⚡ THIEF STRATEGY ALERT: Golden Cross Breakout Setup

📈 TRADE PLAN OVERVIEW

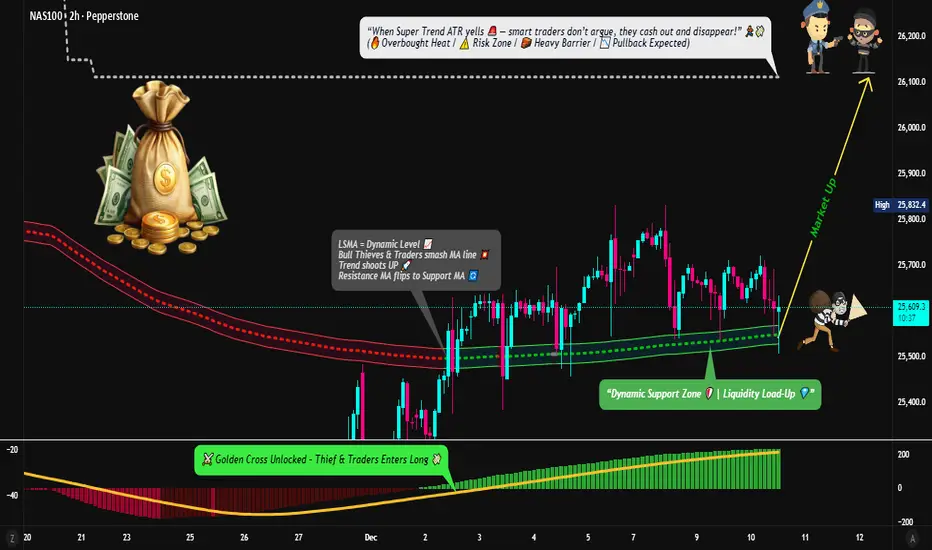

Asset: NAS100 (NASDAQ 100 Index)

Timeframe: Day/Swing Trade

Market Bias: 🟢 BULLISH (Moving Average Breakout + MACD Golden Cross Confirmed)

Strategy Type: Layered Entry Approach (Multi-Level Limit Orders)

🎯 ENTRY STRATEGY - "THIEF LAYERING METHOD"

Multiple Limit Order Entry Points (Build Position Gradually):

📍 Layer 1: 25,400 (First Entry)

📍 Layer 2: 25,500 (Second Entry)

📍 Layer 3: 25,600 (Third Entry)

💡 Pro Tip: Adjust layer levels based on your capital allocation & risk tolerance. This pyramiding approach reduces average entry cost and limits downside risk.

Why This Method? The layered entry reduces emotional trading, averages down your entry price, and ensures you're not all-in on one level.

🛑 STOP LOSS - "THIEF OG PROTECTION"

Suggested SL Level: 25,200

⚠️ IMPORTANT DISCLAIMER: This is a reference level only. Adjust your stop loss based on:

Your personal risk tolerance

Account size & position sizing

Technical support levels on your timeframe

🔴 Remember: Risk management is YOUR responsibility. Set stops that protect YOUR capital.

🎁 PROFIT TARGET - "POLICE BARRICADE RESISTANCE"

Primary Target: 26,100

📊 Technical Confluence:

SUPERTREND ATR Line = Strong Dynamic Resistance

Overbought Zone Alert = Potential Reversal Risk

Resistance Trap = Take profits before reversal occurs

⚠️ CRITICAL NOTE: Partial profit-taking recommended. Don't be greedy at target levels—accumulate gains gradually:

🟢 Take 30-40% profit at 26,100

🟢 Move SL to breakeven, trail remaining position

🟢 Exit second half on additional resistance or SUPERTREND reversal

💰 YOUR DECISION: Profit targets are YOUR choice. Trade at your own risk and manage your exit strategy.

🔗 CORRELATED PAIRS TO WATCH (Risk/Opportunity Indicators)

1. SPY (S&P 500 ETF) - USD Strong Correlation (0.95)

Key Point: Leads or confirms NAS100 moves

Watch For: If SPY breaks below key support, NAS100 pullback likely

Action: Use SPY strength to confirm NASDAQ100 breakout validity

2. QQQ (NASDAQ 100 ETF) - Perfect Mirror (1.0 Correlation)

Key Point: Direct tracker of your asset

Watch For: Volume spikes, divergence patterns

Action: Cross-reference QQQ volume with NAS100—lack of volume = weak breakout

3. DXY (US Dollar Index) - Inverse Correlation (-0.75)

Key Point: Strong dollar = tech selloff risk

Watch For: DXY rejection at key levels

Action: If DXY rallies hard, NAS100 bullish bias weakens—be cautious

4. TLT (20-Year Treasury ETF) - Indirect Inverse (-0.60)

Key Point: Rising rates pressure growth stocks (NASDAQ)

Watch For: TLT breakdown = rate hike concerns = tech pressure

Action: Monitor TLT support; if breaks, expect NAS100 resistance

5. GLD (Gold ETF) - Risk-On Indicator (0.40)

Key Point: Flight-to-safety alternative

Watch For: Sharp gold strength = risk-off environment forming

Action: Gold spike with NAS100 move down = sell signal confirmation

6. VIX (Volatility Index) - Fear Gauge (-0.80)

Key Point: Rising VIX kills bullish momentum

Watch For: VIX above 20 = caution on long positions

Action: If VIX spikes during entry, wait for stabilization before scaling in

✅ CHECKLIST BEFORE ENTRY

Moving Average crossover confirmed (golden cross visible)

MACD histogram turned positive

Price closed above key moving average

Volume supporting the move

Correlated pairs (QQQ/SPY) confirming bullish setup

DXY not in strong uptrend (tech-unfriendly)

VIX stable or declining

🎯 TRADE MANAGEMENT RULES (THIEF OG STYLE)

Scale In: Use limit orders—don't chase price

Protect Profits: Move stop to breakeven after first target hit

Trail Stops: Let winners run while protecting gains

Take Partials: Secure profits incrementally—greed kills traders

Monitor Correlations: Watch correlated pairs for early warning signals

Respect Risk: NEVER risk more than 2% per trade

⚠️ RISK DISCLAIMER

This is an Educational Guide Only for trading strategy examples.

🔴 NOT Financial Advice: I am not a financial advisor, and this does NOT constitute investment advice.

🔴 Your Responsibility: All entry, exit, and stop-loss decisions are YOUR choice and YOUR responsibility.

🔴 Past Performance ≠ Future Results: Market conditions change; strategies may fail.

🔴 Risk Capital Only: Trade only with money you can afford to lose completely.

Trade at your own risk. Always do your own research (DYOR).

💪 THIEF OG'S MINDSET

Dear Ladies & Gentlemen (Thief OG's),

Success in trading isn't about following someone else's exact setup—it's about understanding the WHY behind each decision, adapting to YOUR risk tolerance, and executing with DISCIPLINE.

This guide provides the framework. You provide the execution. Make your profits, protect your capital, and trade smart. 🎯

Now go earn those tendies, OG's! 💰📈

Last Updated: December 2025

Strategy Type: Day/Swing Trade | Timeframe: 4H-Daily

📈 TRADE PLAN OVERVIEW

Asset: NAS100 (NASDAQ 100 Index)

Timeframe: Day/Swing Trade

Market Bias: 🟢 BULLISH (Moving Average Breakout + MACD Golden Cross Confirmed)

Strategy Type: Layered Entry Approach (Multi-Level Limit Orders)

🎯 ENTRY STRATEGY - "THIEF LAYERING METHOD"

Multiple Limit Order Entry Points (Build Position Gradually):

📍 Layer 1: 25,400 (First Entry)

📍 Layer 2: 25,500 (Second Entry)

📍 Layer 3: 25,600 (Third Entry)

💡 Pro Tip: Adjust layer levels based on your capital allocation & risk tolerance. This pyramiding approach reduces average entry cost and limits downside risk.

Why This Method? The layered entry reduces emotional trading, averages down your entry price, and ensures you're not all-in on one level.

🛑 STOP LOSS - "THIEF OG PROTECTION"

Suggested SL Level: 25,200

⚠️ IMPORTANT DISCLAIMER: This is a reference level only. Adjust your stop loss based on:

Your personal risk tolerance

Account size & position sizing

Technical support levels on your timeframe

🔴 Remember: Risk management is YOUR responsibility. Set stops that protect YOUR capital.

🎁 PROFIT TARGET - "POLICE BARRICADE RESISTANCE"

Primary Target: 26,100

📊 Technical Confluence:

SUPERTREND ATR Line = Strong Dynamic Resistance

Overbought Zone Alert = Potential Reversal Risk

Resistance Trap = Take profits before reversal occurs

⚠️ CRITICAL NOTE: Partial profit-taking recommended. Don't be greedy at target levels—accumulate gains gradually:

🟢 Take 30-40% profit at 26,100

🟢 Move SL to breakeven, trail remaining position

🟢 Exit second half on additional resistance or SUPERTREND reversal

💰 YOUR DECISION: Profit targets are YOUR choice. Trade at your own risk and manage your exit strategy.

🔗 CORRELATED PAIRS TO WATCH (Risk/Opportunity Indicators)

1. SPY (S&P 500 ETF) - USD Strong Correlation (0.95)

Key Point: Leads or confirms NAS100 moves

Watch For: If SPY breaks below key support, NAS100 pullback likely

Action: Use SPY strength to confirm NASDAQ100 breakout validity

2. QQQ (NASDAQ 100 ETF) - Perfect Mirror (1.0 Correlation)

Key Point: Direct tracker of your asset

Watch For: Volume spikes, divergence patterns

Action: Cross-reference QQQ volume with NAS100—lack of volume = weak breakout

3. DXY (US Dollar Index) - Inverse Correlation (-0.75)

Key Point: Strong dollar = tech selloff risk

Watch For: DXY rejection at key levels

Action: If DXY rallies hard, NAS100 bullish bias weakens—be cautious

4. TLT (20-Year Treasury ETF) - Indirect Inverse (-0.60)

Key Point: Rising rates pressure growth stocks (NASDAQ)

Watch For: TLT breakdown = rate hike concerns = tech pressure

Action: Monitor TLT support; if breaks, expect NAS100 resistance

5. GLD (Gold ETF) - Risk-On Indicator (0.40)

Key Point: Flight-to-safety alternative

Watch For: Sharp gold strength = risk-off environment forming

Action: Gold spike with NAS100 move down = sell signal confirmation

6. VIX (Volatility Index) - Fear Gauge (-0.80)

Key Point: Rising VIX kills bullish momentum

Watch For: VIX above 20 = caution on long positions

Action: If VIX spikes during entry, wait for stabilization before scaling in

✅ CHECKLIST BEFORE ENTRY

Moving Average crossover confirmed (golden cross visible)

MACD histogram turned positive

Price closed above key moving average

Volume supporting the move

Correlated pairs (QQQ/SPY) confirming bullish setup

DXY not in strong uptrend (tech-unfriendly)

VIX stable or declining

🎯 TRADE MANAGEMENT RULES (THIEF OG STYLE)

Scale In: Use limit orders—don't chase price

Protect Profits: Move stop to breakeven after first target hit

Trail Stops: Let winners run while protecting gains

Take Partials: Secure profits incrementally—greed kills traders

Monitor Correlations: Watch correlated pairs for early warning signals

Respect Risk: NEVER risk more than 2% per trade

⚠️ RISK DISCLAIMER

This is an Educational Guide Only for trading strategy examples.

🔴 NOT Financial Advice: I am not a financial advisor, and this does NOT constitute investment advice.

🔴 Your Responsibility: All entry, exit, and stop-loss decisions are YOUR choice and YOUR responsibility.

🔴 Past Performance ≠ Future Results: Market conditions change; strategies may fail.

🔴 Risk Capital Only: Trade only with money you can afford to lose completely.

Trade at your own risk. Always do your own research (DYOR).

💪 THIEF OG'S MINDSET

Dear Ladies & Gentlemen (Thief OG's),

Success in trading isn't about following someone else's exact setup—it's about understanding the WHY behind each decision, adapting to YOUR risk tolerance, and executing with DISCIPLINE.

This guide provides the framework. You provide the execution. Make your profits, protect your capital, and trade smart. 🎯

Now go earn those tendies, OG's! 💰📈

Last Updated: December 2025

Strategy Type: Day/Swing Trade | Timeframe: 4H-Daily

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.