Candlestick Analysis

Short trade

Sell-Side Trade — BTCUSDT (15m)

Pair: BTCUSDT

Bias: Sell-side

Date: Fri 16th Jan 2026

Session: London Session AM

Time: 5:00 am (UK)

Entry TF: 15-minute

Execution Levels

Entry: 95,525.7

Take Profit: 94,140.5 (1.45%)

Stop Loss: 95,623.3 (0.10%)

Risk–Reward: RR 14.19

Session-Based Narrative

🌏 Tokyo Session

Price formed a tight consolidation beneath resistance.

Liquidity was engineered but not expanded.

Typical range-building and inducement behaviour.

➡️ Sentiment: Neutral → Bearish setup

🇬🇧 London Session

London attempted continuation but failed to reclaim premium.

Multiple reactions at FVGs and prior highs without displacement.

Structure showed weak bullish follow-through.

➡️ Sentiment: Distribution

🇺🇸 New York Session

NY delivered sell-side displacement, breaking internal structure.

Buy-side liquidity above was left untapped → confirmation of failed continuation.

Price began targeting sell-side liquidity and inefficiencies below.

➡️ Sentiment: Bearish continuation

Trade Thesis Summary

Following a completed bullish expansion, BTCUSDT entered a distribution phase marked by failure to hold premium pricing and repeated rejection from higher-timeframe supply. London and New York sessions confirmed bearish intent through internal structure breaks and sell-side displacement. With buy-side liquidity exhausted and inefficiencies resting below, price is expected to continue lower toward sell-side targets.

GBPAUD: Bullish Move From Support 🇬🇧🇦🇺

There is a high probability that GBPAUD will pullback

from the underlined support.

Goal - 2.0004

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Long trade

5min TF overview and entry

Pair YGG

Buyside trade

LND Session AM

Thu 15th Jan 26

4.15 am

Entry 0.07274

Profit level 0.07274 (5.52%)

Stop level 0.06878 (25.4%)

RR 25.4

Neutral → Bearish corrective within a broader bullish impulse

The price is transitioning from expansion into distribution, with sell-side pressure emerging after the buy-side objective was achieved.

🧠 Structural & Liquidity Read

Price delivered a strong bullish expansion from the sell-side drawdown low, efficiently rebalancing multiple FVGs. The rally fulfilled a buy-side objective, reaching into premium pricing relative to the prior dealing range.

Following the expansion, the price failed to hold above the London/NY highs, signalling buy-side liquidity exhaustion. The rejection from highs shows distribution behaviour, not continuation.

Narrative Summary

Price completed a bullish expansion phase, efficiently delivering into buy-side liquidity resting above prior session highs. Subsequent failure to hold premium pricing, combined with NY session rejection and volume acceptance below the high-volume node, signals distribution rather than continuation. Current sentiment favours a bearish corrective phase or consolidation until sell-side liquidity is sufficiently rebalanced.

Hindustan Petroleum Corporation Ltd (HPCL) Demand Zone Reversal

HPCL has shown a strong price reaction from a well-defined demand zone, indicating active accumulation at lower levels. The stock has respected this support area multiple times, suggesting downside exhaustion.

From a macro perspective, easing concerns around the global crude oil supply—supported by improving diplomatic dialogue with Iran—have reduced pressure on oil prices. This acts as a sentiment tailwind for OMCs, including HPCL.

Technically, price action indicates:

Potential downtrend reversal with higher buying interest near support

Improving structure after prolonged corrective phase

Early momentum shift favoring bulls if price sustains above the demand zone

If follow-through buying continues, HPCL may attempt a pullback rally towards nearby resistance levels. However, failure to hold the demand zone could invalidate the reversal and resume the broader downtrend.

Trade Outlook:

Bias: Cautiously Bullish

Key Zone to Watch: Demand support area

Confirmation: Sustained price action above short-term resistance with volume

Note: Trade with proper risk management and confirmation, as broader market sentiment remains a key variable.

AUDJPY: I finally Bought 🇦🇺🇯🇵

This morning, I finally opened a long position on AUDJPY.

I was patiently waiting for a pullback, after the last bullish wave

and BoS.

The price testing a powerful confluence zone based on a rising

trend line and a horizontal support.

With a high probability, it will rise now and reach 106.65 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#GBPAUD ShortI believe there is a short coming for GA is Friday/ end of the week. Usually, Fridays a bit tricky and risky but at times it continues the trend of Thursday close, and as of now is a strong bearish. Even though I like catching pullbacks, I just believe on a Friday, it will just liquidate is current trend and try to set up the bullish move next week. There is also no price down there in recent months which means orders are waiting to get tapped in and most of them are going to be sell stops because if price falls to that area everyone will predict it will fall as it creating new lows, until the market makers liquidate those sell stops and buy out those orders and push price bullish, while trapping retail traders and small banks. reversing the trend and there planning this move friday to set them up next week.

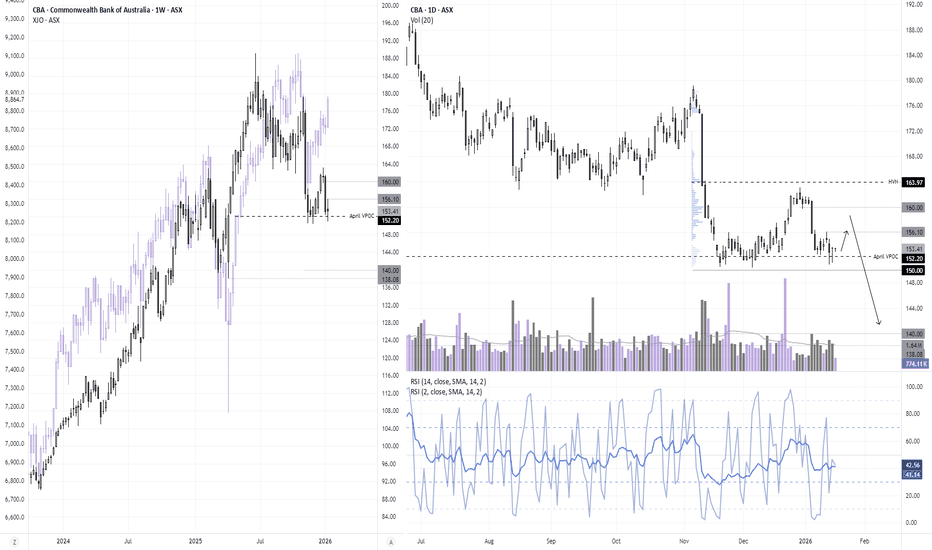

CBA To Bounce from Support?With the risk of Reserve Bank of Australia (RBA) hikes rising, the ASX financials sector could face further pressure ahead. I therefore retain my bias that CBA will eventually break below 150. For now, however, it continues to hold above this level while the broader ASX enjoys a materials-led bounce. The longer support holds, the greater the chance CBA attempts to close the gap with the ASX over the near term — provided the index itself does not roll over.

CBA remains above support despite Wednesday’s high-volume bearish candle, and a bullish pin bar has since formed. Bulls could look to fade dips within Thursday’s range for a minor counter-trend move towards the 156.10 high. A break above this level would open the door to a move towards 160.

Beyond that, I will continue to look for evidence of a swing high, in anticipation of an eventual break below 150.

Matt Simpson, Market Analyst at City Index

Simplicity at its best Simply liquidated previous day's highs, inversed a Fair Value Gap and the first bearish candle to close below a 5min low was confirmation to take a sell order.

I'll admit i experienced a bit of turbulence but because my SL was placed 10 ticks above most recent high, i avoided manipulation and went on to close a few hours later at tp

Catch Hood's 2026 bounce. Hello I am the Cafe Trader.

Today we’re looking at Robinhood (HOOD).

Last Year, we nailed the bottom.

Seasons of Range

Coming off that huge run, it is natural for HOOD to cool off. As you can see, we are Consolidating off those highs. Price has not found real demand yet, but it is working its way lower toward an area where buyers are likely to start showing interest.

Patience Pays

We are right in the middle of the range, if you were looking to go long, I have a great area to add to your long term or to play the reversal.

Long Idea

Entry: ~97 (Demand zone)

Stop: 87.76

TP: 131.90

Note:

This is a Wide demand range, The bounce can happen anywhere in this zone, so If you are adding to your long term you can Dollar Cost Average . If you are playing the bounce with the shorter term, or playing options, Then you will want to get aggressive where I have this entry.

Stay patient, Let the price come to you.

Happy Trading,

@thecafetrader

EURAUD SHORTMarket structure bearing on HTFs 3

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Weekly EMA retest

Daily Rejection at AOi

Previous Daily Structure Point

Around Psychological Level 1.75000

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 120%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

CADCHF LONGTrade IDEA 1 for 2026:)

Market structure bullish on HTFs DW

Entry at both Weekly And Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Daily Structure Point

Around Psychological Level 0.57500

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

Pullback in Financial ETFThe State Street Financial Select Sector SPDR ETF hit a new high last week, and now it’s pulled back.

The first pattern on today’s chart is October 3's final price of $53.72. XLF stayed below that weekly close most of the fourth quarter, stalling there in mid-November before breaking out in December. XLF tested that level yesterday before bouncing, which may suggest that old resistance has become new support.

Second, Wednesday’s rebound from lows produced a “hammer” candlestick. That’s a potentially bullish reversal pattern.

Third, the bounce occurred at roughly 50 percent of the distance between the November low and the high earlier this month. It’s also near the 50-day simple moving average (SMA). Do those points confirm its direction is pointing higher?

Next, the 20-day SMA is above the 50-day SMA. Both are higher than the 100- and 200-day SMAs. Such a sequence, with faster SMAs above the slower SMAs, may indicate a bullish long-term trend.

Finally, stochastics have dipped near oversold territory.

Standardized Performances for the ETF mentioned above:

SPDR Select Sector Financial ETF (XLF)

1-year: +13.33%

5-years: +85.79%

10-year: +183.05%

(As of December 31, 2025)

Exchange Traded Funds ("ETFs") are subject to management fees and other expenses. Before making investment decisions, investors should carefully read information found in the prospectus or summary prospectus, if available, including investment objectives, risks, charges, and expenses. Click here to find the prospectus.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.