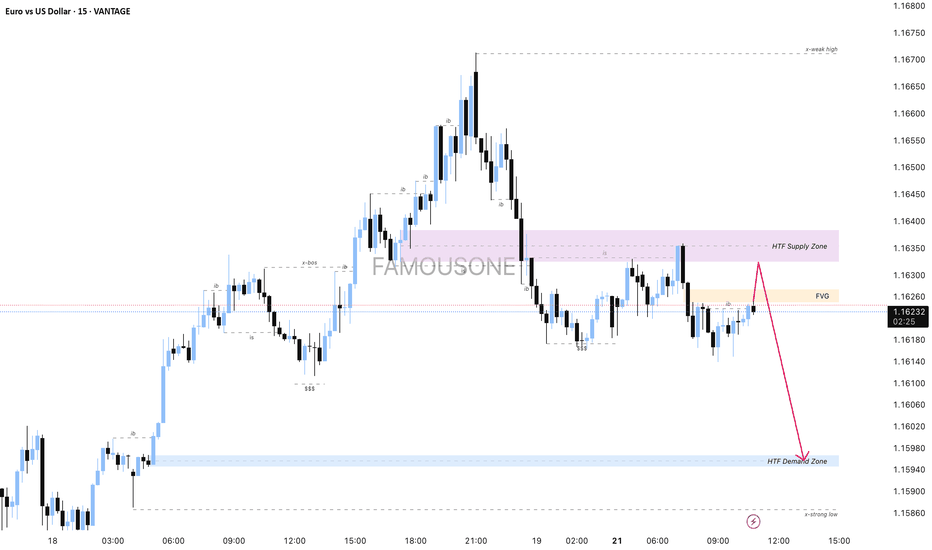

EURUSD - M15 Supply Zone RetestThe current price action shows that the market is expected to first fill the Fair Value Gap (FVG) area, which acts as a price inefficiency zone demanding liquidity clearance. After the FVG is filled, the price is anticipated to retest the Higher Time Frame (HTF) Supply Zone, which serves as a strong resistance area.

Following the retest of the supply zone, the prevailing downtrend is likely to resume, pushing the price downwards towards the HTF Demand Zone. This demand zone is identified as a key support level where buying interest is expected to emerge, potentially halting the decline temporarily or initiating a reversal.

This trading plan emphasizes waiting patiently for the FVG fill as a prerequisite step before looking for a supply zone retest confirmation to enter short positions targeting the demand zone below, aligning with the overall bearish trend continuation.

Smartmoneyconcept

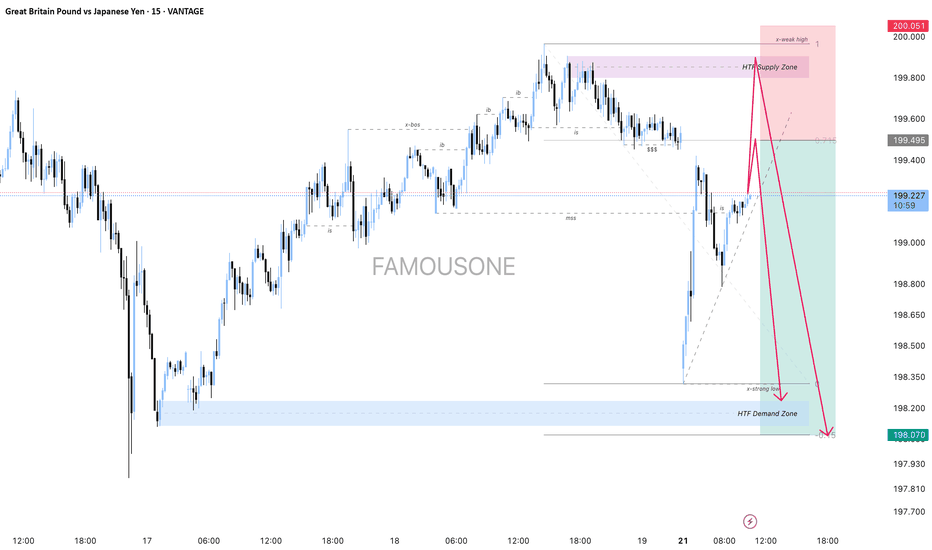

GBPJPY 15-Minute Analysis with Supply and Demand Zones1. Market Context

The price recently experienced a strong upward move followed by a rejection at the Higher Time Frame (HTF) Supply Zone near the 200.051 level.

Key levels have been identified including an HTF Supply Zone (resistance area) and HTF Demand Zone (support area).

2. Price Structure and Key Levels

The chart marks a weak high (x-weak high) near the supply zone which indicates possible exhaustion of upward momentum.

A break of structure (x-bos) was followed by a retracement to the supply zone.

The HTF Demand Zone around 198.070 marks a strong support area from which price might potentially rebound.

3. Trading Plan and Execution

Entry: Consider a short (sell) position near the HTF Supply Zone (around 199.8 to 200.05) after confirmation of bearish rejection or reversal patterns.

Target: Set the take profit near the HTF Demand Zone (around 198.07), which represents a strong support level.

Stop Loss: Place a stop loss just above the HTF Supply Zone to protect against unexpected breakouts.

Trade Management: Expect a possible retest or small pullback after the initial move from the supply zone before continuing the downward trend.

4. Outlook and Strategy

The primary expectation is a downward movement from the supply zone to the demand zone.

Watch for price action cues such as bearish engulfing candles or strong rejection wicks at the supply zone to confirm entry.

If price breaks above the HTF Supply Zone strongly, reconsider the bearish bias for possible trend shifts.

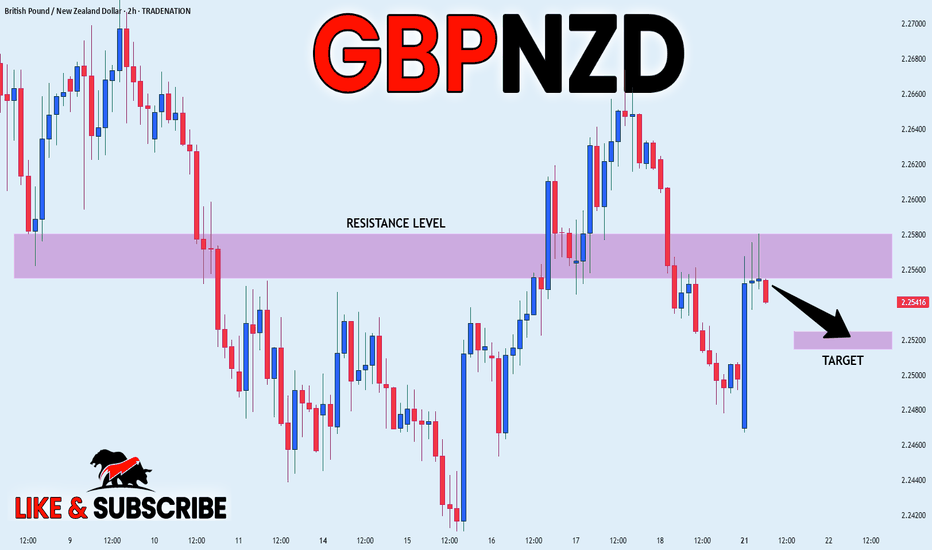

GBP_NZD LOCAL SHORT|

✅GBP_NZD made a retest of the

Local horizontal resistance level of 2.2580

And as you can see the pair is already

Making a local pullback from

The level which sends a clear

Bearish signal to us therefore

We will be expecting a

Further bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

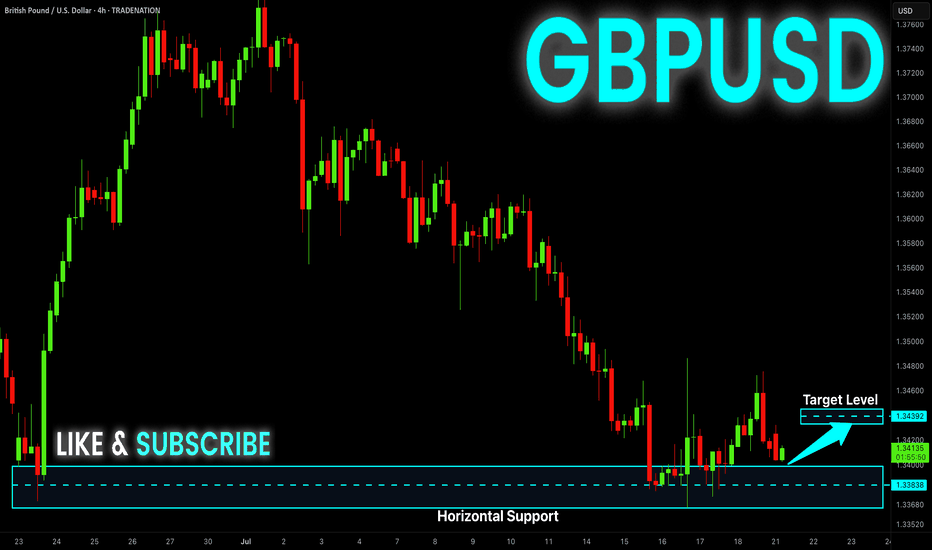

GBP-USD Local Long! Buy!

Hello,Traders!

GBP-USD is about to retest

The horizontal support

Level below at 1.3383

And as this is a strong

Support level we will be

Expecting a local bullish

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

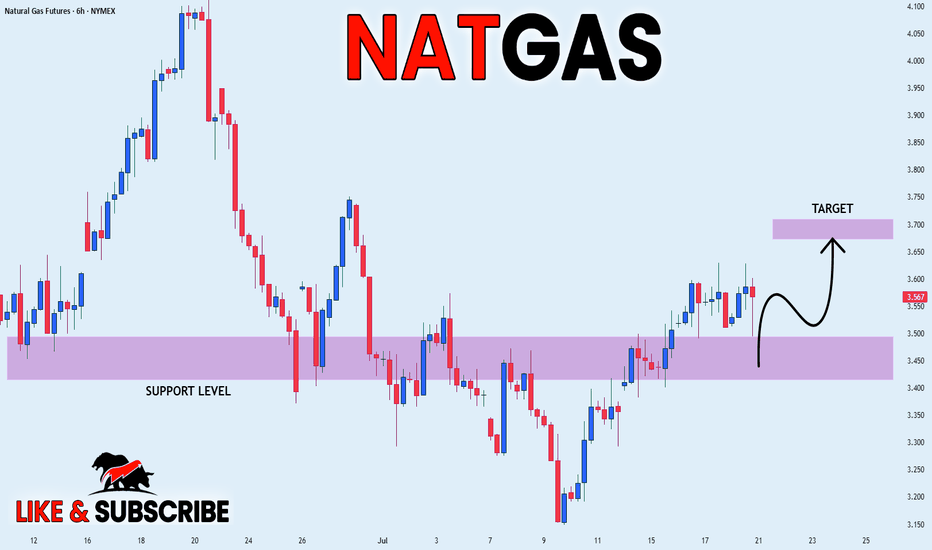

NATGAS REBOUND AHEAD|LONG|

✅NATGAS is going up now

And the price made a bullish

Rebound from the horizontal

Support level around 3.50$

So we are bullish biased and

We will be expecting a

Further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

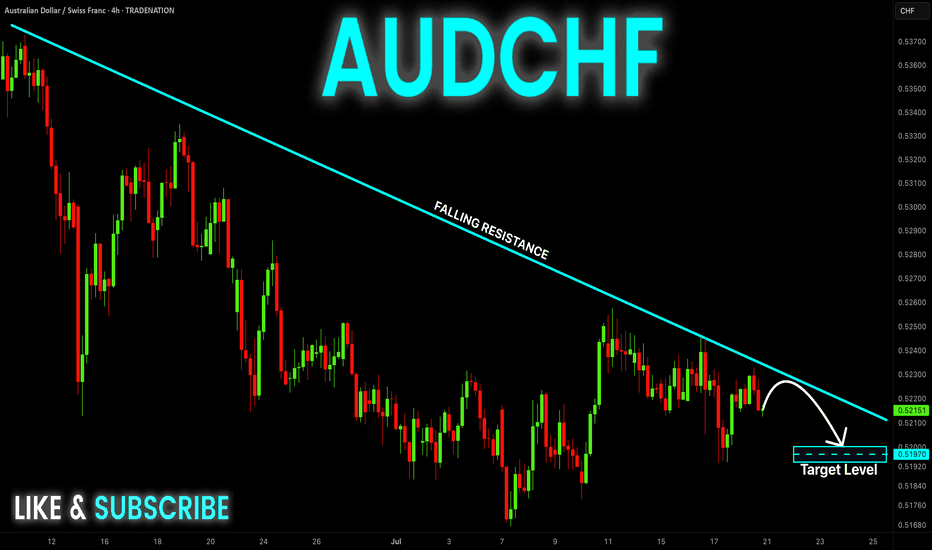

AUD-CHF Risky Short From Falling Resistance! Sell!

Hello,Traders!

AUD-CHF is trading in a

Downtrend along the falling

Resistance line so we are

Bearish biased and after

The potential retest of the

Falling resistance we will

Be expecting a further

Bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

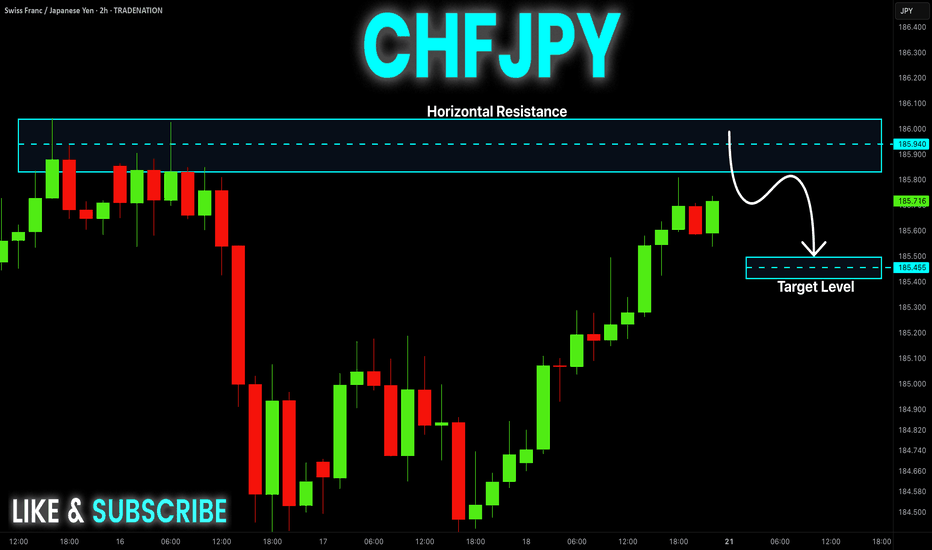

CHF-JPY Resistance Ahead! Sell!

Hello,Traders!

CHF-JPY keeps growing in

An uptrend and the pair is

Locally oversold so after the

Retest of the horizontal

Resistance of 186.000

From where we will be

Expecting a local bearish

Pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

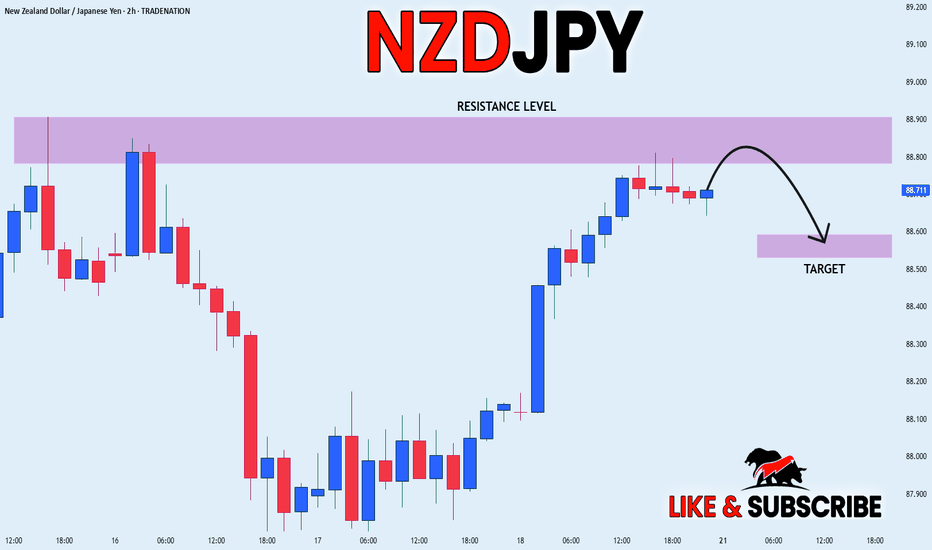

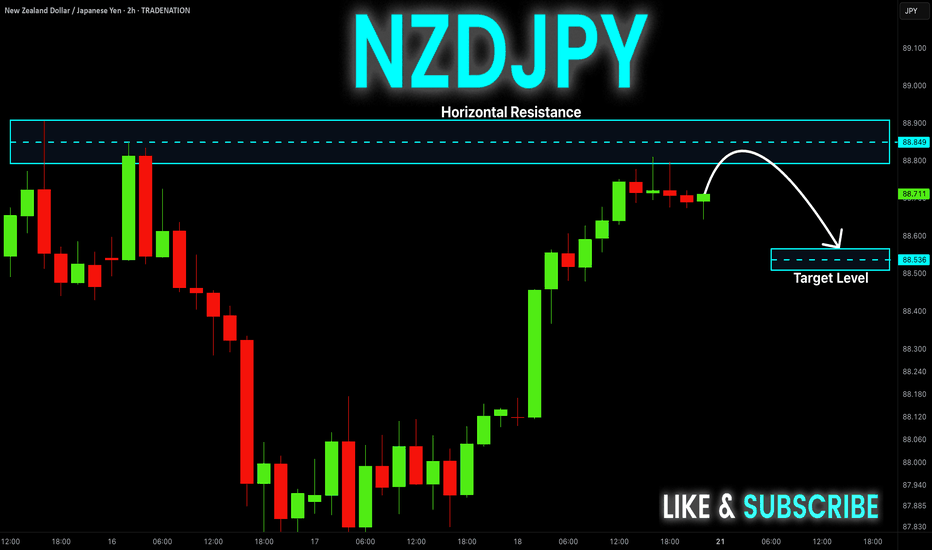

NZD_JPY PULLBACK EXPECTED|SHORT|

✅NZD_JPY has been growing recently

And the pair seems locally overbought

So as the pair has approached

A horizontal resistance of 88.900

Price fall is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

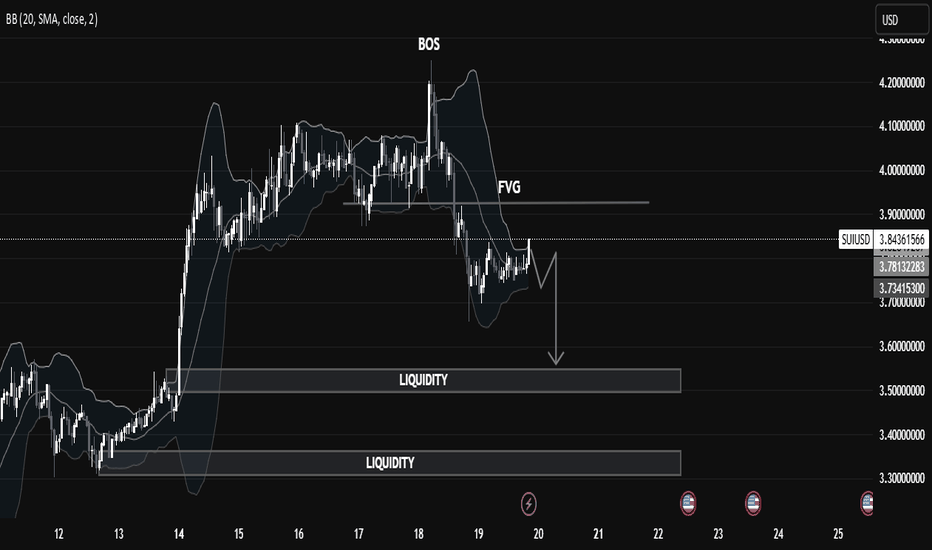

SUIUSD Liquidity Trap in Motion: Price Targeting Deeper Pools🧠 Market Structure Insight (SMC Framework)

🔍 1. Break of Structure (BOS):

The most recent BOS around the $3.95 level marked a bull trap, indicating a transition from bullish momentum to a distribution phase. This suggests institutional players offloaded liquidity at premium prices before initiating a markdown.

🕳️ 2. FVG (Fair Value Gap):

A visible Fair Value Gap (Imbalance) remains unmitigated above the current price action. This zone acted as a supply area, where price sharply moved down, leaving inefficiency in its trail—now serving as a potential point of rejection if revisited.

📌 Liquidity Zones:

Upper Liquidity Cleared: Price has swept highs before reversal (a sign of engineered liquidity grab).

Double Liquidity Pools Below:

First pool: Around $3.55 - $3.60

Second pool: Deep liquidity around $3.30 - $3.35

These levels are highly attractive for Smart Money to target next, suggesting continuation to the downside.

📉 Current Price Behavior:

Market is consolidating in a tight range just below FVG, signaling potential re-accumulation of sell orders.

The chart pattern suggests a potential lower high forming, likely to precede a bearish leg towards liquidity zones.

Bollinger Bands show compression, hinting at volatility expansion soon.

🎯 Trade Outlook (Not Financial Advice):

🔻 Bearish Bias:

Unless price breaks above the FVG zone with strong bullish momentum, the probability favors a bearish continuation targeting:

1st Target: ~$3.55

2nd Target (Deeper liquidity grab): ~$3.30

A rejection from FVG followed by a BOS to the downside would serve as confirmation for this bias.

📚 Educational Takeaway:

This chart is a clean illustration of Smart Money Concepts in play:

BOS > FVG > Liquidity Sweep

Price respects institutional footprints: grab liquidity, fill imbalances, then drive toward untouched liquidity zones.

Recognize market intent through structure shifts and imbalance reaction.

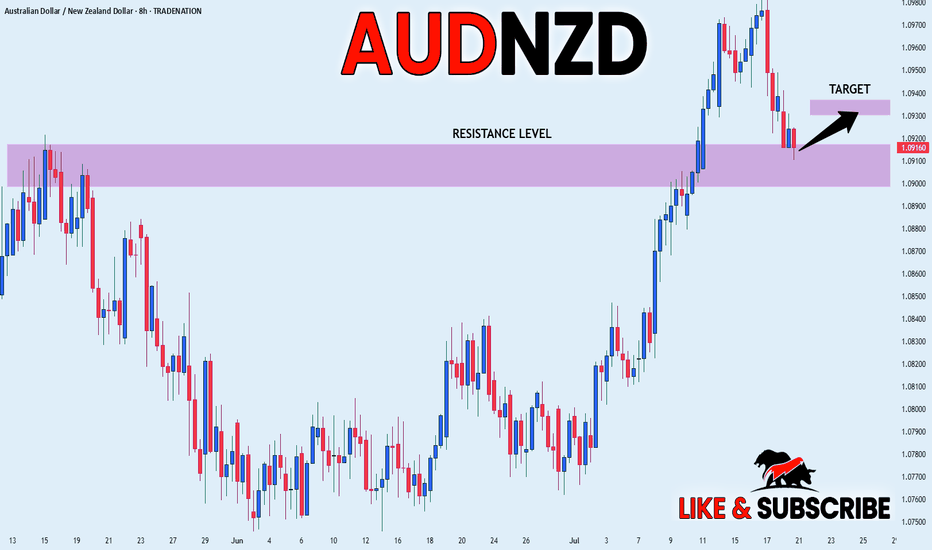

AUD_NZD GROWTH AHEAD|LONG|

✅AUD_NZD fell down sharply

But a strong support level was hit at 1.0910

Thus I am expecting a rebound

And a move up towards the target of 1.0930

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

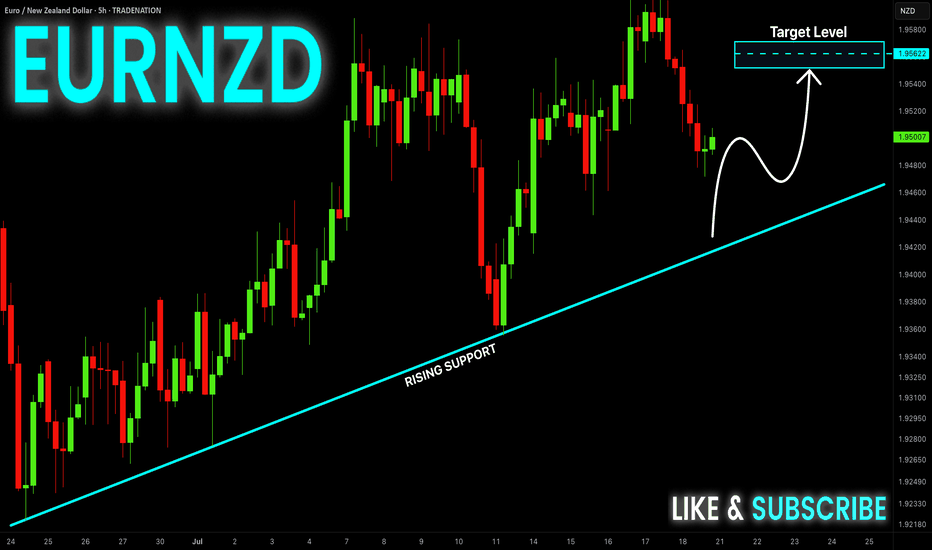

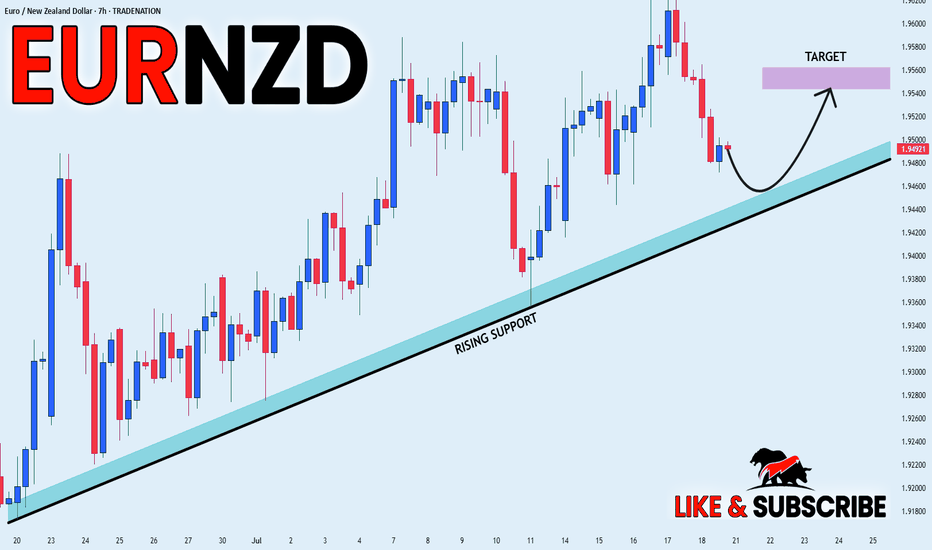

EUR-NZD Will Grow! Buy!

Hello,Traders!

EUR-NZD is making a local

Bearish correction while trading

In an uptrend along he rising

Support so after the pair hits

The support line a local bullish

Rebound is to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-JPY Local Short! Sell!

Hello,Traders!

NZD-JPY has hit a horizontal

Resistance level of 88.851

And we are already seeing

A bearish reaction so we will

Be expecting a local

Bearish move down

On Monday!

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin - Bearflag Structure Taking ShapeBitcoin is showing signs of weakness after a clean rejection from a 4H fair value gap, where price also swept the previous swing high. This aligns well with a broader bearish context as the market failed to sustain above the upper bounds of the trend channel, indicating potential exhaustion of the bullish correction.

Rejection Zone and Fair Value Gap

The rejection took place precisely within a 4H imbalance, adding confluence to the idea that this was a premium retracement in a bearish leg. The high formed inside that zone has now been swept, setting up conditions for distribution. A smaller 1H fair value gap was also left behind during the displacement move down, creating a clean area for price to return to and potentially react from.

Channel Structure and Bearflag Formation

Structurally, price has been climbing in a rising channel that resembles a bearflag pattern. The recent market structure shift broke the channel low, confirming that the rising structure is likely corrective. The rejection from the top of the flag and the subsequent breakdown align with a typical bearflag setup, suggesting a continuation move to the downside.

Short-Term Retracement Expectation

Before the next leg down, price may retrace to fill the unmitigated fair value gap while possibly sweeping the minor swing high that caused the current drop. This retracement would offer a premium shorting opportunity in alignment with the bearish bias, especially if internal structure remains weak on the lower timeframes during the return to the FVG.

Draw on Liquidity and Price Objective

The main objective for this setup is a sweep of the last equal lows near 115950, which represents a strong draw on liquidity. If the bearflag setup plays out fully, this area is highly vulnerable and could be the next significant target once the FVG is filled and lower timeframe distribution confirms.

Conclusion

Price has rejected from a 4H imbalance and swept liquidity to the upside, forming a clean bearflag structure. As long as price remains below the recent high and fills the 1H FVG without invalidating the shift, the path of least resistance looks to be down toward the liquidity resting below 115950. I’ll be watching for signs of weakness during the return to the FVG for a potential short trigger.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

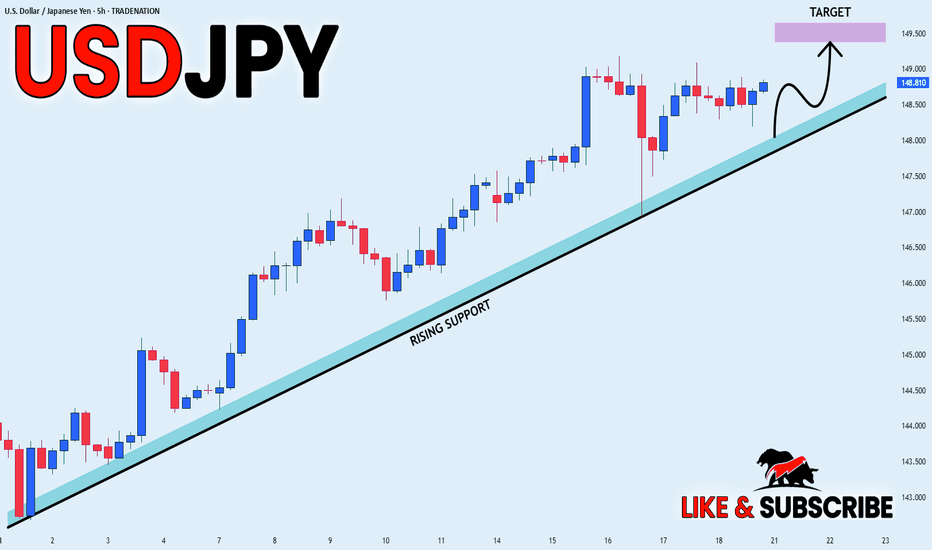

USD_JPY STRONG UPTREND|LONG|

✅USD_JPY is in a strong

Long-term uptrend now

And the pair is accumulating

For the next leg up so we will

Be expecting a bullish continuation

On Monday!

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

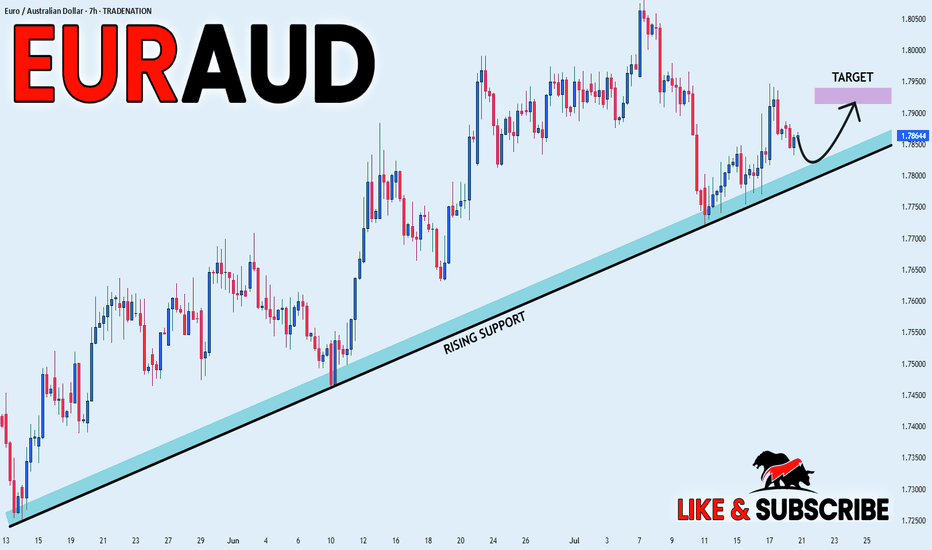

EUR_AUD WILL GROW|LONG|

✅EUR_AUD is trading in an uptrend

With the pair set to retest

The rising support line

From where I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

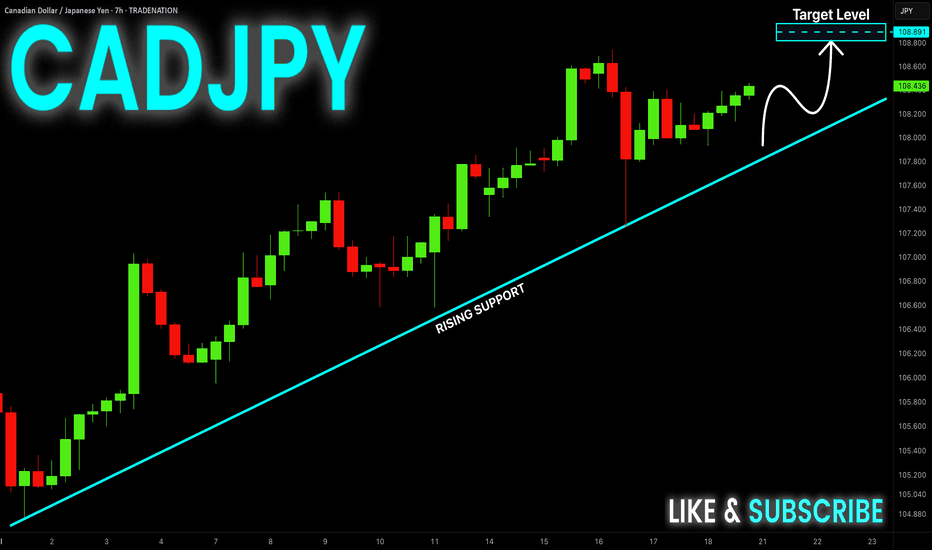

CAD-JPY Will Keep Growing! Buy!

Hello,Traders!

CAD-JPY keeps trading in

An uptrend and there is a

Rising support below so

We are bullish biased

And we will be expecting

A further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

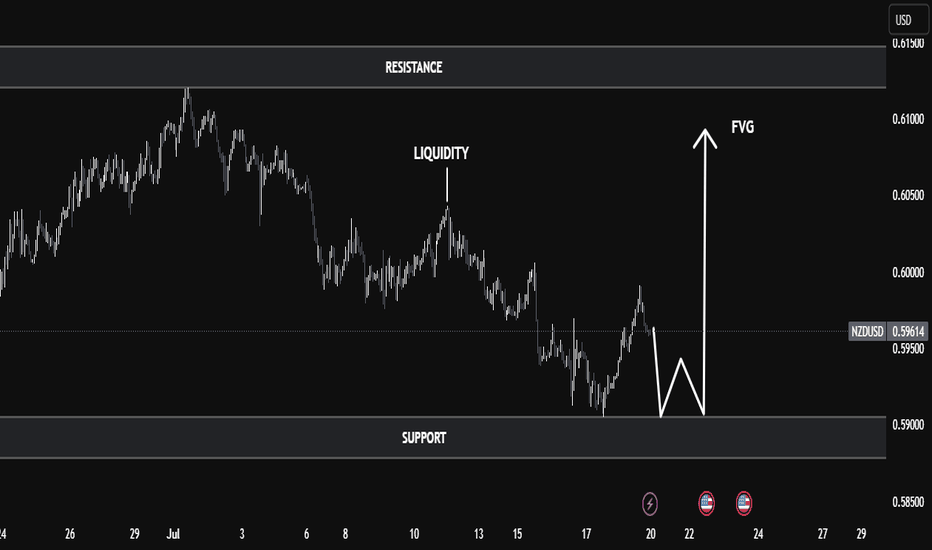

NZD/USD Technical Analysis | Smart Money Perspective🧠 NZD/USD Technical Analysis | Smart Money Perspective

On the current NZD/USD chart, price is trading around 0.5960, positioned between a clearly defined resistance zone (0.6130–0.6150) and a support zone (0.5890–0.5900).

We can observe the following key technical elements:

🔹 1. Liquidity Sweep

Price recently broke below the previous swing low near 0.5900, tapping into a pool of sell-side liquidity. This movement is commonly interpreted as a liquidity grab, where institutions manipulate price to trigger retail stop losses before reversing.

🔹 2. Double Bottom Formation

The chart indicates a potential double bottom forming at the support level — a classic accumulation signal. This pattern suggests buyers may be stepping in after liquidity has been taken out, anticipating a reversal.

🔹 3. Fair Value Gap (FVG)

An FVG (imbalance) is visible in the range of 0.5985 to 0.6015. This inefficiency was created by a sharp bearish move, leaving price action unbalanced. Price is now expected to retrace into this area to rebalance orders — a common smart money behavior.

🔹 4. Market Structure Outlook

If the double bottom confirms with a bullish break of structure above 0.5980, we could expect a continuation toward:

First Target: FVG zone around 0.6015

Second Target: Major resistance near 0.6150, where past distribution occurred.

✅ Conclusion

This setup combines key smart money concepts:

Liquidity grab below support

Accumulation phase at demand

FVG as target

Potential bullish market structure shift

Traders should monitor price action around the support zone for confirmation (e.g., bullish engulfing or break of short-term highs) before entering long positions. Targets remain at the FVG and resistance zones, but risk management is essential in case of a deeper sweep or macroeconomic catalyst.

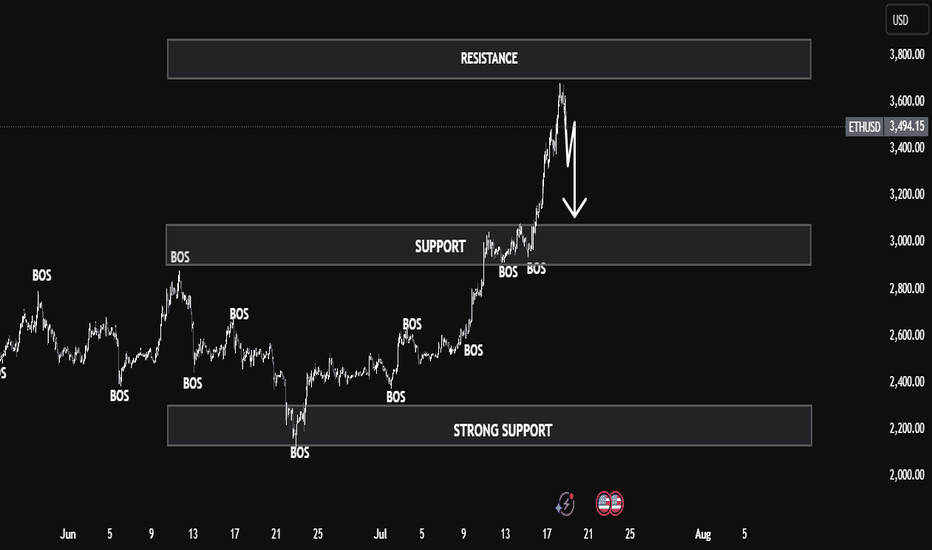

ETHUSD Smart Money Breakdown – Price Rejection from Premium ZoneEthereum has shown a strong impulsive rally after multiple Breaks of Structure (BOS) from early June, signaling a clear shift in market sentiment from bearish to bullish. Each BOS indicates that demand zones have been respected and liquidity has been efficiently used to fuel higher prices — a classic signature of institutional involvement.

🧠 Smart Money Insight

As price aggressively rallied into the resistance zone ($3,600–$3,800), the market entered a premium pricing area, where smart money typically offloads positions and hunts liquidity from late buyers. This area has historically been a high reaction zone — and as seen on the chart, ETH shows signs of buyer exhaustion, suggesting a possible short-term reversal.

🔁 Anticipated Market Behavior

A corrective move is likely from this resistance, and the first target for retracement lies in the support zone around $3,000–$3,200. This level aligns with:

Previous BOS retest area

Fair value imbalance fill

Mid-range equilibrium

If momentum continues downward, the next zone of interest will be the strong support region at $2,200–$2,400, which served as a major accumulation zone. That’s where large orders previously entered the market — and a strong reaction is expected again.

📊 Market Structure Summary:

BOS Confirmations: Validated bullish structure

Liquidity Grab: At resistance – potential sweep and reversal

Premium Zone Rejection: Smart money short opportunity

Discount Zone Targets: Support & strong support zones

✅ Conclusion

ETH is at a critical decision point. If price holds below resistance with continued bearish pressure, a retracement is not only healthy — it's expected. Traders should wait for confirmation of lower timeframe structure breaks before entering shorts, and target the $3,000 zone first, with eyes on $2,200 if momentum persists.

CAD_JPY BULLISH BIAS|LONG|

✅CAD_JPY is trading along

The rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels

Above at 108.708

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-AUD Strong Uptrend! Buy!

Hello, Traders!

EUR-AUD is trading along

The rising support line in a

Strong uptrend so we we are

Bullish biased and as the pair

Is going down to retest the

Support we will be expecting

A rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR_NZD LONG FROM RISING SUPPORT|

✅EUR_NZD is trading in an uptrend

Along the rising support line

Which makes me bullish biased

And the pair is about to retest the rising support

Thus, a rebound and a move up is expected

With the target of retesting the level above at 1.9544

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-JPY Will Keep Growing! Buy!

Hello,Traders!

USD-JPY is trading in an

Uptrend along the rising

Support line and the pair

Already made a bullish

Rebound and is consolidating

In a local range so as we

Are bullish biased we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CRUDE OIL BEARISH BREAKOUT|SHORT|

✅CRUDE OIL broke the rising

Support line which is now a resistance

And the price made a retest an a pullback

So we we are bearish biased and we

Will be expecting a further

Bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.