The rise in gold is still continuing.Wave -(i) of (E) is forming, and the target of 3900-4050 remains valid, and it could even go higher than this price. After the completion of wave -(i) of (E), there is a possibility of a corrective period in both time and price. A time-based corrective period is more likely.

Good luck

NEoWave Chart

Elliott Wave

EURUSD changing directioEUR/USD Finally Breaks Below Key Moving Averages | Technical Analysis Update

In this video, I share my latest EUR/USD analysis — the pair has finally broken below both the exponential (blue) and simple (red) moving averages, marking a potential shift in market structure after months of consolidation since February.

We go step by step through:

🔹Breaking under the EMA + SMA

Elliott Wave count & correction phase

🔹 Confirmation from the stochastic oscillator

🔹 Key trendline break setup

🔹 Fibonacci retracement (61.8%) and projection confluence

🔹 Short entry zones and target levels between 1.08 – 1.09

💡 Important: This is not financial advice — I’m just sharing my personal market analysis and thoughts. Always manage your risk and use proper stop-loss techniques.

If you enjoy detailed, no-nonsense technical breakdowns of the forex market, make sure to:

👍 Like the video

🔔 Subscribe to the channel for more EUR/USD, GBP/USD, and market updates

ETHUSD: Where Price Could Go?4h tf

ETHUSD has bounced back strongly from around $3,826 after completing an A-B-C wave pattern. Right now, the price is testing resistance near $4,756. It could drop a little to around $4,440 before moving higher again. If the uptrend continues, the next target levels are $4,955, $5,300, and $5,500.

Stay tuned!

Thank you,

@Money_Dictators

Future of #GOLD #XAUUSDSurprises from #Gold #Levels and #Positional #Targets.

Based on Analysis from yearly chart and #Fibonocci retracement and #extension

& Based on Elliot wave theory, Gold didn't give a retracement at 1.618 levels, which means, Gold broke and holding above 2950., which means the next possible stop is at 2.618 Fib extension and #elliot wave #analysis 3rd wave. Until it reaches this levels the momentum will continue and will reach quickly !

So the ultimate possible target will be #4617.

The Intermediate monthly resistances will be 4041 / 4277 / 4617.

Riding the 3rd wave, which is an Impulse wave will give quick positional targets.

Need not believe this analysis blindly. Do your own analysis and wait and watch the wonders.

Analysis shared for Educational purpose only. Do your own analysis, to be successful on a longer run !!!

#technical #analysis #wonders. There is no holy grail.

GOLD → The correction will trigger growth to $4,000.FX:XAUUSD hit a new record high of nearly $3,977 and entered a correction phase to build up potential before further growth. Despite the local strengthening of the dollar, the upward trend continues thanks to a combination of macroeconomic and geopolitical factors.

Key supporting factors: Ongoing US government shutdown: The Democrats' fifth unsuccessful attempt to resolve the issue increases uncertainty. Markets expect two interest rate cuts before the end of the year.

China has been increasing its reserves for the 11th consecutive month, and global central banks bought +15 tons in August.

No bearish triggers: Any correction is seen as a buying opportunity.

Gold maintains its upward momentum. Breaking through $4,000 seems a matter of time if current drivers remain in place. Key risks are an unexpected resolution to the shutdown or hawkish signals from the Fed.

Resistance levels: 3977, 4000

Support levels: 3945, 3927, 3920

Technically, a false breakdown of support could lead to continued growth. A retest of 3945 is possible; a weak reaction could trigger a deeper correction, for example to 3927, before further growth.

Sincerely, R. Linda!

Gold Watching 3,850 Support as Dollar Weakens on UsGovt ShutdownHey Traders, in today’s trading session we are monitoring XAUUSD for a potential buying opportunity around the 3,850 zone. Gold is trading in an uptrend and currently in a correction phase, with price approaching this important support/resistance level.

Structure: Gold remains within an overall bullish structure and is also trading inside an ascending channel.

Key level in focus: 3,850 — a key support zone where buyers may look to step in.

Upside target: 3,930 — aligning with the channel resistance and potential area for bullish continuation.

Fundamentals: The ongoing US government shutdown is adding bearish pressure on the US Dollar. Given Gold’s negative correlation with DXY, this environment continues to support the bullish bias for Gold.

Trade safe,

Joe.

AUDUSD Eyes 0.65900 as Gold Nears Record HighHey Traders, in the coming week we are monitoring AUDUSD for a potential buying opportunity around the 0.65900 zone. AUDUSD remains in an uptrend and is currently in a correction phase, with price moving toward this key support/resistance level.

Structure: The broader bias is bullish, with price retracing toward trend support.

Key level in focus: 0.65900 — an important area where buyers may look to re-enter.

Fundamentals: Gold continues to rise and is nearing a fresh ATH, supported by a bearish US Dollar bias. Given the positive correlation between AUDUSD and Gold, further upside on the pair remains likely.

Next move: Monitoring price reaction at 0.65900 to assess whether the trend resumes higher.

Trade safe,

Joe.

Gold. Waiting NFP trigger? 7/Oct/25XAUUSD nonstop surging need some profit taking? what event trigger the heavy sell off? Coming this Friday delayed NFP? "time / cycle - wise" Look like "some cash out" not just from Gold but also equities market?. 4007.885 are the confluence zone of 1) Monthly R1 2) Parallel Line Resistance 3) AB = CD price volume. and many...P/s all impulsive wave consist of abc subwaves not 1,2,3,4,5 waves

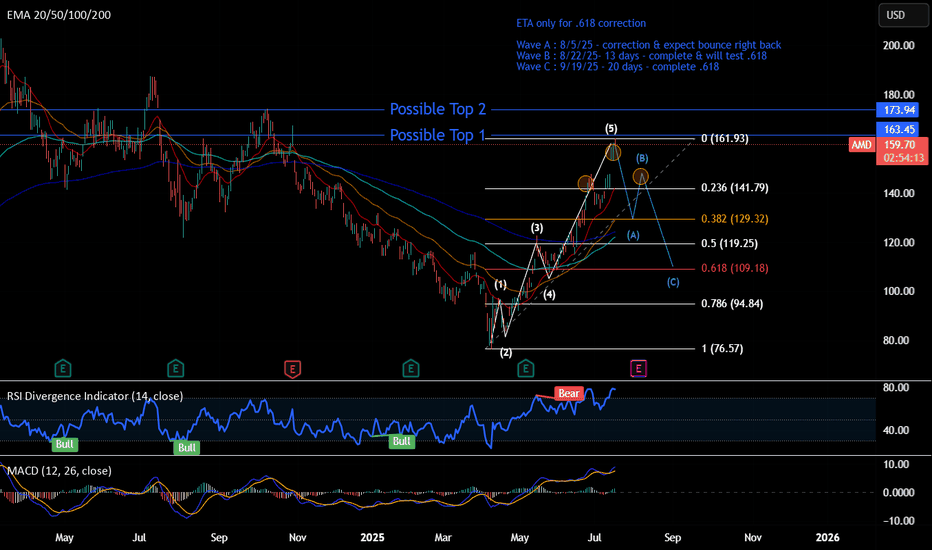

Short - AMDTime period for this play : week to months

Analysis : Elliot wave 12345 ABC. Expect hitting .618 and bounce back up to go higher.

Pattern if wave B completed : Head & Shoulder

Price Target: Wave ABC

ETA Timeline for correction. Please refer to the chart.

Upcoming events:

Tariff active on 8/1/25 - Friday

Earning on 8/5/25 - Tuesday

Top is not in yet, so 2 Possible top-in levels:

Top 1 - $163.45 : Retesting to hit 163.45, rejected, and break $158

Top 2 - $173.94 : Breaking 163.45 and reject at 173.94

=> Overall, It begins trading side way and show some weakness now.

The correction may not pull back to .618, which is the best level. Other scenarios:

- 0.5 fib, where it test wave 3

- 0.328 fib, strong bullish level if it doesn't break & go to the upside faster

Silver Is Extending Impulsively Higher; All-Time Highs SoonSilver Is Extending Impulsively Higher, which can push the price into all-time highs from a technical point of view and by Elliott wave model.

Silver is on the rise and has been outperforming gold quite a lot over the last week, and it looks like an extended leg up is still in progress; seems like wave three of an extended impulse, therefore more gains are possible after next three-leg retracement. Based on the 4-hour chart, there is a chance that price goes towards 50usd, but there can be some new pullback first. Ideally red wave (4) could stabilize near 45.86. Only a sharp impulse down closer to 43 level will be an indication that higher degree wave four has started.

Higher Time frame charts show an ongoing bull cycle that is now targeting the high from April 2011, which could be the next major level and a potential area for a new retracement, maybe sometime in 2026.

BTQQF - Tommy Lee's Quantum NameBTQ name is lately popular after Tommy Lee mentioned it for Quantum Crypto POC blah blah..

Anyways, Technically this is in a good buy zone.

- Above 200MA

- Above big volume shelf support zone

- Finished ABC correction and Wave 2 about to begin on the primary cycle.

Low float 138M shares, Small Market cap 512M

Can do a epic run if it starts moving up.

Target 1 - 8

Target 2 - 12

Target 3 - 14ish..

Have a tight stop loss below 2.75

The path wont' be straight up but volatile.

APT — Diametric Pattern Completed? Wave G in Play!APT appears to have completed a 7-leg Diametric correction (A–G) — a rare and complex Elliott structure often seen before major trend reversals.

Currently, price has broken out of the descending channel, confirming the start of Wave G, which could extend toward the $7.0 zone — aligning with the previous Wave A resistance.

Key Points:

• 🌀 Completed Diametric structure (A–G) over ~233 days

• 🟢 Breakout from the descending wedge

• 🎯 Potential target: $6.8 – $7.2

• ⚠️ Support to watch: $4.8 – $5.0 (retest area)

If momentum holds, this move could mark the first bullish leg of a larger reversal phase.

Too early? - LINK weekly update Oct 7 - 13thLooking at Chainlink this morning, it shows us just another 1-2 setup to trade on. Watching this to develop top-down, we are in the 3rd wave of the cycle, the 3rd wave of the primary cycle and now the 3rd wave of the intermediate cycle starts. Within the intermediate cycle I suspect the minor cycle to from another 1-2 soon, presenting us a beautiful chance to buy in. Besides that, I can recommend taking a swing-long trade here aiming for 40$, with the stop loss at the red marked low. This scenario also fits the expectation for Ethereum as those coins correlate. The alternative scenario would mean to break the red marked low and drop further. The indicators also support this scenario, as the RSI rises from the oversold zone and momentum builds up. Funding rates are also at typical levels for this wave and the open interest shows inflows.

Have a meaningful week,

Phillip

CoinbaseToday price continued higher and ideally finished its sub-minuette wave iii. There is still a chance that it gets another high closer to the 1.618 before kicking off wave iv though. This is signified by the turquoise label on the chart.

The wave ii was very short and shallow so one should expect the wave iv to be deep and long if the theory of alternation is to remain intact. Generally speaking, if the move lower breaches the 0.5 retracement fib, you're likely dealing with something other than a wave iv. However, due to how shallow the wave ii was, I will give this next consolidation a little more leeway. Keep in mind too, the wave 4 of a lesser degree bottomed at $368.80. Again, I won't be surprised if price breaches this low. My thought is that price will come down right to the area of the 0.5 retracement fib @ $362.19 with the possibility of a minor breach. After, I anticipate price to move up to the $411 area as we have strong confluence there.

My plan is to buy back in when/if price makes it to the smaller target box. I will then be looking to sell at the above-mentioned target area.

Link UPDATE (1D)LINK is about to complete its accumulation phase. On the daily chart, it’s breaking out of a clearly visible bull flag pattern, and according to Elliott Wave Theory, the 5th wave is now beginning.

If LINK manages to hold above $20, it could be on its way toward a target zone between $34 and $35.

ETHUSD Breaks The Channel, Pointing Above 5kEthereum has been rising sharply over the last two weeks after only a three-wave retracement from all-time highs, so it looks like a textbook fourth-wave pullback within an incomplete bullish structure that is now ready to resume. We’re seeing a break and push beyond the upper line of the corrective channel, suggesting price is stepping into wave five, so more upside can show up in the weeks ahead.

Ideally, price could rise beyond 5000, possibly even toward 5336, where wave five could match the distance of wave two.

When it comes to potential trading setups, it may be interesting to watch for intraday retracements, especially if we see one while the market still trades below wave three highs. Then, opportunities could show up around the 4350–4500 support area.

GH

Remaining strong - ETH weekly update 06 - 12th OctAfter some misconceptions in the past, I am back with new knowledge now. I think Ethereum currently unfolds the 5th wave in the intermediate cycle, which completes the 1st wave in the primary cycle and means the first step towards the end of the bullrun. It is crucial to sustain this pump now, as if not it would signal us that the 4th wave of the intermediate cycle is not completed yet. If so, the alternative scenario comes into play and we would form a drop out of 5 parts. The indicators rather support this move, as the strength of the trend rises and momentum pushes higher meanwhile the RSI enters overbought areas as expected from 3rd waves. Besides that, funding rates are rising as we would like to and the open interest shows inflow. Taking a look at the week in front of us, Jerome Powell is going to have a speech on thursday at the Community Bank Conference. Volatility is expected. On friday we will also receive some economic data like the unemployment rate.

Have a sucessful week,

Phillip

USDCAD | Yield Gap Supports Wave (y) Push to 1.40

The U.S.–Canada yield spread has widened back toward 1.0%, reflecting hawkish Fed–dovish BoC divergence. This has underpinned broad USD strength and weighed on the CAD.

Technical Lens:

USDCAD has progressed into wave (y) of the corrective structure, breaking through interim resistance and testing the upper channel toward the 1.40 region. The structure remains constructive as long as the channel holds, with the Elliott count framing 1.40 as a key inflection point.

Scenarios:

If the yield gap continues to widen and the channel holds → potential extension to 1.40.

If spreads narrow and price rejects 1.40 → pullback toward mid-channel support near 1.37–1.38.

Catalysts:

U.S. economic data & Fed communication.

Canadian growth signals and BoC policy stance.

Oil price stability (limited CAD support so far).

Takeaway:

The 1.40 zone is the decision point where macro divergence and technical structure converge.