How I Use SMA Angle + Pullbacks for High-Probability EntriesIn today’s video I reveal a powerful strategy using my SMA Angle Alert Indicator combined with precision pullback entries.

This setup helps filter fake breakouts, avoid chop, and only take trades when momentum AND price structure align.

👉 SMA Angle + Pullback Entry Indicator

www.tradingview.com

➡️ Core Concept:

Use the SMA Angle to confirm trend direction + strength, then wait for a pullback into value before entering.

This creates high-probability continuation trades that work beautifully on MES, ES, NQ, MGC, and Forex pairs.

📌 What You’ll Learn in This Video

How the SMA Angle detects trend strength

The exact pullback entry trigger I use

How to avoid chop and false breakouts

How to time entries with precision (no guessing)

My personal tips for SL/TP placement

Live chart examples

How to add alerts for automated entries

💡 Why This Works

Most traders enter too late.

This strategy forces you to:

✔ Identify strong trend

✔ Wait for a clean pullback

✔ Enter when momentum returns

✔ Avoid over-trading

✔ Catch the meat of the move—not the noise

This video is for educational purposes only and is not financial advice. Trading futures, Forex, and derivatives involves substantial risk and may not be suitable for all investors. Always trade with money you can afford to lose. Past performance is not indicative of future results. You are responsible for your own trading decisions.

Moving Averages

How to Trade with Bollinger Bands in TradingViewBollinger Bands are a volatility indicator that helps traders identify market extremes, trend strength, and potential breakout setups by measuring how far price moves away from its average.

What You’ll Learn:

• Understanding Bollinger Bands as a volatility-based trading tool built around a moving average

• How the middle band represents the 20-period simple moving average (SMA)

• How the upper and lower bands are calculated as two standard deviations above and below that SMA

• Why expanding bands signal rising volatility — and tightening bands signal market compression

• Recognizing overbought and oversold conditions when price touches or moves beyond the upper or lower bands

• Why these signals aren’t automatic buy or sell triggers, and how to confirm them with other tools like RSI or MACD

• Identifying the “Bollinger Band squeeze,” a setup that often precedes major breakouts

• Spotting potential mean-reversion trades when price closes back inside the bands after moving outside

• How to add Bollinger Bands on TradingView via the Indicators menu

• Understanding the default settings (20, 2) and how adjusting the period or deviation affects sensitivity

• Practical examples using the E-mini S&P 500 futures chart

• Applying Bollinger Bands across daily, weekly, and intraday timeframes for volatility analysis and signal confirmation

This tutorial is designed for futures traders, swing traders, and technical analysts who want to integrate volatility dynamics into their trading approach.

The methods discussed may help you identify breakout conditions, trend continuation signals, and potential reversal zones across multiple markets and timeframes.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only.

Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools — not forecasting instruments.

How To Catch The Pullback - Part 1Forex ticker: OANDA:EURJPY OANDA:USDJPY OANDA:AUDJPY OANDA:CADJPY

Step 1 — Interpret MACD Colors Only (Bullish Table)

Given:

• 1H: Light Green 🟢

• 4H: Light Green 🟢

• Daily: Dark Green 🟢 + Rising Three Soldiers

From the Bullish MACD Table:

Daily

4H

1H

Interpretation

Probability

🟢 Dark Green

🟢 Light Green

🟢 Light Green

Daily regaining strength, intraday momentum accelerating

🟠 75-85%

MACD-only base probability: 75-85% (High)

Step 2 — Add Candlestick Pattern

Given Pattern:

• Daily: Rising Three Soldiers + Dark Green MACD

From Bullish Candlestick Table:

Daily - Rising Three Soldiers + Dark Green:

Three White Soldiers + 🟢 Daily + 🟢 4H + 🟢 1H → 95% base → 99% final

Since your 4H and 1H are Light Green (not full Dark Green), the probability

adjusts slightly but remains very high due to the strength of the Rising Three Soldiers pattern.

Step 3 — Combine for Final Probability

This is a very strong bullish setup:

Strengths:

• Strong MACD alignment: Daily Dark Green (maximum momentum), 4H & 1H Light Green (bullish momentum building)

• Powerful bullish pattern: Rising Three Soldiers on Daily (strongest pattern in your system)

• Good confluence across all timeframes

• All timeframes aligned bullish

Final Probability:

🔥 90-95% (Very High)

Trade Insight:

This represents a high-probability bullish continuation setup because:

• Daily shows maximum bullish momentum with the strongest pattern (Rising Three Soldiers)

• 4H and 1H confirm with bullish momentum (Light Green)

• Rising Three Soldiers indicates sustained buying pressure across multiple

sessions

• Perfect setup for continued upward movement

Action:

Excellent long entry - strong setup:

• Enter on any pullback toward Daily Rising Three Soldiers support

• Add positions on break above recent highs

• Place stops below the Daily Rising Three Soldiers pattern low

• Expect strong upward continuation

This is a high-confidence bullish trade with the strongest pattern (Rising Three Soldiers) aligned with solid momentum across all timeframes. The Daily pattern

provides exceptional bullish conviction that overrides the slightly weaker momentum on lower timeframes.

Rocket Boost this content to learn more

Warning! : Trading is risky please learn risk management and profit

taking strategies

also use a simulation trading account

before you trade with real money

How to Trade with MACD in TradingViewMaster the MACD indicator using TradingView’s charting tools in this comprehensive tutorial from Optimus Futures.

The Moving Average Convergence Divergence (MACD) is a momentum and trend-following indicator that helps traders identify shifts in market direction and momentum strength. It measures the relationship between two exponential moving averages (EMAs) to reveal when momentum may be building or fading.

What You’ll Learn:

Understanding MACD as a tool that tracks the convergence and divergence of moving averages

How the MACD line is calculated as the difference between the 12-period and 26-period EMAs

How the Signal line acts as a 9-period EMA of the MACD line and serves as a trigger for potential buy or sell signals

How the Histogram visualizes the distance between the MACD line and Signal line to show momentum strength

Recognizing bullish and bearish crossovers between the MACD and Signal lines

How to interpret the Zero Line as a momentum baseline — above zero suggests an uptrend, below zero suggests a downtrend

Identifying bullish and bearish divergences between MACD and price to anticipate potential reversals

Why crossovers and divergences should be confirmed with price action and trend structure, not used in isolation

How to add MACD to a TradingView chart via the Indicators menu

Understanding the default settings (12, 26, 9) and how adjusting them changes responsiveness

Practical examples on the E-mini S&P 500 futures chart to illustrate MACD signals in real market conditions

Applying MACD across multiple timeframes — daily, weekly, or intraday — for higher-confidence confirmations

This tutorial will benefit futures traders, swing traders, and technical analysts who want to incorporate MACD into their trading process.

The concepts covered may help you identify trend changes, momentum shifts, and potential entry or exit points across different markets and timeframes.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only.

Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools — not forecasting instruments.

How To Detect A Bearish Pattern ON The 4 Hour ChartDetecting thee patterns takes time and patience

but with the right mindset you can actually

see these patterns play out.

Think of trading like farming. Once you discover

a system that you are comfortable with

YOu make sure to refine it and make

sure it gives you profit

Always remember to take profits

It wont be easy.But in this video

we use the candlestick pattern detection

system that i created.

Maybe one dday i will publish the code.

But for now you can see me use it

inside this video

Thanks for watching

And watch it again to learn more.

Rocket boost this content learn more

Disclaimer:Trading is risky because of this

first use a simulation trading account before

you trade with real money.

How to Use Moving Averages in TradingViewMaster moving averages using TradingView's charting tools in this comprehensive tutorial from Optimus Futures.

Moving averages are among the most versatile technical analysis tools available, helping traders analyze trends, identify overbought/oversold conditions, and create tradeable support and resistance levels.

What You'll Learn:

Understanding moving averages: lagging indicators with multiple applications

Simple moving average basics: calculating price averages over set periods

Key configuration choices: lookback periods, price inputs, and timeframes

How to select optimal lookback periods (like 200-day) for different trading styles

Using different price inputs: close, open, high, or low prices

Applying moving averages across all timeframes from daily to 5-minute charts

Analyzing price relative to moving averages for trend identification

Using 50-day and 200-day moving averages for trend analysis on E-Mini S&P 500

Mean reversion trading: how price tends to return to moving averages

Trend direction analysis using moving average slopes

Famous crossover signals: "Death Cross" and "Golden Cross" explained

Trading moving averages as dynamic support and resistance levels

Advanced moving average types: weighted and exponential moving averages

Applying moving averages to other indicators like MACD and Stochastics

Balancing sensitivity vs. noise when choosing periods

This tutorial may benefit futures traders, swing traders, and technical analysts who want to incorporate moving averages into their trading strategies.

The concepts covered could help you identify trend direction, potential reversal points, and dynamic trading levels across multiple timeframes.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting

The 3 Step Rocket Booster Strategy ExplainedIn this video i show you

the rocket booster strategy + Fibonacci levels.

So what is the rocket booster strategy:

It has 3 steps:

1-The price has to be below the 50 ema

2-The price has to be below the 200 ema

3-The price should gap down

In this video we see the bearish engulfing pattern

and the falling 3 soldiers patterns.

Watch this video to learn more.

Disclaimer: Trading is risky please learn risk management and profit taking strategies.Also feel free to use a simulation trading account before you trade with real money.

Visa (V) Buy Signal: 3-Step Rocket Booster StrategyVisa (V) Buy Signal – Daily Trigger + Weekly Pullback + Rocket Booster 🚀💳📈

Visa Inc. (V) NYSE:V is flashing a compelling buy signal, supported by daily price action, weekly momentum readings, and long-term trend confirmation via the Rocket Booster Strategy.

Step 1 – Daily Candlestick: Bullish Signal

On the daily chart, Visa is showing bullish candlestick formations, including long lower shadows that confirm buyers are stepping in to defend support. This provides the entry trigger.

Step 2 – Weekly Oscillators: Sell / Strong Sell

The weekly oscillator rating is currently in Sell / Strong Sell territory. This highlights short-term momentum weakness, which in the context of a bigger

uptrend often creates an ideal buy-the-dip scenario. Traders can use this temporary pullback as an opportunity to position before momentum flips back upward.

Step 3 – Monthly Moving Averages: Rocket Booster Strategy (Strong Buy / Buy)

On the monthly timeframe, Visa shows a Strong Buy / Buy rating on moving averages. This is the Rocket Booster Strategy in action: the long-term trend is

powerful and acts like a booster, propelling prices higher once short-term weakness fades.

The Buy Case for Visa

Daily Candlestick → Bullish trigger (buyers defending support)

Weekly Oscillator → Pullback offering better entry levels

Rocket Booster (Monthly MAs) → Long-term trend remains strongly bullish

This multi-timeframe alignment makes Visa a high-probability candidate for further upside.

Trade Idea

Entry Zone: Near current levels or on dips

Stop-Loss: Below recent daily lows

Profit Targets: Previous swing highs and psychological resistance levels

The combination of a daily entry trigger, weekly pullback, and monthly Rocket Booster creates a textbook buy setup.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Trading and investing carry risks. Always practice on a demo account first , and develop solid risk management and profit-taking strategies before committing real capital.

Charts In 3 Steps-Bitcoin (BTC/USD) Buy Signal – Trend Resumes Bitcoin (BTC/USD) Buy Signal – Trend Resumes After Pullback ₿🚀

Bitcoin is also flashing a buy signal when viewed with the same 3-step system, showing strong confluence across timeframes.

Step 1 – Daily Candlestick: Bullish Reversal

On the daily chart, Bitcoin has printed a bullish engulfing/rejection candle, suggesting buyers have stepped in aggressively after a recent pullback. This is a strong reversal signal.

Step 2 – Weekly Oscillators: Sell / Strong Sell

The weekly oscillator rating is showing Sell / Strong Sell. This may appear bearish at first glance, but in the context of Bitcoin’s structural uptrend, it

signals a short-term dip that may provide an attractive entry zone before momentum turns bullish again.

Step 3 – Monthly Moving Averages: Strong Buy / Buy

On the monthly chart, Bitcoin remains firmly in a Strong Buy / Buy rating above its key moving averages. This confirms that the long-term uptrend remains strong, and pullbacks should be treated as buying opportunities.

✅ Daily Candlestick → Bullish reversal

✅ Weekly Oscillator → Temporary weakness offering entry

✅ Monthly MAs → Long-term bullish structure

Trade Idea: Traders may look for long entries on confirmation candles, with

stops below the daily reversal low. Profit targets could be staged toward recent highs and key psychological levels like $75,000 and beyond.

Disney (DIS) Buy Signal – Pullback Creates Opportunity 🎬📈

Disney (DIS) is flashing a fresh buy opportunity backed by multi-timeframe alignment in the 3-step trading system.

Step 1 – Daily Candlestick: Bullish Pattern

On the daily chart, Disney has printed bullish candlestick signals, including rejection wicks showing buyers defending support levels. This confirms demand is stepping in at lower prices.

Step 2 – Weekly Oscillators: Sell / Strong Sell

The weekly oscillator rating is in Sell / Strong Sell territory. This reflects short-term momentum weakness, but in the context of a bullish backdrop, this

pullback is often the perfect setup for positioning early before momentum swings back upward.

Step 3 – Monthly Moving Averages: Strong Buy / Buy

On the monthly timeframe, moving averages are firmly in Strong Buy / Buy mode. This confirms that the long-term trend is bullish and the bigger picture supports higher prices ahead.

✅ Daily Candlestick → Bullish trigger

✅ Weekly Oscillator → Short-term weakness = buy-the-dip setup

✅ Monthly MAs → Long-term trend intact and rising

Trade Idea: Traders may consider entering on dips with stops below recent daily lows. Potential upside targets include previous resistance zones and long-term highs.

⚠️ Disclaimer: These analyses are for educational purposes only and not financial advice. Trading stocks, forex, or crypto carries risks. Always test strategies on a demo account first , and make sure to use proper risk management and profit-taking strategies to protect your capital.

GBP/JPY Bullish Breakout Setup – 2 Key Signals to Watch!We're keeping a close eye on a potential bullish breakout forming on the OANDA:GBPJPY and there are two strong signals pointing in that direction:

1️⃣ A recent daily Chore candle showing bullish intent

2️⃣ An Inside Bar the day after suggesting potential momentum buildup

⚠️ One thing to note: we haven’t yet violated the previous key resistance level, which could be a red flag for some traders. However, for aggressive breakout traders, this could present a solid opportunity if we get a confirmed bullish push.

If you have any questions or comments, please leave them below. And remember to hit that like button before you go.

Akil

The 3 Step Rocket Booster "Once you master this strategy ..."When you watch this video i want you to think of the

the 3 step rocket booster strategy.

Once you master this strategy then it will

be easy for you understand the other indicators

and how they work.

This video is very very advanced and i dont expect you to understand

unless you are a trading expert.

But the point am trying to make to you

is that everything is connected.

Even understanding one strategy is better than

understanding not even one.

understanding one strategy is the building block.

So in this video am taking you through

the building blocks of trading.

My strategy is very advanced but i want to show you

that even in this advanced strategy

the Rocket booster strategy

is a building block.

So watch this video to learn more now.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please learn risk management and profit taking strategies also feel

free to use a simulation trading account

before you trade with real money.

When to buy the dip of Spotify?

Prices are at strong support, coinciding also with a 50% retracement level

A slight rise in RSI is a bullish sign

The convergence of the 50 and 20 day EMAs could be a source of resistance

Conclusion: let prices break above the 50 and 20 EMAs and wait for a retracement before buying

Bullish "Daily Chore" Setup on the EURUSDWe had one on Silver last week that played out nicely, now we have another Daily Chore signal setting up on the $EURUSD.

This is a short & sweet type of setup where we are looking for a test and rejection of a moving average an an opportunity to catch the next potential move upwards.

As mentioned in the video, we have A LOT of high impact news events happening this week so please be aware of that when looking to involve yourself in this and any other trading opportunities this week.

Please support by hitting that like button.

Follow so that you don't miss my future trading ideas.

And if you have any questions, comments or want to share you views on the market, please do so below.

Akil

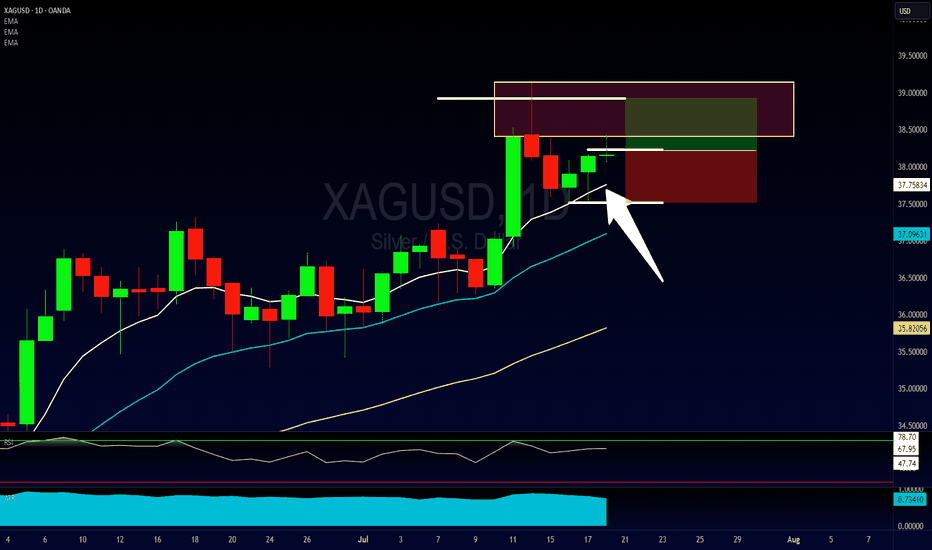

Bullish Daily Chore Strategy Entry on SilverFirst time I've spoken about this strategy here (as I don't personally trade it myself), but the "Daily Chore" is a very popular one amongst the traders I work with.

Essentially what we're looking for is for price action to be on the correct side of our 3 EMA's (8, 20 & 50), and for those EMA's to be running in the correct order.

If so, we are then looking for a pullback into the EMA's and for a pin bar rejection candles to give us a sign for entry.

This is a very difficult strategy to figure out as it requires a lot of testing and tweaks to optimize, but it also allows for a lot for freedom as it only requires a few minutes a day to check up on.

Please leave any questions or comments below and make sure to give me a follow so you don't miss my next shared trading idea.

Akil

ATAI bulls look primed for another leg upATAI gave us the highest close we've seen in nearly 3 years today as bulls closed at high of the day approaching resistances from the gap up on July 1st. Today saw 2x the volume traded yesterday which is a great sign when looking for daily continuation.

Anticipate resistance at 2.81. 3.00, 3.01, and weekly 200 SMA

Red flag from here would be to fail at 3.00 and reverse to break below 2.53.

EMA SystemThe system of Moving Averages I started out using is the 9-21-50 SMA. I would use the Fast EMA as a trailing stop loss and only trade long when it's above the 50 SMA. The 21 SMA is often a zone where price can bounce back.

12-21 EMA—EMA of EMA can work as well. So can 50-200 SMA or EMA of EMA for telling the larger trend if you want to enter an Option, then trading against it can be fatal.

Beating the S&P 500 with TradingView's Stock ScreenerThis is Mo from MWRIGHT TRADING. The date is Friday, June 27th, 2025.

This video is about selecting stocks that collectively have the potential to consistently beat the S&P 500

I look for smooth and consistent long-, mid-, and short-term performance. For that we need

Building a Screener

What I look for

- Liquidity - that means money, or trading volume.

- Room to move - no overhead resistance

- Favorable trends - stable moving averages

- Good short term signals - a good intraday chart

Filters

- Market Cap 300M to 2B

Not too big, and not too small

- Perf 10Y > Perf 5Y

No long term dips in performance

- Perf 5Y > Perf 1Y

No short term dips in performance

- SMA(300) < Price

Price above moving average

- SMA(200) < Price

Price above moving average

- Avg Volume 10D > 100K

No lightly traded stocks. Liquidity needed

- + SMA(200) >= SMA(300)

Stacked long-term SMAs

- + SMA(50 >= SMA(200)

Stacked short-term SMAs

- + ROE, Trailing 12 Months > 0% (Chris Mayer)

Improving ROE

Examples

- SENEA

- DGII

Review the charts

- Verify short term performance

- Multi-VWAP (1 hr Chart) - Free Indicator

- Above a rising 5-Day AVWAP

- Magic Order Blocks (5 min Chart) - Free Indicator

- No major overhead resistance

- Verify fundamentals and long term performance

- ROE (Quarterly) - TV Indicator

- Rising ROE

- Float Shares Outstanding - TV Indicator

- Lower float means lower supply. When high demand occurs, this can act as a price catalyst.

- Multi VWAP from Gaps - Free Indicator

- Stacked is good

- 3 SMA Ladies - Custom Indicator

- Stacked is good

How to Tell BITCOIN is BULLISH using MOVING AVERAGES OnlyBTC is trading sideways and it sparks a lot of debate whether or not we are at the beginning of a new bearish cycle, or if there is still a push upwards waiting to happen.

Here's how you can use the Moving Averages to determine whether or not BTC is bullish.

Don't miss this update on my stance on the market and why I think ALT Season is waiting:

______________________

BINANCE:BTCUSDT