U.S. Indices Price Action Market Outlook (S&P500, NASDAQ, DOW)Hello everyone:

Many have asked me about my outlook and analysis on the US indices currently, so let's take a quick look at them.

My overall bias on the indices are bearish. There could be some lower time frames bearish price action to give us confirmation of the bigger sell setups.

All of them are pretty much sitting at the top of the overall higher time frame price action, so certainly has good probability that we can get some bearish reversals.

I will go over them from a mid-long term approach.

Once again patience is key, if the bearish price action does not develop or continue, then no trade and entry, move on to other opportunities and different scenarios.

SPX

NAS

DOW

Any questions, comments or feedback welcome to let me know.

Thank you

Jojo

Flag

Detail Breakdown on GOLD Mid-Long Term OutlookHello traders:

Today I breakdown GOLD's current price action, and I discuss the potential possibility on the mid to long term outlook.

There could be different possible scenarios from the price, so its a good practice to have a solid trading plan and management.

Mid term wise I prefer to see price makes one more move to the downside, breaking previous lows and hit the bottom for the HTF flag/channel structure before reversing.

Alternatively we can also expect price to consolidate here and form a LTF impulse to breakout of the LTF flag/channel as well.

In both cases, long term outlook is certainly bullish if we get a completion of the LTF flag/channel that will have high probability to lead into next bullish impulse run.

Any questions, comments or feedback welcome to let me know.

Thank you

Jojo

OIL higher time frame outlook (Multi-time frame analysis)

Hello everyone:

Doing a quick bearish outlook on oil.

I like the price had a strong reversal bearish price action from the top of the HTF double tops area, and could lead into further continuation on the LTF

I will be patiently waiting for price to develop into the price action I want to see before executing any trades.

Thank you

Jojo

AUDCAD Continuation Sell (Multi-Time Frame Analysis)

Hello everyone:

Looking at AUDCAD for continuation sell opportunities.

WE can see price had a bearish impulse phrase on the HTF, after breaking out from the rising wedge, and is now forming consolidation which can lead into the next down move.

I would be waiting for a confirmed breakout from the continuation correction, and any LTF correction to get in on the sell

thank you

P.S. If you enjoy a video analysis breakdown moving forward, please let me know :) thx

Jojo

flemish patern is formed in many tokens. so just take a look!since yesterday, flama patern has been formed. I think it's starting to take a little easy. in the video I hastily showed my observations. as these are #avax #ada #1inch #ONT #TRX #IOTA #ZRX

all sign re up and fibo is used for patern conf.

cheers

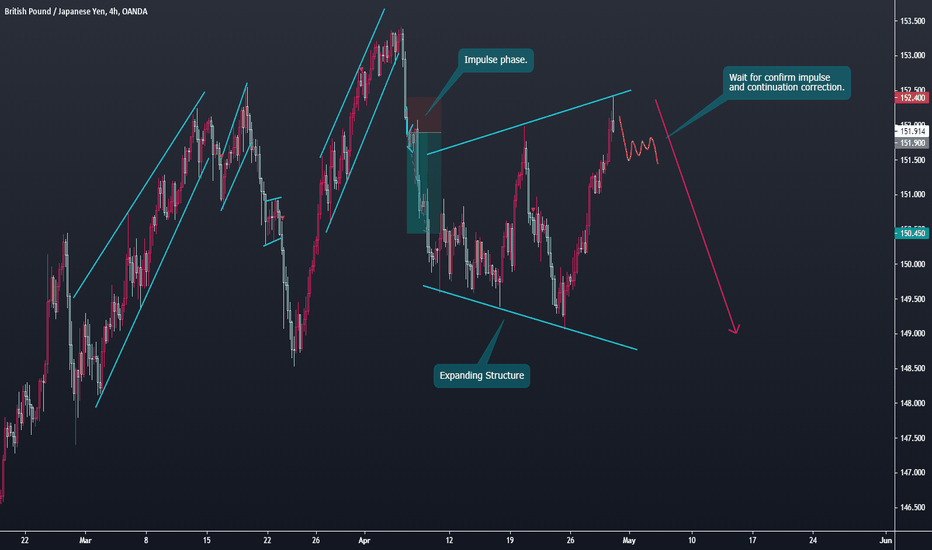

JPY Bearish Outlook (GJ, AJ, NJ, CJ)

Hello traders:

Similar like the USD outlook, I have made a quick video breaking down some of the JPY pairs I am looking at.

Same trading plan and risk management approach like the USDs, I would wait and see the bearish development first before enter any positions.

So watch out for some LTF development on some of these pairs in the up coming days.

Thank you

USD Outlook (GU, EU, AU. NU)Hello everyone:

Welcome back to a quick updates on the USD.

In this quick video I breakdown 4 USD pairs that are shaping up to for a good sell potential on them.

All of them will need a bit more development to give me the positive confluence to enter the trades, so patient is key here.

IF the price doesn't develop into what I like to see, then no entry for me. :)

EURUSD

s3.tradingview.com

GBPUSD

s3.tradingview.com

AUDUSD

s3.tradingview.com

NZDUSD

s3.tradingview.com

Any questions, comments or feedback welcome to let me know :)

Thank you

How To Trail Stop Loss Effectively | Capture All day's ActionMaximise your Day Trading Profits 5X | Apply this trade management system to hold trades all day without much effort

In this video I'm going to share with you a trade management idea which would allow you to trade and hold the trade from the start to the end of the day trading session.

The Chart I'm using is US30 / DOW30. The Time frame for day trading would be the five minute chart.

The idea is to make entries on the 5 minute chart and then use a few swings to add on.

This can become part of your Trade Plan and you can apply to any time frame or symbol of your choice. It's a great way to maximise your profits using nothing but the data provided by the market itself.

Price Action is surely The King!!! I bow....

Weekly Trading Recap: GBPCHF, EURUSD Apr 24 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week.

I will explain my approach on the entry, SL, TP and management.

GBPCHF - Running 2% profit

Full analysis/forecast:

EURUSD 0 Closed for BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: LTCUSD, XLMUSD, BNBUSD, GBPCHF Apr 17 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Litecoin (LTCUSD) - Running about 2% profit

Full analysis/forecast:

Stellar (XLMUSD) - Running about 2.5% profit

Full analysis/forecast:

Binance Coin (BNBUSD) - closed down for +9.5% profit

Full analysis/forecast

GBPCHF - Closed down for +0.5% profit

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: BNBUSD, GBPJPY, GBPUSD, XLMUSD, Apr10 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

Binance Coin (BNBUSD) - running about +8% profit, will exit at $500

Full analysis/forecast

GBPJPY - Exit for +3% profit first trade, and -1% loss on second scale in.

Full analysis/forecast

GBPUSD - Exit for +2% profit

Full analysis/forecast

Stellar (XLMUSD) - running about +1% profit, SL still at BE

Full analysis/forecast:

EURNZD - Exit for +0.5% profit

Full analysis/forecast

NZDCAD - exit for about -0.25% loss.

Full analysis/forecast

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap: BNBUSD, LINKUSD, EURAUD April 03 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week. I will explain my approach on the entry, SL, TP and management.

BNBUSD - Running about 1.5%

Full analysis/forecast

LINKUSD - Running about BE

Full analysis/forecast

EURAUD - 1 % profit

Full analysis/forecast

NZDCHF -1% loss

Full analysis/forecast:

GBPJPY - 1% loss

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

Thank you

Jojo

Weekly Trading Recap ADAUSD, EURUSD, USDCAD, AUDCAD, Mar 20 2021Hello everyone:

Welcome back to this week’s trading recap video. Let's take a look at the positions that closed down this week, and what are still running. I will explain my approach on the entry, SL, TP and management.

ADAUSD (Cardano) - BE

Full analysis/forecast:

USDCAD -BE

Full analysis/forecast:

EURUSD - BE

Full analysis/forecast:

AUDCAD - 2 trades closed down for 4%

Full analysis/forecast:

EURNZD - BE

Full analysis/forecast:

Any questions, comments or feedback please let me know. :)

I will always do a weekly trading outlook live stream at the beginning of each week to discuss any potential opportunities ahead in the forex, crypto, indices, and commodity markets. Feel free to tune in to my forecast. :)

Thank you

Jojo

Weekly Trading Recap: GOLD, AUDCAD, EURNZD March 13th 2021Hello everyone:

Welcome back to this week’s trading recap video. I took 3 trades this week, and 2 are still running profits.

Let's take a look at them and see my approach on entry, SL, TP and management.

GOLD - Took BE

Full analysis/forecast:

AUDCAD - Currently running about 2:1 profit.

Full analysis/forecast:

EURNZD - Currently running about 1:1 profit.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

I will always do a weekly trading outlook live stream at the beginning of each week to discuss any potential opportunities ahead in the markets. :)

Thank you

Jojo

Weekly Trading Recap: UC, EN, CJ, AJ, UM, US30, Mar 6th 2021Hello everyone:

Welcome back to my weekly trading recap video. This week I have several trades resulting in Break Even, let's take a look at these trades and what my approaches are as well.

EURNZD -

First Trade : Break Even

Second Trade - Break Even

Full analysis/forecast:

USDCAD - Break Even

Full analysis/forecast:

CADJPY - Break Even

Full analysis/forecast:

AUDJPY - Break Even

Full analysis/forecast:

USDMXN - (-1%)

Full analysis/forecast:

US30 (DOW) - (-0.69%)

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your week. :)

Jojo

Weekly Trading Recap: GOLD, SPX500, GBPUSD, BTCUSD Feb 27th 2021Hello everyone:

Welcome back to my weekly trading recap video. This week I took more trades than usual, resulted in more losses.

Overall still in the positive for the month not include my BTC long term trade, so lets take a look at the trades taken this last week.

Full trading journal in my profile link.

GBPNZD - Got tagged out for 0.5% profit.

Full analysis/forecast:

GBPUSD - Took a full 1 % loss.

Full analysis/forecast:

SPX500 - Manually exit for 0.33% profit.

Full analysis/forecast:

GOLD - Took 2 trades, 2 full 1 % loss.

Full analysis/forecast:

AUDCAD - 1% loss

Full analysis/forecast:

USDCHF - 0.5% loss

Full analysis/forecast:

BTCUSD - Closed both trades down. First trade in 12.39%, second one BE.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your weekend. :)

Jojo

Weekly Trading Recap: GBPNZD, ADAUSD, BTCUSD February 20th 2021

Hello everyone:

Welcome back to my weekly trading recap video. This week I entered just 1 trade, closed down 1 trade and I still have 2 BTC positions open. Let's take a look into it.

GBPNZD - Been talking about it last couple days in the live stream market updates, was waiting for more development. Finally LTF gave me enough confluence to set a stop entry order.

Currently running about 1.5% in profit. May look for further bearish scale in positions.

Full analysis/forecast:

ADAUSD - Hit TP of 8.94%. Was in my plan to take profit at $1 price, and monitor to see how the price breaks above, and potentially get back in for a further bullish move.

Full analysis/forecast:

BTCUSD - 2 positions still running, total about 20% in profit. Still holding and sticking to my long term investing approach and management.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your week. :)

Jojo

Weekly Trading Recap: ADAUSD, BTCUSD, NZDJPY, USDJPY Feb 13 2021Hello everyone:

Welcome back to the weekly recap video. This week I entered just 3 trades, closed down 2 trades and I still have several positions open. Let's take a look into it.

ADAUSD - Currently running about 7% in profit.

Price continues to push up impulsively on the lower time frame.

I have set a TP of $1.

Full analysis/forecast:

BTCUSD - Running about +12% in profit in both trades. I scaled in another buy entry once price broke ATH, and formed LTF continuation correction.

Full analysis/forecast:

NZDJPY - Take a 1% loss.

Got in on this entry when price broke down from the ascending channel, and formed a LTF correction. I stick to my plan to let the trade run since it hasn't reach 1:1 profit yet to allow me to move the SL to BE.

Full analysis/forecast:

USDJPY - Trade close for 0.5% profit. Had my SL at BE first, then moved up as I saw the LTF turned in bearish price action. My plan was to secure some profit if price no longer shows further bullish continuation price action.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your week. :)

Jojo

Weekly Trading Recap: ADAUSD, USDJPY, BTCUSD February 6th 2021Hello everyone:

Welcome back to the weekly recap video. This week I entered just 1 trade, and I am still holding BTC. Let's take a look into it.

ADAUSD - Price approached the previous swing highs, and started to form continuation correctional price action.

We then see a strong breakout above the highs, and LTF continuation correction. Set stop entry order for the buy. Currently running about ~1.5:1 profit.

Full analysis/forecast:

USDJPY - Enter once price broke out of the descending channel structure, and there was a LTF continuation correction.

Put in the stop entry order and got tagged in. First TP would be the highs of the descending channel, and second target would be the top of the HTF structure.

Currently running about ~1.5% profit.

Full analysis/forecast:

BTCUSD - Still holding, currently running about 8.5% profit. Price may be completing this HTF continuation flag structure, and we can potentially see more upside.

My management and approach remains the same, still looking at it as an investment trade, and plan to hold for the long term.

Full analysis/forecast:

Any questions, comments or feedback please let me know.

Enjoy your week. :)

Jojo

Analysis of heavy Return Stock - Shre Digvijay Cements this is the first time i recorded generally i analyse my chart and i personally took trades only

today, i recorded this video for all those guys those who want to trade the stock which is not very popular coz in popular stock generally heavy amount of buy/sell possible at any time

but, this small cap stock showed a emence rally returns

if you like then do let me know or if i need something to prove please dont forget to review me

thanks

god bless you all