Key facts today

MicroStrategy holds 672,497 BTC worth about $59.04 billion, with a 17.04% unrealized gain. Its stock price is currently $151.95, influenced by market views on Bitcoin.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

26.02 USD

−1.17 B USD

463.46 M USD

267.18 M

About Strategy Inc

Sector

Industry

CEO

Phong Q. Le

Website

Headquarters

Vienna

Founded

1989

IPO date

Jun 11, 1998

IPO offer price

12.00 USD

Identifiers

3

ISINUS5949724083

Strategy, Inc. engages in the provision of enterprise analytics and mobility software. The firm designs, develops, markets, and sells software platforms through licensing arrangements and cloud-based subscriptions and related services. Its product packages include Hyper. The company was founded by Michael J. Saylor and Sanjeev K. Bansal on November 17, 1989, and is headquartered in Vienna, VA.

Related stocks

The Interplay of Investors, Traders, and Policymakers1. The Global Trading Ecosystem: An Overview

Global trading encompasses equity markets, bond markets, commodities, currencies (forex), derivatives, and alternative assets such as cryptocurrencies. These markets operate across multiple time zones, making trading a 24-hour phenomenon. Capital flows s

STRATEGY Is this a 2000 Dotcom crash all over?Strategy (MSTR) has been on a strong sell-off since its November 2024 All Time High (ATH). A little more than 1 year of downtrend is classified as a Bear Cycle and it may be no coincidence that this ATH was priced marginally above Strategy's previous ATH of March 2000.

That was at the peak of the i

My MicroStrategy Investment - Overview and Strategic AllocationToday, I am pleased to announce the initiation of a new investment position in the equity MicroStrategy (MSTR). The company presents several positive factors, including the , and

Fundamental Analysis:

- The strategic use of its Bitcoin holdings as collateral to support stock repurchases, thereb

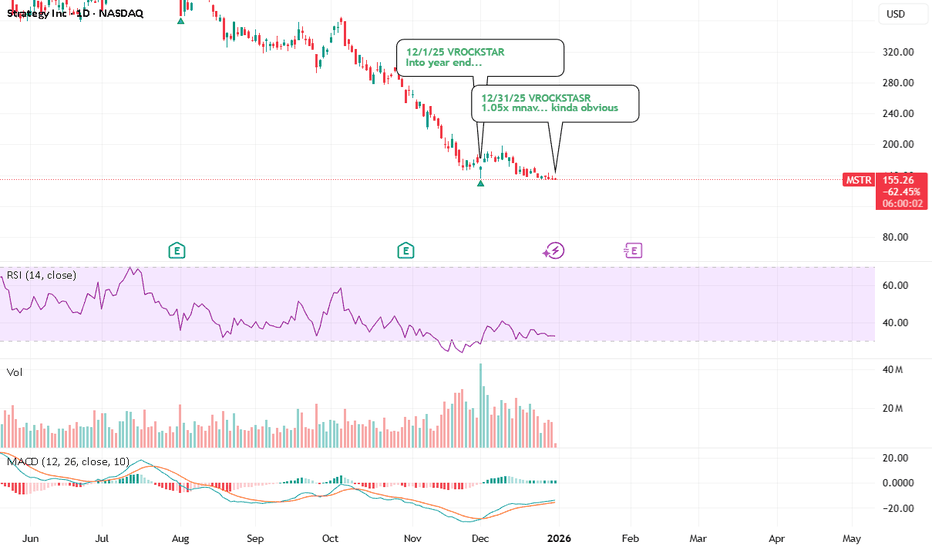

12/31/25 - $mstr - 1.05x mnav... kinda obvious12/31/25 :: VROCKSTAR :: NASDAQ:MSTR

1.05x mnav... kinda obvious

- saylor has like 80% of the DAT liquidity which is all that matters in this game, bc it allows you to do all sorts of interesting things e.g. have the suite of products (perpetuals) he's launched

- so this will obviously trade on a

MicroStrategy presses key support as traders position for bounce

Current Price: $158.81

Direction: LONG

Confidence Level: 47% (Signals are mixed, but the balance of trader commentary and price location near a major support zone favors a short-term upside attempt)

Targets:

- T1 = $165.00

- T2 = $172.50

Stop Levels:

- S1 = $153.00

- S2 = $147.50

**Wisdom of P

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MSTR6034213

Strategy Inc 0.875% 15-MAR-2031Yield to maturity

—

Maturity date

Mar 15, 2031

US594972AN1

Strategy Inc 2.25% 15-JUN-2032Yield to maturity

—

Maturity date

Jun 15, 2032

MSTR6032672

Strategy Inc 0.625% 15-MAR-2030Yield to maturity

—

Maturity date

Mar 15, 2030

MSTR6242992

Strategy Inc 0.0% 01-DEC-2029Yield to maturity

—

Maturity date

Dec 1, 2029

US594972AT8

Strategy Inc 0.0% 01-MAR-2030Yield to maturity

—

Maturity date

Mar 1, 2030

US594972AQ4

Strategy Inc 0.625% 15-SEP-2028Yield to maturity

—

Maturity date

Sep 15, 2028

See all MSTR bonds

MSTE

Harvest MicroStrategy Enhanced High Income Shares ETF Trust Unit AWeight

130.52%

Market value

280.03 M

USD

SP5G

Multi Units Luxembourg SICAV - Amundi Core S&P 500 Swap Daily Hedged to GBP DWeight

0.56%

Market value

152.72 M

USD

Explore more ETFs

Curated watchlists where MSTR is featured.

Frequently Asked Questions

The current price of MSTR is 151.95 USD — it has decreased by −1.23% in the past 24 hours. Watch Strategy Inc stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Strategy Inc stocks are traded under the ticker MSTR.

MSTR stock has fallen by −2.23% compared to the previous week, the month change is a −8.66% fall, over the last year Strategy Inc has showed a −52.06% decrease.

We've gathered analysts' opinions on Strategy Inc future price: according to them, MSTR price has a max estimate of 705.00 USD and a min estimate of 229.00 USD. Watch MSTR chart and read a more detailed Strategy Inc stock forecast: see what analysts think of Strategy Inc and suggest that you do with its stocks.

MSTR reached its all-time high on Nov 21, 2024 with the price of 543.00 USD, and its all-time low was 0.42 USD and was reached on Jul 3, 2002. View more price dynamics on MSTR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MSTR stock is 3.55% volatile and has beta coefficient of 1.01. Track Strategy Inc stock price on the chart and check out the list of the most volatile stocks — is Strategy Inc there?

Today Strategy Inc has the market capitalization of 43.66 B, it has decreased by −10.32% over the last week.

Yes, you can track Strategy Inc financials in yearly and quarterly reports right on TradingView.

Strategy Inc is going to release the next earnings report on Feb 3, 2026. Keep track of upcoming events with our Earnings Calendar.

MSTR earnings for the last quarter are 8.42 USD per share, whereas the estimation was −0.10 USD resulting in a 8.35 K% surprise. The estimated earnings for the next quarter are −0.08 USD per share. See more details about Strategy Inc earnings.

Strategy Inc revenue for the last quarter amounts to 128.69 M USD, despite the estimated figure of 116.65 M USD. In the next quarter, revenue is expected to reach 118.78 M USD.

MSTR net income for the last quarter is 2.79 B USD, while the quarter before that showed 10.02 B USD of net income which accounts for −72.21% change. Track more Strategy Inc financial stats to get the full picture.

No, MSTR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jan 1, 2026, the company has 1.53 K employees. See our rating of the largest employees — is Strategy Inc on this list?

Like other stocks, MSTR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Strategy Inc stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Strategy Inc technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Strategy Inc stock shows the sell signal. See more of Strategy Inc technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.