$ETH / Ethereum - Don't Try and Catch KnivesUpdated ETH chart and thoughts:

I will wait until our weekly close to remove the demand/support weekly area near $2800 for further invalidation. I will then add a new supply/resistance area near $3000.

Areas of interest for a bounce/reversal are in green.

Not calling anything until I see slowed selling pressure. Don’t try and catch knives out here hoping for v shape reversal. A foundational bottom takes time to form.

There will be opportunities to buy and add more.

Heikinashi

$FIL / Filecoin FundamentalsThis is one of my favorite cryptos, Filecoin. I like it because of its practical use and utilization, as well as its tenure in the blockchain, over 5 years.

It has been hit the hardest as other coins have, but sometimes you have to remind yourself of the fundamentals.

I used Grok to quickly perform a fundamental analysis with metrics and visuals of Filecoin and found several items encouraging, like its increasing storage utilization rate and total committed storage capacity. Also, the development has not stopped.

With privacy & AI being in the spotlight, I feel as though it's just a matter of time for FIL.

Would I buy right now?

No, I wouldn't, not based on the technicals currently. Price has to successfully reclaim $1.50 weekly level and base before I have confidence in a potential reversal. But even though I wouldn't add it now, keep your eye out for one of the crypto OGs.

$CELH / Celsius party?This is what you want to see from a manipulation & reclaim.

If we close the week above the support point (within the supply zone) as it currently is now, you can do a happy dance because the party is back on. Great area to buy with confidence as well.

Feeling good but still want to wait for this weeks close.

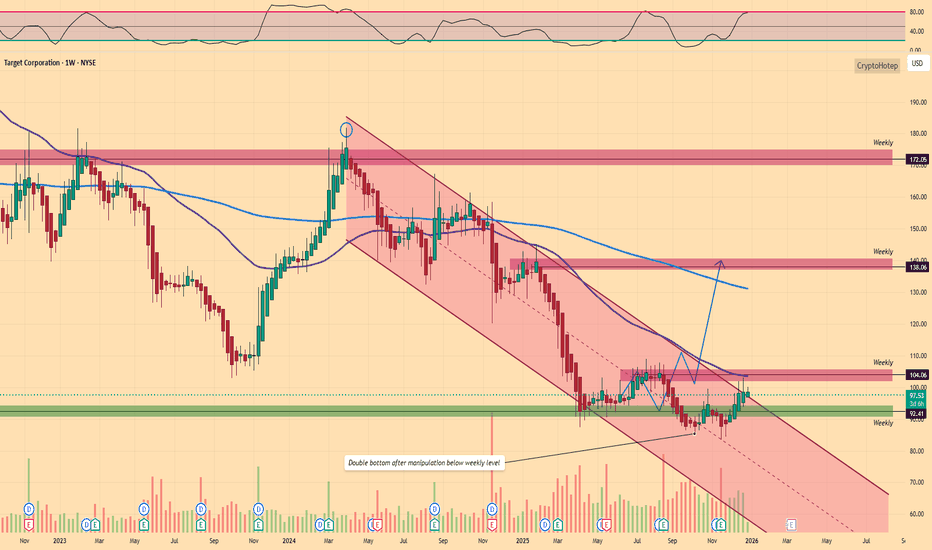

$TGT / Target Comeback Year?Watch out for Target next year......may be their comeback year in 2026.

Their technicals look good as price looks to be double bottomed near the $95 area (along with manipulation) and the only thing standing in it's way is to clear $105 weekly level and this downward trend.

If those two items are addressed, $135 - $138 could be in the cards and a definitive market shift for the red company.

$UNI / Uniswap's $6.00 Is HoldingThe $6.00 weekly level seems to be holding for Uniswap nicely as a reclaim looks to potentially be forming.

We had a break of the downtrend most recently and the slow stochastic is extremely oversold as well. In addition to this, the current weekly candle is above the support point within the demand zone (green rectangle). We still have a lot of week left in the candle though but if we close still above these areas, I will add more to my BME:UNI position.

We shall see. (my prior buys are in the green labels)

$DOT / Polkadot - Life SupportWith price coming out of the accumulation range in a downtrend and collapsed under weekly mitigated support/demand.

Price is now retesting this weekly level in a textbook 'break & retest'.

Bulls need to reclaim this area for a chance, other than that it could be curtains.

HA-RSI + Stochastic Ribbon: The Hidden Gem for Trend & MomentumNavigating volatile markets requires more than just raw price action. The Heikin Ashi RSI Oscillator blends the power of smoothed candlesticks with momentum insights to give traders a clearer picture of trend strength and reversals.

At Xuantify , we use the Heikin Ashi RSI Oscillator as a hybrid momentum and trend tool. While the indicator calculations are based on Heikin Ashi values to smooth out noise and better capture trend dynamics, the chart itself displays standard candlesticks (real price data) . This ensures that all signals are aligned with actual market structure, making it easier to execute trades with confidence and clarity.

This dual-layer approach gives us the best of both worlds: clarity from smoothing and precision from real price action. MEXC:SOLUSDT.P

🧠 How We Use It at Xuantify

At Xuantify , we integrate the Heikin Ashi RSI Oscillator into our multi-layered strategy framework. It acts as a trend confirmation filter and a momentum divergence detector , helping us avoid false breakouts and time entries with greater precision. We pair it with volume and volatility metrics to validate signals and reduce noise. Note the Stochastic Ribbon Overlay as shown in the chart, very accurate for momentum.

⭐ Key Features

Heikin Ashi Smoothing : Filters out market noise for clearer trend visualization.

RSI-Based Oscillation : Measures momentum shifts with precision.

Color-Coded Bars : Instantly identify bullish/bearish momentum.

Dynamic Signal Zones : Customizable overbought/oversold thresholds.

Stochastic Ribbon Overlay : A powerful multi-line stochastic system that enhances momentum analysis and trend continuation signals.

💡 Benefits Compared to Other Indicators

Less Whipsaw : Heikin Ashi smoothing reduces false signals common in traditional RSI.

Dual Insight : Combines trend and momentum in one visual.

Better Divergence Detection : Easier to spot hidden and regular divergences.

Visual Simplicity : Clean, intuitive design for faster decision-making.

⚙️ Settings That Matter

RSI Length : Default is 14, but we often test 10 or 21 for different timeframes.

Smoothing Type : EMA vs. SMA – EMA reacts faster, SMA is smoother.

Overbought/Oversold Levels : 70/30 is standard, but 80/20 can reduce noise in trending markets.

📊 Enhancing Signal Accuracy

Combine with Volume Oscillators to confirm momentum strength.

Use Price Action Zones to validate oscillator signals.

Look for Divergences between price and oscillator for early reversal clues.

🧩 Best Combinations with This Indicator

MACD : For cross-confirmation of momentum shifts.

Bollinger Bands : To identify volatility squeezes and breakouts.

Support/Resistance Levels : For contextual trade entries and exits.

⚠️ What to Watch Out For

Lag in Strong Trends : Like all smoothed indicators, it may react slightly late.

Over-Optimization : Avoid curve-fitting settings to past data.

Standalone Use : Best used in conjunction with other tools, not in isolation.

🚀 Final Thoughts

The Heikin Ashi RSI Oscillator is a powerful hybrid tool that simplifies complex market behavior into actionable insights. At Xuantify, it’s a core part of our strategy toolkit, helping us stay ahead of the curve with clarity and confidence.

🔔 Follow us for more educational insights and strategy breakdowns!

We regularly share deep dives into indicators, trading psychology, and backtested strategies. Stay tuned and level up your trading game with us!

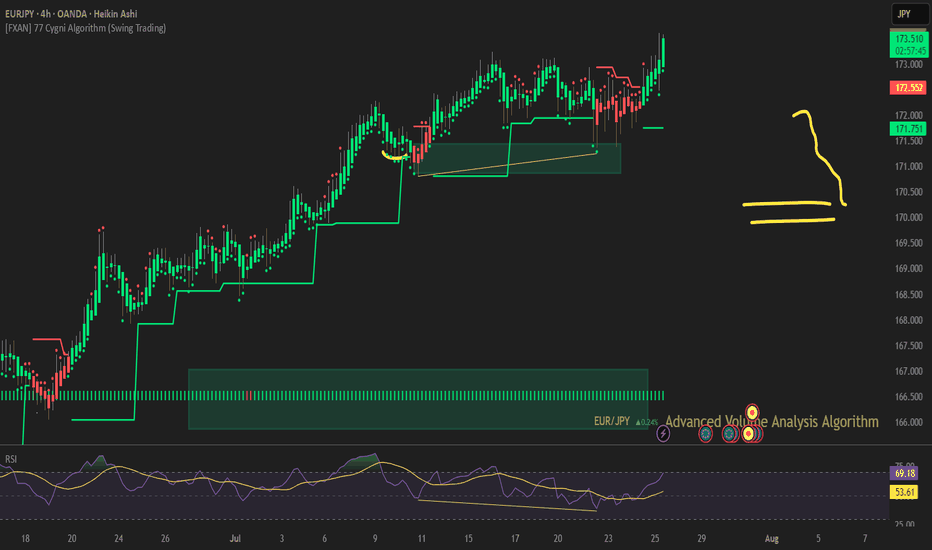

GBPCHF; FXAN & Heikin Ashi trade exampleOANDA:GBPCHF

In this video, I’ll be sharing my analysis of GBPCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

FXAN & Heikin Ashi Trade IdeaOANDA:AUDNZD

In this video, I’ll be sharing my analysis of AUDNZD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Looking Bullish Immediately on Mastercard!🔉Sound on!🔉

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Master Trading with Heiken Ashi Candles in 11.32 minutes Let’s talk about how to DOMINATE the market using Heiken Ashi candles for perfect entries and exits! This is where your trading game levels up.

First, when those candles start turning smooth and green with no wicks at the bottom, that's your entry signal! It’s like the market saying, "Hop on, this train is about to take off!" You ride those green candles as long as they stay strong and wick-free at the bottom.

Now, here’s the key – watch for red candles starting to form with wicks on top! That’s your signal to EXIT! Don’t get greedy, secure those gains, and get out before the market turns against you.

With Heiken Ashi, you get smoother trends, cleaner signals, and better trades! Enter with confidence, exit with precision, and OWN the market!

That's it, fast and powerful! Now go crush those trades!

Mastering Market Trends: An Introduction to Heikin Ashi CandlesHeikin Ashi candles, originating from Japan, are a distinct type of candlestick chart used in technical analysis to identify market trends. The term "Heikin Ashi" translates to "average bar" in Japanese, which reflects their method of calculation

This video explains Heikin Ashi candles and how they can be used to improve entrances and exits.

Examples of criteria for creating a trading strategyHello traders!

If you "Follow" us, you can always get new information quickly.

Please also click “Boost”.

Have a good day.

-------------------------------------

We analyze charts in a variety of ways to determine trends.

I think the important thing is how to create a trading strategy using these analysis methods, not whether you can match the trend or not.

Therefore, even if you know the trend, if you do not create a trading strategy properly, you may end up with small profits or even losses.

Therefore, I think it is extremely important to find support and resistance points that can ultimately create a trading strategy and how to create a trading strategy based on those points.

(Heikin Ashi 1D chart)

(Renko 1D chart)

I think the Heikin Ashi chart and Renko chart supported by TradingView charts are good charts for identifying trends.

However, since the HA-Low and HA-High indicators created using the Heikin Ashi chart are implemented, we will not talk about the Heikin Ashi chart.

The advantage of Heikin Ashi charts and Renko charts is that they reduce fakes and whipsaws.

However, it is not easy to actually trade with only two charts.

That's because it's so difficult to see.

In particular, Renko charts can be more esoteric than Heikin Ashi charts.

The reason is that the price is expressed in certain blocks.

However, if you look at the way the chart is drawn, you can see that fakes and whipsaws have been reduced more than the Heikin Ashi chart.

So, just as I created the HA-Low and HA-High indicators using the Heikin Ashi chart, I am trying to create a standardized trading strategy using the Renko chart.

We added the TS-BW auxiliary indicator used in the existing chart to verify the basic direction.

The overall direction can be verified by whether the BW indicator is in an upward or downward trend.

Additionally, you can verify more detailed direction through the movements of the StochRSI indicator and the StochRSI EMA indicator.

We added the MS-Signal indicator to the price chart section to help you see the chart trend more intuitively.

With the addition of the MS-Signal indicator, I don't think there is a need to add the superTrend indicator.

Since the MS-Signal indicator is a curve, we wanted to help create a trading strategy by adding the superTrend indicator, which is expressed as a line.

Next, in order to create a more confident trading strategy, various indicators are displayed on the price chart so that you can intuitively check support and resistance points.

By doing this, I believe that the Renko chart, which was used as a trend chart, was expressed as a tradable chart.

No matter how good an analysis technique you know, if you cannot create a trading strategy that suits you, your trading is likely to ultimately fail.

Therefore, once you have found an analysis technique that suits you, you should focus on reducing your psychological burden by investing more time in creating a trading strategy rather than trying to develop the analysis technique.

The trading strategy is

1. Investment period

2. Investment size

3. Trading method and profit realization method

I think it consists of the three things above.

Steps 1 and 2 are steps to begin with a broader observation of the coin (token, item) you want to trade rather than the chart.

Therefore, in the coin market, it is necessary to check whether the coin ecosystem is expanding and which themes it is included in.

If you decide to trade a coin (token, item) that has been confirmed in this way, you must look at the chart of the coin (token, item) and create a trading strategy.

The decisions made in steps 1 and 2 of the trading strategy are classified into intraday and medium-term investment, short-term and day trading, etc., and the appropriate investment size is determined. Accordingly, actual purchases, sales, stop losses, etc. are made in step 3. You decide.

When purchasing, it is important to try to estimate the average purchase price as much as possible.

To do this, it is recommended to proceed with split purchases at the support and resistance points expressed in the chart above.

Selling for profit is also recommended through split sales.

However, you should try to sell when the price is rising.

This is because if you sell while the price is rising and falling, it can be quite difficult to create a follow-up trading strategy.

Therefore, when selling, it is recommended to conduct split sales using auxiliary indicators such as the BW indicator and StochRSI indicator.

I think stop-loss is something that should be done when there is a possibility that the price will fall further and cause larger losses.

Therefore, how to sell at the stop loss point is very important.

I believe that you can quickly learn a clear way to practice stop loss by conducting futures trading.

I believe that the overall rate of return is ultimately determined by how well you do your stop loss.

However, if possible, it is important to confirm your profit in advance before taking a stop loss.

Therefore, I think that when deciding buy, sell, or stop-loss points, you should not rely on price issues other than the chart.

This is because issues other than charts add subjective thoughts and can interfere with creating a proper trading strategy.

Therefore, when deciding on step 3 of your trading strategy, it is best to look at the charts first and then read various articles afterwards.

Whatever the method, if you have a trading strategy standard that suits you, that standard is the best trading strategy standard.

No matter how good the trading strategy standard is, if it does not fit your investment style, there is a high possibility that the transaction will ultimately fail.

When studying charts, it is best not to try to memorize the names of patterns or various indicators.

Those names are not helpful at all in creating a trading strategy.

Therefore, when studying charts or analysis techniques, you should try to find out what the key is.

Once you understand the core content, you need to think deeply about how you can use it to create a trading strategy.

You may have difficulty understanding this article because it contains a description of what you learned while conducting the transaction.

Also, it may sound abstract.

However, since it is information obtained through actual trading, I think it can be a way for those studying charts to learn more quickly.

Have a good time.

thank you

--------------------------------------------------

You don't need Heikin AshiHeikin Ashi is a popular trend indicator.

The open values of Heikin Ashi point out the potential trend reverse price level.

However, not all chart services privide Heikin Ashi.

In fact, there is an another way to estimate the open values of Heikin Ashi.

It is SMMA.

William Alligator uses 3 SMMA at a time.

We can set

Offset = 0

Lips = 2

Teeth = 8

Jaw = 32

Lips , also SMMA(2), estimate the open values of Heikin Ashi of the current timeframe.

Teeth and Jaw are the preview of the open values of Heikin Ashi in higher timeframes.

Long USDJPYLast week USDJPY posted a green Heiken Ashi candle on the weekly time frame. This suggests to me that we may have another green week.

It is also the case that a green Heiken Ashi candle posted on the daily time frame after a red candle. This suggests to me that this could be the beginning of a muli-day bull run.

Using Heikin Ashi Candles to Exploit the BIG REVERSAL on $FAs you can see, on NYSE:F there is a large area of supply on the daily timeframe from 14.72-15.00. The blue dotted line at 14.55 is a point of control. I have started a small position short on NYSE:F 1-2 months out. Notice the 1 and 4 hour Heikin Ashi candles already showing the start of a bearish trend. I'd like for the daily candles to confirm the bearish trend before adding to this position. Let it dump, I never liked Ford vehicles anyway!