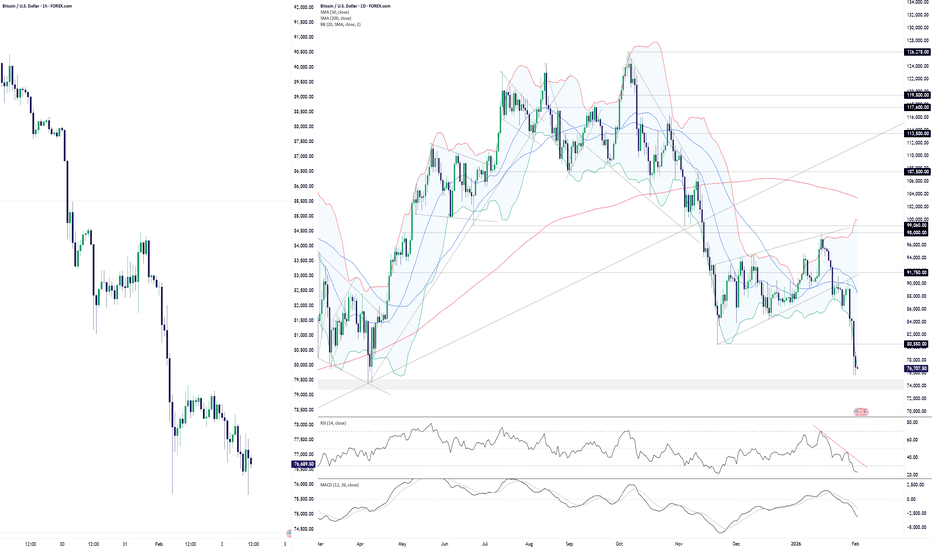

02.02.26 BTCUSD Chart AnalysisThere exists:

- The previous days' high and low,

- A fair value gap,

- A breaker Block.

Price is currently heading towards internal range liquidity in the form of the daily fair value gap.

From there, I believe price will head for external range liquidity which could be either the previous days high or the previous days low.

If Price is bullish, I believe price will retrace to the discount bullish fair value gap, respect it by closing within the range, create a stop hunt on the lower time frame, retest and expand bullishly.

Lets see,

Cheers.

Candlestick Analysis

British Pound - Never Trust Relative Equal LowsIt's More Obvious With GBP In Comparison To EUR When You Compare Both Prices To Each Other.

Euro Has Been Moving Whilst GBP Is The 'Sick Sister', Trailing Slowly Behind.

I Favour GBP Rather Than EUR As The Obvious Draw On Liquidity Is Evident.

1.36357 Is The 1st Price I Am Targeting Going Into The Middle Of This Week.

Short trade Pair: BTCUSD

Bias: Sell-Side

Date: Sun 1st Feb 2026

Session: NY Session AM

Entry: 77,873.26

Target: 70,607.88 (−9.33%)

Stop: 78,210.51 (+0.43%)

RR: 21.54R

Target Logic:

HTF liquidity + value re-pricing + structural support magnet

BTCUSD Sell-Side trade idea (1D / NY Session AM),

🧠 Market Sentiment — BTCUSD (Sell-Side Bias | HTF + NY AM)

Market sentiment is bearish-to-risk-off, with Bitcoin operating in a macro distribution phase following a prolonged expansion cycle. Price action shows failure to sustain above prior value and HTF resistance, with rallies increasingly sold into rather than accepted. The daily structure reflects weak upside follow-through, suggesting that bullish momentum has transitioned into exhaustion and re-pricing lower.

On the 5-minute timeframe, sentiment is bearishly aligned, confirming lower-timeframe acceptance of sell-side delivery within a broader HTF distribution context.

Price action shows compression beneath prior resistance, with multiple failed attempts to reclaim the premium / 0.75–1.0 PD Array. Each rally is being sold into, indicating that upside is functioning as liquidity for short positioning, not continuation.

Key 5-minute sentiment signals:

Lower highs forming beneath intraday resistance

Buy-side liquidity induced and absorbed above minor highs

Bearish displacement following each sweep

Price respecting discount PD Arrays (0.25–0.50) as magnets

This behaviour reflects active distribution, where market participants fade strength rather than defend dips.

DOW JONES INDEX (US30): Bullish Move After Trap

US30 will likely rise after a false violation of an intraday

horizontal support.

A double bottom pattern and the formation of a buying

imbalance candle indicate a strong bullish sentiment.

Goal - 48837

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver – When Overextended Conditions Finally Become Too MuchLast week set several records for Silver. First, another new all-time high was registered at 121.625 on Thursday in a volatile day that saw prices fluctuate wildly in a $15 range. It wasn’t known at the time but that was just a precursor for an even bigger move on Friday. A day which set the record for the biggest drop in Silver’s long trading history. A move which at one point saw prices slump 37% from an early morning high of 118.45 to a low of 73.67, before recovering slightly to close the week at 85.026, a daily fall of 26%.

The catalyst for Friday’s move was the decision of President Trump to nominate Kevin Warsh as the next Federal Reserve Chair, a position which he would take up in May. Warsh is seen by traders as more hawkish than other candidates for the role, meaning he may be less likely to cut interest rates as had initially been expected moving through 2026. This gave the US dollar a boost which weighted on Silver and triggered a wave of profit taking and stop loss selling.

Looking at the early price action this morning, it seems it may be too early to suggest that the excessive volatility for Silver is over, with prices opening the week at 80.71, jumping to a high of 87.91, before slumping again, currently trading down 10.5% at 75.909 (0615 GMT).

In situations such as this, referring to the technical outlook can be helpful to gain perspective. To establish the impact of recent moves on the trend outlook, as well as to identify the potential key support and resistance levels that could have an influence on where Silver prices may move next.

Technical Update: When Overextension Finally Becomes Too Much

It’s highly possible that the past few months of trading in Silver will be remembered as a textbook example of how bullish euphoria can extend far longer than expected, with barely any meaningful corrections seen until sentiment suddenly shifts and a sharp sell‑off erupts.

With this in mind, let’s look at how Silver prices entered this extended phase of strength, how it became so overextended for so long, and then consider if there is ever a clear signal that the advance is ending?

Why Did Silver Accelerate So Sharply?

Silver’s surge has been fuelled by a powerful combination of structural and psychological drivers. A deepening global supply deficit, now several years in the making, has collided with booming industrial demand from solar, EVs, electronics, and AI‑related manufacturing. This tightening backdrop has been reinforced by geopolitical tensions and macro uncertainty, which pushed investors toward hard assets and boosted safe‑haven flows into Silver as well as other precious metals.

Market psychology amplified the move. Once Silver began breaking major price milestones, momentum traders, retail speculators, and algorithmic funds all turned into aggressive buyers. Importantly, because Silver’s total market size is much smaller than Gold’s, these flows had an outsized impact on prices, creating a rally driven by confidence, momentum, and classic FOMO.

What This Meant for Silver’s Price Action

A combination of these forces produced a powerful, sustained advance. From the October 28th 2025 low to last Thursday’s high, Silver rallied 167% in an almost uninterrupted climb, reflected in the dominance of green candles throughout the move in the chart below.

During this phase, traditional “overbought” readings were ignored. Traders were willing to pay increasingly higher prices, unconcerned by how far the market had already run. Silver became a clear example of how overbought conditions can be dismissed if sentiment and trending measures remain firmly positive. Only when sentiment finally shifts do these stretched conditions matter, leading to the kind of violent snap‑back seen on Friday.

Was There Any Warning of a Sentiment Shift?

In truth, no.

The January 29th all‑time high at 121.625 didn’t result in a close above resistance at 120.973, the 261.8% Fibonacci extension. However, throughout the advance, several extension levels briefly slowed the trend before eventually giving way and triggering further upside. On its own, the inability to close above 120.973 wasn’t a meaningful warning, only Friday’s liquidation confirmed the shift.

Predicting the end of a euphoric phase like this is impossible. Only proactive risk management can protect traders.

That means monitoring price action closely and being willing to drop down to shorter‑term charts, such as the 1‑hour, to spot the earliest signs of a change in behaviour. Short‑term structures almost always highlight potential sentiment shifts first.

On the hourly chart above, the trend into the January 29th high was consistently positive, with each break above prior highs opening scope for further gains. Even when a new high temporarily capped the move, previous lows held as support, allowing the trend to resume.

The first real change came after the most recent record high at 121.625, when the sell‑off into Thursday’s lows at 106.71 was followed by a rally that failed to break the previous high and instead reversed lower. At that point, treating 106.71 as a key support, as it was now the last correction low in price, and placing stop losses just below it, would have been a prudent risk‑management step. No one could have predicted the speed of the subsequent collapse, but such an approach would have prevented exposure to the full extent of the decline.

What Is the Potential for Silver Now?

Looking forward to the week ahead, after a 39% drop from last Thursday’s all‑time high, uncertainty and volatility may continue to remain elevated, meaning adopting a more conservative approach to trading Silver could be sensible.

Friday’s sharp decline and activity so far this morning, is finding support at 74.530, which is the 61.8% retracement of the October 28th to January 29th advance. If this level holds on a closing basis and a recovery phase develops, traders may focus on resistance at 91.591, which is the 38.2% retracement of last week’s sell‑off. A closing break above this level could suggest scope for further upside.

If weakness resumes, closes below 74.530 may increase the risk of deeper declines, shifting attention to potential support to the December 31st low at 69.427 and possibly lower if that level fails.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

DXY (USD Basket) - Breakdown (Confirmation candle in progress)Expecting DXY to confirm the downtrend. We need a weekly candle close below the white trendline, which would mark a break of the trend that’s been intact since 2008. I expect this to be bullish for Bitcoin. Gold and silver have too much downside risk from here, in my opinion, while BTC/XAU looks more promising from a Risk/Reward perspective.

USD/JPY: Confirmed Change of CharacterThe USDJPY price violated a significant horizontal resistance level, specifically the most recent lower high within a minor bearish trend, and closed above it on a 4-hour timeframe.

This violation is considered a confirmed Change of Character, suggesting that the currency pair is returning to a bullish trend.

Further growth is now anticipated. The subsequent target is 154.72.

EURJPY: Morning Gap Trade 🇪🇺🇯🇵

EURJPY will most likely fill a gap up opening

after a confirmed bullish trap above an intraday resistance.

Goal - 183.48

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin Slide Deepens as BTC/USD Squeeze Risk BuildsBuying bitcoin right now looks a low probability play given the price action, resembling something closer to catching a falling knife, but it is extremely stretched. That creates the type of condition that could easily spark a countertrend squeeze given the speed and scale of the recent falls.

Looking at the daily timeframe on the right, RSI (14) continues to trend deeper into oversold territory, sitting at 22.03, similar to levels seen in November 2025 just ahead of a bounce. As was the case then, price is also trading below the lower Bollinger Band, again reinforcing how stretched bitcoin looks after falling more than 20% since mid January.

Of course, stretched short-term positioning and oversold conditions are not a reason to buy in isolation, particularly at a time when downside momentum is strengthening rather than slowing. However, with bitcoin now approaching a zone between $75,000 and $73,500 that has previously acted as both support and resistance, near-term price action above and within this area could prove instructive in assessing whether the risk of a countertrend squeeze is increasing.

Should a notable bottoming pattern emerge on a shorter timeframe such as the hourlies on the left, whether a hammer, bullish pin or a multi-candle formation like a morning star, the option would be there to buy with a stop below the recent lows. Initial upside targets would include the November 21 low at $80,550, with $85,000 another area of interest given price bounced there on multiple occasions prior to the latest breakdown.

Given the bearish message from both price action and oscillators, there is no need to move pre-emptively to set longs. For now, the idea remains firmly in watch-and-wait mode until a clear signal emerges.

Long trade 🟡 MGC1! — Sentiment & News Analysis (1-Hour)

Context: Bullish → pullback → potential re-accumulation

🧠 Market Sentiment Overview

Gold recently completed a strong impulsive expansion (multi-session trend leg)

Current move is a corrective retracement, not impulsive selling

Selling pressure is orderly and overlapping, characteristic of profit-taking

🧩 Structural Read

Higher-timeframe bullish structure has not been invalidated

Pullback is respecting prior expansion lows and imbalance zones

No decisive bearish BOS on the 1H — structure remains corrective

Trend context:

📊 Price Behaviour

Sharp move up created inefficiencies (FVGs) below

Market is now: Filling inefficiencies, Re-pricing into prior demand.

Wicks and rejection tails at the lows suggest responsive buying.

📰 News & Macro Context (Key Driver)

Recent Gold strength was driven by:

Softer real-yield expectations

Defensive allocation flows

Pullback likely influenced by:

Short-term USD stabilisation

Profit-taking after a steep % move

Importantly:

No hawkish shock

No structural USD breakout

🧾 Summary

MGC1! presents a high-timeframe buy-side re-accumulation opportunity following a sell-side liquidation event. Absorption at prior demand and intact bullish structure support a measured expansion toward external liquidity.

FVG Mitigation PhaseMarked a Fair Value Gap (FVG) from a recent imbalance while BTC is trending lower. The daily structure shows a break of the prior Market Structure Break (MSB), suggesting continuation risk toward the previous lows from April 25. Price appears likely to reach this level and potentially hold as support before exhibiting a Change of Character (CHOCH), signalling either a reversal to the upside or continuation of the downtrend.

AUDNZD BUY CALLAUDNZD – DAILY TIMEFRAME (BULLISH CONTINUATION SETUP)

Price has reacted cleanly off a well-defined DAILY DEMAND ZONE, confirming strong buyer interest after the recent pullback. This demand aligns with a previous structure low, showing that smart money is actively defending this area.

🔍 Market Structure Insight

The higher-timeframe structure remains bullish.

The pullback into demand was corrective, not impulsive.

Sellers failed to sustain price below the demand zone → sign of exhaustion.

📌 Support & Demand

Strong demand zone holding around 1.1520 – 1.1540

Multiple rejections confirm accumulation and buyer commitment

📈 Bullish Confirmation

Rejection wicks from demand

Strong bullish response after mitigation

Buyers stepping in ahead of previous support → early entry strength

🎯 Targets (Next Supply / Resistance Zones)

TP1: Previous resistance / minor supply around 1.1640

TP2: Major DAILY resistance & supply zone near 1.1750

🛑 Invalidation

A strong DAILY close below the demand zone invalidates this bullish bias.

🧠 Bias Summary

As long as price remains above demand, I expect buyers to push AUDNZD toward the next resistance zone, targeting the unfilled supply above. This setup favors buy continuation from demand into resistance.

Trade what you see, manage your risk, and let structure do the work.

In the next 1-2 weeks, the price is between 4600-5200.In the next 1-2 weeks, the price is between 4600-5200.

Gold spot prices fluctuated wildly last week, falling from a high of $5,602 on Thursday, January 29th, to a low of $4,679 on Friday, January 30th, a difference of approximately $900, marking the largest price swing since 1983. Looking at the daily candlestick chart, Friday's candlestick has a long lower shadow, indicating strong buying support below $4,800. The key level to watch in the first week of February is the psychological support level of $4,800, while the resistance level of $5,000. In the next 1-2 weeks, prices are unlikely to reach new highs, and are expected to fluctuate between $4,600 and $5,200.

H4: As shown in the chart, the long lower shadow on the last candlestick of the H4 pattern indicates support at $4800. However, a sharp drop will likely create selling pressure above $5000 due to buying pressure from the previous 1-2 weeks. In the coming days, a long position can be considered primarily in the $4580-$4820 range. Short positions can be considered around the $5000 psychological level and the $5250 resistance zone. See the strategy below for details.

H4 Strategy:

Buy Zone @ 4580 - 4820

SL: 40-80, TP: 120-240

Sell Zone 1 @ 4960 - 5080

SL: 40-60, TP: 120-180

Sell Zone 2 @ 5200 - 5300

SL: 40-60, TP: 120-180

Yen February view

- Where is price?

Price is in Area3 on the quarterly and area 4 on the monthly timeframe. February candle will open in area 4, making it a congestion entrance candle. Direction is turning up, slopes also up on the monthly, the qyarterly has still three months for the candle to form

- What is it doing?

February will be congestion entrance candle, notfying us that the next type of trading after the trend down up till now will be congestion action. The congestion entrance target is two PLDots back, limits of congestion action is the January candle low and high in this case

- What is next?

For the monthly to trade in congestion action, the weekly needs to trade between the dotted line and the block level which in this case is Jan candles low and high. Next week, there is strong support at the static ETOP where price will open and should continue to push price towards the congestion entrance target which should be reached within Feb. (0.006632).

DXY February analysis

- Where is price?

Price is in Area3 on the quarterly and area 2 on the monthly timeframe. January candle is finished and February candle will also open in Area 2, below the current live EBOT which will become static EBOT on monday. Price is in c-wave down on the monthly time frame. Direction is down, slopes are down

- What is it doing?

On the monthly timeframe, price is in c-wave down, and opening below the static EBOT, price will usually find resistance there and continue the c-wave down to the exhaus areas. Direction is down and slopes are down, Areas 3-6 are down. For that to happen the weekly needs to find resistance at the next weeks EBOT and continue with the c-wave down.

- What is next?

The monthly will continue its c-wave down with strong resistance at the next months live PLdot (currently at 97.7 to the static PLdot at 98.52) and support at 94.828 - 94.663 which is the static Area 1 bottom and the quarterly 5-9 up. If the probable PLdot refresh has enough energy, then it might go in February to the extremely strong support at 91.5.

Failed breakout EUR/USD at crossroadsEUR/USD failed to breakout and formed a gravestone doji candle last week

further downside to the 1.175 level is likely

after that, EUR/USD is at crossroads - with Warsh being nominated and the narrative leaning heavily hawkish - EUR should retrace further targetting 1.13

only when the narravtive softens around Warsh to a less restricting policy expectation EUR could aim for 1.23

Nifty Analysis EOD – February 1, 2026 – Sunday🟢 Nifty Analysis EOD – February 1, 2026 – Sunday 🔴

STT Shockwave: Nifty’s 800-Point Budget Bloodbath!

🗞 Nifty Summary

Budget-26 delivered a session of extreme emotional turbulence and unprecedented volatility. The market’s movement today can be categorized into three distinct phases:

1. Pre-Budget (The Calm): Until 10:00 AM, Nifty remained in a disciplined 95-point range. A breakout of the HTF Trendline and IBH saw the index climb steadily toward resistance levels at 25,370 and 25,430.

2. During Budget (The Confusion): After marking the day’s high, the index began to slip. The sentiment turned sour following the announcement of an STT (Securities Transaction Tax) rise. Initially, options premiums remained subdued as the market processed the news.

3. Post-Budget (The Chaos): After 11:55 AM, the floodgates opened. A massive manipulation candle at 12:05 PM triggered aggressive long unwinding and fresh short build-ups. Amidst a vacuum of buyers and rampant panic, Nifty plummeted 800 points (3.15%) in just 25 minutes, crashing from 25,370 to a floor of 24,571.75. An immediate V-shaped recovery retraced back to 25,120, but the strength was fleeting. The index eventually gave back 400 points of that recovery to close at 24,770.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

Today was not a day for the faint-hearted. The 12:05 PM candle will go down in history as a “liquidity vacuum” where the absence of buyers led to a vertical freefall.

The V-shape recovery was purely a product of profit-booking and high-risk bottom fishing, but the final close below 24,800 indicates that the market is still reeling from the tax implications.

We are now in a “no-man’s land” technically; we must wait for the dust to settle before building a fresh structural view.

📉 Daily Time Frame Chart with Intraday Levels

⚔️ Gladiator Strategy Update

ATR: 254.37

IB Range: 104..20 → Medium

Market Structure: Balanced

Trade Highlights:

10:11 Long Trade: Target Hit (1:2.47) (HTF Trendline Breakout).

11:08 Long Trade: SL Hit (R1 Breakout attempt failed as news leaked).

12:01 Short Trade: SL Hit (Initial IBL breakdown whipsaw).

12:15 Short Trade: Trailing Target Hit (1:4.36) (The “Big One” — IBL + PPDL Breakdown).

Trade Summary: The morning provided a clean winner, but the mid-day news shift resulted in a choppy period. However, the strategy excelled during the panic; the 12:15 PM short entry captured the meat of the 800-point fall, delivering a massive 1:4.36 R:R that turned a difficult day into a highly profitable one.

🧠 Final Thoughts

“Panic has no logic, and neither does a 3% fall in 25 minutes.”

The Budget has fundamentally altered the playing field. The STT news was the catalyst for a structural reset.

For now, there is nothing next but to wait.

We need the index to find a new equilibrium and for the weekly expiry to clear the “bad blood” from the system.

Stay away from the noise, protect your capital, and let the market settle.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

BTCUSD - Cycle Analysis UpdateHi guys! 👋

🔔 As you can see on the chart, we are following the setup precisely.

🔔 I'm still expecting another red candle to complete the Three Black (Red) Crows pattern.

🔔 The third red candle will signal us for a short-term uptrend to revisit $100K and have a steep drop.

🔔 There's also a chance of having an extended impulsive moves which consists of 9 waves.

🔔 Nevertheless, the next week's candle is much important. The original Cycle Analysis is attached to this article.

✊ Good luck with your trades! ✊

• If you like the idea, hit the 🚀 button

• Please ✍️ your thoughts in the Comments section

• And follow me for more updates.