BOND Break Out?💣 Bonds Near a Major Breakout — And It’s Not Bullish for Risk Assets

We’re approaching a critical breakout zone in bonds.

At first glance, you might think: “High demand for U.S. debt? That’s great! Higher bond prices, lower yields, cheaper interest payments!”

That’s Trump-math logic — the same kind that says prices are “down 300%.” 😅 You can only go down 100%, folks. No matter where the price goes!

Here’s the real story:

For bond prices to surge, investors must be running from risk. Big money managers don’t dump billions into a $250k FDIC-insured savings account 😅 — they rotate into Treasuries when fear spikes.

That’s a double whammy:

1️⃣ Reducing margin

2️⃣ Stocks and other risk assets get liquidated.

When this rotation accelerates, expect risk assets to crater — the “buy-the-dip,” “crypto-Lambo bros,” “GME, AI memers” & "Colorful Chartists" crowd gets ANNIHILATED!

All of that from this one silly chart? No, there is no single holy grail of an analysis chart. Just a piece of the puzzle.

Smart money is moving to safety. Don’t get caught holding the bag. Keep an eye on this chart!

Thank you ALL FOR getting me up to 5,000 followers!! ))

Click boost, follow, comment nicely for more authentic, no BS, raw analysis. Let's get to 6,000 followers. ))

BOND

Global Bond and Fixed Income Markets1. Introduction

The global bond and fixed income markets form the backbone of the world’s financial system. These markets are where governments, corporations, and institutions raise capital by issuing debt instruments—promises to repay borrowed funds with interest. Bonds, treasury bills, notes, and other fixed-income securities collectively represent trillions of dollars in outstanding obligations, making this one of the largest and most liquid asset classes globally.

Unlike equity markets, where investors purchase ownership stakes in companies, the fixed income market revolves around lending. Investors essentially become creditors, earning predictable income through periodic coupon payments and principal repayment upon maturity. The stability and reliability of these returns make bonds a cornerstone for institutional investors, central banks, and individuals seeking steady income or capital preservation.

In 2025, the total global bond market exceeds $140 trillion, spanning government debt, corporate bonds, municipal debt, supranational issuances, and structured credit instruments. The market’s depth, liquidity, and risk-return spectrum make it indispensable to modern finance, influencing monetary policy, interest rates, and economic growth worldwide.

2. The Role and Importance of Fixed Income Markets

The global fixed income market serves several critical economic functions:

Capital Formation:

Governments and corporations issue bonds to fund infrastructure projects, corporate expansion, research, and public programs. Without bond markets, large-scale financing would rely solely on bank loans, limiting growth.

Monetary Policy Implementation:

Central banks conduct open market operations primarily using government securities. By buying or selling these securities, they manage liquidity, control interest rates, and influence inflation.

Benchmark for Other Assets:

Government bond yields act as a benchmark for pricing corporate bonds, equities, and even mortgages. The risk-free rate, derived from sovereign bonds, forms the foundation for asset valuation models globally.

Portfolio Diversification and Risk Management:

Bonds often move inversely to equities during downturns, providing diversification benefits. Institutional investors use them to balance portfolio risk and stabilize returns.

Safe-Haven Investment:

During financial uncertainty or geopolitical instability, investors flock to high-quality government bonds (such as U.S. Treasuries or German Bunds), seeking safety and liquidity.

3. Major Segments of the Global Bond Market

The fixed income universe comprises several segments, each catering to different issuers, investors, and risk profiles.

3.1. Government Bonds

Issued by national governments, these are considered the safest investments in the market.

Sovereign Bonds: Examples include U.S. Treasuries, U.K. Gilts, Japanese Government Bonds (JGBs), and Indian Government Securities (G-Secs).

Emerging Market Debt: Countries like Brazil, Mexico, or South Africa issue bonds denominated in local or foreign currency. These carry higher yields due to higher default risk.

Government bonds are critical for monetary policy, as their yields reflect market expectations of inflation and interest rates.

3.2. Corporate Bonds

Corporations issue bonds to raise capital for operations, expansion, or refinancing existing debt.

Investment-Grade Bonds: Issued by financially strong corporations (rated BBB- or higher).

High-Yield (Junk) Bonds: Issued by riskier companies offering higher yields to compensate for credit risk.

Corporate bonds are vital for economic expansion, providing businesses with an alternative to equity financing.

3.3. Municipal Bonds

Issued by states, cities, or local authorities to finance public projects like roads, hospitals, and schools. In countries like the U.S., municipal bonds offer tax-exempt interest income, making them attractive to individual investors.

3.4. Supranational and Sovereign Agency Bonds

Organizations such as the World Bank, European Investment Bank (EIB), or Asian Development Bank (ADB) issue bonds to fund development projects. These securities often enjoy high credit ratings and are used to promote sustainable financing globally.

3.5. Structured and Securitized Products

These include Mortgage-Backed Securities (MBS), Asset-Backed Securities (ABS), and Collateralized Debt Obligations (CDOs). They pool loans or receivables and repackage them into tradable securities. Structured finance became notorious after the 2008 financial crisis but remains a vital part of credit markets.

4. Key Participants in the Global Bond Market

Issuers:

Governments, municipalities, corporations, and supranational agencies.

Their objective is to raise funds at the lowest possible cost.

Investors:

Institutional Investors: Pension funds, insurance companies, mutual funds, and sovereign wealth funds dominate demand due to their large asset bases and need for steady returns.

Retail Investors: Participate through direct purchases or mutual funds.

Foreign Investors: Often buy sovereign and corporate bonds for yield diversification and currency exposure.

Intermediaries:

Investment banks underwrite and distribute bond issues.

Dealers, brokers, and electronic trading platforms facilitate secondary market trading.

Regulators and Rating Agencies:

Agencies like Moody’s, S&P Global, and Fitch Ratings assess issuer creditworthiness.

Regulators (like the SEC, ESMA, or SEBI) oversee transparency, disclosure, and market integrity.

5. Bond Valuation and Pricing Mechanisms

The value of a bond depends primarily on three factors — coupon rate, maturity, and prevailing market interest rates.

5.1. Present Value of Cash Flows

A bond’s price equals the present value of its future cash flows (coupons and principal). When market interest rates rise, bond prices fall, and vice versa. This inverse relationship between yields and prices defines fixed income market dynamics.

5.2. Yield Measures

Current Yield: Annual coupon divided by current price.

Yield to Maturity (YTM): The internal rate of return if held to maturity.

Yield Spread: The difference between yields of different securities, indicating relative risk.

5.3. Credit and Duration Risk

Credit Risk: Possibility of default by the issuer.

Duration: Measures bond price sensitivity to interest rate changes. Longer-duration bonds are more sensitive to rate movements.

6. Global Market Size and Regional Overview

6.1. United States

The U.S. has the world’s largest bond market, valued over $50 trillion. U.S. Treasuries are considered the global benchmark for risk-free assets. The Federal Reserve’s actions in buying or selling Treasuries directly impact global liquidity.

6.2. Europe

The Eurozone bond market includes German Bunds (considered ultra-safe) and peripheral debt from countries like Italy, Spain, and Greece. The European Central Bank (ECB) manages yields via quantitative easing and bond-buying programs.

6.3. Asia-Pacific

Japan’s bond market, dominated by JGBs, is the largest in Asia, though yields remain extremely low. China’s bond market has grown rapidly, becoming a key avenue for global investors seeking exposure to yuan-denominated assets. India’s G-Sec market is expanding, supported by reforms that enhance foreign participation.

6.4. Emerging Markets

Countries in Latin America, Africa, and Eastern Europe issue both local and dollar-denominated bonds. These offer higher returns but carry risks such as currency depreciation and political instability.

7. Fixed Income Derivatives and Innovations

Derivatives based on bonds—such as futures, options, swaps, and credit default swaps (CDS)—allow investors to hedge or speculate on interest rate and credit movements.

Interest Rate Swaps: Exchange fixed and floating rate payments to manage rate exposure.

Credit Default Swaps: Provide insurance against bond default.

Bond Futures: Allow hedging of portfolio value against rate changes.

The rise of Exchange-Traded Funds (ETFs) and green bonds has further diversified access and objectives within fixed income investing.

8. Influence of Macroeconomic Factors

Bond markets are deeply intertwined with macroeconomic conditions.

Interest Rates:

Central banks’ rate decisions directly affect bond yields. A rate hike lowers bond prices, while cuts drive them higher.

Inflation:

Rising inflation erodes the real return of fixed-income securities, leading investors to demand higher yields.

Fiscal Policy:

Government deficits increase bond supply, potentially pushing yields upward.

Currency Movements:

Exchange rate fluctuations impact returns on foreign-denominated bonds.

Global Risk Sentiment:

During crises, investors move funds from risky assets to safe-haven bonds, causing yield compression in developed markets.

9. Technological Evolution and Market Infrastructure

Modern bond markets are increasingly electronic, transparent, and efficient.

Electronic Trading Platforms: Platforms like Tradeweb and MarketAxess have revolutionized secondary bond trading.

Blockchain and Tokenization: Tokenized bonds and blockchain-based settlements are improving speed, transparency, and cost efficiency.

AI and Big Data Analytics: Used for credit analysis, risk modeling, and market forecasting.

These innovations are making fixed income markets more accessible and integrated across borders.

10. ESG and Green Bond Revolution

Environmental, Social, and Governance (ESG) investing has reshaped the bond landscape. Green bonds finance environmentally sustainable projects such as renewable energy and clean transportation.

The global green bond market surpassed $2 trillion in cumulative issuance by 2025.

Sustainability-linked bonds tie coupon payments to ESG performance metrics, promoting responsible corporate behavior.

Governments, development banks, and corporations alike are leveraging ESG bonds to align with global climate goals and attract sustainability-focused investors.

Conclusion

The global bond and fixed income markets are the quiet yet powerful engines of global finance. They enable governments to fund development, corporations to grow, and investors to achieve stability and income.

In an era marked by technological transformation, sustainability goals, and shifting monetary landscapes, fixed income markets are evolving rapidly. The interplay of interest rates, inflation, and global capital flows continues to shape their dynamics.

As the world transitions into a more interconnected, digital, and climate-conscious financial system, the bond market remains indispensable—not just as a financing mechanism but as the foundation upon which the modern economy rests.

The ability of fixed income markets to adapt—through innovation, transparency, and sustainability—will determine their continued strength and relevance in the decades ahead.

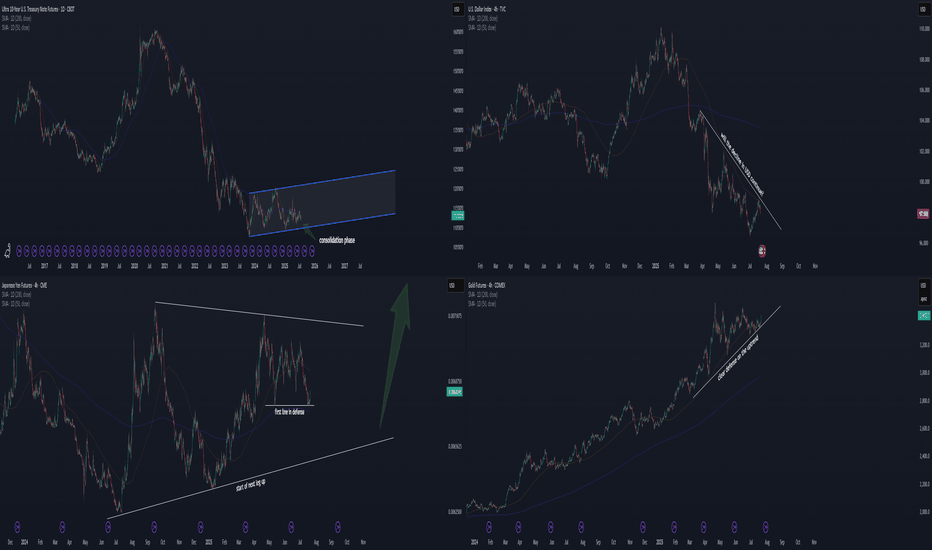

Time to invest in JPY and TN/bond? Hello FX/futures traders!

Market is at a pivotal point. Not in a bad way, but in a good way!

Chart 2: TVC:DXY

Let's start with the US Dollar . A declining USD was just well defended the last few days. If this is true, then the stock up, dollar down scenario is likely to continue. This is good for equities.

Chart 4: COMEX:GC1!

Gold defends its trendline as well. It seems like gold wants to go up more. A raising gold in the current scenario suggests declining USD TVC:DXY . This isn't always true, but we have to look at the current correlation and makes the best educated guess on this.

Logical Deduction 1:

Chart 1: CBOT:TN1!

A consolidation phase has been going on for almost 2 years now. This is definitely

a good sign to long bond, as at least we know the likely bottom for stoploss. With dollar leaning down and gold up, I think TN will defend its current level around 110-113.

Logical Deduction 2:

Chart 3: CME:6J1!

JPY is defending its first key level since May 2025. A wedge is forming, and the breakout is about to take place later this year. Likely the consolidation phase will take more time (with likelihood to breakout to either side). But with a declining USD side by side, I consider now a good entry point to long JPY with controllable risk.

Let me know what you think!

Divergence Since 2020 - What Happens When Bonds Continue?When Stocks & Bond Move Opposite Direction what does it mean?

We have observed a divergence between the stock and bond markets since 2020. While U.S. Treasury bonds entered a bear zone, the stock markets continued their upward climb. What are the implications of this decoupling?

Will the stock market resume its uptrend and hit new highs? Or is this merely a retracement before further downward pressure?

A healthy, three-way interdependent relationship occurs when the economy, bonds, and stocks move in the same direction. When investors have confidence in the U.S. economy, they tend to invest in long-term bonds, which it usually will benefits the stock market.

This alignment was evident between 2000 and 2020, during which bonds and stocks moved largely in tandem.

However, from 2020 onward, bonds began declining—signaling a loss of investor confidence in the economy. Technically, this should exert downward pressure on stocks as well.

Yet, we are witnessing a divergence: Where U.S. Treasury bonds have fallen while stocks have continued to rise.

When such a divergence surfaces, it signals the need for caution in our approach in the stock markets.

What could be the other reasons why US T-bond has peaked in 2020 and depreciated by 44% since then?

Micro E-mini Nasdaq Futures and Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

When Stocks & Bond Move Opposite Direction - Its implicationWhen Stocks & Bond Move Opposite Direction what does it mean?

We have observed a divergence between the stock and bond markets since 2020. While U.S. Treasury bonds entered a bear zone, the stock markets continued their upward climb. What are the implications of this decoupling?

Will the stock market resume its uptrend and hit new highs? Or is this merely a retracement before further downward pressure?

Micro E-mini Nasdaq Futures and Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

10 Yr Bond Yield breaks downtrend & then falls back into it!10 Yr Bond yields seem to have topped after that massive 1 week run. That was an impressive run! TVC:TNX

Even though the downtrend was broken, the 10Yr Yield put in a LOWER high.

We can also see that the recent uptrend was violated, back in a down trend.

Short term interest rates look worse!

Why Is the T Bond Heading Down?The downward pressure did not start with the Liberation Day tariffs on 2nd April.

Based on the 30-year long-term bond price chart, the market peaked in 2020, then broke below a major support line—established since the 1980s—in 2022.

Since that break, US bonds have been on a downward trajectory.

So, what happened in 2020 and 2022 that set the bond market on shaky ground?

Why is the recent tariff shock just a continuation of developments that began back then?

And where are bond prices heading next?

This goes beyond investors offloading its US Treasury holdings after 2nd April.

U.S. Treasury Futures & Options

Ticker: ZB

Minimum fluctuation:

1/32 of one point (0.03125) = $31.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

Can Brazil’s Bonds Defy Global Chaos?In an era of escalating trade tensions and economic uncertainty, Brazil’s financial markets offer a compelling enigma for the astute investor. As of March 3, 2025, with the USD/BRL exchange rate at 1 USD = 5.87 BRL, the Brazilian real has shown resilience, appreciating from 6.2 to 5.8 this year. This strength, intriguingly tied to a bond market boasting 10-year yields near 15%, prompts a deeper question: could Brazil emerge as an unexpected sanctuary amid global turmoil? This exploration unveils a landscape where high yields and domestic focus challenge conventional investment wisdom.

Brazil’s bond market operates as an idiosyncratic force with yields dwarfing those of peers like Chile (5.94%) and Mexico (9.49%). Driven by local dynamics—fiscal policy, inflation, and a central bank unbound by global rate cycles—it has seen yields ease from 16% to 14.6% year-to-date, signaling stabilization. This shift correlates with the real’s rise, suggesting a potent inverse relationship: as yields moderate, confidence grows, bolstering the currency. For the inquisitive mind, this interplay invites a reevaluation of risk and reward in a world where traditional havens falter.

Yet, the global stage adds layers of complexity. U.S.-China trade tensions, while not directly targeting Brazil, ripple through its economy—offering trade diversion benefits like increased soybean exports to China, yet threatening slowdowns that could dim growth. With China as its top trade partner and the U.S. second, Brazil straddles opportunity and vulnerability. Investors must ponder: can its bond market’s allure withstand these crosswinds, or will global forces unravel its promise? The answer lies in decoding this delicate balance, a challenge that inspires curiosity and strategic daring.

Bond Looks ready for PumpHi Guys

Bond Looks good here for move up.

Best buy area is around 3.30 - 3.40 but also we can buy a part here.

Dyor plz.

If u bought it please use stoploss.

Good luck.

Trump's Impact on Interest Rates: Higher Rates Ahead?After Trump’s decisive win on November 6th, Bitcoin, the USD, and yields (or interest rates) moved higher. In fact, these markets began moving upward in September, more than a month before Donald Trump became the 47th President of the United States.

We will study the direction of interest rates based on the actual market sentiment as reflected in U.S. bond yields.

10 Year Yield Futures

Ticker: 10Y

Minimum fluctuation:

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

The Best Explanation of The Bond Market You're Ever Gonna Get12 Month US10Y Bollinger Bands between 2.5 and 2.9 Standard Deviations away from a moving average model greater than 4 years in length, preferably exponential. I haven't optimized this to perfection, but it's close enough to give you the basic idea.

The bond market is just a simple oscillator emerging from a complex system and simply does what every other very large and complex system does. It has a trend around which it travels but in decades and centuries not years. It isn't complicated, but it is extremely slow.

There are 2 phases and a 5,000 year long trend. It goes up. It goes down. Over the course of centuries it declines. In the down phase, it stays below trend and does the exact opposite in the opposite phase. A kindergartener can trade this thing.

Currently the phase is turning over from a down phase that lasted from 1980 to 2020, and entering into a new up phase that will most likely last for 3-4 decades.

Trading it: buy secondary market long duration government bonds at the bond yield 3 standard deviation line and sell at the trend. Repeat for the next 30-40 years. Easy peasy.

BOND symmetrical triangle patternBased on the Symmetrical triangle pattern I see bond falling down further for around 50%. I depend the 50% because of its last big drop where the symmetrical triangle pattern started. If BOND can NOT break out then I will go in position. If BOND will breakout we will see if it faked out or go up higher.

What are your thoughts?

I suggest to always Do Your On Research (DYOR) and that this is no Financial Advice (FA).

BONDUSDT Break Out or Break Down? Crucial Levels to Watch Now!Yello, Paradisers! Are you prepared for #BONDUSDT's potential breakout? This analysis will keep you on the edge of your seat!

💎#BOND has shown a price rebound from the demand zone and is attempting to break out of the descending resistance. A successful breakout of this resistance could be a positive sign for the next movement of BOND.

💎However, for a shift to a bullish trend, the price needs to break through the supply zone around the 2.8 area. If this happens, there's a high probability that the price will move significantly upward, possibly reaching our target resistance and the strong resistance area.

💎On the flip side, if BOND fails to break out of the descending resistance and gets rejected, the price will likely move downward and revisit the demand area.

💎The demand area at 1.88 is a crucial level for BOND. It needs to rebound and attempt to break out of the descending resistance again. But if BOND fails to rebound and breaks through the demand area, the bullish scenario will be invalidated, and the price could dip further.

If you want to be consistently profitable, you need to be extremely patient and always wait for the best, highest probability trading opportunities. Stay focused, patient, and disciplined, Paradisers.

MyCryptoParadise

iFeel the success🌴

BOND looks BearishIt looks like we have a large diametric that we are now in the G wave of.

The G wave looks like a triangle.

Keeping the red range, we expect wave c to be hit from G.

The targets are clear on the chart.

Closing a daily candle above the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Rates are breaking recent up trends, $TNXGood Morning Everyone!

The 2Yr Yield is retesting the recent support level, highlighted by arrows.

The 10Yr #yield is currently breaking the recent uptrend.

The yellow box was highlighted in the last post showing the WEAKNESS. However, forgot to speak on that yesterday (see profile for more info).

They cannot lower #interestrates... But they must, at least short term.

QT is done.

BOND UPDATE (1D)This analysis is an update of the analysis you see in the "Related Ideas" section.

Now we are in the green range of the previous analysis, but due to a small pump and rejection from the QM L range, we see a bearish QM on the chart.

BOND can drop towards the targets while maintaining the red range.

The targets are clear on the chart.

Closing a daily candle above the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Bond/UsdtWe expect an bullish movement to the point specified in the chart as a target. We are waiting...

BONDUSDT.4HOn this BOND/USDT 4-hour chart, I’m examining the inclusion of the RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) indicators alongside identified support and resistance levels.

The RSI, currently at 51.38, is hovering around the mid-point, which suggests neither an overbought nor oversold condition. In the context of the RSI, a reading above 70 typically indicates that an asset is becoming overbought, while a reading below 30 indicates an oversold condition. Therefore, the current RSI level provides no clear directional bias.

The MACD, which is near the zero line and appears with minimal histogram bars, also shows a lack of strong momentum in either direction. The convergence, or lack thereof, of the MACD line and the signal line can offer insights into potential price movement, but as it stands, it's not indicating a strong bullish or bearish momentum.

Looking at the price chart, we see that price has recently been making higher lows, which is tentatively bullish as it suggests an uptrend. However, price action is currently compressed below the resistance level (R1) at $4.734. A breakout above this level could indicate bullish momentum leading towards the next resistance level (R2) at $5.417.

Support levels are marked as S1 at $4.013 and S2 at a lower point. These would be areas to watch for potential buying opportunities if the price were to retrace. Particularly, the $4.000 level is psychologically significant and aligns closely with S1, which could reinforce it as a strong support zone.

To form a complete trading strategy around this chart, I would seek confirmation from price action, such as a bullish breakout above R1 with increased volume. A stop-loss strategy would be prudent, potentially just below S1 to mitigate risk in the case of a false breakout or sudden reversal. As always, it’s wise to consider the broader market context, including any news or events that could impact the price of BOND.

Interest Rates NOT showing cuts...Let's keep looking at #InterestRates. Gives us an idea of what the Fed may do.

The 1 & 2 Year are still under their RESISTANCE level. Struggling a bit, but not breaking down. Trend is still there, weak though.

10 Yr looks like it wants to break the resistance zone.

30 YR looks like it's gone. Does not look like it wants to retrace at the moment.

#FederalReserve TVC:TNX

bondSupport and press the rocket to cheer me up

Observe the ten percent loss limit

Stay away from Bitcoins

Feel free to buy and sell and post your comments