GOOGL to Low $100s?Overview

Google ( NASDAQ:GOOGL ) is in the dangerous territory of a double top formation. I've discovered this same macro-pattern with a few other assets as well. In combination with a rise in long-term Treasury Yield Curve rates since December 2023, I think a rush of selling pressure could be around the corner.

Technical Analysis

Utilizing Fibonacci retracement levels along with historical supports & resistances, the $126-136 range appears to be a key level in the share price. The double top formation is a bearish reversal pattern that resembles the letter "M" and, when valid, the second peak is greeted with significant selling pressure. According to technical indicators GOOGL is beginning to reveal the symptoms of a bearish reversal.

The share price has risen on dwindling volume, Money Flow Index (MFI) is approaching overbought territory, and the On-Balance Volume (OBV) is still under a ceiling created in March 2022. A rising wedge is also visible on the hourly charts with a micro Head & Shoulders in development. Should a high volume breakdown occur then I believe a price target range between $109-126 is probable, however, I am expecting adequate support around $126 as it correlates with both a 61.8% Fibonacci level and has history as a key area of support & resistance.

Speculations

Earnings season is a great time to profit from derivative trading, however, it can also be more treacherous due to the volatility most stocks experience in the days leading up to and immediately following their Quarterly Releases. Because GOOGL is having their Earnings Call in the next few days, I would not be surprised to see sharp price movements in either direction regardless of the current trends. Concrete stop-losses and price targets should be determined before entering any positions.

Doubletoppattern

Mr. Double Top is that you?Following a contracting triangle breakout today, NIFTY zoomed up with a fair amount of pull backs which denote more than just a regular retracement. Over a larger time frame, one can observe NIFTY ultimately forming lower highs since it made the last all time high. Today, near the closing bell NIFTY made a double top and slipped down from what one would consider a healthy retracement. These sharp pull backs show the power of bears to cause a dip and trap for buyers hoping a fresh bull run.

However, patterns can break so keeping in mind the risks you should not stick to any particular pattern assuming the holy grail to market formations. On the right axis is Fibonacci retracements we can observe if a sharp fall occurs if the double top pattern holds true.

S&P500: Moving to the DowOverview

I decided it was time to start taking control of my own retirement account. For years my account has been pulling in mediocre gains and the only reason I've put up with it for so long is because: 1) it took me years to hone my trading skills and 2) my employer matches my contributions.

Well, after reviewing my available fund allocations and performing a quick technical analysis of the respective funds, I decided to pull completely out of the S&P500 ( SP:SPX ) and placed them into the Dow Jones ( DJ:DJI ).

Technical Analysis

SP:SPX

A double top has appeared on the 1W chart. Combined with dwindling volume on top of increasing value, I think it's ready to fall. Utilizing Fibonacci retracements I believe a good time to re-enter the S&P 500 will be in the range of $2200-$3200 USD.

DJ:DJI

While it is still slightly early to confirm, it appears that the Dow Jones has escaped the double-top and in my opinion looks coiled up and ready to spring. Utilizing Fibonacci retracement levels -- supported by increasing volume with rising value -- $56.8K appears to be a practical price target.

BTC / USDT - Bearish Signals at 4H TimeframeBTC / USDT - Bearish Signals at 4H Timeframe

Technical Analysis:

Double Top Break and Retest: price is showing signs of weakness with a break below the double top neckline followed by a retest, suggesting potential bearish pressure.

VWAP Break: The VWAP (Volume Weighted Average Price) has been breached, indicating a shift in market sentiment and potentially favoring the bears.

Bearish Divergence: A bearish divergence is observed, adding to the indications of potential downside movement.

Weakness Confirmation:

If the price fails to hold the critical level at $41,666, it could trigger further downside movement.

Target:

The initial target is set at the 200 moving average (MA), acting as potential support in a bearish scenario.

Risk Management:

Consider implementing risk management strategies, including stop-loss orders, to protect against adverse market movements.

BluetonaFX - USDJPY Tumbling After Failed Record High BreakHi Traders!

The 151.946 apex level proved to be too strong and there is a now potential double top pattern on the USDJPY 1W chart after the market failed to break and close above 151.946.

Price Action 📊

After the initial break and close above the previous strong resistance level at 145.073, the market traded with continuous bullish momentum to target the psychological 150 handle and then the apex level, but the market seems to have run out of steam and is rapidly pulling back towards 145.073.

Fundamental Analysis 📰

We have the FOMC minutes meeting today, and depending on what is revealed in the minutes meeting, we have further downsides this week for the US dollar.

Support 📉

146.711: 20 EMA

145.073: PREVIOUS RANGE ZONE RESISTANCE

Resistance 📈

149.991: WEEKLY HIGH

Risk ⚠️

No more than 2% of your capital.

Reward 💰

At least 4% of your capital.

Please make sure to click on the like/boost button 🚀 as your support greatly helps.

Trade safely and responsibly.

BluetonaFX

CADJPY_28.09.2023_Potential to develop triangle & double topCADJPY analysis:

1. Time frame daily & weekly, currently price in a strong resistance area, but the upward movement in prices is starting to slow down.

2. Time frame daily, price has the potential to develop double top pattern which is a reversal pattern.

3. Time frame H-4, price has the potential to develop rising wedge pattern.

Double top & rising wedge patterns have potential to form in a strong resistance area, so we can make this momentum to find a good position to have a selling position.

Notes:

- This is a personal analysis, please adjust it to the existing conditions.

- This is not a buy/sell recommendation. This is just my personal analysis.

- Please analyze again, because you are responsible for your decision. Your losses are your responsibility, your profits are yours.

- Still in the learning process, let's learn together :)

Thank You

MY WOO DOUBLE PATTERN TRADEIn the past days, I posted an idea about BINANCE:WOOUSDT forming a potential double top pattern. Then, entered with the confirmation of a breakout on the first diagonal support line along with other confluences such as good selling volume and the RSCD (RSI and MACD).

Take profit areas:

1) Price touching the second and the longer diagonal support.

2) Price reaching the neckline support.

3) Price on the 0.5 fib area/ common support line.

4) Stop profit above neckline.

How to Use the TP/SL Split Target Feature on Binance Futures

www.binance.com

WOO: DOUBLE TOP PATTERNIn this technical analysis, the idea presented is the 4-hour chart of BINANCE:WOOUSDT , which appears as a bearish indication of a double top pattern. With that, I plotted two potential diagonal support lines to consider for a breakdown to materialize.

I have a bearish sentiment for WOO based on an unlocking happening this October 10 per defillama.com . What is unlocking? From a coin perspective, investors have the attempt to sell the unlocked tokens that they held for some time, which can decrease the price of the coin.

We're currently on a weekend, so we can't expect volume. I will continue to monitor this coin from time to time and provide updates as well in the comments.

On another note, consider checking my article about BTC CRUCIAL TRIANGLE as we could expect a massive move and could correlate with altcoins as well.

Always plan your trades by knowing your support and resistance along with take profit or stop-loss areas when entering a position. Happy trading!

NAS100 Double BottomNASDAQ forming a double bottom on 15min time frame with bullish divergence.

Manage your Risk!

Potential Double Top Formation in USDCHFDear Traders,

Please be aware of the USDCHF chart, as the potential for an uptrend continuation is diminishing. We’re approaching the formation of a second top, which could indicate the development of a double top pattern, a bearish signal.

Take profits have been indicated on the chart to help you make informed decisions. Exercise caution and consider your risk management strategy in light of this potential pattern.

Happy Trading

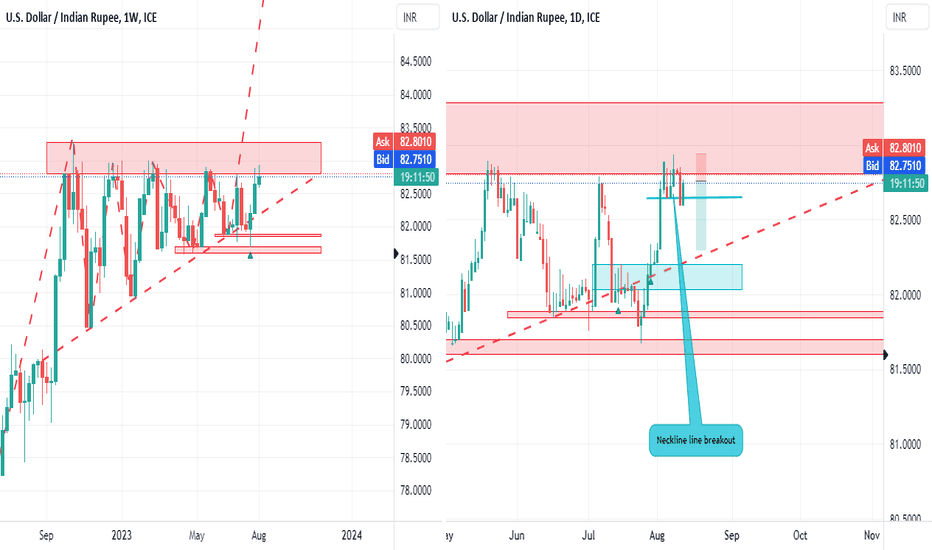

Double top neckline breakout In weekly the market is in Ascending triangle pattern. where the current market price is at weekly resistance.

In daily time frame there is change in trend(from bull to bear) formed by double top neckline breakout, so the market is expected to fall further till the weekly ascending trend line(support).

After the DT neckline breakout now the market is in retest, a good level to sell where minimum risk : reward ratio is 1:2.5

DOUBLE TOP in play on AUDCHFOANDA:AUDCHF wanting to continue it's bearish momentum as a critical resistance at 0.8759 rejected by double top. I entered short here. If we see lows of 2020 the trade would close at 16x gain!

This post is intended for education only. It is hypothetical and by no means financial advice. Trading is risky and consultation with your financial advisor is always recommended prior to investing or trading.