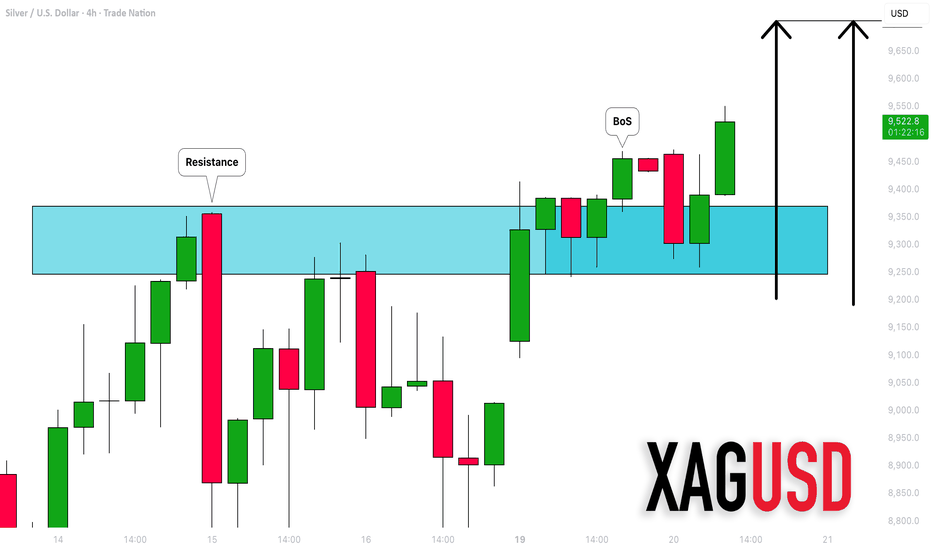

SILVER (XAGUSD): Bullish Continuation

Silver will likely rise more, following

a confirmed bullish break of structure on a 4H time frame.

The next strong resistance is 97.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Candlestick Analysis

Long trade

Pair EURJYP

Mon 19th Jan 26

9.00 am (NY time)

Entry 183.754

Profit level 184.282 (0.28%)

Stop level (0.067%)

RR 4.29

🧠 Sentiment & Market Narrative — EURJPY (Buy-Side Bias)

Market sentiment has shifted bullish, with EURJPY transitioning from sell-side delivery into buy-side expansion.

Price previously completed a sell-side liquidity run below prior session lows, inducing short participation at a discount. This move failed to gain continuation, signalling absorption and accumulation rather than sustained bearish intent. The subsequent bullish displacement and reclaim of internal structure confirmed a change in order flow.

From a session perspective:

Tokyo provided the initial liquidity sweep and range compression.

London confirmed the reversal with strong bullish follow-through from the discount.

New York acted as the continuation engine, driving price back into premium.

Price is now trading above equilibrium, with upside draw aligned toward unmitigated buy-side liquidity and higher-timeframe inefficiencies. Pullbacks into FVGs and the 0.25–0.50 PD Array are viewed as re-accumulation, not distribution.

Unless price re-accepts below the discounted demand zone, sentiment remains risk-on, favouring buy-side continuation.

USOIL (2)2nd sell entry on Oil. This is more risky because price has already mitigated the OB I marked earlier that might push price higher. Price is also reacting from m5 sell OB

Don't bother taking this sell if you took the first one sent and you can set the first sell at Breakeven. Manage risk well pls

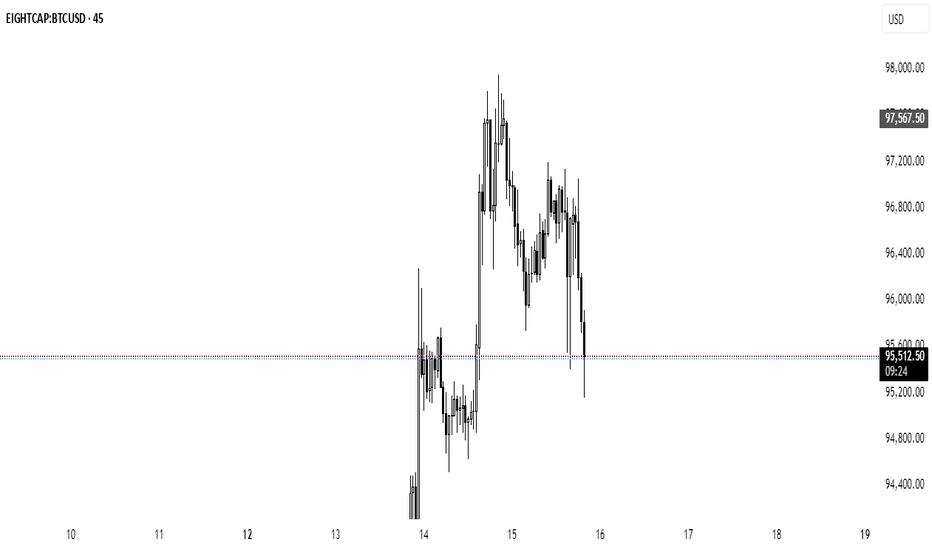

Short trade Sell-side trade

Pair BTCUSDT

Mon 19th Jan 26

5.00 pm

LND Session PM

Entry 92959.3

Profit level 90720.9 (2.40%)

Stop level 93335.0 (0.40%)

RR 5.96

Sentiment & Market Narrative — BTCUSDT (Sell-Side Bias | London PM)

Market sentiment during the London PM session was bearish, with BTC firmly positioned in a distribution → sell-side delivery phase.

15min TF overview

Earlier in the day, price completed a buy-side liquidity sweep into prior highs and premium PD Arrays. This upside move failed to achieve acceptance, signalling exhaustion rather than continuation. As London PM unfolded, price repeatedly rejected premium levels, confirming that strength was being sold into.

Key sentiment drivers during London PM:

Failure to hold premium pricing after the liquidity run

Rejection from internal resistance and unmitigated FVGs

Bearish displacement confirming a shift in intraday order flow

London PM acted as the transition window, converting earlier distribution into active downside delivery, with price beginning its draw toward sell-side liquidity and inefficiencies resting below.

This behaviour reflects a risk-off environment, where rallies are used for short positioning, not accumulation.

Unless BTC reclaims and holds above the prior range high and premium PD Arrays, sentiment remains sell-side favoured, with a continuation lower being the higher-probability outcome.

GBPUSD – Major Event Risk on the HorizonIt’s hard to deny there is a lot going on right now in financial markets, however in terms of the world of G7 FX the macro-outlook has been decidedly mixed with conflicting drivers working against each other to keep GBPUSD in a relatively tight range between 1.3350 and 1.3550.

After a brief initial push to the topside at 1.3568 (January 6th) in the first few trading days of 2026, a resurgence of the US dollar towards the back end of last week, supported by resilient US data, led GBPUSD to probe the bottom end of its range, culminating in a gap open in Asia yesterday to register a low of 1.3339.

That move was again short lived, with traders preferring to sell US dollars again in response to President Trump’s weekend threat to impose new trade tariffs on imports of any European countries, including the UK, opposing his plans to buy Greenland. The basis being that retaliatory tariff moves from the EU/UK could weaken the US economy.

Now, looking forward, event risk could be higher than usual, with numerous events scheduled for tomorrow (January 21st) that could spark a much more volatile reaction in GBPUSD. The first is the next UK CPI release at 0700 GMT. A lower than expected reading could renew hopes for the Bank of England to speed up their current pace of interest rate cuts to support a weak economy, a move which could weigh on GBP. However, a higher reading could mean the opposite.

Then, later in the day President Trump is due to speak from the World Economic Forum in Davos, Switzerland. It is anticipated that he will initially concentrate on laying out his latest plans for easing cost of living issues for US households, but he may find it hard not to comment on the escalating trade tensions with European allies, provide further insight into who will be the new Fed Chair, Kevin Hassett or Kevin Walsh, as well as discuss the current political challenges his administration are making to the independence of the Federal Reserve, all of which could impact the US dollar side of the GBPUSD currency pair.

Importantly, on Wednesday evening, the US Supreme Court is expected to provide their guidance on the legality of President Trump’s authority to sack Federal Reserve Governor Cook. The outcome of this hearing could have a significant impact on FX markets, especially if the top US court are seen to be siding with the President.

With so much to consider, there is the possibility that the relative calm of FX markets, and GBPUSD in particular, seen at the start 2026 could be shattered, so being prepared to react to wider directional moves could be beneficial.

Technical Update: Correction Themes Ending?

Within Technical Analysis, and especially when using Fibonacci retracements, it’s generally accepted that a correction in an uptrend, or a recovery in a downtrend, can retrace at least 38.2% of the prior move. In an uptrend, this means a pullback in price can find its first support around the 38.2% retracement of the preceding advance.

The daily GBPUSD chart above shows that after the strong advance from the November 4th low to the January 6th high, price weakness has emerged as a natural reaction to over‑extended upside conditions. Last weeks and initially yesterday’s decline tested 1.3363, which aligns with the 38.2% Fibonacci retracement of that prior move, and this level held on a closing basis which helped see a bounce in price to current levels around 1.3435 (0645 GMT).

Traders may now be questioning whether the sell‑off from the January 6th high has completed its corrective phase, creating possibilities for fresh attempts to rebuild price strength.

If so, identifying and monitoring this week’s important support and resistance zones could be pivotal, as their ability to hold or trigger reversals may heavily influence the next directional bias.

Possible Support Levels:

After testing and holding the first retracement level at 1.3363 on a closing basis, this now appears to be the initial support for GBPUSD. While this level holds on a closing basis, scope remains for renewed attempts to rebuild the uptrend.

However, if the 38.2% retracement support at 1.3363 fails to hold on a closing basis, downside risks may increase. In Fibonacci terms, a break below 1.3363 could shift the support focus toward the 50% retracement at 1.3300, potentially even the 61.8% level at 1.3237.

Potential Resistance Levels:

While 1.3363 holds on a closing basis, the bias could still be toward further attempts at uptrend development. However, renewed strength may require closing breaks above resistance levels to suggest upside momentum. The Bollinger mid‑average at 1.3459 could be the next level to monitor.

Closing breaks above the mid‑average at 1.3459, could encourage traders to look for further attempts to push toward higher levels. As the chart above highlights, the next resistance may then be marked by 1.3495, which is the January 13th high, possibly even 1.3568, which is the January 6th high.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

EURNZD: Time for Pullback?! 🇪🇺🇳🇿

EURNZD tested a key daily horizontal support.

With a high probability, the price will pull back from that.

I expect a bullish movement to 2.0048 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NASDAQ INDEX (US100): Another Gap to Be Filled

I think that there is a high probability that a gap down opening

will be filled on Nasdaq Index soon.

Expect a bullish continuation to 25490.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#USDCHF BullishI believe we are bullish on USDCHF. What I believe is going to happen right now is liquidate my Breakout Box to the sell side, or possibly just retest the equilibrium, and go bullish. As of now, we need to wait for more candles to be revealed to confirm where price really wants to move, and for that to happen we need to wait for the London session. We need to pay attention to the 4hour and 1hour timeframe when they are closing and how they are close/ forming. Knowing what the big timeframes are doing and OANDA:USDCHF let it all be in sync with the 15minute timeframe.

NZDJPY to form a higher high?NZDJPY - 24h expiry

Trend line resistance is located at 91.95.

Early optimism is likely to lead to gains although extended attempts higher are expected to fail.

Short term momentum is bullish.

Prices expected to stall near trend line resistance.

Expect trading to remain mixed and volatile.

We look to Sell at 91.95 (stop at 92.31)

Our profit targets will be 90.91 and 90.61

Resistance: 91.80 / 92.00 / 92.50

Support: 91.20 / 90.62 / 89.97

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Euro eyes trend break as bullish signals clusterSeveral bullish reversal signals have been triggered on EUR/USD following a strong bounce from the 200DMA, putting traders on alert for a possible trend change should the pair break sustainably above the December downtrend.

Should the morning star or bullish engulfing candle delivered on Monday prove reliable, watch for a potential extension of the bullish move on Tuesday. If that plays out, consider initiating longs above the downtrend with a stop below, targeting 1.1700 initially. Given the reversal signals were delivered on a U.S. public holiday, the preference is to wait for a close above the downtrend before entry.

While RSI (14) and MACD sit in bearish territory, with the former breaking its downtrend and pushing back towards 50 and the latter curling back towards the signal line from below, downside strength looks to be dissipating, producing a neutral message that favours placing more emphasis on price signals.

Good luck

DS

Nifty Analysis EOD – January 19, 2026 – Monday🟢 Nifty Analysis EOD – January 19, 2026 – Monday 🔴

Open = High: Bears Punch First, Bulls Hold the 25,500 Line!

🗞 Nifty Summary

Nifty started the week with a cold shoulder, opening with a 45-point Gap Down and immediately printing an Open = High (OH) formation.

The bears wasted no time, sliding the index another 145 points to test the psychological floor at 25,500. After hitting a low of 25,494.35, the market entered a 3-hour “snooze fest” within a tight 50-point range.

A breakout attempt at 1:45 PM reached 25,630, but the recovery lacked legs, resulting in an 88-point pullback to close the day at 25,585.50 (-0.42%).

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

The “Open = High” structure was a clear warning from the first tick—bears were in the driving seat. The 3-hour consolidation mid-day was like a movie interval that lasted too long, providing zero directional clues until the late-session spike.

However, that spike at 1:45 PM was quickly sold into, proving that sellers are still lurking at the 25,630 ~ 25,650 resistance zone. Despite the red close, the 91-point lower wick shows that the 25,500 fort is being guarded closely.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,653.10

High: 25,653.30

Low: 25,494.35

Close: 25,585.50

Change: −108.85 (−0.42%)

🏗️ Structure Breakdown

Type: Bearish candle with a strong lower wick.

Range: ≈ 159 points — moderate volatility.

Body: ≈ 68 points — controlled selling pressure.

Upper Wick: ≈ 0.2 points — Total Bearish Dominance at the open.

Lower Wick: ≈ 91 points — Significant buyer defense at the 25,500 level.

📚 Interpretation

The OH formation is a “no-nonsense” bearish signal. By closing near the mid-point of the day’s range, the market has left the door open for both sides. The long lower wick prevents a breakdown for now, but the lack of an upper wick confirms that bulls are struggling to even initiate a recovery at the open.

🕯 Candle Type

Bearish Candle with Lower-Wick Support — Bears have the edge, but buyers are active at the 25,500 discount zone.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 210.22

IB Range: 125 → Big

Market Structure: ImBalanced

Trade Highlights:

No Trade

Trade Summary: The strategy strictly forbade an IB breakout or contra trade today. With a Big IB + Imbalanced structure, the risk of being “chopped” or caught in a fakeout was too high. Sitting on hands was the most profitable trade today.

🧱 Support & Resistance Levels

Resistance Zones:

25650 (Immediate)

25690

25750 ~ 25780

Support Zones:

25550

25495 ~ 25475

25440

25375 ~ 25365

🧠 Final Thoughts

“Discipline is the bridge between goals and accomplishment.”

Tomorrow’s session looks dicey with the expiry looming. Will it be a “V-shape” recovery, more manipulation, or a bearish continuation? No one knows, and frankly, we don’t need to. We just need to stick to the strategy and follow the structure. If the IB is big again, I’m happy to stay a spectator. Better to miss a move than to lose capital on a “maybe.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.