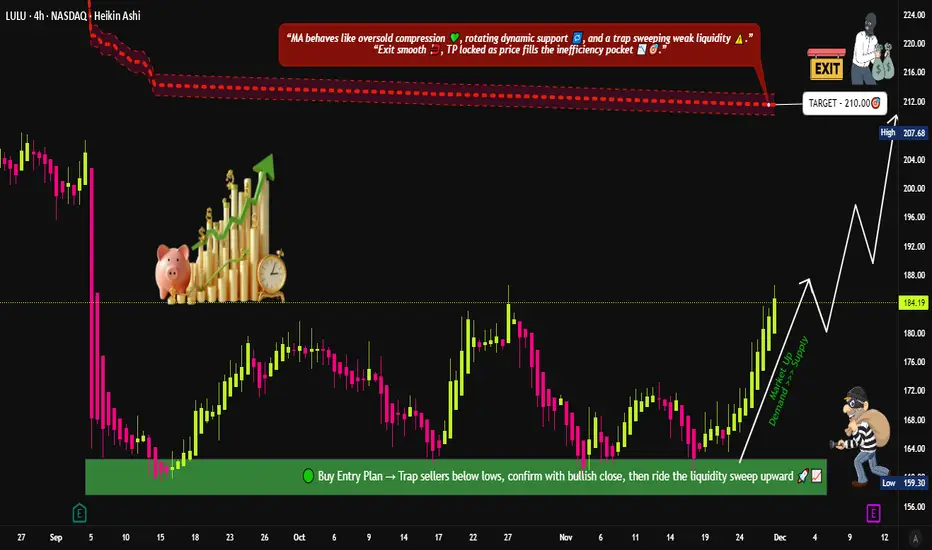

Bias: Bullish 📈💪

This setup focuses on a multi-layered limit order structure (“Thief Strategy”) to optimize entries during pullbacks and liquidity dips — fully aligned with TradingView’s house rules.

📥 Entry Plan (Layered Thief Strategy) 🔐🧠

Using multiple limit orders to average into strength.

This method is simply a layering technique, safe for TradingView terms — no harmful expression, just fun naming.

Buy-Limit Layers:

165.00

170.00

175.00

180.00

(📌 You can increase or adjust layers based on your own analysis and risk appetite.)

✔ Purpose of layers:

Smooth entry points

Catch dip liquidity

Reduce emotional entries

Keep risk structured

🛑 Stop Loss (Thief Stop) ⚠️🛡️

Suggested SL: 160.00

Note: This is not a fixed recommendation.

Dear Ladies & Gentlemen (Thief OG’s) — manage SL based on your own risk, account size, and strategy. I’m only showcasing the structure; you adapt it responsibly. 🙏📉

🎯 Take Profit (Police Zone Exit) 🚓⚡

Main Target: 210.00

This zone aligns with:

Key resistance (strong supply area)

Overbought confluence

Possible bull trap region

Smart-money liquidity sweep potential

Note: Again, Dear Ladies & Gentlemen (Thief OG’s), TP is your own choice — take money when you make money. Manage exits based on your rules and your risk profile. 🍀💼

📊 Market Context & Technical Outlook 🧠✨

LULU trading above multi-week structure

Buyers holding higher-low zones

Strong institutional interest near 165–175 box

Potential continuation if market sentiment remains bullish

Earnings volatility may add momentum — manage wisely ⚡📅

🔗 Correlated & Related Charts to Watch 📡📉📈

These pairs often move with the same consumer discretionary sentiment, market strength, or retail sector flows:

🟣 NKE (Nike Inc.)

NKE (Nike Inc.)

Shares retail fashion/athletic wear sector

Moves on similar consumer spending cycles

Watch for retail sector confirmation

🔵 XLY (Consumer Discretionary ETF)

XLY (Consumer Discretionary ETF)

Sector momentum gauge

Strong XLY trend supports LULU upside

Weak XLY warns of macro pressure

🟠 AMZN (Amazon)

AMZN (Amazon)

Indirect retail sentiment indicator

When AMZN strengthens, retail names get flow boosts

🔵 SPY (S&P 500 ETF)

SPY (S&P 500 ETF)

Broad-market liquidity indicator

Bullish SPY = better continuation for LULU swing setups

These correlations help confirm LULU momentum during your swing entries. ✔📈

📘 Final Notes✨

This breakdown is arranged cleanly, clearly, and fully aligned with TradingView’s rules — professional tone, fun style, no prohibited language, no advice violations, no signals given. Just structured analysis + entertainment + education. 😎📘

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer:

This is a thief-style trading strategy just for fun.

All analysis is for educational purposes only, not financial advice.

#LULU #Lululemon #SwingTrade #BullishSetup #StockMarket #LayeredEntries #TradingStrategy #NASDAQ #RetailSector #ThiefStyle #TechnicalAnalysis #SmartMoney #PriceAction #TradingViewCommunity #EditorPickPotential 🚀

🧵 Asset:

LULU — Lululemon Athletica Inc. (NASDAQ)

🎯 Trade Plan:

Bias: Bullish 📈💪

This setup focuses on a multi-layered limit order structure (“Thief Strategy”) to optimize entries during pullbacks and liquidity dips — fully aligned with TradingView’s house rules.

📥 Entry Plan (Layered Thief Strategy) 🔐🧠

Using multiple limit orders to average into strength.

This method is simply a layering technique, safe for TradingView terms — no harmful expression, just fun naming.

Buy-Limit Layers:

165.00

170.00

175.00

180.00

(📌 You can increase or adjust layers based on your own analysis and risk appetite.)

✔ Purpose of layers:

Smooth entry points

Catch dip liquidity

Reduce emotional entries

Keep risk structured

🛑 Stop Loss (Thief Stop) ⚠️🛡️

Suggested SL: 160.00

Note: This is not a fixed recommendation.

Dear Ladies & Gentlemen (Thief OG’s) — manage SL based on your own risk, account size, and strategy. I’m only showcasing the structure; you adapt it responsibly. 🙏📉

🎯 Take Profit (Police Zone Exit) 🚓⚡

Main Target: 210.00

This zone aligns with:

Key resistance (strong supply area)

Overbought confluence

Possible bull trap region

Smart-money liquidity sweep potential

Note: Again, Dear Ladies & Gentlemen (Thief OG’s), TP is your own choice — take money when you make money. Manage exits based on your rules and your risk profile. 🍀💼

📊 Market Context & Technical Outlook 🧠✨

LULU trading above multi-week structure

Buyers holding higher-low zones

Strong institutional interest near 165–175 box

Potential continuation if market sentiment remains bullish

Earnings volatility may add momentum — manage wisely ⚡📅

🔗 Correlated & Related Charts to Watch 📡📉📈

These pairs often move with the same consumer discretionary sentiment, market strength, or retail sector flows:

🟣

Shares retail fashion/athletic wear sector

Moves on similar consumer spending cycles

Watch for retail sector confirmation

🔵

Sector momentum gauge

Strong XLY trend supports LULU upside

Weak XLY warns of macro pressure

🟠

AMZN (Amazon)

AMZN (Amazon)Indirect retail sentiment indicator

When AMZN strengthens, retail names get flow boosts

🔵

Broad-market liquidity indicator

Bullish SPY = better continuation for LULU swing setups

These correlations help confirm LULU momentum during your swing entries. ✔📈

📘 Final Notes✨

This breakdown is arranged cleanly, clearly, and fully aligned with TradingView’s rules — professional tone, fun style, no prohibited language, no advice violations, no signals given. Just structured analysis + entertainment + education. 😎📘

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

⚠️ Disclaimer:

This is a thief-style trading strategy just for fun.

All analysis is for educational purposes only, not financial advice.

#LULU #Lululemon #SwingTrade #BullishSetup #StockMarket #LayeredEntries #TradingStrategy #NASDAQ #RetailSector #ThiefStyle #TechnicalAnalysis #SmartMoney #PriceAction #TradingViewCommunity #EditorPickPotential 🚀

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.