Deere and Company is a stapleIt looks like a good time to buy Deere shares, I have done an evaluation on the perceived intrinsic value of the company. To back up my philosophy about what I think a "good deal" on the shares is, I have included a technical analysis including a trendline being touched for the third time at a measured Fibonacci retracement.

Looking ahead five years, based on the revenues the company is expected to generate according to wall streets current estimates. I have used the discount cash flow model to determine what I believe a suitable margin of safety would be to buy and hold shares of Deere. I am taking into account, the time value of the investment by measuring 5 years ahead, the risk to me at this point is very low. $570 seems to be a fair price taking into account all the fundamentals, I have been holding the stock for some time, but am increasing my exposure to 5% allocation in my portfolio.

Naturally I like the stock because I have worked around these machines a lot in my life. So I have a good understanding of how the company will make money and why the company will make money. The current price of a share is $461, while the intrinsic value according to my model is $570, essentially that means the shares are about %25 undervalued right now. I would personally rate Deere a buy despite the short term headwinds the company faces, we need them.

Dividends

Kenvue Tylenol Turmoil: Does the 33% Drop Scream Undervalued?While many stocks (especially tech) are near all-time highs and have high PE ratios, I'm still hunting for bargains, and Kenvue seems to be relatively cheap. More recently, it came under fire because of Trump's remarks on Tylenol, and the stock lost over 10% in a few days.

Since May 2025, the stock has lost 33%, putting it, in my opinion, in an undervalued zone.

Kenvue is the manufacturer of a bunch of health-related products, including Tylenol, Neutrogena, Band-Aid, Listerine, Benadryl, Zyrtec, Motrin, Aveeno, Johnson's, Rogaine, and many more.

I like this kind of health-related beaten-down stocks because they exhibit good uncorrelation with the rest of the stock market, and in bear markets, they tend to hold up well because people always need to buy healthcare products.

WHY BUY KENVUE STOCK?

The stock has a strong moat, with excellent market penetration, top-of-mind brand recognition, and consumer loyalty, as well as economies of scale, worldwide.

They have great management, with Kirk Perry and Andy Dasgupta leading the company. This guy has a great track record in the consumer product sector.

Despite the decent performance, the stock price is now at an all-time low.

KEY NUMBERS AND FUNDAMENTALS

Where should I start... Since they spun off from Johnson & Johnson, the stock is now the cheapest when compared to their revenue, income, and other metrics.

Diluted EPS is now at $0.22. The same level as in 2023, when the stock was at $24. The difference is that the stock is now at $16 (33% cheaper).

The dividend ratio is now at 5%, the best level ever. The last time it was this close to the current level was in mid-2024, when the dividend yield reached 4.6%. After that, the stock rose by 38% in less than 6 months. If you like dividends, you should definitly take a look at Kenvue.

The PE ratio is 22, which is low compared to the sector and the company's historical data.

Similar story for the PB ratio, which is now at an all-time low.

This data is telling us that the stock is comparatively cheap. Of course, one needs to ask: Is it cheap because of poor prospects for the company, or because the market is overly fearful? I'd lean for the second.

It's also worth adding that their gross margin is 58%, the EBITDA margin is 24% (quite good), and the forward PE is at around 15.

Finally, the analyst's price targets average $22, giving it an upside of around 34%.

MY GAMEPLAN

I'm going to allocate close to 1% of my net worth to this stock. In case the price drops, I will average down my purchasing price, considering that this company is likely to continue having a very strong moat for the coming years.

I plan to hold it for the medium/long term, potentially selling part or the entirety of my holdings once I get over 30% return. I will re-evaluate it later this year.

Quick note: I'm just sharing my journey - not financial advice! 😊

2270 To buy1. Key Levels

Support: 250 SAR (a break below may push toward 230 SAR).

Resistance 1: 270 – 280 SAR.

Resistance 2 (major): 300 SAR (POC + psychological level).

2. Dividend Impact (9 SAR)

Strong dividend makes the stock attractive for long-term investors.

Provides a yield cushion, supporting the 250–270 SAR zone as a potential accumulation area.

Enhances fundamental value if earnings remain stable.

For long-term investors, this zone is attractive.

For traders, the stock needs to clear 270–280 SAR to confirm momentum toward 300 SAR.

Oxymoronically pounding the table here for CALMThere are a lot of reasons I like the trade I entered into yesterday at the close here. I'll start with some reasons I'd like CALM regardless of my trading style.

I think everyone can agree we are in an overvalued market right now. That inherently creates risk with any stock you buy right now. Not saying we are gonna go down, but the more overvalued the market gets, the greater the risk that creates. CALM has several things going for it in that regard.

1--it has a TTM P/E of 4.12. Not 41.2 - FOUR!!! This is good even for a value stock.

2--their current yield is 8.11%. Give your head a second to wrap itself around that one - this stock has a yield that is twice its P/E. To put that in perspective, NVDA has a P/E of 50. If its yield were 2x its P/E, it would be paying a 100% dividend. This is not really an anomaly, either. It has always been a high dividend stock.

3--in the event inflation picks up again, foods are an area where costs can be passed through to customers better than in other areas. Eggs will still be eaten, even if they cost more. We've already proven that once. People will complain, but they still buy them.

Now for the part that really intrigued me here. 18-2 on trade signals in 2025 with an average gain of 3.5% and an average holding period of 9 days (including that 109 day marathon). That includes the two losing trades recently, and works out to a gain of .39% per day held. Note: trade returns on the chart are basis points (.01% per bp)

Those are beyond tech stock level daily returns on a stock that has been flat overall on the year, that sells something Americans bought 108 BILLION of last year (while griping about prices) that has a low P/E and if the trade goes sideways, pays me 2% a quarter to hold onto. That's .03% per day just to hold it, not including any gain on the trade itself. The average historical daily gain of SPY is around .04%, for comparison.

Why is this stock not being talked about? I don't know and I don't care, but I went long at yesterday's close at 103.01 and it's trading just below that as I put the finishing touches on this post.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Agree Realty | ADC | Long at $72.37Agree Realty NYSE:ADC

Summary: A "boring" REIT with a 4.2% dividend, ~68% investment-grade tenants, high occupancy (~99%), average lease terms of 10+ years, which include major tenants Walmart (top tenant), Dollar General, Tractor Supply, Best Buy, Dollar Tree, TJ Maxx, O'Reilly Auto Parts, CVS, Kroger, Lowe's, Hobby Lobby, Burlington, Sherwin-Williams, Sunbelt Rentals, Wawa, Home Depot....

Technical Analysis: Cup and handle formation may be forming off the recent double bottom (bullish). Two open price gaps remain on the daily chart since 2020 (down near $59) - chance these may get closed if the market turns in the near-term. However, REITs average +30% returns within 16 months post-Fed rate cuts, so patience may benefit investors here.

Follow the Money : Insiders buying .

Company Financial Health: Strong. $2.3B liquidity, no material debt maturities until 2028, and investment-grade balance sheet (A- rating from Fitch). Debt-to-assets ~40%, covered by stable net-lease rents. Macro risks (e.g., tenant bankruptcies like At Home, consumer slowdown) exist but are mitigated by diversification. Altman Z-Score suggests low distress and no near-term catalysts for insolvency.

Earnings and Revenue Growth: ~4% between 2025 and 2027 (slow growth, but good/steady for a REIT).

Thus, at $72.37, NYSE:ADC is in a personal buy zone for a likely move up given the high probability of lower interest rates in the future. A near-term risk of a drop to $59 could occur, but REITs often move higher within 1-2 years after interest rates cuts. It's a solid company financially with a good dividend.

Targets into 2028:

$80.00 (+10.5%)

$90.00 (+24.3%)

Flowers Food | FLO | Long at $13.51Flowers Food NYSE:FLO . Maker of Nature’s Own (the top-selling bread brand in the US), Wonder Bread, Tastykake, and many others, has entered my "crash" simple moving average zone. While the fall has been steep since 2022, the company is trading at a price-to-earnings of 13x (typical food industry is around 20x) and offers and 7%+ dividend. It's not a play for future growth, however, which is expected to be mild to stagnant ( based on forward annual earnings and revenue . This position is a value / dividend play given the high likelihood of lower interest rates and a certain group of investors moving out of banks and into dividend / income stocks.

So, while I wouldn't be shocked if NYSE:FLO dips into the $12 rage in the near-term, I have created a starter position in the company at $13.51. My targets are modest, although there is a blaring gap in the $27-$28 range that will likely be filled... some time.

Targets into 2028:

$14.75 (+9.2%)

$16.25 (+20.3%)

Long TLT/SPY📌 Bonds Explained: What They Are, How They Work & Key Risks

Bonds are one of the oldest and most important financial instruments in global markets. They are used by governments, corporations, and institutions to raise money, and by investors to earn income, diversify portfolios, and manage risk.

At their core, a bond is a loan:

The issuer (borrower) raises capital by selling bonds.

The investor (lender) provides money in exchange for periodic interest payments (coupon payments) and the return of the principal (face value) at maturity.

🔹 1. What is a Bond?

When you buy a bond, you are lending money to the issuer. The issuer promises:

Interest payments (usually fixed) on a regular schedule (semiannual or annual).

Repayment of principal (the original investment amount) when the bond matures.

📌 Example:

You invest $1,000,000 in a 10-year bond paying 3% annually (semiannual coupons).

Every 6 months, you receive $15,000 in interest payments.

At the end of 10 years, you (hopefully) receive back your original $1,000,000 principal.

🔹 2. Why Do Companies and Governments Issue Bonds?

Governments → Fund infrastructure, social programs, defense, or refinance existing debt.

Corporations → Finance expansion, research, acquisitions, or refinance loans.

Municipalities → Build schools, hospitals, and roads.

Bonds allow issuers to access large pools of capital without giving up ownership (like stocks).

🔹 3. Why Do Investors Buy Bonds?

Stable Income: Regular coupon payments.

Capital Preservation: Return of principal at maturity (assuming no default).

Diversification: Bonds often behave differently from stocks, balancing risk.

Hedging Inflation/Interest Rates: Certain bonds (like TIPS) protect against inflation.

Relative Safety: High-quality government bonds are considered safe-haven assets.

🔹 4. Key Types of Bonds

Government Bonds

Issued by sovereign states.

Example: U.S. Treasuries, UK Gilts, German Bunds.

Generally low risk, lower yields.

Corporate Bonds

Issued by companies.

Higher yields than government bonds but higher risk.

Municipal Bonds

Issued by local governments or agencies.

Often come with tax benefits for investors.

High-Yield (Junk) Bonds

Issued by lower-credit issuers.

Higher potential returns, but much riskier.

Inflation-Protected Bonds

Coupon/principal linked to inflation.

Example: U.S. TIPS (Treasury Inflation-Protected Securities).

🔹 5. Three Main Risks of Investing in Bonds

Even though bonds are often seen as “safe,” they carry risks that investors must understand:

1️⃣ Credit Risk (Default Risk)

The issuer may fail to pay coupons or repay the principal.

Higher with corporate bonds and emerging market government bonds.

Mitigated by credit ratings (Moody’s, S&P, Fitch).

📌 Example:

If a company defaults, you may lose part or all of your investment.

2️⃣ Interest Rate Risk

Bond prices move inversely to interest rates.

If rates rise, existing bond prices fall (since new bonds offer better yields).

If you sell before maturity, you could face a loss.

📌 Example:

You bought a 10-year bond at 3%. A year later, rates rise to 5%. Your bond’s market value falls, because investors prefer newer bonds paying higher coupons.

3️⃣ Inflation Risk (Purchasing Power Risk)

Even if you hold the bond to maturity, rising inflation erodes the real value of your returns.

A 3% coupon loses attractiveness if inflation rises to 6%.

📌 Example:

Your bond pays $30,000 annually, but inflation pushes up costs by $40,000 per year → you are effectively losing purchasing power.

🔹 6. Bonds vs. Stocks

Bonds: Debt, fixed income, contractual obligation, lower risk, limited upside.

Stocks: Equity ownership, dividends (optional), higher risk, unlimited upside.

In a company bankruptcy, bondholders are paid before shareholders.

🔹 7. How Investors Use Bonds in Portfolios

Income generation: Retirees and pension funds rely on coupon payments.

Diversification: Bonds often rise when stocks fall, reducing portfolio volatility.

Risk management: Safe-haven bonds (like Treasuries) act as “insurance” during crises.

Speculation: Traders can bet on interest rate moves via bond futures and ETFs.

🔹 8. Bonds vs. Stocks: The TLT–SPY Correlation

One of the most widely followed relationships in global markets is the correlation between:

TLT → iShares 20+ Year Treasury Bond ETF (tracks long-dated U.S. Treasury bonds).

SPY → SPDR S&P 500 ETF (tracks U.S. equities).

📈 Historical Relationship

Over the past two decades, TLT and SPY have often moved in opposite directions. (The Correlation between SPY/TLT often hovers around 0.)

Why? When stocks sell off, investors typically seek safety in Treasuries, pushing bond prices up (yields down).

This negative correlation makes bonds a powerful diversifier in equity-heavy portfolios (60/40).

📌 Example:

2008 Financial Crisis → SPY plunged ~37%, while long-dated Treasuries (TLT) surged as investors fled to safety.

March 2020 COVID Crash → SPY fell ~34% peak-to-trough, TLT spiked ~20% as the Fed cut rates and investors piled into Treasuries.

🐂 Strategy #1 (MA):

Buy SPY when TLT crosses below the 95 MA.

Sell SPY when TLT crosses above the 95 MA.

🔄 But the Correlation Can Shift

In inflationary environments, bonds and stocks can fall together.

2022 is a perfect example:

Inflation spiked → Fed hiked rates aggressively.

TLT dropped ~30% (yields surged).

SPY also fell ~19%.

Both asset classes sold off simultaneously, breaking the hedge.

🐂 Strategy #2 (Re-Balancing):

Buy TLT at the close of the seventh last trading day of the month.

Sell TLT at the close of the last trading day of the month.

Sell TLT short at the close of the month.

Cover TLT at the close of the seventh trading day of the month.

Higher Returns after rate hikes.

📊 Why This Matters for Investors

In normal times: TLT acts as a counterweight to SPY, smoothing portfolio volatility.

In inflationary shocks: Both can decline, reducing diversification benefits.

Lesson: Don’t assume bonds will always hedge equities — context (inflation, Fed policy, growth cycles) matters.

📌 Practical Uses of the TLT–SPY Correlation

Portfolio Diversification

A 60/40 portfolio (60% stocks, 40% bonds) relies on the negative correlation.

Works best when inflation is low and stable.

Risk-On / Risk-Off Gauge

If both SPY and TLT rise → markets are calm, liquidity flows into both risk and safety.

If SPY falls while TLT rises → classic risk-off move (flight to safety).

If both fall → inflation or policy tightening environment (no safe haven).

Trading Signals

Divergence trades: When SPY rallies but TLT also rallies strongly, it may signal equity rally exhaustion (risk-off brewing).

Macro hedge: Long TLT positions can offset downside risk in SPY-heavy portfolios — but only in disinflationary or deflationary shocks.

🔹 9. EWJ–TLT Correlation: Japan Equities vs. U.S. Treasuries

EWJ → Tracks Japanese equities (large & mid-cap companies).

TLT → Tracks U.S. long-dated Treasuries.

Unlike the classic SPY–TLT inverse correlation, the EWJ–TLT relationship is more complex, shaped by:

Global risk sentiment (risk-on/risk-off flows).

Currency effects (USD/JPY exchange rate).

Japan’s ultra-low interest rate environment (BoJ policy).

📈 Historical Tendencies

1️⃣ Risk-Off Periods (Global crises → flight to safety):

TLT rallies (U.S. Treasuries bid).

EWJ often falls, as Japanese equities are highly cyclical and export-driven.

Negative correlation dominates.

📌 Example:

2008 Crisis → TLT surged; EWJ plunged with global equities.

2020 COVID Crash → Same pattern: safety flows to Treasuries, Japanese stocks sold.

2️⃣ Risk-On Periods (Liquidity, global growth optimism):

EWJ rallies with global equities.

TLT may drift lower (yields rising on stronger growth).

Correlation weak to moderately negative.

📌 Example:

2016–2018: Global growth rebound → EWJ rose, TLT fell as U.S. yields climbed.

3️⃣ Currency Channel (USD/JPY)

Japanese equities (EWJ) are sensitive to the yen.

A stronger USD/JPY (weaker yen) boosts exporters (good for EWJ).

TLT rallies often coincide with USD weakness (yields down, dollar down), which can hurt Japanese exporters, adding another layer of inverse correlation.

🔄 Shifts Over Time

Long-term average correlation: Mildly negative (similar to SPY–TLT, but weaker).

During inflation shocks (2022): Correlation turned positive at times:

TLT fell as U.S. yields spiked.

EWJ also struggled due to global tightening & yen weakness.

Both moved down together, breaking the hedge.

📊 Why EWJ–TLT Matters

Global Diversification Check: Investors often think Japanese equities diversify U.S. equities, but they can be just as cyclical. Adding TLT creates the real hedge.

Risk-Off Signal: When both EWJ and TLT rise, it may indicate global liquidity easing (rare but bullish).

Currency Overlay: Always factor USD/JPY → sometimes EWJ’s move is more about currency than equities.

🐂 Strategy #3 (EWJ):

When Japanese stocks are above their 150-day moving average, go long TLT (US long-term Treasury). When the average is below the 150-day average, stay out. The correlation between TLT and EWJ can serve as a breath signal.

📌 Conclusion: Bonds as the Foundation of Finance

Bonds are the backbone of the global financial system, connecting borrowers (governments, corporations) with lenders (investors).

✅ Bonds provide regular income and capital preservation.

✅ They carry risks: credit, interest rate, and inflation.

✅ They are essential for diversification and risk management.

✅The TLT–SPY correlation is dynamic. Historically negative, providing diversification. In inflationary shocks (like 2022), the correlation turns positive, breaking the hedge.

✅ EWJ–TLT is a Global Macro Hedge, But Fragile. Usually inverse: Risk-off = TLT up, EWJ down. Sometimes aligned: Inflation shocks or synchronized global tightening → both down. Currency filter essential: USD/JPY often mediates the relationship. This makes EWJ–TLT correlation a powerful barometer of global macro regimes: Disinflationary slowdowns → Strong hedge. Inflationary crises → Hedge breaks.

For investors, understanding bonds is crucial, even if you primarily trade equities or commodities, because bond yields influence everything: stock valuations, mortgage rates, and even currency markets.

Long Cotton📌 Cotton Futures: Seasonality, Market Drivers & How to Trade

For more than 7,000 years, cotton has been one of humanity’s most important raw materials. Once spun by hand and woven into basic cloth, today cotton is at the core of the global textile industry, used in apparel, home furnishings, industrial fabrics, and even specialized materials like fishnets and early forms of gunpowder.

Currently, cotton accounts for over 35% of all fiber consumed globally, making it a multibillion-dollar market. Most price discovery happens through cotton futures (CT contracts), which are actively traded on ICE. These futures allow farmers, textile factories, and investors to hedge against price swings, diversify portfolios, or speculate on supply-demand cycles.

🔹 1. Seasonality of Cotton Futures

Like most agricultural commodities, cotton prices follow predictable seasonal cycles:

📈 Winter & Spring (Nov–May): Historically the strongest performance period for cotton futures. Global demand rises as textile factories restock, and weather risks emerge in key producing regions.

📉 Summer & Fall (Jun–Oct): Often weaker, as new crop supply pressures the market.

📌 Example:

Between Nov 2020 and May 2021, cotton futures rallied more than 25% as strong textile demand from China collided with weather-related yield concerns in the U.S.

🔹 2. What Moves Cotton Prices the Most?

Cotton futures are influenced by both global supply conditions and consumer demand cycles.

1️⃣ Global Producers (U.S., India, China)

These three nations account for over 65% of world cotton production.

Weather shocks, export bans, or lower yields in any one of them can create global scarcity.

2️⃣ China’s Cotton Policy

As the largest consumer, China’s stockpiling and release strategy directly impacts global prices.

Import/export restrictions and subsidies amplify volatility.

3️⃣ Substitute Fabrics

Prices of polyester, rayon, and synthetic fabrics influence demand for cotton.

When synthetics are cheap, cotton demand softens; when synthetics are costly, cotton regains market share.

4️⃣ Energy Prices

Cotton production is energy-intensive. Rising oil prices push up cotton costs.

5️⃣ Domestic Policies

Subsidies, tariffs, and trade policies (especially U.S.-China trade tensions) have a strong impact.

🔹 3. How to Trade Cotton & Related Companies

Cotton is not just a commodity — it is directly tied to the global fashion cycle and the profitability of apparel brands. Traders can gain exposure either by trading cotton futures directly or through companies sensitive to cotton prices.

🌎 Publicly Traded Companies with Strong Cotton Exposure

✅ Textile & Apparel Stocks (Direct Cotton Users)

Levi Strauss & Co. (LEVI) → Denim giant heavily dependent on cotton.

Rising cotton = margin squeeze, unless prices are passed to consumers.

📌 2021: Cotton spike → Levi raised jeans prices to protect margins.

V.F. Corporation (VFC) → Brands include Vans, Timberland, The North Face.

High cotton usage in apparel lines.

📌 2022: Cotton inflation + weak demand → VFC’s profits fell sharply.

Ralph Lauren (RL) → Premium brand with better pricing power.

Less vulnerable than mass-market peers.

📌 2023: Cotton price drop improved margins → RL stock up ~20%.

Hanesbrands (HBI) → Global cotton undergarments producer.

Very exposed to raw cotton cycles.

📌 2022: Rising cotton costs + supply chain issues → stock collapsed ~70%.

Gildan Activewear (GIL) → Supplier of cotton-heavy t-shirts & socks.

📌 2021–22: Cotton spike pressured margins, though hedging softened impact.

🌎 Cotton Producers & Agricultural Stocks

Bunge (BG) & Archer Daniels Midland (ADM) → Global agricultural traders handling cotton exports.

Louisiana-Pacific (LPX) → Agricultural supplier with indirect cotton exposure.

Plains Cotton Cooperative Association (Private) → One of the world’s largest cotton cooperatives.

📌 2021 Example: When cotton demand surged, both BG and ADM rallied as trading volumes spiked.

🌎 Private Cotton Leaders (Not Publicly Traded)

Cotton Incorporated (USA) → Research & marketing firm for cotton.

Lummus Corp (USA) → Cotton ginning & processing equipment.

Sateri (China) → World’s largest producer of cotton-based textiles.

❌ Indirect Retail Play: Dick’s Sporting Goods (DKS)

While not a pure cotton stock, DKS sells cotton-heavy apparel and sportswear.

📌 Best during: Sporting event seasons + cotton demand cycles.

However, DKS is more tied to Nike/Adidas trends than cotton futures directly.

🔹 4. Cotton Trading Playbook

✅ When Cotton Prices Rise:

Bullish: Cotton producers & traders (BG, ADM, LPX).

Bearish: Apparel companies (Levi, Hanes, Gildan).

Neutral: Premium brands (Ralph Lauren) → can pass costs to consumers.

📌 2021 Example: Cotton surged → producers gained, apparel stocks fell.

✅ When Cotton Prices Fall:

Bullish: Apparel companies (Levi, Hanes, Gildan, DKS).

Bearish: Cotton producers face revenue compression.

📌 2018 Example: Cotton dropped → apparel margins expanded, retail stocks gained.

📌 Best Cotton Trading Strategy - Short-only

✅ When Cotton Prices Fall below the 200 SMA.

Short the following open after the close is higher than the 20-day high.

Cover after 5 days, at open.

📌 Conclusion:

Cotton is one of the most historically important and globally traded soft commodities, directly linking farmers, textile factories, fashion brands, and consumers.

✅ Seasonality Edge: Cotton tends to rally in winter & spring (Nov–May) and weaken in summer & fall (Jun–Oct).

✅ Fundamental Edge: Watch U.S., India, China output + China’s stockpiling policy.

✅ Corporate Edge: Trade apparel stocks alongside futures — when cotton prices rise, buy producers (BG, ADM) and short consumer apparel (Levi, Hanes). When prices fall, flip the trade.

✅ Hedging Edge: Cotton futures remain a reliable hedge against inflation, textile input costs, and global supply chain shocks.

Americold Realty Trust | COLD | Long at $13.28Americold Realty Trust NYSE:COLD

Technical Analysis:

The price is currently touching the top of my "crash" historical simple moving average bands (green lines). This area is often reserved for share accumulation and can signal a bottom. The price, however, may extend to the bottom of "crash" bands which is currently near $11.80. These bands don't always signal a bottom - there is a still a "major crash" zone - but with interest rates likely dropping in the next 1-2 months, REIT's are poised to benefit as money flows into dividend-paying stocks ( NYSE:COLD dividend is just over 6%).

Earnings and Revenue Growth

EPS and revenue growth are expected between 2025 and 2028 (while REITs are rarely high-growth, the future appears relatively good for the company - especially if their debt levels drop)

www.tradingview.com

Health

Debt-to-Equity: 1.29x (not great, but not terrible)

Altman's Z-Score/Bankruptcy Risk: .5 (high risk - likely higher than 50% chance the company could go bankrupt in the next 24 months *if* interest rates don't drop, but ....)

Market Niche

NYSE:COLD operates in a specialized sector with high barriers to entry due to the capital-intensive nature of building and maintaining temperature-controlled facilities.

The company is an esential service - critical for food safety and pharmaceutical integrity, providing stable demand even in economic downturns.

The company's extensive network ( NASDAQ:KHC , NYSE:CAG , NYSE:WMT , etc) and global footprint (facilities in the US, Australia, New Zealand, Canada, and Europe give it a competitive edge over smaller players.

Insiders

$2 million in recent insider purchases near $17.

openinsider.com

Action

Due to the high likelihood of interest rate lowering and the market niche NYSE:COLD has as a REIT, I am personally going long at $13.28 and will liekly add more share in the $11 range *if* fundamentals improve. Major warning is bankruptcy risk.

Targets in 2028

$15.00 (+12.9%)

$18.60 (+40.1%)

HUPSENG - dividend gem at an attractive priceThis stock provides awesome dividend yield of around 7.0%.

It recently broke the downtrend with price hovering around 1.00 and forming a tight flag for the past few days.

Looking back, this stock tends to test the MA20 before moving higher so currently, waiting for price to test 0.97 is a reasonable bet.

Dividend ex date for this quarter is on 17.9.2025 so there is a potential for it to touch MA20 by then.

Fundamentally, its sound, nothing fancy.

Recent QoQ revenue was positive. But its hard to find "cookies" like this nowadays.

UPS: From Delivering Packages to Delivering ValueAs you probably know by now, my strategy consists of finding cheap, deep-value, beaten-up, underdog stocks. This is the strategy I've been using for the last 5 years and that allows me to consistently outperform the S&P 500 by 2x to 3x every year.

This does not guarantee that all my analyses are correct. But if I'm correct 6 or 7 times out of 10, then I'm a rich man!

Now back to UPS!

Over the last 3 years, the stock lost 64% of its value. But... did sales or income decline by the same account? Did margins decline? Did the company decrease its fleet by 60%?

The answer to all these questions is NO, and this is why I think the stock is undervalued.

Yeah, the tariff war and Amazon's slowing of the UPS agreement hurt sales, but these are transient.

Overview

UPS stock is down 64% since its ATH in 2022.

P/S ratio is at 0.8, the lowest since 2009.

P/E ratio is at 12.6, the lowest in the history of the stock

The P/B ratio is at 4.58, the lowest since 2006.

Dividend yield is at 7.8%.

The CEO recently bought $1 million worth of UPS stock.

This data gives us some clues. The stock is obviously underpriced, despite the fact that UPS is still one of the market leaders and the sales are stable.

Financial performance

Revenue: TTM $90.69 billion (+1.3% YoY); Revenue is improving, but still 10% down since the $100 billion in 2022.

Profitability: Operating margin 9.4% (TTM), net margin 6.4%;

EPS is now at $7.70, which is a similar level to what it was in 2020 and 2021, when the stock price was at $120. However, now the stock price is at $85.

Balance Sheet: Debt $26 billion, debt-to-equity 1.45x, which is totally fine.

Growth prospects

UPS is cutting costs and jobs, targeting $3.5 billion in savings by 2026 via automation/AI (5-7% annual cost reduction).

E-commerce will sustain long-term growth.

The company is innovating with AI-improved routes, self-driving trucks, and drones.

Technical Analysis

The stock price is right above the $85 resistance level, which has been a support/resistance level since 2005.

My target

Considering the prospects, estimates, etc, I can see UPS going to $110 to $130 range in mid-2026, providing an upside of 30% to 40%. This level also aligns with the Fibonacci 0.236 level.

If the stock continues to drop, I will simply average down. I don't think it can drop much more from here, and it will definitely not go bankrupt.

I'm gonna invest approximately 1% of my wealth into this stock.

Remember, I'm just sharing my journey and this is not financial advice! 😎

Prospect to ride copper train up to 0.35 (66% gain)?Prospect Resources (PSC) classic cup and handle, showing extension to around 0.35, coinciding with parallel channel.

Switching to the weekly and looking further back since the Arcadia lithium mine was sold in July 2022, there is also a double bottom / W.

Fundamentals pretty strong being a copper explorer with substantial Maiden Resource Estimate, extensive drilling programme and strong track history.

GENIUS Act Spurs Corporate Stablecoin Ambitions Amid Legal HurdlThe newly enacted GENIUS Act has created a landmark regulatory framework for stablecoins in the United States. The law mandates 1:1 backing, rigorous audits, and full transparency for issuers, effectively opening the door for large-scale corporate entry into the sector.

Major corporations — including top banks, retail giants, and global tech firms — are now exploring the launch of their own dollar-backed digital tokens. Others are considering strategic partnerships with established issuers to accelerate their entry into the market. The potential applications range from global remittances to supply chain finance, with the promise of faster settlement, lower fees, and improved liquidity.

However, significant challenges remain. The regulatory rollout will be phased and compliance-heavy, requiring ongoing coordination with multiple federal agencies. Businesses must also decide whether to operate on public blockchains like Ethereum or Solana, or develop private networks for greater operational control and security.

The stablecoin market is expected to expand rapidly under the new law, but issuers must navigate complex issues around anti-money laundering controls, customer identity verification, and capital reserve management. Striking the right balance between regulatory compliance and market competitiveness will be crucial.

Meanwhile, established stablecoin providers are adjusting their strategies to align with the new rules, focusing on building institutional trust while maintaining product scalability. For new entrants, the GENIUS Act represents both an opportunity and a challenge — those who move quickly yet carefully may secure a decisive advantage.

As the stablecoin infrastructure matures, regulated token issuance by reputable corporations could drive the next wave of crypto integration into mainstream finance. The companies that master compliance, security, and utility will be the ones to define this new era in digital currency.

Robert Half | RHI | Long at $37.58Robert Half NYSE:RHI is a company that provides talent solutions and business consulting services in the US and internationally. It's a cyclical stock. Currently, the price has entered my "crash" simple moving average zone ($37-$33) and has historical bounced from this area. This doesn't mean the "major crash" area won't be reached ($26-$21 or below), but the company has been around since 1948 and survived many hurdles along the way.

Earnings are forecast to grow 8% annually and it has a 6.3% dividend. P/E = 21x and financially healthy (low debt-to-equity: .2x, low bankruptcy risk/Altmans Z Score: 5; and enough cash to pay current bills/quick ratio: 1.6).

Regardless of bottom predictions, I think there is a high chance the stock may reach $33 before a slight bounce. If the market flips for a bit, that "major crash" area ($20s) may be hit.

So, a starter position for NYSE:RHI has been created at $37.58 with additional entries near $33 and $25-$26.

Targets into 2028:

$46.00 (+22.4%)

$53.00 (+41.0%)

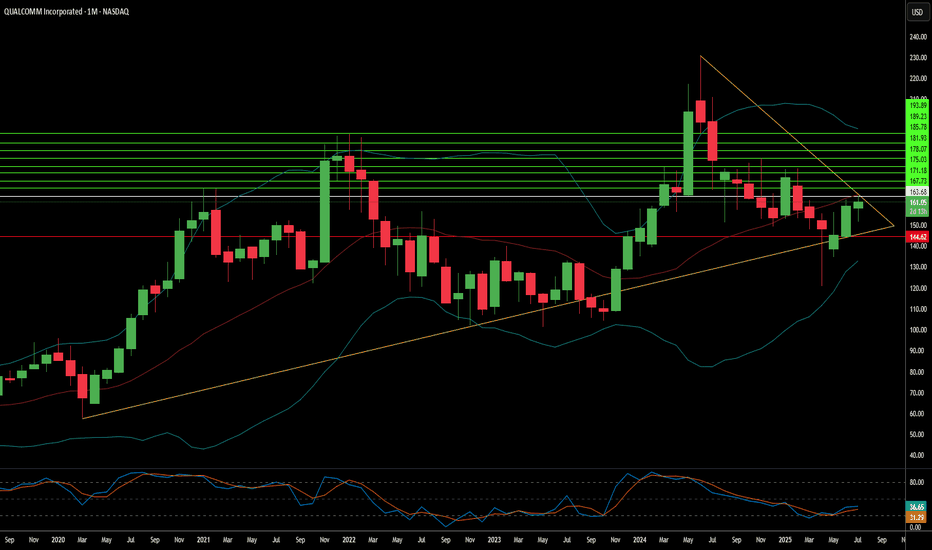

Qualcomm: Beyond the Smartphone Storm?Qualcomm (NASDAQ:QCOM) navigates a dynamic landscape, demonstrating resilience despite smartphone market headwinds and geopolitical complexities. Bernstein SocGen Group recently reaffirmed its "Outperform" rating, setting a \$185.00 price target. This confidence stems from Qualcomm's robust financials, including a 16% revenue growth over the last year and strong liquidity. While concerns persist regarding potential Section 232 tariffs and Apple's diminishing contribution, the company's strategic diversification into high-growth "adjacency" markets like automotive and IoT promises significant value. Qualcomm currently trades at a substantial discount compared to the S&P 500 and the Philadelphia Semiconductor Index (SOX), signaling an attractive entry point for discerning investors.

Qualcomm's technological prowess underpins its long-term growth narrative, extending far beyond its core wireless chipmaking. The company aggressively pushes **on-device AI**, leveraging its Qualcomm AI Engine to enable power-efficient, private, and low-latency AI applications across various devices. Its Snapdragon platforms power advanced features in smartphones, PCs, and the burgeoning **automotive sector** with the Snapdragon Digital Chassis. Further expanding its reach, Qualcomm's recent acquisition of Alphawave IP Group PLC targets the data center market, enhancing its AI capabilities and high-speed connectivity solutions. These strategic moves position Qualcomm at the forefront of the **high-tech revolution**, capitalizing on the pervasive demand for intelligent and connected experiences.

The company's extensive **patent portfolio**, encompassing over 160,000 patents, forms a critical competitive moat. Qualcomm's lucrative Standard Essential Patent (SEP) licensing program generates substantial revenue and solidifies its influence across global wireless standards, from 3G to 5G and beyond. This intellectual property leadership, combined with a calculated pivot away from its historical reliance on a single major customer like Apple, empowers Qualcomm to pursue new revenue streams. By aiming for a 50/50 split between mobile and non-mobile revenues by 2029, Qualcomm strategically mitigates market risks and secures its position as a diversified technology powerhouse. This assertive expansion, alongside its commitment to dividends, underscores a confident long-term outlook for the semiconductor giant.

Bitcoin Cycles Signal Major Move — BIT500 on What Comes NextBitcoin’s historical price action is known for its cyclical behavior — driven not only by supply dynamics like halving events, but also by global macroeconomic forces. This week, leading crypto macro analyst TechDev released a widely discussed model projecting that Bitcoin may be entering a new explosive phase, closely linked to a shift in monetary policy, global liquidity cycles, and risk asset rotation.

At BIT500, we see this as more than a theory — it’s a playbook. Understanding macro-driven crypto cycles gives institutional and high-net-worth investors a clear advantage. And, when used properly, it can become the foundation for consistent alpha generation in the digital asset space.

TechDev’s Model: Liquidity as the True Driver

According to TechDev, Bitcoin’s major uptrends are synchronized with global liquidity expansions. In particular, the model links Bitcoin price surges with:

Falling real interest rates,

Expanding global M2 money supply,

Weakening U.S. dollar (DXY decline).

This pattern played out in 2016–2017 and again in 2020–2021. As global central banks prepare to shift toward more accommodative policies — especially amid slowing GDP growth and rising debt burdens — similar conditions may be taking shape for late 2025 and into 2026.

BIT500 analysts agree: the macro landscape is increasingly favorable for risk-on positioning, especially in hard assets like Bitcoin.

On-Chain Indicators Confirm the Thesis

Supporting the macro thesis is a growing set of on-chain signals. Our internal models — as well as public indicators like Dormancy Flow, MVRV ratio, and Realized Cap metrics — show long-term holders are accumulating, while short-term holder activity has flattened.

The decline in exchange reserves, increased self-custody trends, and decreased miner selling pressure all align with prior pre-bull market phases. This combination of tightening supply and macro liquidity can act as fuel for the next leg up — one that could catch passive investors off-guard.

How BIT500 Capitalizes on Bitcoin Cycles

At BIT500, we convert insights into execution. Our team applies cycle-based, quantitative strategies to capture asymmetric upside while managing downside risk.

Here’s how we turn macro analysis into market performance:

Phased Capital Deployment

We deploy capital in staggered allocations, entering during compression phases and scaling in as trend confirmation emerges — minimizing exposure during volatility and maximizing return during expansions.

Volatility Harvesting

We implement delta-neutral and volatility-arbitrage strategies across Bitcoin derivatives markets, generating income in all phases of the cycle — especially when price is range-bound.

Multi-Asset Rotation Models

Based on cyclical rotation, we dynamically adjust exposure between Bitcoin, Ethereum, and select altcoins. These models are tested to outperform static portfolios across halving-based and macro cycles.

Custom Risk Monitoring Systems

BIT500 clients benefit from our proprietary Cycle Risk Dashboard, which sends alerts when market structure shifts — enabling proactive rebalancing rather than reactive trading.

Conclusion

Bitcoin’s next major price movement is likely to be shaped not just by crypto-native factors, but by broader shifts in global liquidity, interest rates, and investor sentiment. TechDev’s research confirms what BIT500 has long modeled — that understanding economic cycles is key to anticipating large-scale Bitcoin breakouts.

For investors seeking not just exposure but performance, the coming months represent a rare window of opportunity. At BIT500, we don’t just track cycles — we build strategies to monetize them with discipline and precision.

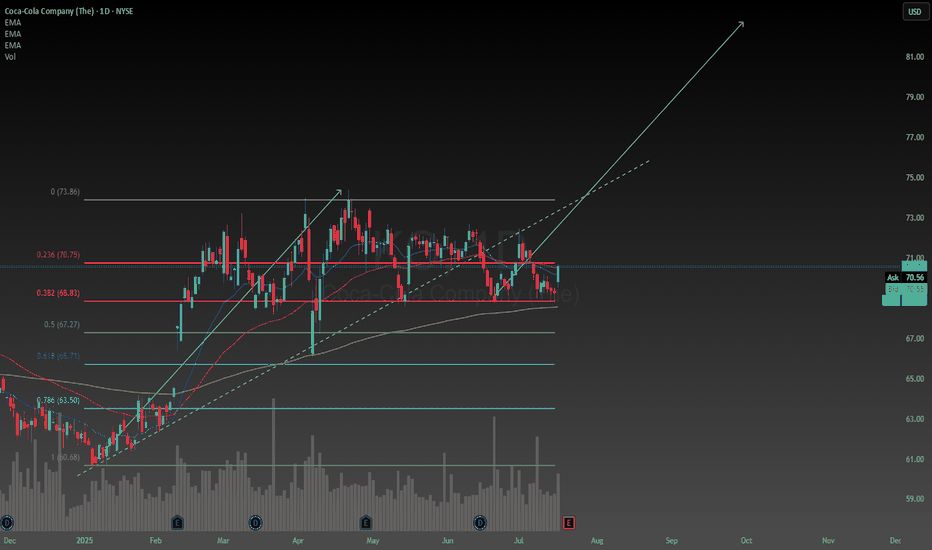

Coca Cola to protect my portfolio and help it growOne of the most important things we must try to determine as investors is what company is the best at what they do in their field. In my opinion Coca Cola is and has always been the number one soft drink manufacturer, always finding new yet subtle ways to stay ahead of their competition.

The reason I have allocated a decent amount of my portfolio to Coca Cola is a combination between their reliable track record of creating value, and paying dividends. People love junk food so it gives me high conviction to hold the stock long term. The company also demonstrates consistent, and reliable methods of generating organic revenue, and constantly finding new ways to cut costs and improve their profit margins.

Despite what some other critics may claim about the stock being over valued, the intrinsic value of the stock happens to be $77 with a range between $48-$180. According to technical analysis it is over valued. I have too much respect for Coca Cola to trust technical analysis in my decision to hold the stock, I am rely solely on fundamentals. According to my perspective on the company it is in fact undervalued.

Another positive catalyst I have noticed was when President Trump said he thinks Coca Cola should be made with cane sugar in the US, I think that would be a great idea, not only would it be healthier the soda would also taste better. Coca Cola looks like its going to stay ahead of the game for the foreseeable future.

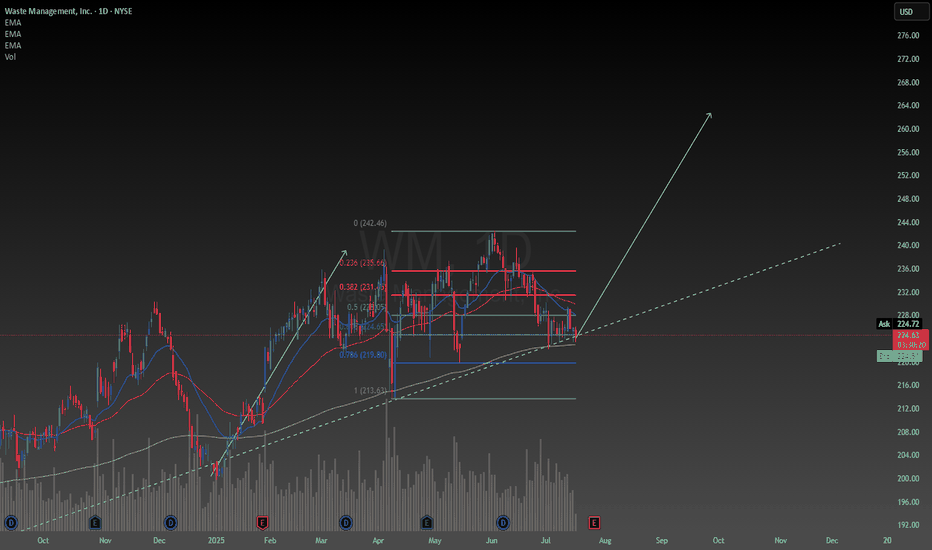

Waste Management confluencesFirst of all fundamentally the company is basically essential to our survival so I have no reason to believe they will go out of business any time soon. Earnings report soon should bring about some volatility. I was foolish enough to buy the top a couple months ago and deciding today I will add the the position because I like this price. Even though I bought the top, it was still below the intrinsic value at the time so it was a reasonable decision.

With my simple trendline and rudimentary use of a Fibonacci I am able to set a price target of $260 depicted by my drawing of a potential new leg up. This is backed up by the absolutely fundamental usage of a calculation of the intrinsic value, which by my calculation is $280, and has a range between $170-$640 however these numbers may need to be adjusted after the earnings report. The value is now well below the intrinsic value so I am seeing this stock as a really good deal now.

Despite any uncertainty in the economy Waste Management has seemed to outperform during these times so it is in my portfolio defensively. This stock is strong when it needs to be, which is why I like it.

ConAgra Brands | CAG | Long at $19.38ConAgra Brands NYSE:CAG , maker of Marie Callender's, Healthy Choice, Birds Eye, Orville Redenbacher's, Slim Jim, and many more, has seen a continuous drop in share price since the rise of interest rates, inflation, and tariffs. The stock is currently trading near its book value of $18.71 and has a dividend yield of 6.9%. Debt-to-equity is reasonable (0.9x), but the company does have a Quick Ratio of 0.2x (short-term liquidity issues) and a Altman's Z Score (bankruptcy risk) of 1.7, which should ideally be 3+. Like almost every large-scale food company, earnings growth is relatively low, but 2025 is anticipated to be its worst performing year - which explains the price.

While the stock is not likely to generate triple-digit returns in the near-term, NYSE:CAG is a strong company with a nice dividend and some growth ahead. I foresee such stocks getting new life with drops interest rates. However, a dip near $17 (into my "crash" simple moving average area) or even slightly lower is possible - which may likely result in another stock entry.

Thus, at $19.38, NYSE:CAG is in a personal buy-zone with future entries planed near $17 or below.

Targets into 2028

$22.00 (+$13.5%)

$25.00 (+29.0%)

Where is Verizon headed next?Some quick points about the slight dip Verizon experienced over the past 5 trading days. Did bears step in and reject higher prices for VZ? Is the potential for a rally over?

In my opinion. No. But why you ask?

This stock trades relatively inverse to 10 year treasury yields. The 4 down days recently coincided exactly with 4 green days for 10 year yields. This is because if treasury prices fall, and thus yields go up, it makes Verizon theoretically less appealing because though you will generate less yield from treasuries, they are backed by the US government.

So in order for Verizon's yield to be more competitive with treasuries, naturally the price declines. When treasury yields drop, VZ can naturally rise, because the dividend can decline relative to price, and it's still appealing. This wasn't investors souring on Verizon, or the bears rejecting a rally, it was investors worrying about US debt repayment, and demanding higher interest payments from the government.

So why did yields spike for 4 days? The Big Beautiful Bill. Basically if the government borrows a bunch of money, and investors think that maybe there is a risk that they won't be able to pay them back, they demand a higher yield (treasury prices fall, and yields go up).

But if you ask me, that yield spike may already be over. The market tends to over-react to big news like this, and there are a few things happening right now that favor VZ going higher, I will list them below :

10 year yields have been trending down for months, they spiked, but only touched the top of the downtrend channel before retreating. They look poised to continue the downtrend for the second half of the week. Remember, the trend is your friend. Until yields break this channel convincingly and create an uptrend, you can assume they will continue downwards.

When tech stocks fall, yields tend to fall even faster, because investors seek the safety of treasuries to preserve capital and wait out the dip, which pushes bond prices up, and drives yields down (good for high dividend stocks like VZ).

Most tech stocks, and the QQQ ETF are looking very overbought. Earnings season is coming, but it looks like all of that action has already been priced in. There are bearish divergences appearing all over the place in tech stock RSI charts, I personally started closing out some positions already.

I'm still bullish on tech into the end of the year, but right now there is a lot of risk chasing the big names higher IMO. This is the longest stretch of days in 3 years without a 5-10% correction, which is already a red flag in itself. I won't be surprised to see some of the big names start to pull back as early as tomorrow, some of them have already begun to pull back. At least a minor correction looks highly probable, a deeper correction within the next few weeks.

10 Year Bond futures bounced and started climbing today (albeit, just a little, but in the right direction).

The market seems to be forgetting that US Treasury Sec. Scott Bessent's former job was literally selling US debt (driving yields down). He has made a career out of pushing yields down, and has stated it's his major goal with this administration. And like Elon said "if you are betting against the bond market, I think you are on the wrong side of that bet." (in short, this is a bullish theme for dividend stocks which are sensitive to yield fluctuations).

All in all, my thesis from previous posts remains. VZ is going higher, so long as 10 year yields don't rocket to all-time highs and stay there forever, and there is no apocalyptic earnings report, I see no reason why it won't.

$PEP Bullish Swing Setup – Oversold & Ready to Rebound ?PepsiCo ( NASDAQ:PEP ) is sitting at a major long-term support after a deep pullback — this could be a strong opportunity for a risk-defined bounce. Here's what the chart is signaling:

🔹 Entry Zone: Price is currently near $128 — a historically significant level that acted as resistance in the past and now aligns with a potential support flip.

🔹 Oversold & Stretched: After a consistent downtrend, NASDAQ:PEP is looking oversold. A bounce is likely as sellers exhaust and dip buyers return at this key level.

🔹 Reversal Structure Building: Early signs of a bottoming pattern are emerging, with potential higher lows forming. If the current structure holds, we could see a climb toward the next resistance zones.

🎯 Targets:

TP1: $154 – minor resistance and previous consolidation zone.

TP2: $197 – major resistance and range high, aligning with earlier highs.

🛡️ Stop Loss: Below $102 — invalidates the support thesis and breaks structure.

💡 Why Price May Rise:

PEP is a defensive name with strong fundamentals, often benefiting during uncertain macro cycles.

Valuation is now more attractive after the sell-off.

The setup offers a high reward-to-risk ratio, especially if broader markets stabilize.

⚖️ Setup Summary:

Entry: ~$128

SL: $102

TP1: $154

TP2: $197

📌 Watching for confirmation with volume or bullish candle structure over the next few sessions.

🚫 Not financial advice — just a technical outlook based on structure and probability.

XRP Price Finds Some Relief — But Headwinds Remain,Says ArtavionAfter slipping below $0.50 last week, XRP has rebounded modestly, now trading above $0.52. While this short-term recovery provides relief for holders, fundamental and structural challenges still limit the token’s upside potential, according to analysts at Artavion.

The recent bounce appears largely technical. Support held near $0.48, and with Bitcoin regaining strength above $66,000, sentiment across altcoins briefly improved. XRP’s Relative Strength Index (RSI) has moved out of oversold territory, suggesting some room for additional upside — but resistance between $0.56 and $0.60 remains firm. Low trading volume suggests the rally lacks conviction.

A major ongoing concern remains XRP’s legal battle with the U.S. Securities and Exchange Commission (SEC). Although Ripple Labs scored partial wins, the case is unresolved. Until a final judgment or settlement is reached, institutional investors will likely remain cautious, and U.S.-based platforms will continue restricting XRP exposure.

🗨️ “The legal cloud hasn’t lifted — and that limits capital inflows,” says a regulatory analyst at Artavion.

From a network perspective, XRP Ledger remains functional and Ripple’s payment infrastructure is active, particularly in select cross-border corridors. However, XRP still lacks integration with key crypto sectors like DeFi, NFTs, and gaming, which restricts organic demand and developer activity.

Externally, macro conditions are neutral to negative for altcoins. The Federal Reserve’s rate outlook and rising bond yields continue to pressure speculative assets. Stablecoin inflows into XRP trading pairs have slowed — another signal of fading short-term appetite.

Outlook

At Artavion, we believe XRP is currently locked in a range-bound pattern. A breakout above $0.60 is unlikely without:

Full legal clarity in the U.S.;

Stronger altcoin sentiment market-wide;

Renewed ecosystem development and integrations.

🗨️ “XRP isn’t broken — it’s waiting,” says the Artavion market desk. “But without a catalyst, it stays reactive — not directional.”