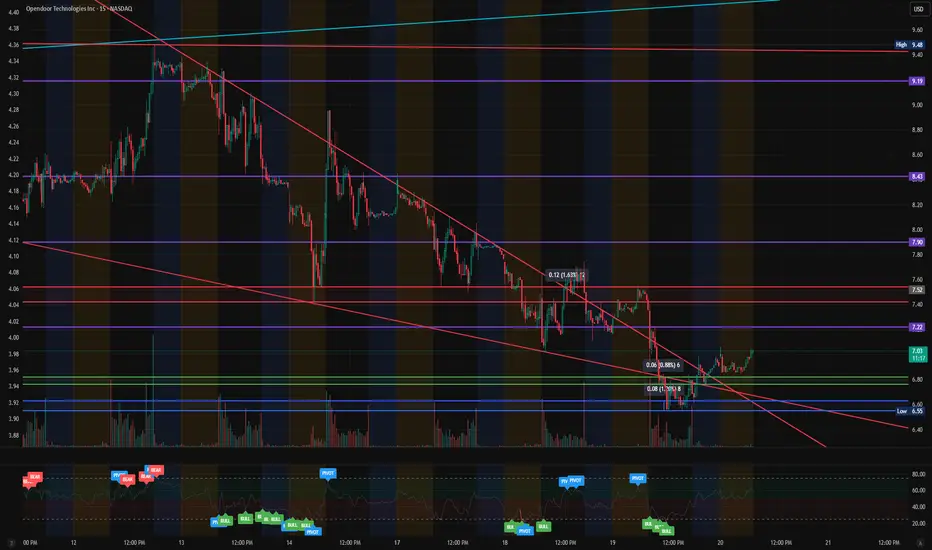

We’ve now seen a Break of Structure (BOS), early CHoCH signals, rising volume, and the EMAs beginning to curl upward — all classic signatures of a bearish cycle ending and a bullish cycle beginning.

If buyers continue stepping in, this move has room to expand.

Technical Overview

Support Levels:

- [] $6.70

[] $6.55 (major demand + must hold) - $6.40

Resistance Levels:

- [] $7.22 (first reaction level)

[] $7.52 (EMA cluster + supply zone)

[] $7.90 (strong high)

[] $8.43

[] $9.19

[] $9.48 (full structure flip level)

Structure:

- [] Multi-day downtrend channel still intact, but breaking

[] Fresh BOS + multiple CHoCH signals

[] EMAs compressing and curling upwards

[] Micro higher-low formed at $6.55

Momentum:

- [] RSI rising from oversold levels

[] Volume rotation from distribution → accumulation - Buyers stepping in aggressively at the lows

Trend Bias:

- [] Bullish above $7.00

[] Strongly bullish above $7.22

As long as

A confirmed breakout above $7.22 opens the door to $7.52 → $7.90 → $8.43, with broader reversal potential toward $9.19–$9.48.

A breakdown below $6.55 invalidates the setup.

Sector Context

Opendoor continues to trade as a high-beta real estate tech play with strong correlation to mortgage rate volatility and risk-on sentiment. When risk rotates back into mid-cap growth,

💡 My Plan

Entry Zone: $6.70–$7.05 (only on strength)

Targets: $7.52 → $7.90 → $8.43

Stretch Target: $9.19 → $9.48

Invalidation: Close below $6.55

Drop your thoughts ⬇️ and I’ll post a MyMI follow-up with updated price targets.

Trade active

We entered With Friday closing up the week, we expect a relief trade in stocks going into the close tomorrow. Still targeting above $7 on this one.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.