Double EMA (DEMA) From ScratchHello, traders!

Today we’ll speak about the most trivial, but very useful indicator that’s called DEMA. As you know, moving average is a backbone of 90% complicated indicators. It’s able to give lots of information about the price action. Well, let’s speak about it.

The double exponential moving average (DEMA) is a technical indicator introduced by Patrick Mulloy in his January 1994 article "Smoothing Data With Faster Moving Averages" in Technical Analysis of Stocks & Commodities magazine.

The DEMA uses two exponential moving averages (EMAs) to eliminate lag, as some traders view lag as a problem. The DEMA is used in a similar way to traditional moving averages (MA), but DEMAs react quicker than traditional MAs.

How to use DEMA?

-The average helps confirm uptrends when the price is above the average, and helps confirm downtrends when the price is below the average. When the price crosses the average that may signal a trend change.

-Indicate areas of support or resistance.

-Cross overs of 2 DEMAs. We sometimes draw fast DEMA(20) and slow DEMA(50). When the fast line crosses the slow below, it’s a bearish signal, when above - bullish. It’s consider to be a good entering signal. However, we shouldn’t forget that the indicator is still lagging.

Guys, I should remember you that every indicator shouldn’t be used in solo. You should only use them in conjunction with other indictor when they confirm each other. I hope, this knowledge will boost your trading skills and make your trading staff more interesting and profitable. Have a nice day, dear traders.

Support

EURUSD Recent Price Action| Identifying a break of a key levelEvening Traders,

In this educational post I will analyse how a price action level breaks and puts in a retest.

Assessing the chart, we have a clear Resistance on the left that was breached with an impulse break. The level was retested and confirmed as support with an S/R Flip Retest.

This shows strength in the price action; however volume was not evident, leading to a bearish expansion back below the level.

EURUSD eventually retraced and broke the resistance again with a strong impulse and is currently trading above the level.

For this breakout to be valid on the retest, we need to see an increase in the volume profile. This will signify a true break as incoming volume will lead to an expansion.

I hope this educational peace helped,

Thank you for following my work!

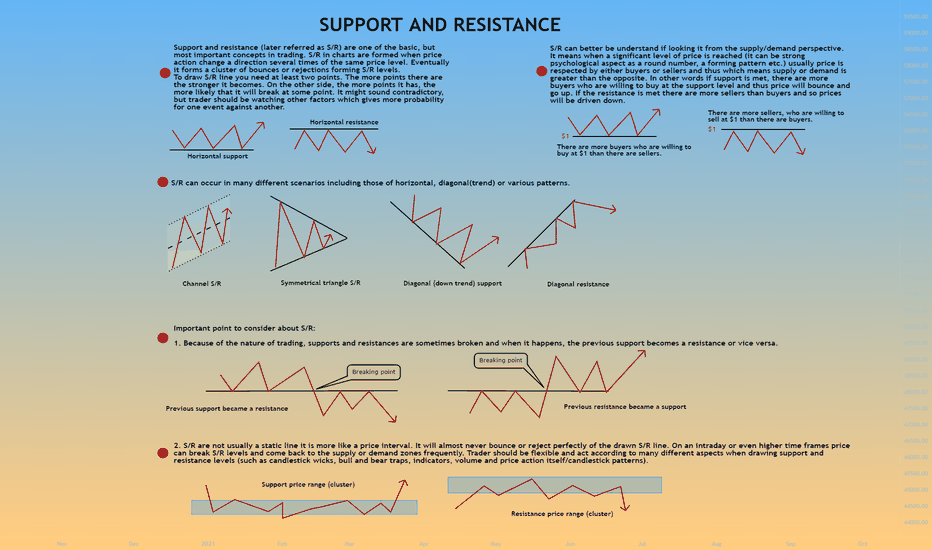

Explained Supports Resistors and Trend, Guide part 11Supports,Resistors and Trend

First of all say that all the forms of Supports and Resistances mentioned in this guide are based on my personal experience, there are several ways to really see it, but you can take it as you wish.

This topic is broad, and it is not based on the use of a tool, I consider that the tools are good enough to give you ideas, but it all depends on the psychological of both institutional and retail investors, points where they want to buy. Obvious points they want to get into. Knowing this, let's get started.

What is a Support?

Support is that psychological zone where retailers and institutions believe that the price would have a good maintenance of its price. (Shopping area).

What is a resistor?

Resistance is that area where retailers and institutions believe that the price will have a maximum peak to initiate a fall.

What are trends?

A trend is a movement, whether bullish or bearish, Side of the asset which we are reviewing. Identifying them is usually quite simple.

• Lateral Trend: Range Zone between a Maximum and Minimum price.

• Bullish Trend: Bullish zone marking new highs of highs and lows.

• Bearish Trends: Corrective Zone marking new resistance and lower lows.

Trends:

1- Bullish trend:

This is an upward trend, quite obvious, in this type of trend the price tends to make new highs and mark higher lows. As long as it does not break the trend we could join it looking for new highs.

Example:

NDAQ, 04 Mar 2021, Bullish.

2- Bearish Trend:

The downtrend tends to seek higher lows, it is also easy to identify on the chart.

Example:

BTC, 1 week Chart.

3- Lateral Tendency:

It is usually an area in which the price is in a range.

BTC, 31 Jul 2020 to 03 Sep, Start Bearish Trend.

Already handling these concepts let's go to topics of Supports and Resistances a little clearer.

False Trend Breaks:

1- GAP:

A gap is an empty space. This empty space can be explained as follows:

What is a gap?

A gap is called a gap in the continuity of the price line with respect to time. It occurs when the price experiences a marked movement up or down without any operations between the previous price and the current price.

Gaps occur for various reasons, from market buying and selling pressures to important publications of economic data that cause a temporary lack of liquidity, not being able to complete transactions in a certain price range. In this way the price jumps from one security to another without going through the intermediate prices. The most frequent gaps in the forex market are due to the publication of key economic indicators and more usually to weekend events. However, gaps are relatively rare in forex compared to other financial markets where they can occur on a daily basis. This is mainly due to the large volume and continuous hours of the forex market.

Definition Copied, but this is a GAP. It can occur after the close of the stock market. And since BTC is already in these in part of Futures we could say that GAP could happen on weekends. Or when there is a lack of liquidity or a sharp upward movement after the closing of CME.

Example Gap:

BTC1! , CME, Close. And Open. Is GAP.

2- Rupture V:

The Break in V in a trend could indicate a possible change in trend, but there is always the possibility that "Pullback" attempt to change the trend does not work and that the trend will continue. That is why we do not usually enter the pullback, if not after it, hoping to get rid of the trend.

Example V:

It should be added that these 2 things can continue to be a continuation of the trend or an attempt to change. Although there may also be a breakout. The common thing is to wait for Pullback, and enter there.

Supports and Resistances in trends.

1- Bearish Trend

Basic rules:

• The trend is bearish.

• We do not enter Long, we look for a Short in the trend, resistance points, resistance placed in Blue CIRCLES. We can see the supports in the red dots, and we can visualize a Pullback trying to take it higher but being rejected by the bears. We always seek to enter the blue points. Never go against the trend. Seek to go with her.

Example:

Tip: Do not enter a trend when it is ending.

2- Bullish Trend

Basic rules:

• The trend is bullish.

• We seek to enter Long, At the support points, As we see there is a bearish pullback being rejected and led to the upside. The red points are resistances, and the blue points would be entries in Support. Green is the pullback. Always go along with the trend.

Example:

Tip: Do not enter a trend when it is ending.

Example :

First of all we see a very clear resistance, support. And we see that when it touched support, a bullish happened.

Where was the R1 now it became a support that when tested had a magnificent bullish

Then the strongest resistance. It becomes a nice support. That when tested starts a bullish.

3- Lateral Tendency

Lateral Tendency

In a lateral trend, both resistances and supports are possible entries, here you can make your own decision of where to enter depending on where you think the price continues to go.

Here we can see that this time I have not placed it so easily, it is simple, a trend in graphics is not like the drawings, you must learn to identify them, and this is done with practice, this trend is lateral, it has small trends within it. trend. We could say that in chart 1d the trend is bearish, but in monthly chart it is still bullish, this is what I mean.

Applying what has been learned:

As we can see in the image we see the 3 trends.

1- Bullish trend.

As we can see, the blue dots are entry areas. And the red dots would be resistances, applying the rule that we will only seek to enter within the trend. In addition to visualizing an attempt to bring the price down that is rejected being driven up.

2- Lateral Tendency.

We already know that this trend is a side zone in a price range to make a decision. So knowing this, what we will do is look for entry areas. As we can see, I still do not consider the first R3 as an entry since it is still within the uptrend zone, but I take into account the consequent lateral zones.

Here a hedge mode could be applied, prioritizing a Short or Long depending on the current market situation.

An example is that the market is bearish, so we would seek to open a Short first and then open a Long to have a Hedge mode and make a decision as to where this lateral channel breaks.

3- Bearish trend

Here we can see that the Lateral channel broke down. So if we use Hedge mode (Open Long and Short in the same asset that is hedge mode).

We would be looking to confirm that a pullback to the upside is rejected to the downside, to close our long and let the short run. Thus obtaining profits from our hedge mode.

Finally as we can see, we end up with similar resistances and supports. That it will not always be fulfilled. But it is a way to get out. It is clear that there are other ways to identify support and resistance.

Let's talk about those other ways ...

Fixed Supports and Resistors

Fixed levels are support and resistance zones that remain unchanged. They are still valid at the same level, unless the price breaks through it.

In order to identify fixed support and resistance levels, you should pay attention to:

Psychological price levels

vAnnual highs and lows

•Candlestick highs and lows

•Opening and closing of candles

Psychological levels of resistance and support

Most novice traders tend to rely on round numbers, numbers that place buy and sell orders being too exact. Here is a problem. Since the institutional ones are aware of this point of view including traders with more experiences and can make that the price does not touch those round numbers. These numbers are considered Psychological Numbers. Where inexperienced people usually decide to enter, being too obvious and therefore may:

•You have a short, your round stop touches, and it goes to the Bajada.

•You have an order in Short or Long, do not touch it and it goes to the direction you thought

•Touch your liquidation and it goes up.

•You have Long, touch your round stop touch, and it goes up.

Dynamic supports and resistors

Dynamic levels are areas of support and resistance that change. Don't worry if you don't know how to identify those new support and resistance levels, every time a new bar or candle appears on the chart, that zone is automatically recalculated.

Moving averages:

As we can see, the moving averages help you see possible rebound areas, which are changing and vary according to time periods and where the price goes in real time.

We can see that moving averages of 20, 50, 100 and 200 days are mostly used.

Here we can see an example of rebounds when touching the 50-day moving average, and we see that BTC is breaking them with the idea of a possible support in the 200-day moving average.

As we can see in CryptoGoUp Triple EMA says that the moving average is at the level of 42056 dollars. Being a possible support area. That is why many traders often use moving averages as testing areas to determine the direction of the price together with the use of indicators.

2- Parabolic SAR

SAR is an indicator widely used by some traders to see dynamic support zones. Here we can visualize it.

Sar is easy to use, as we can see it places points where a new trend appears, the first points being the resistance zone. And the same in case an uptrend starts.

Semi-dynamic supports and resistors

Semi-dynamic support and resistance levels are between the fixed and dynamic levels.

While the dynamic levels of Forex support and resistance are changing and updating and the fixed levels remain constant, the semi-dynamic levels change at a constant rate.

A perfect example of a semi-dynamic support and resistance level is the trend line, which changes at a fixed rate per candle.

Other Tools:

Fibonacci:

We could also use Fibonacci but this topic will be personally touched on in another Tradingview explaining all the tools that the platform offers us using Fibonacci.

We are using fib retracement projection, it usually exceeds the levels of 1.23-1.618 in cryptocurrencies with high demand. And as possible maximum peaks it usually takes the levels of 2.23-2.618. This doesn't always happen, but personally it works quite well for me.

Although it should be added that it depends on where you place it, if you place the retracement or projection from another point, this could be totally different, so for this, I prefer to use Objects and you get the best probabilities according to how the fundamentals in global economics go in general.

If we wanted to measure a setback, it is the same. Mostly it touches 38-61.8%. Although being liquid coins it touches the 50% levels. Known as psychological zones.

As we can see when changing 3d graph. and placing the fib retracement from the start of the uptrend from 2020 at 4400 we are touching 50%. Therefore you should know where to place it, or in the best case, try.

Pivot Points:

Also Pivot Points, which places us different supports and resistances of each drop and rise that occurred. But it does not indicate possible areas of exact shape.

We will see all these things mentioned in a telegraph by topic. I want to touch them in depth, but here you can get an idea of how to start.

Remember to follow me.

Support and ResistanceThere is no magical tactic or indicator to "see" the support levels on a chart, but how do astronomers know a black hole is around without seeing it? They use their brain.

There are several types of support/resistance, the obvious ones, and the less obvious ones, and which ones do you think separate the bottom 95% from the top?:

- Horizontal price level (Bitcoin 9000, 6000, 3000)

- Diagonal price level (trendline)

- Moving averages self fulfilling prophecy

- Constant flow of positive news

- Sovereign fund buying or selling (CCP bags) program

- There is more, up to us to find it, good luck

In my weight gain & weight loss example what supports the increase and decrease?

You cannot predict what exactly that person will eat everyday, if someone will drop them home or not,

how much they will walk, if they hear in the media about a "science" paper claiming chocolate is super healthy.

Those are all random factors (to us puny humans), they are part of the normal day to day fluctuations.

Mere mortals including the best know those fluctuations happen but do not trade them, only daytraders do.

The weight has some support during the visible uptrend. This support is the regularly added calories from the weekly pizza.

Exact same as an institution running an algo to buy shares by increments every week at the same hour (that you could scalp).

On the weight loss period, there is a resistance, which is made up of the every other day walk home and the lack of pizza.

Yes mostly the resistance here is not something but the absence of this something!

So while predicting with precision is not possible we can enter on what we consider 2-sigma oscillations for example.

If we bet on the early "reversal" being just noise with a stop at 3 or 4 sigma we get an asymmetric risk to reward.

The average casual investors (and Bill Ackman) are the ones betting on the 4-sigma "never give up! strong hands! we will win! the power of love!".

4 sigma is human nature (for most people), also not understanding probabilities intuitively is. But I'll make a separate idea about that.

Skilled investors not only exit but even if a trend starts with good support (fundamentals + visible with technicals) they will join the new trend.

But careful not mixing everything. "4 sigma" meaning very low p of being noise in the original trend does not mean high odds of opposite trend.

So this is it, to estimate what supports the price the smart market speculator has to work as a detective, find clues, and as a statistician, put these clues together with p weights,

add potential clues with their own p weights.

How can novices possibly imagine they can use "TA" to magically find these supports, they really expect some big red flashy arrows on the chart that anyone can see?

It's so delusional. As detectives they'd expect the killer to scream "I DID IT! I AM HERE!"?

And of course get a big paycheck for their work as a detective. This is not a video game.

How to Draw Support & Resistance Lines for StocksIn this video I use simple easy to learn processes to mark out support and resistance levels. And importantly analyse if buyer or sellers are currently in control of the market.

If you have found this useful then please like the post, follow my page and share with any friends you think will find it useful.

The Regular Divergence (2) Stock price is lower low, but indicator is higher low. The price touches the support trend line.

Tips:

This is index, not a stock. But the tips should apply as well.

2013 dec 13, price and stochastic have divergence.

Stochastic is to value price momentum.

The divergence is a regular divergence. Means the price will bouce back. Here is for price lower low, but indicator higher low.

Stochastic works only for a range price move. For strong trend, not working. Here the indicator value is very low, and the stock not in a strong trend swing, means oversold. More probably to bounce back.

The stock runs in a very long range. The price drops almost on the support trend line.

Over all these, a strong buy hint is here.

S&R Indicators MA That I Work WithThought that someone will find useful or want to compares his/hers supports and resistances and instruments with someone else's.

Also they are pretty accurate you can check them by yourself.

Thank you for reading my post, have a great day, wish you all the best !

Information provided is only educational and should not be used to take action in the market.

Feel free to ask anything on the comments :)

I LOST 70% OF MY CAPITAL WITH THE SAME MISTAKE => OVERTRADINGHello Traders,

today I want show you a point of my live, that I constantly overlooked. I want sensitize you for it and also make me so a reminder for the future!

1. OVERTRADING

It's the truth: In the past I lost 70% of my capital with overtrading. If you find yourself there then I would be sensitize you to rethink your approach of trading.

On the chart above you can see how I take at the beginning all rules what I learned before:

Only 1% of my capital I choose for risk with using StoppLoss

Support and Resistance are STOPPLOSS and TAKEPROFIT, depence on trading direction

I choose a Takeprofit more then 2 times of my risk

=> I lost the most time with this rules

But the rules are not the problem!

The problem was my overtrading. I see only "ONE" signal to take action => then it overcomes to reaction buy, no no, sell... dame, better buy and so on => always if I was in loss I tried to rethink my trade 24/7 hours in front of the screen.

2. SUPPORT AND RESISTANCE: THE WORST ENTRY POINTS EVER, BUT GOOD STOPLOSS AND TAKEPROFIT AREAS

Another thing is, that support and resistance areas are good reverse moments. Every greedy trader like I used to be, try to catch the early trade to make more money than anyone can imagine. Then back to reality: you get stopped. The market takes your money and you don't realize why!

On this moment, you have your own opinion of the market and this your mistake to believe you are right. You hadn't wait enough!

3. BE PATIENCE - TRADE LATE AND RIGHT THEN EARLY AND WRONG (MULTIPLE)

The headline above in point 3. is since my realizing the importast rule. Trade late and right!

Because the other thing of trading you can: the right risk, the winning opportunity.

Sometimes it helps to look in deeper timeframes, to get enough win-risk-ratio.

Hopefully it helps you!

Kind regards

NXT2017

How To Correctly Draw Support And Resistance LinesWelcome Traders!

In today's trading episode, you will learn how to identify support and resistance levels on your chart. These are places where the price can do one of three things: hesitate, bounce, or breakout.

Take time to practice what you learned in today's video.

Until next time, have fun, and trade confident :)

FOREX MARKET MANIPULATION - BIG BANKS🎡 FOREX MARKET MANIPULATION 👾

What is the first thing you learned when you started your journey in the forex market?

I will answer for the majority, Support/Resistance, trendlines, chart patterns and etc

Have you ever asked yourself why is it so common?

When we are introduced to the foreign exchange, we are thrown in a deep ocean with a lot of sharks.

Unfortunately for most of us, get eaten alive by these sharks.

We are thrown in the ocean without any clear context or a clear understanding of who is in charge behind the scene.

It is very easy to get lost in this deep ocean if you don't know where you are swimming to.

You may be diving right into a trap that the sharks intentionally made..

You won't even notice that you are lost.. the ocean is that deep.

Now ask yourself, do you think (you) as a (swimmer) in the ocean have more knowledge than the sharks that had been in the ocean before you came?

As crazy as it sounds, many traders believe they do and this confidence leads them to bad decisions.

New Trader Journey Timeline =

"Searches on the web" ---> "gets greeted with" ---> "learns a strategy" ---> "strategy fails"

---> ---> "looks around" ---> "learns a new strategy" ---> "strategy fails"

Sharks/Devils Timeline =

"Distribute false knowledge" ---> "give a false sense of hope" ---> "plant the trap"

---> "show the chart patterns" ---> "Trader left confused."

Retail Trader Development

(I want to trade) --->(Give me a strategy) ---> (It doesn't work)

Pro Trader Development

(I want to trade) --->(This is how the market behaves) ---> (This is how we will exploit it) ---> (I'm improving)

It's 90% mentality when it comes to trading the market.

You don't make the big moves, the banks do.

You have no control over any move, the banks do.

You are in no position to move the market by any means, banks do.

You are taught this basic information intentionally, by the devils.

You are falling into the traps of the sharks, they show you the patterns you are taught.

You are trading at any set time, you have no real strike time.

Once you understand that (You) are in no control of this market, you will start to think differently in many ways and build an anti-devil strategy.

As much as it is important finding the right entry, it is also crucial to find the right tike to strike.

Stop looking at other traders, because I guarantee you they are also a victim..

Focus on you.

Bitcoin Traders Beware!, Buyers Will win this War(Short Squeeze)Like And Subscribe(😊 Thanks in advance)

Why do Support and Resistance hold but sometimes break forcefully? you may ask after bitcoin recent price actions.

I am sincerely more than happy😳 to welcome our new subscribers.

My analysis are always multi-timeframes, so please do expect a full week play out of my predictions.

as a result of my busy hectic schedules, I will be making only weekly analysis every weekends on what to expect from the market through out the new week before a new weekend.

I will do my best to try to constantly update the posts during the week, to keep you updated incase we have any sudden incoming changes in price action that could affect our results.

Thanks for your constant supports and understanding.

It is crazy to know that the bull(buyer) and the bear(seller) can be same trader at any point in time in the market, and sometimes even confused of what she/he should be doing, buying or selling.

To answer the above question, first I will start by explaining what Resistance and Support truly is in the most simplest way that I can, for the sake of new born traders reading along.

what then is Support And Resistance?

For Support;

The simplest definition I can gave you is that , a Support is simply an invincible form of form(🛏)made floor area on the chart where price somehow bounces off from, this invincible floor prevents price from going farther down

when falling from a higher price range as a result of coming in contact with an invincible barrier called resistance.

Ones price comes close to the support, here it manages to find a way to bounce back to the upside after being pushed down(sold off) by sellers in the market.

this support are build or formed by unusual huge number of buyers(when you have huge number of traders willing to buy at a particular price range on the chart) .

To better understand how a support works, I will like you to see this support built floor by the buyers as a form 🛌 floor because it is breakable and can be sliced to the worst piece with no remorse when the sellers are huge in numbers.

Here is my lil secret for trading supports (secret source😉):

*See support as an area on the chart and not a line because, it is likely price breaks the line only to find buyers below your line.

* Whenever price gets closer to support, start by focusing more on the candle formations even before it comes in contact with it. If any candlestick pierces the support with a full grown body, this will most likely mean that price could go down lower more if the next two to three candles doesn't give bulls(buyers) a bounce above the support area( the last swing low that was broken). It will likely seek the next support below for assistance of a bounce(price is looking for more buyers)

* If price gets to the support and starts to go side ways, then bounce strongly with strong reversal candle stick pattern, don't jump the gun yet, wait for price to come back to confirm by forming higher low on the support, to prove the buy power on the support, price always retest a support before taking off from it(if it finds large enough strong buyers, it will make a higher stronger bounce before it even touch the support on the retest, this therefore leads to a higher low as a result of too many traders watching that support and are racing each other on the buy zone , when more buyers see this they will also jump in because now they know that the support is likely to HOLD.

*The more a support is hit 🧐,the more lower the strength of the bounce grows, the more likely price will break below it. to trade, start by watching the candle sticks forming on the area of support. This simply means that, hitting the support countlessly times leads to it breaking because it is likely that soon one candle will break the support. too much sideways on support will lead to its break or pierce also.

* Support holds, but the can also sometimes easily break as well. When supports are broken they automatically turn to new resistance.this simply means that the buyers house is now having now owners(sellers), if you understand this particular tip, it easily explains why supports got broken in the first place because the buyers at home were to small in number to defend the house so sellers killed them all🤣(bull hunt) and took over the ownership of the support there by turning it into their now home(resistance),

*Horizontal support areas are the strongest while the slanting trendline buyers are weak and more prone to break easily.

What is Resistance ?

Resistance is simply an invincible Form🛌made barrier area where price comes in contact with then starts to drop, this invincible barrier prevents price from moving upward any further, next this barrier pushes price down(sometimes even after price successfully pushes above these barriers they some how manage to get the bulls tail and drag them back down, this is also know as fake out by price action traders. just like the buyers support, these resisitance areas built by sellers can be sliced to pieces if the buyers are huge in number and out number the sellers, the barrier will be 😱 destroyed 💸 with out remorse!

Here is my lil Resistance secret source😉:

here everything is just the opposite of my tip for support.

* when price starts to gets closer to the resistance, start focusing more on the candlestick formations even before it comes in contact. if any candlestick pierce the resistance with a full grown body(make sure the candle that follows doesn't close below the resistance, it will likely go down below more if the next two to three candles doesn't give bulls(buyers) a follow through, above the that resistance area that was broken. It is most likely, price will seek to retest that resistance if it succeed in breaking through the form barriers. buyers will allow price to comeback to the top of the barrier, here they will take time to reenforce and also make sure the barrier is turned into a new support( new home owners).

The current bitcoin price is in a buy support area. in my last analysis, the vertical support line was broken and price went below it to 28900 zone still within the horizontal support area, we saw price seeking stronger buyers zone on the support . I still remain bullish o! as I believe a short squeeze is coming, and can still see a strong bull bounce before the major retest of the last breakout of 12k resistance as a result of the weekly chart.

this new week coming we are likely seeing a reaction buy from the pullback. if buyers successfully holds the 32k support and get a bounce, their first target will be 37k resistance and if they succeed to break the edge at 39k of that barrier then 46k to 60k range will be their next target before a major big dump of over 40% drop will occur in my opinion.

but what if sellers break the support area as a result of countless touch?

Trading is a game of probability so yes the chances of that happening exist . though the first option has higher chances of playing out, if the second do play out instead, here is what to expect

then we will see this play out.

Trend Channel Trading GuideHello, dear subscribers!

Today we are going to discuss a very important topic of the trend trading.

The trend channel is the most reliable tool of the trading during the trends.

Here is an example of the ascending trend channel. For novice traders it is recommended to execute trades only in the direction of a trend.

First of all we should determine the trend channel. The white part of a channel is the formation phase. Here we can find multiple bounces off the lower and upper channel's bands. As a result these band are defined.

The green part of a channel corresponds to the trading time. Let's consider an example of long positions execution. We can do it when the price bounced off the lower band. For the take profit level defining we recommend to use the significant resistance level, like a green line on the chart.

We should be conscious about the potential trend channel's breakout (red point). The breakouts can be fake, but if the price faced with the rejection (red area) for the attempts to re-enter the channel it can be the sign of the potential trend reverse, as we can see at this example.

We will continue this topic with other examples of trend channel if you are interested in it.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions.

Price Action Basics: 1 Tool to Rule them AllIn this vid I will explain about Price action Basic Tool.

This tool is exceptional and most used in trading and technical analysis.

This video will help new traders how to analyse chart and find trades according to price action.

Bump Like if you enjoyed the video and find it useful.

Best regards,

Artem Shevelev

HOW TO DRAW SUPPORT AND RESISTANCE LIKE A PROHello everyone, If you like the materials in this video, do not forget to support with a like and follow.

In this video, we are going to learn how to draw support and resistance in a practical way on NZDCAD Daily timeframe.

Hope you will make good use of it!

Rich

Orderzones Explained : A form of Support & ResistanceHello traders!

In this educational idea im going to be going over the 5 different main types of Order Zones on Crypto Charts & how i identify and draw these zones, aswell as what they are used for.

Orderzones are a way of marking on the chart historically significant areas where price had strong reactions to.

The price tends to come back to these areas and have strong reactions, the Order Zones act as a form of Support & Resistance.

For those who are new to Technical Analysis ; "Support" is a area on the chart price and demand (buying pressure) increases from, with "Resistance" being the opposite, with price decreasing and sell orders (Supply of asset) increasing from the latter.

Why do i use Order Zones?

-Reduces risk & increases probability of potential trades

-Trying to trade with; not against larger size traders such as institutions that use similar price levels due to historic signifcance

-Providing clear entry and exit points to calculate Risk:Reward Ratio (R:R)

-Providing reference points to capitalize on historical areas of market volatility

-Allows us to reduce clutter and find key areas as the volatility on Crypto makes it difficult to chart

We have 5 main types:

-Supply Clusters

-Demand Clusters

-Single Candle Supply

-Single Candle Demand

-Orderblocks

Supply Clusters & Demand Clusters

First we must find areas on the chart that look similar to a tightly squeezed together rectangle . Price should then make a "thrust" (major increase, or decrease in value) from this rectangular area. We use the Rectangle Tool to draw a zone across these areas.

In the below image you can click for a in depth explanation of how to use these clusters in your trades.

Single Candle Supply & Single Candle Demand

To draw and identify the Zones first we must find areas on the chart where a strong reversal occurs, at the start of the trend reversal, or at swing points we can find larger then normal "wicks": (wicks are the thin, needle points at the end of the candlesticks ) as you can see in the above and below images.)

Click the below image for a in depth explanation of how to use these zones in your trades.

Orderblocks

Orderblocks are the small square shaped candle bodies, usually found in between significant price moments. They are small "pauses" before the next move. We use the Rectangle Tool to draw a zone across these areas.

In the below image you can click for a in depth explanation of how to use Orderblocks in your trades.

If you take some time to go back over your charts (especially on the Monthly, Weekly & Daily timeframes) and test out some of these Order Zones, you will see more then often price comes back to these areas before reversing like a magnet towards the next closest Order Zone so they become a useful tool in any traders arsenal.

If you found the idea informative show your support by Liking & Commenting thank you!

EDUCATION: Moving Average Support LineHello, dear subscribers!

Today we examine another one support line type - moving average support.

Definition

Moving average support line is one of the advanced types support lines. It based on price moving average for any period which can be chosen for every particular case. MA helps to define the trend direction at current moment. If the price closed above the MA for at least ten candlesticks in a row we can identify this situation as uptrend.

How to trade with MA support?

Because the uptrend is identified we cam use the MA and price crossing points as entry points. In our case, when (1), (2) and (3) occurs, the next points from (4) to breakpoint can be used to enter the position. In case of success we will see the price touched and bounced off the MA. In opposite, the price break the MA line down, but the stoploss usage can help to eliminate huge losses.

Summary

1)To identify the uptrend when the price closed above the MA 10 times in row

2)To entry the position when the price touched the MA

3)Fix the profit with it's bounce off the MA

4)Set the stoploss to eliminate the losses in case of sharp price decline