DOGE / USDT — Weekly AnalysisFirst time covering DOGE on the higher timeframe.

On the weekly chart price returned to a major historical level after filling the large downside wick — meaning long-term liquidity has been taken.

Structure overview

Major support: ~0.08 – 0.10

Weekly resistance: ~0.14

Major S/R flip: ~0.20

Market structure: macro range after long distribution

What this means

This area has historically been where accumulation starts, not where trends end.

However — holding the level is required first.

Right now price is sitting at decision support:

Hold → multi-week base possible

Lose → continuation into deeper range lows

Market logic

Higher timeframe levels react slower.

So expect consolidation first before any strong move.

Simple plan

Above 0.10 → basing phase

Reclaim 0.14 → bullish momentum returns

Reclaim 0.20 → trend shift on weekly

Lose 0.08 → bearish continuation

This is not a breakout zone — this is a positioning zone.

Do you think DOGE is entering accumulation or preparing another capitulation?

MrC

Technical Analysis

GBP/USD BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

GBP/USD pair is in the uptrend because previous week’s candle is green, while the price is clearly falling on the 4H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.374 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Daily open and close don't work... quote XDHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Gold continued the bearish sequence on the daily, H4, and H1 timeframes.

Even with slightly positive data, the New York session was almost flat.

Price stayed sideways, then formed a bull trap at 17:00.

Exactly on the marked area for a potential sell.

The target was the lower daily level.

Candle open, just below the gap.

Area 4700–4660.

Now the situation is more complex.

That level was reached in a deep way.

We also had a bullish Asian session.

Statistically, Friday tends to be more long than short on gold.

We need to be careful.

No NFP today.

We’ll evaluate together during the US session how to act.

For now, I keep these zones.

See you later live at 14:00.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

#NIFTY Intraday Support and Resistance Levels - 05/02/2026Nifty is indicating a flat opening, and structurally there are no major changes compared to yesterday’s levels, which clearly suggests a continuation of the consolidation phase. The index is currently trading within a well-defined range, and price action shows balance between demand and supply. Such sessions typically start slow, with whipsaws around key levels, and a directional move is usually seen only after a decisive breakout or breakdown with volume support.

On the upside, the 26000 level remains a critical psychological and technical resistance. A sustained move and acceptance above 26000–26050 can trigger fresh long positions, with upside targets placed at 26150, 26200, and 26250+. This zone represents a higher timeframe resistance, so follow-through buying is essential for continuation. Until price sustains above this area, aggressive longs should be avoided.

In the immediate range, 25750–25800 acts as a key reversal and demand zone. If the index shows stability and reversal signs from this area, a short-term pullback rally can be expected towards 25850, 25900, and 25950+. This move would be more of a range play rather than a trending rally, so partial profit booking is recommended near resistance levels.

On the downside, 25950–25900 remains a supply zone. Rejection from this area can lead to short-term selling pressure, pushing the index towards 25850, 25800, and 25750. A decisive breakdown below 25700 will be a bearish signal, opening the path for deeper correction towards 25600, 25550, and 25500, where stronger support is placed.

Overall, the market structure clearly favors a range-bound strategy rather than a trending approach. Traders should focus on buying near support and selling near resistance, avoid chasing breakouts without confirmation, and maintain strict stop-loss discipline. A clean directional move will only emerge once Nifty breaks out of this consolidation zone with strong volume and follow-through.

AUD/NZD BUYERS WILL DOMINATE THE MARKET|LONG

AUD/NZD SIGNAL

Trade Direction: short

Entry Level: 1.162

Target Level: 1.166

Stop Loss: 1.159

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

BITCOIN BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

BITCOIN pair is trading in a local downtrend which we know by looking at the previous 1W candle which is red. On the 4H timeframe the pair is going down too. The pair is oversold because the price is close to the lower band of the BB indicator. So we are looking to buy the pair with the lower BB line acting as support. The next target is 75,119.34 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EURAUD: Bearish Move After Trap?! 🇪🇺🇦🇺

EURAUD may drop after a presumably false violation of an

intraday horizontal resistance.

Today's intraday price action looks bearish after a London session opening.

Goal - 1.6870

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

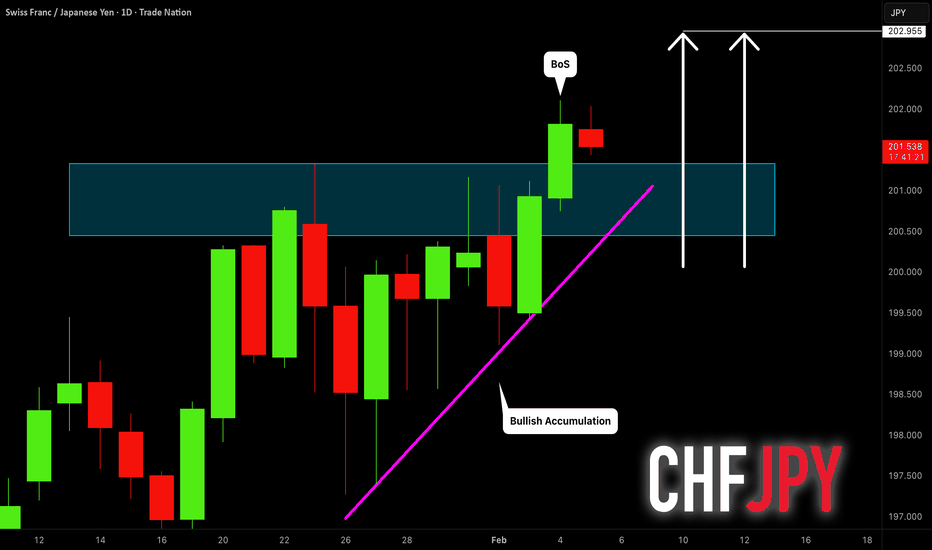

CHFJPY: Important Breakout 🇨🇭🇯🇵

CHFJPY broke a horizontal neckline of an ascending

triangle pattern on a daily time frame.

The next strong resistance that I see is 202.93 level.

With a high probability, it will be reached soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EOSE 1D: Batteries on pauseOn the daily chart EOSE formed a descending wedge following a strong upside impulse. The structure developed through lower highs and lower lows with clear range compression, signaling seller exhaustion rather than the start of a new downtrend. The wedge was broken to the upside and fully worked through with a directional move.

After the completion of the pattern, price shifted into a pullback phase. The current correction represents a standard retracement after the wedge expansion and is now moving toward the key demand area between 12.5 and 13.5, aligned with the base of the wedge and the 0.786 Fibonacci level. This is not structural failure or selling pressure, but a routine test of the base after a completed move.

Volume profile adds important context. The main high-volume node sits in the middle of the range, defining a clear area of balance. The pullback develops through a lower-volume zone, explaining the slow and controlled nature of the decline without downside acceleration. Price is not being rejected, it is rotating back toward a previously active area.

From a structural standpoint, the first reaction area remains near the upper boundary of the former wedge, where prior supply emerged. Acceptance above that area would allow price to expand toward the next higher structural reaction zone above balance. These levels are not targets, but logical points where price is expected to reveal intent.

Momentum indicators confirm a post-expansion pause. MACD remains near the zero line and ADX stays subdued, consistent with redistribution rather than trend development.

The wedge has already played out. Now the market is checking where energy actually accumulates.

#LINK Crash Incoming? Why strong support always Weak...

Yello Paradisers! Did you catch the early signs of this breakdown, or are you still stuck in the trap? As we warned in our previous market commentaries, #LINKUSDT was setting up for a deeper move — and now the chart is confirming that view.

💎After a clean rejection from the trendline resistance, #LINK has decisively broken below a key structural support, confirming a shift in market sentiment. This wasn’t just a random bounce or a short-term wick — the break below structure was accompanied by clear momentum loss on the higher timeframes, which increases the probability of a sustained leg lower. The trendline rejection aligns perfectly with the broader structure, and we’re now seeing continuation as price respects the bearish market geometry.

💎What makes this setup even more compelling is the presence of hidden bearish divergence on the RSI as price retested resistance. This is a technical sign of strength in the prevailing downtrend — price was making lower highs, but RSI was printing higher highs. That kind of signal often goes unnoticed by retail traders but is a critical continuation indicator for experienced analysts. It confirmed that bears were in control and buyers were lacking conviction on the retests.

💎Moreover, the broken support level had been tested three times prior to the breakdown, and many retail traders fell into the trap of interpreting that as strength. But as we’ve mentioned many times in our updates, repeated testing of a level weakens it, not strengthens it. What we saw here was a classic liquidity trap — smart money absorbed retail demand at support, engineered a false sense of safety, and then triggered a breakdown to the downside once enough positions were lured in. It’s a strategy often used to generate liquidity before the real move begins.

💎Now that structure has shifted, the technical landscape becomes clearer. The RSI is currently holding below the 40 level — a zone typically associated with strong bearish control. Until we see a sustained reclaim of that range or a divergence forming closer to oversold levels, there is no reason to assume momentum has faded. The trend remains firmly to the downside.

💎Looking at key levels, the next major support comes in around the $8 region. This zone is significant both psychologically and structurally — a breakdown into that area would align with prior consolidation ranges and potentially trigger more long liquidations. On the upside, the $15 level now acts as strong resistance. Unless that level is reclaimed with conviction, all rallies should be viewed as potential selling opportunities within a broader bearish context.

As always, we’re not here to gamble or chase noise. The structure is breaking down, and our job is to stay on the right side of probability. That is why we are playing it safe right now. If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest probability trading opportunities. This is the only way how you can get inside the winner circle. Stay sharp, Paradisers — and let the rest chase shadows.

MyCryptoParadise

iFeel the success🌴

WLDUSDT.P:short setup from daily support at 0.3640SETUP SUMMARY

Regarding BINANCE:WLDUSDT.P : after a strong drop, the asset has been consolidating for 5 days. Typically, if an asset comes from above and enters consolidation, it will continue in the same direction — downwards.

This move is reinforced by the fact that BINANCE:BTCUSDT.P is dropping heavily today, dragging the entire market with it. BINANCE:WLDUSDT.P could indeed break the level today, even though it has already moved quite a lot relative to its average statistics.

We are currently seeing a pre-breakout base forming right at the level. If volatility decreases even further, it will be an ideal entry point, as it will allow for placing a tight stop loss.

PRO-THESIS FACTORS:

trend alignment

liquidity vacuum beyond level

market correlation

volatility contraction on approach

prolonged consolidation

lack of rejection after false break ADVERSE FACTORS:

high-volatility approach

no near-level base Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas.

PRME 1W(Prime Medicine, Inc.) - Editing the futurePrime Medicine, Inc. is a biotechnology company focused on next-generation gene editing technologies, targeting rare genetic diseases and currently operating in an active R&D phase.

On the weekly chart, PRME has completed a breakout from a long-term downtrend and is now consolidating during a structural retest. Price is holding within the 3.59–4.00 support zone, where the broken trendline retest, the 0.618 Fibonacci level, and a high-interest volume area align. Price remains above the EMA, confirming that buyers continue to control the structure within the current range. Volume expanded during the breakout and has cooled during consolidation, which is typical behavior during accumulation phases. The current area represents a high-demand zone according to the volume profile, reinforcing its structural importance.

From a fundamental perspective, the company remains unprofitable, which is typical for early-stage biotech. Estimated EPS for Q4 2025 is −0.25 USD, with projected revenue of 2.08M USD. Cash flows remain negative, but liquidity levels are high and debt pressure is not critical, allowing continued R&D without immediate capital stress. Market valuation is driven by expectations around clinical progress rather than present financial performance.

This is a higher-timeframe structural transition story, where the market gradually reassesses the asset after a prolonged decline. Biotech is never about comfort, but this is how early reversals usually start.

ORDERUSDT.P: short setup from daily support at 0.05800SETUP SUMMARY

Regarding BINANCE:ORDERUSDT.P , we have a very strong short setup. The asset is currently at its all-time lows. Consolidation above the level has been ongoing for slightly less than a week. Today, there was a strong attempt to push higher, which ended in nothing. We saw a level tap a few hours ago, followed by a close retest a few hours later, right into the level. We have a clear level from which a reliable short can be opened. Stop loss behind the breakdown bar, and in my opinion, we can comfortably expect a 5-10 to 1 risk-to-reward ratio.

PRO-THESIS FACTORS:

trend alignment

liquidity vacuum beyond level

market correlation

liquidity sweep (false move)

volatility contraction on approach

close retest

prolonged consolidation

precise level testing

price compression (Squeeze) ADVERSE FACTORS:

high-volatility approach Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas

GOLD SHORT FROM RESISTANCE

GOLD SIGNAL

Trade Direction: short

Entry Level: 5,028.84

Target Level: 4,836.67

Stop Loss: 5,157.38

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

“EURGBP 4H Weekly High Retest: Sell ZoneEURGBP has ripped back into a key weekly high area, lining up with the upper boundary of the 4H descending channel, creating a SELL zone to fade strength in line with the broader bearish pressure on the cross. I am looking to sell from this weekly high retest if price rejects the zone with clear bearish candles or wicks, aiming for a rotation back toward recent lows within the channel while the higher‑timeframe structure stays heavy.

$SPY & $SPX — Market-Moving Headlines Thursday Feb 5, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Thursday Feb 5, 2026

🌍 Market-Moving Themes

🧠 AI Cost Reckoning

Big Tech spending fears intensify after GOOGL capex shock and AMD collapse, forcing markets to question AI profitability timelines

🏭 Hardware vs Software Divide

Capex-heavy AI buildouts favor chip and infrastructure suppliers while pressure mounts on software margins

💊 Healthcare Rotation Accelerates

LLY strength highlights capital rotation out of volatile Tech into durable growth healthcare

⚖️ Macro Crosscurrents

Weak ADP payrolls clash with strong services data, keeping recession and no-landing narratives in conflict

🛡️ Defensive Repositioning

Gold stabilizes as investors hedge against Tech volatility and labor market uncertainty

📊 Key U.S. Economic Data Thursday Feb 5 ET

8:30 AM

Initial jobless claims Jan 31: 212,000

delayed release due to shutdown

10:50 AM

Atlanta Fed President Raphael Bostic speaks

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #AI #GOOGL #AMD #Macro #Jobs #Gold #Healthcare #Markets #Stocks #Options

AUD/JPY BEST PLACE TO SELL FROM|SHORT

AUD/JPY SIGNAL

Trade Direction: short

Entry Level: 109.805

Target Level: 108.994

Stop Loss: 110.339

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

USD/CAD SENDS CLEAR BULLISH SIGNALS|LONG

USD/CAD SIGNAL

Trade Direction: long

Entry Level: 1.363

Target Level: 1.367

Stop Loss: 1.361

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CAD BUYERS WILL DOMINATE THE MARKET|LONG

EUR/CAD SIGNAL

Trade Direction: long

Entry Level: 1.611

Target Level: 1.614

Stop Loss: 1.609

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

#BANKNIFTY PE & CE Levels(05/02/2026)Bank Nifty is indicating a flat opening, which signals indecision in the market after the recent sharp moves and wide-range volatility. This kind of opening generally reflects balance between buyers and sellers, where neither side has clear control at the start. In such sessions, the first hour often remains range-bound, and directional clarity usually emerges only after a decisive breakout or breakdown from the marked levels.

On the upside, the 60050–60100 zone is acting as an immediate resistance-cum-trigger area. A sustained move and acceptance above this zone can attract fresh buying momentum, opening the path towards 60250, 60350, and 60450+. If Bank Nifty manages to hold strength above 60550, the bullish momentum can further extend towards 60850–60950+, indicating trend continuation rather than just a pullback. These levels are crucial as they align with previous supply zones where profit booking can emerge.

On the downside, 60450–60400 remains an important reversal zone. Failure to sustain above this area may invite selling pressure, leading to a corrective move towards 60250, 60150, and 60050. If weakness deepens and the index breaks below 59950, it could accelerate the downside towards 59750, 59650, and 59550, suggesting that bears are regaining control for the intraday to short-term perspective.

Overall, the structure clearly suggests a range-bound to mildly volatile session unless Bank Nifty breaks decisively above resistance or below support. Traders should avoid aggressive positions in the opening minutes and focus strictly on level-based trading. Confirmation near key zones, strict stop-loss discipline, and partial profit booking are essential, as flat-opening sessions can quickly turn directional once liquidity and volume step in.

Silver — Bullish Correction Into a Bearish WallSilver just printed a fresh bullish ABC on the 1H.

C-target sits around $96 .

Here’s the part that matters:

That $96 level is also a bearish WCL from higher timeframe structure.

So no, this isn’t a “new bull market” victory lap.

HTF is still bearish .

But this pullback? It’s doing exactly what a healthy correction should do — walking straight into HTF resistance.

That’s ideal.

What I’m watching:

Bullish sequence stays valid → price can tag the $96 C-target

That level = decision point, not a blind buy zone

If HTF sellers show up there, continuation lower stays on the table

If $96 gets accepted, HTF bias is in trouble

This is context , not prediction.

Correction into resistance first. Reaction second. Ego last.

Let price speak.

Not financial advice.