USD/JPY Plunges: Intervention & Market AnalysisA multi-domain dissection of the Japanese Yen’s sudden resurgence and its global impact.

The Macroeconomic Shift: Hawkish Signals

The Japanese Yen (JPY) staged a dramatic recovery this week, surging 3.6% against the US Dollar in just two sessions. The catalyst was the Bank of Japan’s (BoJ) January 2026 policy meeting. While the BoJ held interest rates at 0.75%, the accompanying report was decidedly hawkish. The central bank raised inflation forecasts for fiscal 2026 and 2027, signaling a commitment to policy normalization. This shift creates a critical divergence: as the US Federal Reserve stabilizes, Japan is tightening, narrowing the interest rate differential that historically suppressed the yen.

Management and Leadership: A Break from Consensus

A significant cultural shift is occurring within Japan’s monetary leadership. The BoJ’s decision featured a rare 8-1 vote split, with one board member dissenting in favor of an immediate hike to 1.0%. This deviation from traditional Japanese corporate consensus culture signals a new era of aggressive policy debate. Furthermore, Prime Minister Sanae Takaichi has staked her political capital on stabilizing the currency, warning of "bold action" against abnormal movements. This alignment between political will and central bank policy empowers the Ministry of Finance to act decisively.

Geopolitics and Geostrategy: The Global Risk Matrix

Currency markets are reacting to a heightened geostrategic risk profile. The recent US escalation regarding Greenland and associated tariff threats have injected volatility into the Atlantic alliance, driving capital toward safe-haven assets. This follows earlier instability involving US-Venezuela relations. In times of acute geopolitical stress, the yen historically competes with the US Dollar and Swiss Franc as a refuge. The current "triple threat" of trade wars, military posturing, and monetary tightening is accelerating yen repatriation.

Technology and High-Frequency Trading

The mechanics of the recent move suggest algorithmic involvement. Reports indicate the Federal Reserve conducted "rate checks" inquiries into bank position sizes at the London close on Friday. In the world of high-frequency trading (HFT), this acts as a digital signal flare. Algorithms interpret these checks as a precursor to physical intervention, triggering cascading sell orders on USD/JPY. This highlights the cyber-sensitivity of modern FX markets, where regulatory signaling can execute market corrections faster than actual capital deployment.

Industry Trends and Patent Analysis

The volatility in USD/JPY critically impacts Japan’s high-tech export sector. Companies like Sony and Toyota rely on stable exchange rates to fund long-term R&D and patent filings. A rapidly strengthening yen squeezes repatriated profits, potentially forcing a contraction in innovation budgets. Patent analysis suggests that Japanese firms maintain a "defensive moat" of intellectual property; however, maintaining this advantage requires consistent capital flow. If the yen appreciates too rapidly, it risks eroding the profit margins that fuel Japan’s science and technology leadership.

Economics and Commodity Correlation

The currency shock has spilled over into commodity markets. Silver surged 6% to reach $110/oz, driven by the weaker dollar and the unwinding of the "carry trade." When the yen strengthens, global investors who borrowed cheaply in yen to buy assets like silver or stocks are forced to sell those assets to repay loans. This "unwind" creates a correlation where a stronger yen often leads to temporary liquidity shocks in other sectors, threatening the stability of equity markets like the Nikkei 225.

Future Outlook: The Intervention Cap

Goldman Sachs analysts argue that "intervention risk" now acts as a soft cap on USD/JPY upside. While the currency may technically warrant weakness based on fundamental fiscal risks, the threat of state action limits speculative shorting. Traders must now navigate a market where price discovery is driven not just by economics, but by the looming threat of coordinated government suppression.

Carrytrade

USDJPY rallies on BOJ's "dovish hike": Is 158.00 next target?USDJPY is surging past 156.00 despite the BOJ raising rates to 0.75%, the highest level since 1995. This classic "buy the rumour, sell the fact" reaction is fuelled by Governor Ueda's cautious guidance, signalling no rush for further hikes. A lack of commitment to a neutral rate path has kept the carry trade alive.

Key drivers

"Dovish hike" Reaction : The BOJ raised rates to 0.75% as priced in, but Governor Ueda emphasized a "data-dependent" approach with "no pre-set path," disappointing hawks hoping for a rapid tightening cycle.

Neutral rate uncertainty : Ueda admitted it's "challenging to pinpoint" the neutral rate and wants to observe the economy's reaction first, implying a pause that leaves the wide yield gap with the US (3.5%+) intact.

Technical breakout : USD/JPY has cleared the 156.00 resistance zone, confirming a bullish flag breakout on the daily chart. RSI resetting near 50 supports further upside potential.

Key targets : Immediate focus is on the swing high at 157.00, followed by the 2025 peak at 157.93 and the 138.2% Fibonacci extension at 158.77.

Trade plan : Bias is bullish above 156.00. Look to buy pullbacks into the 156.00–156.20 support zone, targeting 157.00+; invalidation below 155.00.

Are you buying the BOJ breakout? Share your USD/JPY targets in the comments and follow for more central bank and technical trade setups.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

BOJ to Stress Test Global Markets? Why a Black Swan Is PossibleWhile US markets are busy debating AI valuations and parsing the Fed’s latest rate cut , something far more understated — and potentially more disruptive — is brewing across the Pacific.

The Bank of Japan is expected to raise interest rates on Friday, marking what could be its first hike in 11 months. That might not sound dramatic by global standards, but in Japan (where ultra-low rates have been a defining feature for decades) it’s the equivalent of flipping a very large switch.

It’s a moment that could stress test global markets, from US equities to crypto markets and beyond. And yes, that includes your favorite high-beta names.

💴 The Yen Problem

The backdrop here is deceptively simple. Despite narrowing interest rate spreads between the US and Japan, the yen has remained stubbornly weak , even as US yields have cooled.

Normally, shrinking rate differentials would support the yen. Instead, Japanese investors have continued to bet on US equities, keeping dollars in demand and the yen under pressure. In other words: the textbook relationship broke down.

That divergence — between what rates say should happen and what FX markets are doing — is increasingly uncomfortable. Forward rate markets are already hinting that the current setup isn’t sustainable, and that yen appreciation may be waiting just ahead.

For the BOJ, patience has its limits.

🏦 Why the BOJ’s Hand Is Being Forced

The BOJ has been cautious to a fault over the past two years, moving slowly and communicating carefully. But a weak currency is difficult to ignore forever.

A rate hike this week, especially if paired with guidance that more tightening could follow, would signal something bigger than a single policy move. It would mark the beginning of a potential yen-strengthening cycle.

And that’s where things get interesting — and a little dangerous.

🧳 The Carry Trade: Cheap Yen, Expensive Consequences

For years, the yen has been the funding currency of choice. Borrow cheaply in Japan, convert to dollars, and deploy the cash into anything that smells like yield or growth.

Stocks? Nvidia NASDAQ:NVDA , Microsoft NASDAQ:MSFT , the Magnificent Seven.

Crypto? Bitcoin BITSTAMP:BTCUSD and friends.

Fixed income? US bonds, credit, you name it.

Just about every hedge fund manager on the planet has had some version of this trade on. And then some. Estimates suggest more than $20 trillion has been borrowed in yen and scattered across global risk assets.

Since the BOJ’s last rate hike, about half of that — roughly $10 trillion — has already been unwound. That still leaves a massive amount of exposure tied to the assumption that yen funding stays cheap and stable.

That assumption is now being questioned.

🧮 A Simple Example With Uncomfortable Math

Say you borrowed 100 million yen when FX:USDJPY was at ¥160. That loan was worth about $625,000. You used it to buy a mix of meme stocks, AI leaders, maybe a little crypto — because why not, it’s free money after all, right?

Now imagine the yen strengthens by 10%, pushing FX:USDJPY down to ¥140. Suddenly, that same loan is worth $714,000.

Nothing went wrong with your stocks. Nvidia NASDAQ:NVDA didn’t crash. Bitcoin BITSTAMP:BTCUSD didn’t implode. But your liability just grew by nearly $90,000.

At that point, selling isn’t about market conviction — it’s about liquidity. You sell what you can, not what you want.

⚠️ Why This Could Become a Stress Test

This is where the word “Black Swan” starts getting thrown around — not because one asset is broken, but because forced selling doesn’t ask permission.

If the BOJ hikes and signals more to come, carry trades get squeezed. Borrowing costs rise. Currency losses pile up. And assets across the risk spectrum can face pressure — not due to fundamentals, but because traders need to cover yen loans before the math turns hostile.

That’s how correlations spike. That’s how unrelated markets suddenly move together. And that’s how calm conditions can flip fast.

🧭 What Traders Should Watch Next

The BOJ decision itself matters — but the guidance matters more. A one-off hike is manageable. A roadmap toward further tightening changes everything.

If the yen begins a sustained strengthening cycle, it could reshape flows across global markets well into 2026. The AI trade may still be intact and US growth may still look solid. But funding conditions would no longer be as forgiving.

In markets, the most dangerous moments often arrive quietly — announced in polite language, during meetings most people aren’t watching.

Off to you : Are you worried about Friday’s decision and subsequent market reaction? How do you think it’ll go? Share your views in the comment section!

USD/BRL: Is the Real’s High Yield a Trap?The Brazilian Real (BRL) stands at a paradox in late 2025. Local innovation thrives, yet the currency weakens against the US Dollar (USD). UBS analysts forecast the USD/BRL exchange rate will hit 5.50 by mid-2026. This analysis explores the hidden friction points driving this forecast.

Macroeconomics: The Deficit Reality

Brazil’s fiscal health remains the primary drag on the currency. The Central Bank is expected to hold rates at 15% through 2025. This creates a lucrative "carry trade" for foreign investors. However, high yields cannot mask the growing deficit. UBS calculates the true current account deficit at 4.2% when including stablecoin flows. This figure reveals deeper structural fragility than official headline numbers admit.

Geopolitics: The BRICS Dilemma

Brazil’s strategic maneuvering within the BRICS alliance complicates the Real’s outlook. The administration actively pushes to reduce reliance on the US Dollar. This political stance introduces significant market volatility. Furthermore, potential US tariffs on emerging markets create a "risk-off" environment. Investors retreat to the Dollar's safety, adding downward pressure on the BRL. Brazil must balance trade with China against the necessary US investment.

Fintech & Business Models

Brazil’s financial sector provides a critical defense for the currency. The Pix payment system has revolutionized money velocity and reduced transaction costs. Fintech giants are exporting this low-cost banking model globally. These successes prove Brazilian firms can compete internationally. Such innovation attracts essential foreign venture capital, sustaining investment flows that support the Real.

Agri-Tech & Patent Analysis

Agriculture remains the backbone of the economy. Recent patent data ranks Brazil fourth globally in harvesting technology innovations. Biotechnology advancements are boosting crop yields significantly. These scientific breakthroughs lower production costs and improve terms of trade. Efficient agricultural exports provide a vital floor for the currency against external shocks.

Cyber Security & Digital Risk

The digital economy introduces new vulnerabilities. Huge financial flows are now linked to stablecoins and crypto assets. This surge demands a robust cybersecurity infrastructure. Brazil is rapidly expanding its "Cyber-Defense" capabilities to protect these digital assets. This industry maturation reassures global investors. It lowers the perceived risk of deploying capital into the country's digital infrastructure.

Leadership & Corporate Culture

Brazilian corporate culture is maturing rapidly. Executives are moving away from improvisation toward rigorous, data-driven compliance. Banks now aggressively employ AI for precise credit risk management. This shift aligns management practices with strict global standards. It reduces the "governance discount" often applied to Brazilian assets, instilling greater confidence in institutional investors.

Conclusion: A Complex Outlook

The USD/BRL trajectory represents a clash of opposing forces. High interest rates and a booming tech sector support the Real. However, fiscal debt and geopolitical friction pull it down. Traders must tread carefully. The yield is high, but the structural risks are rising.

'Sell Japan' trade opens door to 160 USDJPY on fiscal concernsUSDJPY has ripped through 157 with RSI pushing near extreme overbought, and the pair is now magnetised towards a key Fibonacci and prior-high cluster around 158.70–159.

In this video, I break down how the FOMC minutes maintained the recent status quo from the Fed, while blockbuster Nvidia earnings and Japan’s significant new stimulus package have combined to drive the latest leg of the USD/JPY rally. On the chart, the focus is a completed triangle breakout above 155 and an upside trajectory toward 158.70, 160 and potentially the 162 high reached in 2024.

Key drivers

Fed minutes offer no signals that policymakers should cut in December, keeping US yields and the dollar supported.

Nvidia’s earnings beat and guidance have boosted risk appetite and underpinned broad USD strength.

Japan is finalising a ¥17–21 trillion stimulus package, stoking fiscal concerns and encouraging a “sell Japan” trade that weakens the yen.

USDJPY has broken out our prior target of 155 from a triangle pattern, with Fibonacci projections and prior highs aligning around 158.70–159, then 160–162.

If you find this USDJPY roadmap useful, drop your trade levels in the comments and follow for more Fibonacci-based, fundamentals-plus-technical setups in real time.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

USDJPY breakout: Can the rally extend toward 155?The dollar-yen pair smashed through 150 with one of the strongest breakouts recently, confirming a new technical phase as it trades above the 61.8% Fib retracement. Here’s what’s fuelling the move and what traders should watch next:

Dollar strength returned as safe haven flows dominate, even with a US government shutdown, while Japan’s new prime minister’s dovish signals are sending the yen into freefall.

Key drivers

Safe haven flows : Investors seek shelter in the dollar as global uncertainty rises; DXY index hit a 6-week high.

Yield differentials : The Fed/BOJ spread powers further carry trade buying as Japanese rates remain ultra-low.

Japanese political shift : PM Takaichi’s win spurs fiscal stimulus and pushes back market hopes for BOJ tightening, deepening yen weakness.

Technical breakout : Clean break above multi-year resistance and 61.8% Fibonacci retracement; watch for support validation and continuation toward the next 78.6% Fib at 154.80.

What to watch

Holding above 150 and 61.8% Fib support sets the stage for a bullish continuation.

Profit taking is possible near 153.25–154.80, as RSI shows signs of overbought.

Tonight’s FOMC minutes, Thursday’s BoJ/Ueda speech, and political headlines could trigger sharp moves.

Cross-pair momentum : EURJPY at record highs, GBPJPY surging, confirming broad-based yen weakness.

The bulls are in control as long as USDJPY stays above 151.15–150.50. Pullbacks to support offer opportunities to buy dips, with 154.80 as the next bullish target. Keep stop losses disciplined, and don’t ignore the chance for sharp reversals if intervention or a dramatic shift in sentiment emerges.

For more actionable FX insight, follow ThinkMarkets.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

CADJPY carry trade gains traction with iH&S, targets 118+The CADJPY carry trade is in focus as the yen stays weak and risk appetite lifts CAD toward a bigger breakout from an inverse head-and-shoulders base.

Japan’s new PM, Takaichi, leans pro‑stimulus, while the BOJ signals no December hike, leaving JPY structurally soft. At the same time, Canada benefits from improved risk tone and a stable BOC policy, which supports CAD strength.

Key drivers

Structural JPY weakness: A stimulus-first stance and low-rate BOJ keep carry demand elevated, but intervention talk remains a headline risk.

CAD tailwinds: US reopening-driven risk-on, oil support, and BOC on hold underpin the loonie.

Technicals: An inverse H&S with a neckline projection toward 116–117, with a recent retest near 108–109 holding the line and RSI having room to push higher.

Levels: supports at 110.00, then 109.50/108.30, and resistances at 111.50, 112.20, and 115.10, with the measured move pointing toward 116.5–118 from the neckline break.

Bias stays long above 110. Buy dips, invalidate below 108, and scale targets at 111.50, 112.20, and 115.10, leaving a runner at 116.5–118 if the first neckline peak holds.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Carry Trade Profits in the Global Market1. Understanding the Concept of Carry Trade

Carry trade refers to a financial strategy that exploits the difference in interest rates between two countries. Traders borrow funds in a low-yielding currency (called the funding currency) and invest them in a high-yielding currency (called the target currency). The profit from this strategy arises from the interest rate differential — known as the carry.

For instance, if Japan’s short-term interest rate is 0.1% and Australia’s is 4%, a trader can borrow in Japanese yen (JPY) and invest in Australian dollars (AUD). Theoretically, this generates a profit of 3.9% annually, assuming the exchange rate remains stable.

Carry trade profits are not merely theoretical; they are among the major drivers of cross-border capital movements and global liquidity. They depend heavily on macroeconomic stability, monetary policies, and risk appetite in the global market.

2. The Mechanism of Carry Trade

The process of executing a carry trade involves several steps:

Borrowing in the Low-Interest Currency:

Traders borrow funds in a currency where interest rates are minimal. Historically, currencies like the Japanese yen (JPY) and Swiss franc (CHF) have been popular funding currencies due to their ultra-low rates.

Converting and Investing in High-Yielding Assets:

The borrowed funds are converted into a high-yielding currency (such as the Australian dollar, New Zealand dollar, or Brazilian real) and invested in assets like government bonds, corporate debt, or even equities offering higher returns.

Earning the Interest Differential (Carry):

The profit is the difference between the interest paid on the borrowed currency and the interest earned on the invested currency.

Closing the Trade:

Eventually, the investor reverses the process—converting the investment back to the funding currency to repay the borrowed amount. If exchange rates have remained stable or moved favorably, profits are realized.

3. Historical Context and Examples

Carry trades have been instrumental in shaping financial markets over several decades:

Japanese Yen Carry Trade (1990s–2008):

After Japan’s economic bubble burst, the Bank of Japan cut interest rates to nearly zero. Investors borrowed cheap yen and invested in higher-yielding currencies like the U.S. dollar (USD), Australian dollar (AUD), and New Zealand dollar (NZD). This strategy thrived during periods of market stability, contributing to global asset bubbles before the 2008 financial crisis.

Swiss Franc Carry Trade:

The Swiss National Bank maintained low interest rates for years, making the franc an attractive funding currency. However, when the Swiss franc appreciated sharply in 2015 after the SNB removed its euro peg, many carry traders suffered significant losses.

Emerging Market Carry Trades:

Investors often exploit high interest rates in countries like Brazil, Turkey, South Africa, or India. For instance, borrowing in USD or JPY and investing in the Brazilian real (BRL) can yield high returns when emerging markets are stable.

4. The Role of Interest Rate Differentials

The heart of carry trading lies in interest rate differentials — the gap between the borrowing rate and the investment rate. Central bank policies significantly influence these differentials. When central banks like the Federal Reserve, European Central Bank (ECB), or Bank of Japan adjust their rates, global carry trade flows react instantly.

For example, if the U.S. Federal Reserve raises interest rates while Japan keeps them low, the USD becomes more attractive, potentially reversing yen carry trades. Traders must therefore monitor global monetary policies closely, as sudden shifts can either magnify profits or wipe them out.

5. Factors Affecting Carry Trade Profitability

Carry trade profits depend on multiple interconnected factors:

Exchange Rate Stability:

The biggest threat to carry trades is currency fluctuation. If the high-yielding currency depreciates against the funding currency, the losses from exchange rate movements can easily outweigh interest gains.

Interest Rate Differentials:

A widening differential boosts carry returns, while a narrowing one reduces profitability.

Risk Appetite and Market Sentiment:

Carry trades flourish during periods of global economic stability and investor optimism (risk-on environments). When fear or uncertainty rises (risk-off sentiment), traders rush to unwind carry positions, leading to sharp currency reversals.

Global Liquidity Conditions:

Easy monetary policies and quantitative easing increase global liquidity, encouraging carry trade activities. Conversely, tightening liquidity discourages such trades.

Geopolitical Risks:

Political instability, wars, or sanctions can disrupt currency markets, leading to unexpected volatility and losses.

6. Carry Trade and Exchange Rate Dynamics

Carry trading influences exchange rates globally. When investors borrow in a funding currency and invest in a high-yielding one, demand for the target currency increases, causing it to appreciate. This appreciation can reinforce returns in the short run. However, if markets suddenly turn risk-averse, the reverse occurs — massive unwinding of carry positions leads to depreciation of the target currency and appreciation of the funding currency, often triggering volatility spikes.

A notable example occurred during the 2008 global financial crisis, when investors unwound their yen-funded positions en masse, causing the yen to surge sharply while high-yielding currencies plunged.

7. Measuring Carry Trade Performance

Professional investors use several metrics to evaluate carry trade performance:

Interest Rate Differential (IRD):

The expected annual return from the interest rate gap between two currencies.

Forward Premium/Discount:

The difference between spot and forward exchange rates, reflecting market expectations.

Sharpe Ratio:

The risk-adjusted return measure used to assess the profitability of carry trades relative to volatility.

Uncovered Interest Rate Parity (UIP):

According to UIP, currency exchange rates adjust to offset interest rate differentials, meaning there should be no arbitrage profit. However, empirical evidence shows UIP often fails in reality — creating room for carry trade profits.

8. Benefits of Carry Trade

Attractive Yield Opportunities:

Investors can earn higher returns compared to traditional assets, especially when interest rate gaps are wide.

Portfolio Diversification:

Carry trades allow exposure to multiple currencies and economies, improving portfolio risk balance.

Liquidity and Leverage:

The forex market’s deep liquidity and access to leverage make carry trades easily executable and potentially highly profitable.

Macroeconomic Insights:

Understanding carry trades provides insights into global monetary policy trends, capital flows, and risk sentiment.

9. Risks and Challenges in Carry Trade

Despite its appeal, carry trade is inherently risky:

Exchange Rate Volatility:

Even small currency movements can nullify interest rate gains, especially with leverage.

Sudden Policy Shifts:

Central banks’ unexpected rate hikes or currency interventions can disrupt positions.

Liquidity Risk:

During crises, funding markets can freeze, making it difficult to close positions at favorable rates.

Crowded Trade Risk:

When too many traders hold similar carry positions, sudden reversals can amplify losses, as seen in the 2008 crisis.

Interest Rate Convergence:

Narrowing rate differentials can reduce profitability and make carry trades unattractive.

10. Modern Developments in Carry Trade

In recent years, technological and structural changes in financial markets have transformed carry trading:

Algorithmic and Quantitative Models:

Sophisticated algorithms now execute carry strategies using real-time macroeconomic data, optimizing entry and exit points.

ETFs and Derivative Products:

Exchange-traded funds (ETFs) and derivatives allow retail and institutional investors to gain exposure to carry trade returns without direct currency borrowing.

Emerging Market Focus:

Investors are increasingly targeting emerging economies offering high yields, though at the cost of higher volatility.

Impact of Global Rate Cycles:

The post-COVID monetary environment, characterized by aggressive rate hikes followed by normalization, has reshaped traditional carry trade opportunities.

11. Case Study: The Yen Carry Trade in the 2000s

Between 2003 and 2007, the yen carry trade became a dominant global phenomenon. Japan’s interest rates were near zero, while economies like Australia, New Zealand, and the U.S. offered higher yields. Investors borrowed trillions of yen to invest abroad, pushing global equity and commodity prices upward.

However, when the financial crisis hit in 2008, investors fled risky assets, causing a rapid unwinding of carry trades. The yen appreciated sharply against the dollar, and many investors suffered massive losses. This event demonstrated how carry trades can amplify both booms and busts in global markets.

12. The Future of Carry Trades

The profitability of carry trades in the modern global economy depends on several evolving dynamics:

Interest Rate Normalization:

As global central banks return to moderate interest rate levels, carry opportunities may reemerge, particularly between developed and emerging markets.

AI and Predictive Analytics:

Machine learning models are increasingly used to forecast exchange rate movements, improving carry trade timing.

Geopolitical and Inflationary Pressures:

Persistent geopolitical tensions, inflation, and deglobalization trends may increase currency volatility, posing new challenges for carry traders.

Green Finance and ESG Considerations:

Sustainable finance trends could influence capital allocation patterns, potentially affecting carry trade flows into emerging economies.

Conclusion

Carry trade remains one of the most powerful yet risky tools in global finance. Its allure stems from the ability to generate profits from simple interest rate differences — a concept that encapsulates the essence of international capital mobility. However, the strategy’s success depends on stable macroeconomic conditions, disciplined risk management, and accurate forecasting of currency dynamics.

In times of global stability and optimism, carry trades can deliver consistent profits and contribute to global liquidity. But in periods of uncertainty or crisis, they can reverse sharply, amplifying volatility and risk contagion. As the global economy continues to evolve through cycles of inflation, monetary tightening, and digital innovation, carry trade will remain a central, albeit double-edged, element of the international financial landscape.

The dance between the USDZAR and (ZA10Y - US10Y)The chart shows the relationship between the USDZAR and the yield differential between the SA 10-year and the US 10-year (ZA10Y – US10Y).

2025 has been a wild ride for the rand and it has managed to put up a remarkable recovery in the 2Q2025 but where to now for the pair? The pair has not traded below the 200-week MA currently at 17.62, since the March 2022 just before the global rate hiking cycle. The only previous times the pair traded below this moving average was briefly in 2021 before the June/July riots in SA and during the “Ramaphoria” period in 2018.

The 200-week MA also coincides with the 38.2% Fibo retracement from the low in 2021. A brief break below these two support levels will allow the pair to fall onto the 50% Fibo retracement level at 16.62. The yield differential is however suggesting that the rand may not have much room to pull the pair too far below the 200-week MA. The brief break below the 5.00% during December 2024 and January 2025 was a bit of an anomaly given the volatility in the US bond market and I still believe 5.00% is a hard support for the yield differential. A bottom out of the yield differential could see it rise higher towards 7.50% which will be rand negative should the positive correlation hold.

To summarise, the yield differential is suggesting that the rand’s 2Q2025 recovery may be on its last legs but a break below the 200-week MA will allow the rand to pull the pair towards 16.50. I don't see the rand maintaining levels below 16.50 and this level seems like a long-term floor for the pair before another 5-wave impulse to the topside.

Historical trend analysis:

The SA rand is one of the most attractive emerging market currencies due to the carry trade appeal of the currency coupled with SA’s deep and liquid bond market. During periods when there is significant buying pressure on SA bonds, the SA yields will decrease meaning that the yield differential (ZA10Y-US10Y) decreases while in periods when SA bonds are selling off, yields on SA bonds will increase which increases the yield differential, citrus paribus. The USDZAR pair is thus positively correlated with this yield differential.

The chart goes back to 2018 when the USDZAR hit a low of 11.50 following the period dubbed the “Ramaphoria” period. Investor sentiment swinged aggressively positive in this period and the flow of international funds into the SA bond market saw the yield differential drop to a low around 5.00%. The yeld differential has never dropped below this level until early 2025 as indicated on the chart.

The yield differential and the USDZAR pair moved in tandem all the way through to the 1Q2022, maintaining its strong positive correlation. The next period marked the start of the global hiking cycle which saw the US 10-year yield rise from a low of 1.65% in March 2022 to a high of 5.00% in October 2023. This aggressive rise in US 10-year yields marked a period of extensive risk off sentiment and even caused a US banking crises in March 2023. The Fed stepped in and briefly paused their QT to add liquidity to system and provided the US banking system with the bank term funding program to patch up the cracks. The rand sold off due to risk off investor sentiment while the US 10-year yield rose due to the start of the rate hiking cycle which reduced the yield differential. The USDZAR climbed to a high of 19.90 in May 2023 while the yield differential dropped to a low of 7.50%. The yield differential continued to fall until the US 10-year yield topped out at 5.00% in October 2023, after which the positive correlation between the USDZAR and the yield differential was restored.

The next period marked positive sentiment towards SA following the election results and the formation on the government on national unity (GNU). Coupled with the end to the rate hiking cycle, the rand had the wind and risk on investor sentiment in its sails which allowed the rand to pull the pair to a low of 17.03. The optimism of the GNU and the realisation on another Trump presidency however saw the pair bottom out in September 2024. During the last quarter of 2024 the rand experienced sustained selling pressure while the yield differential continued to fall. The break in correlation was largely due to the US10-year yield climbing from 3.60% in September 2024 to a high of 4.80% in January 2025.

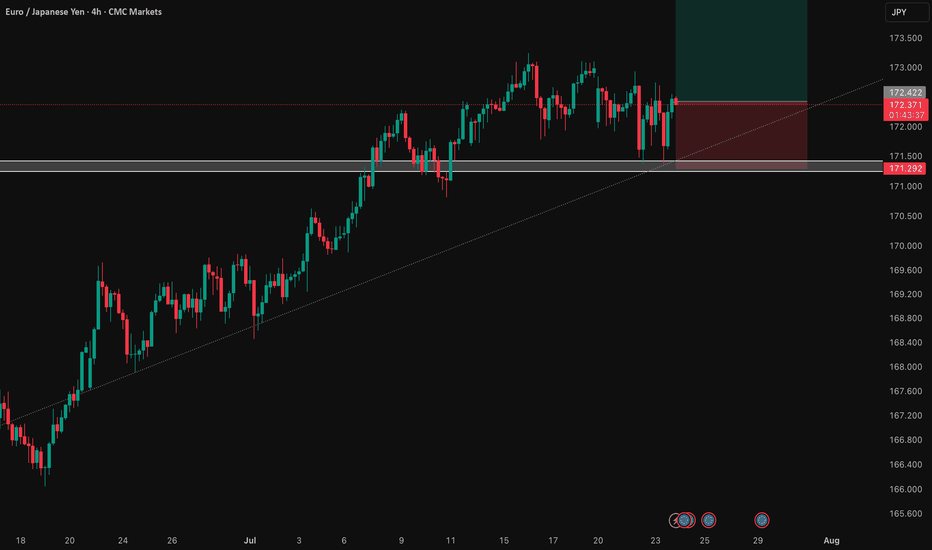

EUR/JPY: Bullish Thesis on Policy DivergenceOur primary thesis is built on a powerful confluence of compelling fundamental drivers and a clear technical structure. We are taking a long position in EUR/JPY with high conviction, anticipating significant upside fueled by a stark monetary policy divergence confirmed by a constructive chart formation.

📰 Fundamental Analysis: The core of this trade is the widening policy gap between the European Central Bank (ECB) and the Bank of Japan (BoJ). While the BoJ is only just beginning to exit its ultra-loose monetary policy, the global environment points toward continued JPY weakness. The upcoming high-impact US news will act as a major catalyst. A "risk-on" reaction to the data would significantly weaken the JPY, providing a strong tailwind for this trade.

📊 Technical Analysis: The chart structure for EUR/JPY is decidedly bullish. The pair has established a clear uptrend, and recent price action indicates a period of healthy consolidation above key support levels. This presents a strategic entry point, as the market appears to be gathering momentum for the next leg higher. The current setup suggests a low-risk entry into a well-defined upward trend.

🧠 The Trade Plan: Based on this synthesis, we are executing a precise trade with a favorable risk profile.

👉 Entry: 172.422

⛔️ Stop Loss: 171.292

🎯 Take Profit: 174.684

⚖️ Risk/Reward: 1:2

NOKJPY – Detailed Macro Analysis & Trade IdeaMacro Bias: LONG NOK / SHORT JPY

Why NOKJPY?

1. Fundamental Macro (ENDO):

Norway (NOK):

Strong inflationary pressure, positive PMI, robust M2 growth.

Massive fiscal surplus driven by energy exports – best debt/GDP ratio in the G10.

Norges Bank still maintaining relatively high interest rates.

Positive Terms of Trade, central bank balance sheet (CBBS) is shrinking (long-term bullish for NOK).

Japan (JPY):

Economic stagnation and deflationary risks, weak PMI and consumer spending.

Negative real yields, central bank remains ultra-accommodative, extreme debt/GDP ratio.

Persistent deflationary sentiment – classic “funding currency” for global carry trades.

2. COT Positioning (Commitments of Traders):

JPY is the most crowded short in the entire G10: hedge funds and leveraged funds are aggressively short JPY.

NOK positioning is neutral to slightly long – no overcrowding risk on the long side.

3. EXO & Sentiment Signals:

Terms-of-trade and projected GDP/CPI all favor NOK.

Sentiment, macro “score,” and risk/reward models consistently generate a long NOKJPY signal.

Exogenous indicators (futures, commodity impulse, sentiment, parity) all support NOK strength.

4. Technicals & Carry Edge:

NOKJPY remains in a strong multi-month uptrend.

Major carry advantage: NOK rates are much higher than JPY, yielding significant positive swap.

Every recent pullback has been bought, and momentum remains bullish.

Key Reasons for the Trade:

Multi-model consensus: No contradiction between macro, COT, exo, and technicals.

NOK is “king of G10” by every fundamental measure; JPY is the weakest currency this cycle.

Textbook carry trade for 2025.

Risks:

Only a sudden global “risk-off” or a central bank policy shock could temporarily disrupt the trend.

Currently, there is no crowding risk on NOK longs.

SUMMARY:

LONG NOKJPY is the cleanest, highest-conviction swing trade for this cycle – every model (macro, COT, exo, sentiment, carry) is in agreement.

Every meaningful pullback is a buying opportunity.

EUR/CAD Bullish Momentum Rising Channel Points to 1.5000 Target EUR/CAD is trading at approximately 1.4800. Your target price of 1.5000 indicates an anticipated upward movement of 200 pips, aligning with a bullish outlook within the context of a rising channel pattern.

Technical analysis on the daily chart suggests a bullish bias, as EUR/CAD continues to trade within an ascending channel pattern. This pattern is characterized by higher highs and higher lows, indicating sustained upward momentum. The pair is approaching the upper boundary of this channel, suggesting potential for further gains toward your target price.

On the 4-hour timeframe, EUR/CAD is trading within a rising channel as it approaches a confluence area. This consolidation pattern increases the likelihood of a bearish outcome, as traders can wait for the break and retest of the trendline support of the channel pattern to confirm a bearish entry.

In summary, the EUR/CAD pair is exhibiting bullish momentum within a rising channel pattern, with technical indicators supporting a potential move toward the 1.5000 target. Traders should monitor key support and resistance levels, as well as fundamental factors influencing the Euro and Canadian Dollar, to make informed trading decisions.

How Does a Carry Trade Work? How Does a Carry Trade Work?

A carry trade is a popular forex trading strategy that takes advantage of interest rate differentials between two currencies, aiming to earn returns from the interest gap. This article explores what a carry trade is, its formula, and how the strategy works, helping traders understand its potential advantages and risks.

Carry Trade: Definition

A carry trade is a popular forex strategy where traders take advantage of the difference in interest rates between two currencies. It involves borrowing money in a currency with a low borrowing cost—this is known as the "funding currency"—and then converting that borrowed amount into another offering higher interest, called the "investment currency." This is done to earn the interest rate differential between the two.

The Mechanics of a Forex Carry Trade

A carry position involves a few key components that work together to create potential opportunities in the forex market.

1. The Funding Currency

The first component is the currency that the trader borrows, the funding currency. Traders typically choose one with low interest costs because the amount to repay will be minimal. Common funding currencies include the Japanese yen (JPY) or the Swiss franc (CHF), as these often have low or even negative borrowing costs.

2. The Investment Currency

The second component is the investment currency, which is the one into which the borrowed funds are converted. This is chosen because it offers a higher interest yield, providing an opportunity to earn returns from the interest rate differential.

Popular investment currencies often include the Australian dollar (AUD) or the New Zealand dollar (NZD), as they tend to have higher borrowing costs. However, in recent years, emerging market currencies, like the Mexican peso (MXN), Brazilian real (BRL), and South African rand (ZAR), have also been favoured due to their high interest yields.

3. Interest Rate Differential

The core concept here is to capitalise on the interest rate differential between the funding and investment currency. If someone borrows in a currency with a 0.5% premium and invests in another offering a 4% yield, the differential (known as the "carry") is 3.5%. This differential represents the potential return, assuming there are no significant changes in the exchange rate.

4. Swaps and Rollovers

Swaps and rollovers are key factors. When you hold a position overnight (roll it over), the difference in interest rates between the two currencies is either credited or debited to your account. This is because when you trade a forex pair, you're effectively borrowing one currency to buy another. The swap rate compensates for the interest rate difference.

Positive Swap Rate: If the interest rate of the currency you are buying is higher than that you are selling, you might receive a positive swap rate, meaning you earn interest.

Negative Swap Rate: Conversely, if the interest rate of the currency you're selling is higher than the one you're buying, you'll pay interest, leading to a negative swap rate.

5. Leverage

Many traders use leverage to amplify their positions. Leverage allows them to borrow additional funds to expand the size of their investment. While this can potentially increase returns, it also magnifies risks. If the position moves against the trader, losses can quickly accumulate due to the leverage.

6. Market Fluctuations

The price of the pair is a crucial factor in the yield of the differential. While the differential offers the potential for returns, any adverse price movement can negate these gains. For instance, if the investment currency depreciates relative to the funding currency, the trader could face losses when converting back to the funding currency.

Conversely, if the investment currency appreciates relative to the funding currency, then they can potentially make an additional gain on top of their interest yield.

7. Transaction Fees and Spreads

Traders must consider transaction fees and spreads, which are the differences between the buying and selling prices of a forex pair. These costs can reduce the overall gains of the operation. Wider spreads, particularly in less liquid forex pairs, can increase the cost of entering and exiting positions.

In a carry position, these components interact continuously. A trader borrows in a low-interest-rate currency, converts the funds to a higher-yielding one, and aims to earn from the differential while carefully monitoring market movements, transaction costs, and swap rates. The overall approach is based on balancing the interest earned, fees, and potential pair’s price movements.

Carry Trade: Formula and Example

To calculate the potential return of a carry trade, traders use a basic formula:

- Potential Return = (Investment Amount * Interest Rate Differential) * Leverage

Let’s examine a carry trade example. Imagine someone borrows 10,000,000 Japanese yen (JPY) at a low interest rate of 0.5% and uses these funds to invest in Australian dollars (AUD), which has a higher borrowing cost of 4.5%. The differential is 4% (4.5% - 0.5%).

If the current exchange rate is 1 AUD = 80 JPY, converting 10,000,000 JPY results in 125,000 AUD (10,000,000 JPY / 80).

They then use the 125,000 AUD to earn 4.5% interest annually:

- 125,000 * 4.5% = 5,625 AUD

The cost of borrowing 10,000,000 JPY at 0.5% interest is:

- 10,000,000 * 0.5% = 50,000 JPY

Converted back to AUD at the original exchange price (1 AUD = 80 JPY), the interest cost is:

- 50,000 JPY / 80= 625 AUD

The net return is the interest earned minus the borrowing cost (for simplicity, we’ll exclude other transaction fees):

- 5,625 AUD − 625 AUD = 5,000 AUD

If the price changes, it can significantly impact the position’s outcome. For example, if the AUD appreciates against the JPY, moving from 80 to 85 JPY per AUD, the 125,000 AUD would now be worth 10,625,000 JPY (125,000 * 85). After repaying the 10,000,000 JPY loan, the trader receives additional returns.

Conversely, if the AUD depreciates to 75 JPY per AUD, the value of 125,000 AUD drops to 9,375,000 JPY (125,000 * 75). After repaying the 10,000,000 JPY loan, the trader faces a loss.

Types of Carry Trades: Positive and Negative

Trades with yield differential can be classified into two types: positive and negative, each defined by the differential between the funding and investment currencies.

Positive Carry Trade

A positive carry trade occurs when the borrowing rate on the investment currency is higher than that of the funding one. For example, if a trader borrows in Japanese yen (JPY) at 0.5% and invests in Australian dollars (AUD) at 4.5%, the differential is 4%. This differential means they earn more interest on the invested currency than they pay on the borrowed one, potentially resulting in a net gain, especially if market movements are favourable.

Negative Carry Trade

A negative carry trade happens when the yield on the funding currency is higher than that on the investment. In this case, the trader would lose money on the rate differential. For example, borrowing in US dollars at 2% to invest in euros at 1% would result in a negative carry of -1%. Traders might still pursue negative yield differential trades to hedge other positions or take advantage of expected market movements, but the strategy involves more risk.

How Can You Analyse Carry Trade Opportunities?

To analyse opportunities, traders focus on several key factors to determine whether a carry position could be effective.

1. Differentials

The primary factor here is the interest rate differential between the two currencies. Traders look for forex pairs where the investment currency offers a significantly higher interest return than the funding currency. This differential provides the potential returns from holding the position over time.

2. Economic Indicators

Traders monitor economic indicators such as inflation rates, GDP growth, and employment figures, as these can influence central banks' decisions on interest rates. A strong economy may lead to higher borrowing costs, making a pair more attractive for a yield differential position. Conversely, weak economic data could result in rate cuts, reducing the appeal of a currency.

3. Central Bank Policies

Understanding central bank policies is crucial. Traders analyse statements from central banks, like the Federal Reserve or the Bank of Japan, to gauge future rate changes. If a central bank hints at raising borrowing costs, it could present an opportunity for a positive carry transaction.

4. Market Sentiment and Risk Appetite

This type of transaction often performs well in low-volatility environments. Traders assess market sentiment and risk appetite by analysing geopolitical events, market trends, and investor behaviour.

Risks of a Carry Trade

While carry trading can offer potential returns from borrowing cost differentials, they also come with significant risks that traders must consider.

- Exchange Risk: If the investment currency depreciates against the funding one, it can wipe out the returns from the differential and result in losses.

- Interest Rate Risk: Changes in the cost of borrowing by central banks can alter the differential, reducing potential returns or even creating a negative carry situation.

- Leverage Risk: Many traders use leverage to amplify returns, but this also magnifies potential losses. A small adverse movement in pairs can push the trader out of the market.

- Liquidity Risk: During periods of low market liquidity, exiting a position may become difficult or more costly, increasing the risk of loss.

A Key Risk: Carry Trade Unwinding

Unwinding happens when traders begin to exit their positions en masse, often due to changes in market conditions, such as increased volatility or a shift in risk sentiment. This essentially means exiting the investment and repurchasing the original currency.

Unwinding can trigger rapid and significant price movements, particularly if many traders are involved, and lead to a much lower return if the exit is timed incorrectly. For example, if global markets face uncertainty or economic data points to a weakening economy, investors may seek so-called safer assets, leading to a swift exit from carry positions and a steep decline in the investment currency.

The Bottom Line

This type of strategy offers a way to take advantage of interest rate differentials between currencies, but it comes with its own set of risks. Understanding the mechanics and analysing opportunities is critical. Ready to explore yield differential trades in the forex market? Open an FXOpen account today to access advanced tools, low-cost trading, and more than 600 markets. Good luck!

FAQ

What Is a Carry Trade?

A carry trade in forex meaning refers to a strategy where traders borrow in a low-interest currency (the "funding currency") and invest in a higher-interest one (the "investment currency") to earn returns from the differential.

What Is the Carry Trade Strategy?

The carry trade strategy consists of borrowing funds in a currency with a low interest rate and using those funds to invest in a currency that offers a higher interest rate. Traders then invest the borrowed funds in the higher-yielding one to earn returns from the borrowing cost differential. The strategy typically relies on both relatively stable forex prices and the interest differential remaining favourable.

How Does the Japanese Carry Trade Work?

The Japanese currency carry trade typically involves borrowing the Japanese yen (JPY) at a low interest rate and converting it into another with a higher yield, like the Australian dollar (AUD). The aim is to take advantage of the gap in borrowing costs.

What Is an Example of a Yen Carry Trade?

An example of a yen carry position is borrowing 10,000,000 JPY at 0.10% interest and converting it to AUD, which earns 4.35%. The trader takes advantage of the 4.25% differential, assuming favourable market conditions.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY carry trade explainedCurrently, the USD/JPY pair is trading around 154.26, influenced by upcoming policy decisions from the US Federal Reserve and the Bank of Japan (BoJ). The US Fed's anticipated 25bps rate cut could potentially narrow the interest rate gap, affecting the carry trade's immediate appeal. However, the strong performance of the US economy, with robust job growth and rising inflation, might sustain the dollar's strength, keeping the carry trade attractive. Meanwhile, the BoJ's steady interest rate at 0.25% and potential for future hikes offer a contrasting backdrop, maintaining the yen's role as a low-interest currency. Global economic uncertainties and political changes in both the US and Japan could impact these dynamics, so traders should monitor central bank signals and economic data closely to navigate potential shifts in the carry trade's profitability.

Cardano ADA Will Outperform Cryptocurrency MarketHello, Skyrexians!

Yesterday we considered the Bitcoin analysis where concluded that the potential growth is not going to be insane, bull market will be finished soon. At the same time on the BINANCE:ADAUSDT weekly chart we can see that price is charged for the flight.

Let's notice, that Cardano has the specific bear market structure, where the corrective wave C has been finished in October 2023. Growth from the bottom was impulsive, so it could not be the wave B, in our opinion it's wave 1 of the new bull market. Since March 2024 most of crypto assets continued the bear market, but drop on ADA was not so big. It means that wave 2 has been formed already.

Look at the green dot on the Bullish/Bearish Reversal Bars Indicator . This is strong bullish signal that this correction is likely to be finished, in conjunction with Elliott waves analysis we can see that the impulsive wave 3 is about to happen soon! Targets can be calculated using Fibonacci Extension. 1.61 and 2.61 corresponds to the area between $1.2 and $1.77. Note that this zone is not likely going to be the end of bull run. This is just wave 3 in this rally. Finally, we expect the new ATH for ADA in 2025.

Best regards,

Skyrexio Team

USD/CAD INSANE 22 Year Cup & Handle about to explode higherWith this week's announcement of 25% duties on MX & CA one would do well to survey the markets for opportunities. What better way to push through a trade of this nature than the FX markets?!

The first thing to check in any FX trade is rate differentials:

CA 10Y: 3.22%

US 10Y: 4.27%

MX 10Y: 9.99%

The carry trade dictates we want to be long the currency with a higher yield, and our suspicion given tariffs tend to strengthen the country levying tariffs means we want to be long USD.

MX offers a much higher yield so that would offset the potential in taking a short position on USD/MXN. CA on the other hand has a modest 1% discount to the US 10Y bond. Moreover, rates in the US look fairly steady, and pressure from the tariffs could cause CA to cut in support of its economy.

A technical inspection of USD/CAD shows a staggering 22 year cup and handle formation on the pair. Now could be the right time to accumulate a leveraged FX position, as this trade could have years ahead of it with the advent of a 4 year Trump term.

USDJPY still has more downside on daily & weekly tfStructurally I'm looking for rejection at 147-149.8 range. Look for renewed selling action below 144 to confirm. Still seeing additional unwinding of the yen carry trade as highly likely over subsequent days & weeks. Targeting 136, 131, and 126 handles on weekly structure as we approach Q1 of 2025.

Particularly as the US Federal Reserve is pressured to cut rates further with recent data.

Entering short positions gradually but the majority is already in place.

Why is the Swiss Franc Defying the Odds?In a global economy where central banks are leaning towards softer monetary policies, the Swiss Franc is charting its own course—strengthening against the odds. But what forces are truly at play here? Is it merely the cautious whispers of the Swiss National Bank, or is there a deeper undercurrent, tied to inflation expectations and global safe-haven flows? As we peel back the layers, we uncover a narrative that challenges conventional wisdom. Discover the intricate dynamics that could redefine how we perceive currency resilience in today's volatile market landscape.

The franc's unexpected strength has sparked a flurry of theories. Some point to the SNB's potential reluctance to cut interest rates as aggressively as its peers. Others suggest that the widening gap between Swiss and global inflation expectations could be fueling the franc's appreciation. Yet, the franc's safe-haven status and its role in carry trades add another layer of complexity to this puzzle.

The EUR/CHF currency pair, a barometer of the Eurozone and Switzerland's economic health, is particularly sensitive to the franc's strength. As the franc appreciates, it can impact trade balances, inflation, and overall economic competitiveness.

As the global economic landscape continues to evolve, the enigma of the Swiss franc's resilience persists. Is this a temporary anomaly, or a harbinger of a new era in international finance? Only time will tell.

Risk-off & The Yen Carry Trade Explained Hi guys,

I'm trying something new here.

In this video I explain what risk-off is and what causes it. I break down the recent yen carry trade and what went on there.

It's good to study these events so that next time you have the knowledge in the bank. That way you can plan and make better decisions.

Let me know if you like this sort of thing and I can do more.

Cheers,

Sam

Shift in Carry Trades: Hedge Funds Embrace USDTRYA Shift in Carry Trades: Hedge Funds Embrace the US Dollar

The once-dominant Japanese yen has historically been the preferred currency for carry trade strategies, where investors borrow low-interest-rate currencies to invest in higher-yielding ones. However, a significant shift is underway, as hedge funds increasingly turn to the US dollar as their borrowing currency. This strategic change is driven by a confluence of factors, including the US Federal Reserve's monetary policy stance, the weakening Japanese yen, and the allure of emerging-market currencies.

The Allure of Emerging-Market Currencies

Emerging-market currencies have long been a focal point for carry trade strategies, offering the potential for substantial returns. The relatively high interest rates in these economies, coupled with their often-growing economies, make them attractive investment destinations. However, the choice of borrowing currency plays a crucial role in determining the overall risk-reward profile of such trades.

The Yen's Diminishing Appeal

The Japanese yen has traditionally been a popular choice for carry trades due to its historically low interest rates. However, a combination of factors has eroded its appeal in recent years. The Bank of Japan's ultra-loose monetary policy, aimed at stimulating the economy, has kept interest rates exceptionally low. Moreover, the yen's weakness against other major currencies has increased the risk of exchange rate losses for investors who borrow in yen.

The Rise of the US Dollar

The US dollar, once a less common choice for carry trades, has gained prominence as a borrowing currency. Several factors have contributed to this shift. First, the US Federal Reserve's more hawkish monetary policy, characterized by interest rate hikes and a reduction in quantitative easing, has made the dollar a relatively higher-yielding currency. Second, the dollar's strength against other major currencies has reduced the risk of exchange rate losses for investors who borrow in dollars.

The Case of USDTRY

One notable example of the shift towards US dollar-funded carry trades is the USDTRY pair. The Turkish lira, with its relatively high interest rates, has been a popular target for carry trade investors. However, the increasing political and economic uncertainties in Turkey have made the lira a riskier investment. By borrowing in US dollars, investors can potentially benefit from the interest rate differential while mitigating some of the risks associated with the Turkish lira.

Challenges and Considerations

While the US dollar-funded carry trades offer potential benefits, they are not without risks. The US Federal Reserve's future monetary policy decisions, geopolitical events, and economic fluctuations in emerging markets can all impact the profitability of these trades. Additionally, the increasing popularity of carry trade strategies can lead to market volatility and potential

reversals.

Conclusion

The shift in carry trade strategies from the Japanese yen to the US dollar represents a significant development in the global financial markets. As emerging-market currencies continue to offer attractive investment opportunities, the choice of borrowing currency will remain a critical consideration for hedge funds and other investors seeking to capitalize on these trends. While the US dollar has gained prominence, the potential risks and challenges associated with carry trades should be carefully evaluated before making investment decisions.

$USDJPY Carry trade unwind to continue? $131-108 targetsFX:USDJPY looks like it's set to fall further here.

Equities took a hit when USDJPY went from 152 to 142. Now you can see that price rallied back up into resistance at 148, rejected it and looks set to fall more unless price can recover that 148 resistance.

I could see another move down into that 131 level, however, there's a possibility that price can fall much more than that.

I could potentially see a move all the way down to 115 -108 before price finds support. Those levels would be a successful retest of the bottoming structure price broke out from. After those levels get tested, then I think USDJPY will enter a long-term bull market.

Let's see how this plays out over the coming months.

Yen Carry Trade Unwind: Is It Really Over?The unwind of the Yen carry trade has led to a significant breakdown in the USDJPY, shattering the ascending channel that had been in place since early 2023. We're now witnessing a retest of the channel's lower bound, where crucial resistance levels come into play. As asset managers continue to unwind their short Yen positions to mitigate risk, we may see a sustained strengthening of the Yen, potentially driving the USDJPY even lower.