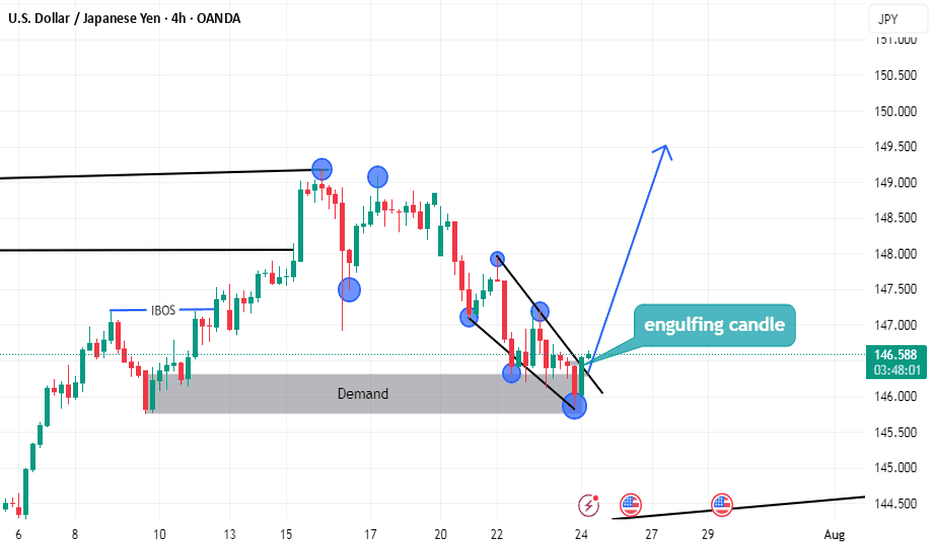

INJ - Back Bullish!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈INJ has been overall bullish trading within the rising wedge pattern marked in blue.

This week, INJ has been retesting the lower bound of the wedge.

Moreover, the green zone is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and green demand.

📚 As per my trading style:

As #INJ approaches the blue circle zone, I will be looking for trend-following bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Trend

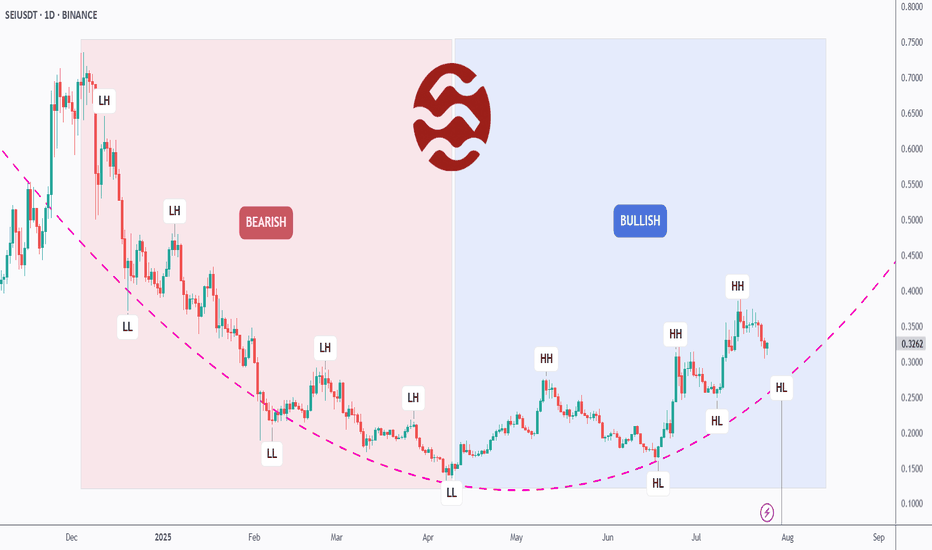

[Deep Dive] SEI – Edition 2: From Pain to Power: A Bull Cycle?SEIUSDT may have just flipped the script.

After months of consistent lower highs and lower lows, SEI has officially broken its bearish structure and is now printing clear higher highs (HH) and higher lows (HL) — a textbook sign of a trend reversal.

📉 Left Side: Bearish Breakdown

From late 2023 to Q2 2025, SEI was stuck in a painful macro downtrend. The structure was brutally clean: LH → LL → LH → LL. Each bounce was weaker than the last, reflecting exhausted buyers and relentless supply.

But something changed in late Q2…

📈 Right Side: Bullish Rebuild

Since its final low around April, SEI began to carve a new path. What started as a subtle accumulation quickly morphed into a solid structure of higher highs and higher lows.

The arc-shaped pink trendline tracks this momentum shift — and we’re now watching a potential continuation of the bullish cycle.

The most recent HL is forming exactly on that curve — a critical moment where bulls may step in for the next impulsive move.

🔥 What’s Fueling the Shift?

SEI is gaining traction as a high-performance Layer 1 designed for trading apps, with native parallelization and a focus on speed and throughput.

Its recent ecosystem growth — including projects in DeFi, gaming, and infrastructure — has started to attract both retail and VC attention.

On-chain metrics are showing increased activity, and whispers of upcoming protocol incentives could be the spark that pushes SEI toward the $0.45–$0.50 range.

🧠 What We’re Watching

- The current HL zone — will bulls defend this level?

- If SEI can break above the previous HH, the bullish structure strengthens.

- A failure to hold this HL would suggest a range or even deeper correction — so risk management is key.

Let’s recap:

- Structure has flipped bullish ✅

- SEI is riding a fresh higher low ✅

- Fundamental momentum is building behind the scenes ✅

It’s now up to the market to decide if this was just a bounce — or the beginning of a much bigger move.

💬 What do YOU think: Is SEI building steam for a breakout, or just teasing us with a fakeout?

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

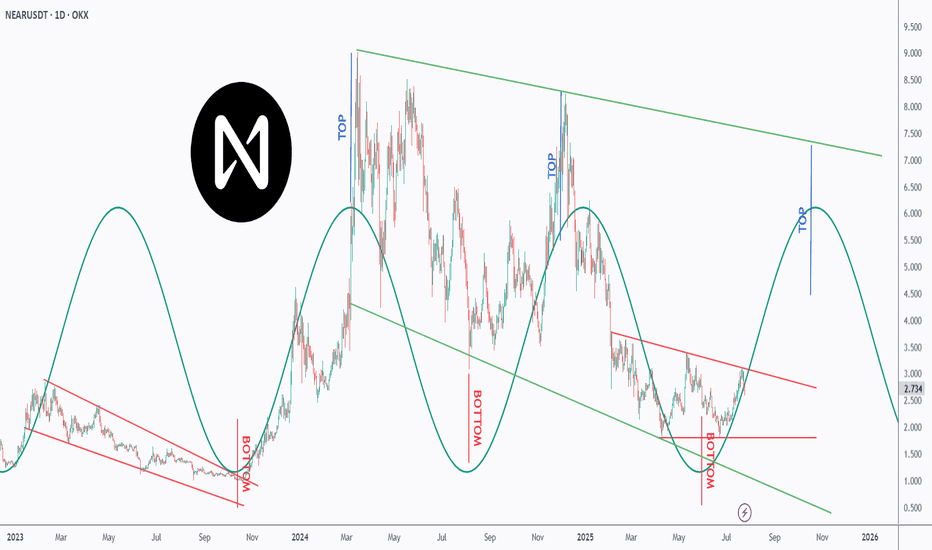

Is NEAR NEARing Its Next Explosion? Watch This Perfect Pattern!NEAR is dancing to a powerful rhythm — and it’s all in the cycles 🔁

This chart uncovers a repeating top-bottom cycle that has held since early 2023, with precise peaks and valleys emerging every few months 📉📈.

After bouncing off a major bottom at ~$2, NEAR is now approaching the mid-line of the descending red channel, suggesting a potential trend reversal is underway 🔄.

Each previous “BOTTOM” aligned with strong recovery waves 🚀, while the projected “TOP” now points toward the $6–7 zone — aligning perfectly with the upper green trendline resistance 🎯.

If the pattern continues, we could be looking at another macro push before year-end 2025 📆.

📊 Will NEAR ride this wave to new local highs — or is it just another lower high in the making? Either way, the rhythm of this chart is too clean to ignore.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

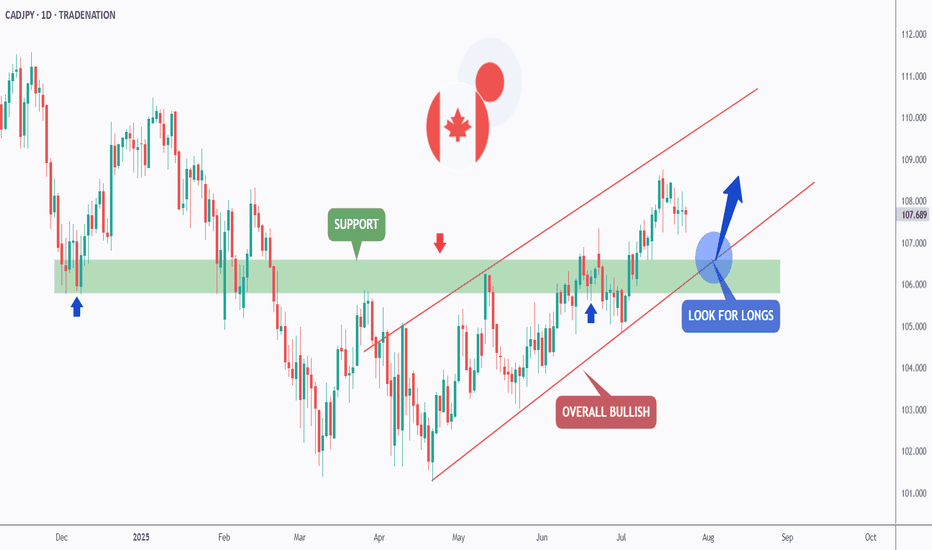

CADJPY - The Bulls Are Stronger than Ever!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CADJPY has been overall bullish trading within the rising wedge pattern marked in red.

This week, CADJPY has been retesting the lower bound of the wedge.

Moreover, the green zone is a strong weekly support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower red trendline and green support.

📚 As per my trading style:

As #CADJPY approaches the blue circle zone, I will be looking for trend-following bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

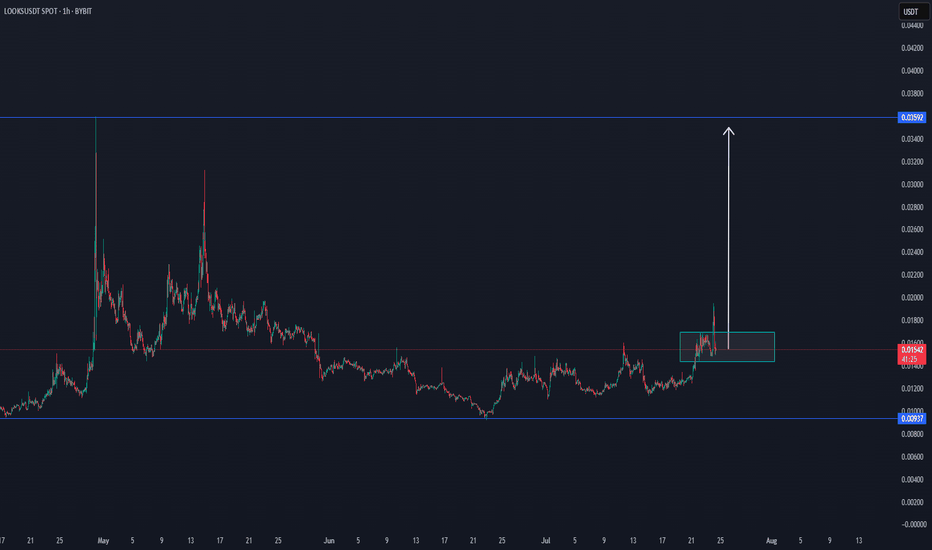

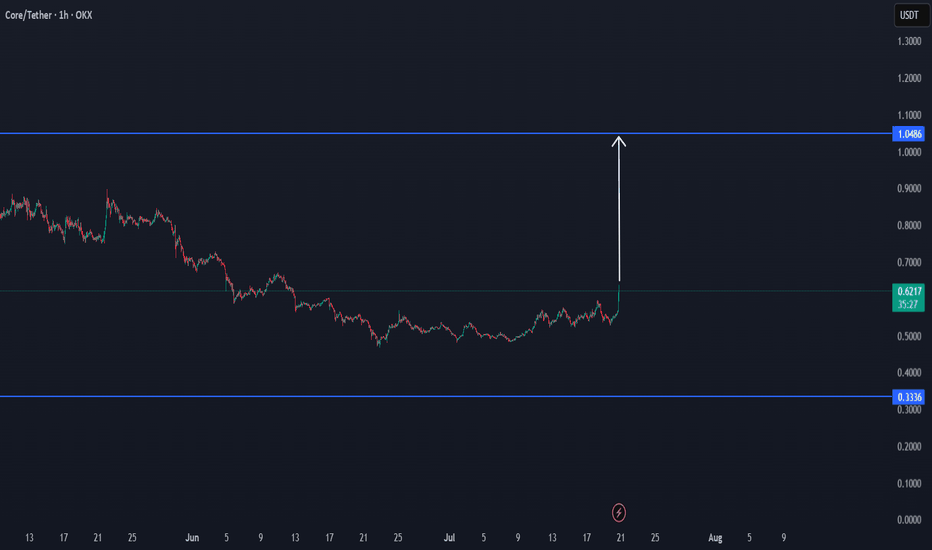

LOOKS CAN ENTER LONG TERM CYCLE AFTER THISLooks seems to make an important trend, which can allow this coin to enter a cycle area.

On the low time frame, it shows breakdown. The main view is that this coin is positive.

$0,035 is an important cycle target, which can be done with time depending on the last confirmations.

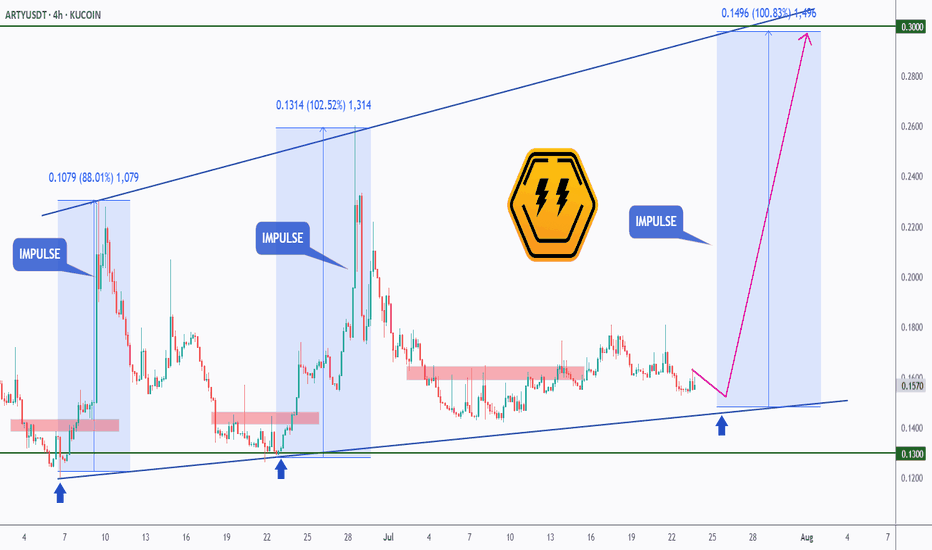

ARTY - The Undervalued Gaming Rocket?While most eyes are on memecoins and major Layer-1s, a sleeping giant may be gearing up in the GameFi sector — and this time, it’s powered by real innovation and user growth.

🎮 Fundamental Boost

Artyfact has just launched its long-awaited Play-and-Earn mode — the first of its kind. This new feature is expected to onboard hundreds of thousands of gamers into the ecosystem. And here’s the catch: players can only purchase gaming NFTs using KUCOIN:ARTYUSDT . This shift not only introduces a fresh wave of demand but also builds real token utility — the kind most GameFi tokens lack.

💼Additionally, recent sell pressure from early investors has now faded. Those who had been staking ARTY for three years have finally taken their profits. With that wave of selling behind us, the token now has room to breathe — and potentially fly.

And yes, I bought ARTY myself — not financial advice, but I’m personally betting on its next big move.

📊 Technical Analysis

AMEX:ARTY has been trading within a bullish ascending triangle, forming higher lows and maintaining strong support around the $0.13 level. Each time it tapped this zone, it triggered strong impulse moves — one up 88%, another over 100%.

Right now, ARTY is back at that exact support level, with a third impulse wave potentially brewing. A bounce from here could send it back toward the upper trendline near $0.30 — our first target.

If that breaks, the next resistance sits around the $0.70 zone, a previous structural high and psychological round number. And if the gaming adoption kicks in as expected, we could be heading toward a macro bull market target of $1+, which would represent a multi-X move from here.

📈 3 Bullish Targets for AMEX:ARTY

$0.30 — top of ascending triangle

$0.70 — structural resistance from prior impulse

$1.00+ — psychological milestone backed by new NFT demand and adoption

📍 Why ARTY?

Artyfact is not just another GameFi project — it’s building a functional gaming economy where NFTs have real use, and where the token is required for participation. In a sea of hype-driven tokens, ARTY stands out by actually shipping product and onboarding users.

With the new Play-and-Earn mode gaining traction, a solid technical base forming, and sell pressure behind us, ARTY could be setting up for its biggest run yet.

➡️ As always, make sure to do your own research and only invest in what you truly believe in.

🎯 Stick to your trading plan — entry, risk, and execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

DOGE Strategy — Momentum Entry, MA Trend Hold, Pullback PhaseThis chart showcases how the MACD Liquidity Tracker Strategy performed on DOGE over the past several days. The strategy entered during a clear momentum breakout and trended cleanly above its MA filter for nearly 48 hours.

Let’s break it down:

🔹 First Signal: Early compression breakout long, but price stayed flat. This entry was managed with a tight close before the second impulse began.

🔹 Second Long: Clean breakout on rising momentum — confirmed by MACD histogram expansion and strong Stoch RSI crossover.

🔹 Trend Structure: MA support held multiple times during this move, reinforcing the uptrend. Dotted trendline shows price respecting structure cleanly.

🔹 Exit Trigger: Price began consolidating and histogram showed waning momentum. The strategy correctly exited before the full reversal began.

🔹 Current Action: Pullback in progress. MACD histogram flipping red, Stoch RSI resetting. This may just be a correction… or the trend might be breaking.

📊 This setup is a textbook use of trend filters, confluence, and exit logic — and a good reminder that the strategy isn’t just about entry… it’s about managing exits with discipline.

Whether this develops into a higher low continuation or rolls into full reversal, momentum confirmation is key before the next entry.

#DOGE #TradingStrategy #AlgoTrading #MACDStrategy #QuantTrading #CryptoTechnicalAnalysis #PriceAction #TrendFollowing #Backtesting #CryptoCharts

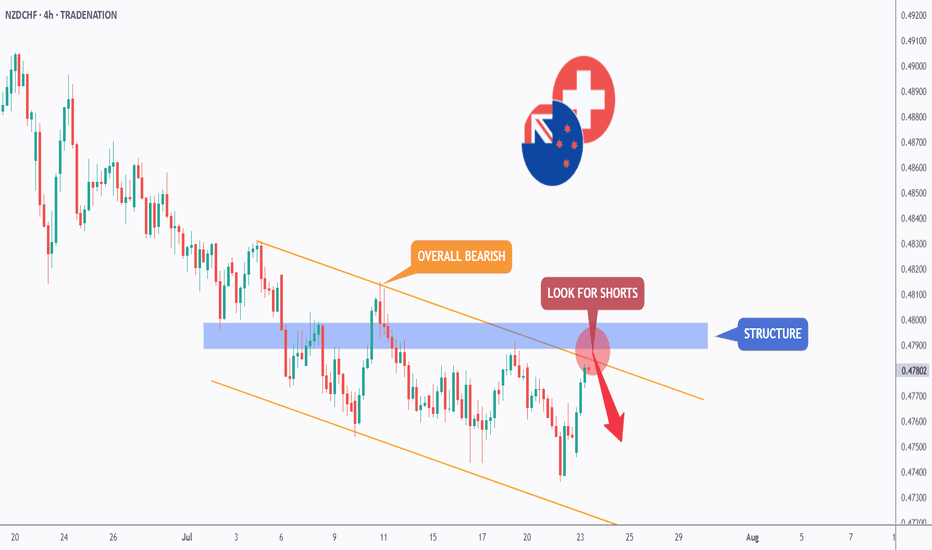

NZDCHF - Follow the Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDCHF has been overall bearish , trading within the falling orange channel and it is currently retesting the upper bound of the channel.

Moreover, it is rejecting a structure marked in blue.

📚 As per my trading style:

As #NZDCHF is around the red circle zone, I will be looking for trend-following sell setups on lower timeframes. (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

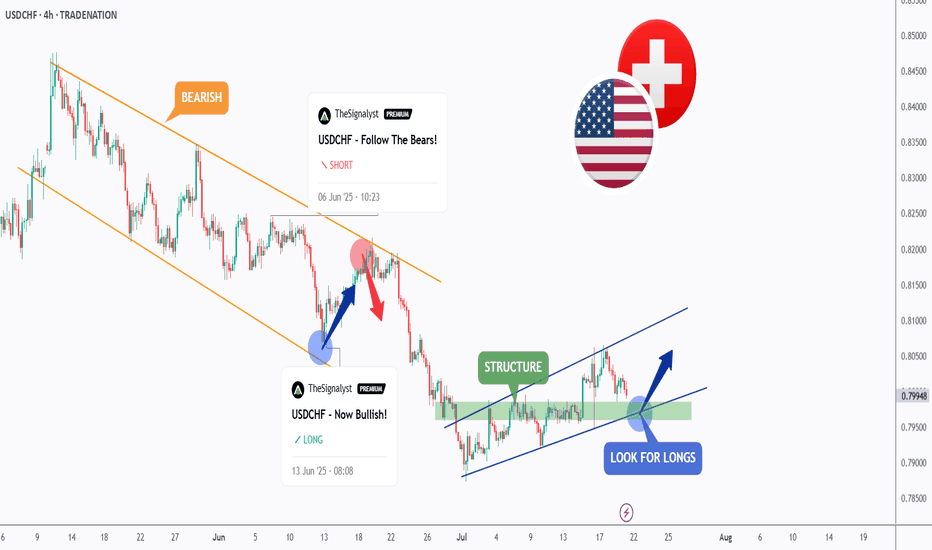

Milking USDCHF again! This time => BULLISH!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCHF has been overall bullish as a correction phase, trading within the rising wedge marked in blue.

This week, USDCHF is retesting the lower bound of the wedge pattern.

Moreover, the green zone is a strong structure.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and green support.

📚 As per my trading style:

As #USDCHF approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

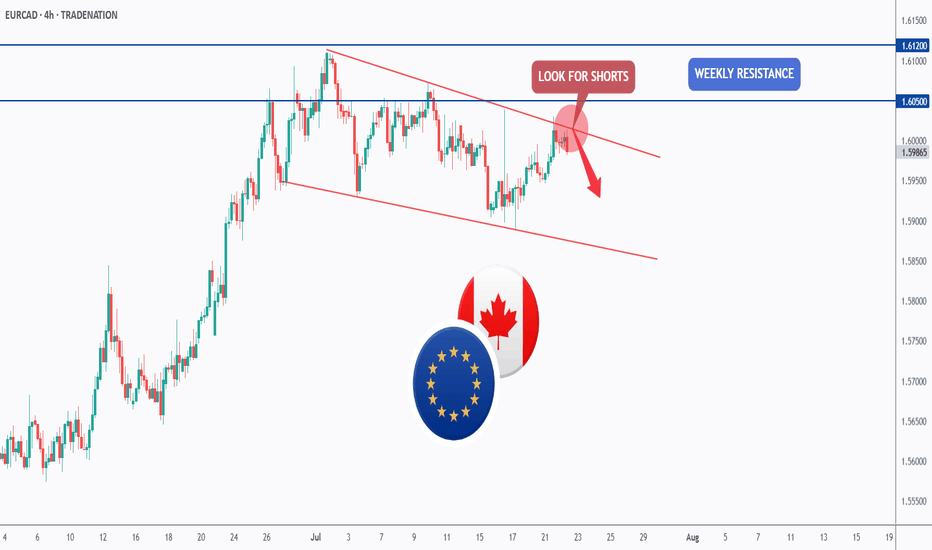

EURCAD - Follow the Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURCAD has been overall bearish , trading within the falling red channel and it is currently retesting the upper bound of the channel.

Moreover, it is rejecting a weekly resistance marked in blue.

📚 As per my trading style:

As #EURCAD is around the red circle zone, I will be looking for trend-following sell setups on lower timeframes. (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

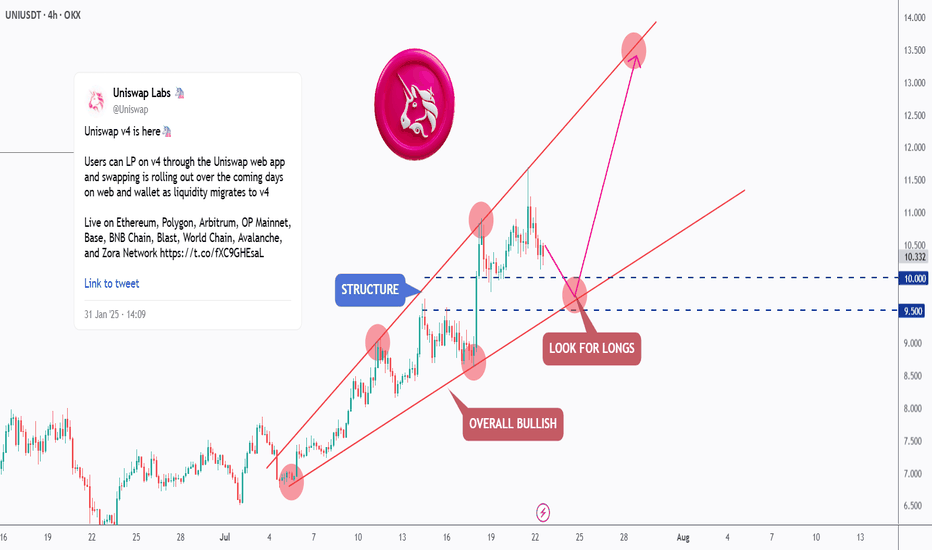

[Deep Dive] UNI – Edition 1: Retest. Reload. Rally?Uniswap (UNI) has been trading within a well-respected rising channel, showing consistent bullish structure across the 4H timeframe.

After a strong rally from the $7.50 region, price is now undergoing a healthy correction — retesting the lower boundary of the channel, which intersects with the $9.50–$10.00 demand zone.

📐 Technical Outlook

The market has printed a series of higher highs and higher lows, confirming the bullish momentum. The recent correction is testing a key support structure — previously a resistance zone — and this confluence aligns perfectly with the channel’s lower bound.

As long as this zone holds, UNI is well-positioned for a continuation toward the $13–$14 region, in line with the pink projected path.

🔥 Fundamental Boost

Uniswap has recently launched its V4 upgrade, introducing "hooks" — customizable smart contracts that allow developers to build more complex DeFi logic directly within liquidity pools. This upgrade not only enhances flexibility and capital efficiency, but also reduces gas costs — making Uniswap an even more dominant player in the DEX ecosystem.

Additionally, with Ethereum L2 adoption growing and Uniswap expanding across multiple chains (Arbitrum, Base, and Optimism), protocol usage and fees are on the rise again.

The UNI token may soon benefit from the proposed fee switch, which would redirect a portion of protocol fees to token holders — potentially adding new value accrual mechanics.

🟢 Conclusion

The technicals and fundamentals are aligning. UNI is in a bullish structure, trading at a key area of interest, and the latest upgrades may unlock new growth for the ecosystem.

Traders and investors alike should keep a close eye on this zone for long opportunities, as the next impulse could be just around the corner.

💬 What do you think — is UNI ready to break toward new highs, or will the demand zone fail? Let me know in the comments 👇

🔔 Disclaimer: This analysis is for educational and informational purposes only. It does not constitute financial advice or a recommendation to buy or sell any asset. Always do your own research and manage your risk accordingly.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

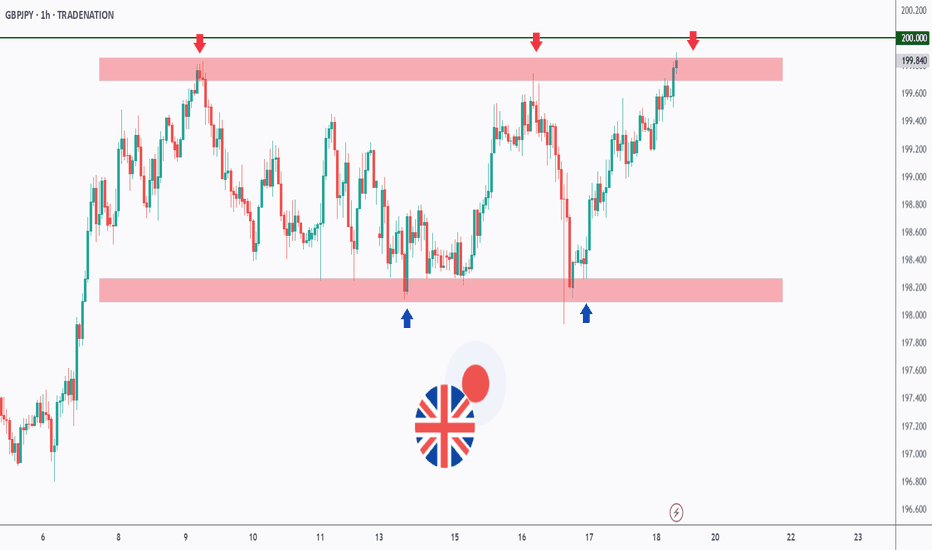

GBPJPY - Trading The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPJPY has been hovering within a big range.

This week, GBPJPY is retesting the upper bound of the range and $200 round number.

As long as the resistance holds, we will be looking for shorts on lower timeframes, targeting the lower bound of the range.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

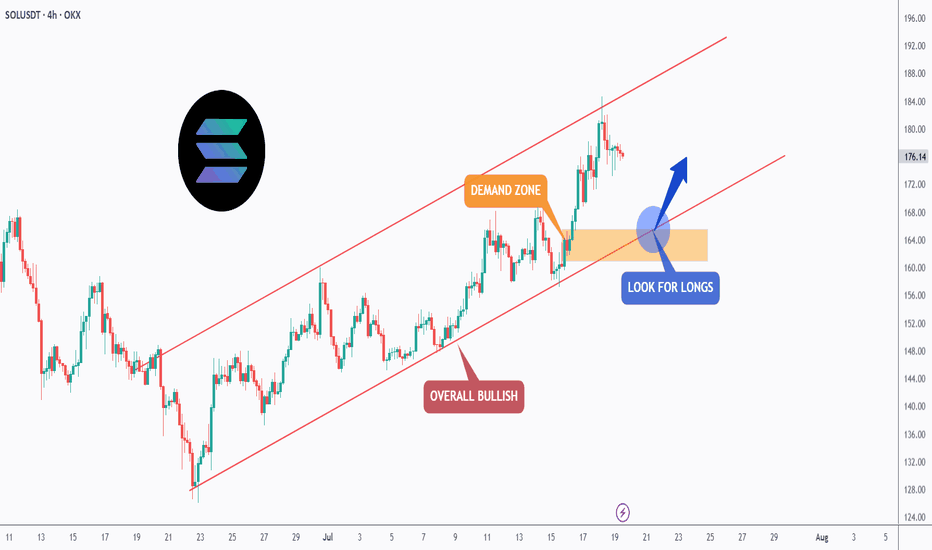

SOL - Trend-Following Longs in the making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈SOL has been overall bullish trading within the rising channel in red.

Moreover, the orange zone is a strong demand.

🏹 The highlighted blue circle is a strong area to look for buy setups as it is the intersection of the orange demand zone and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SOL retests the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GOLD Under Pressure – CPI to Drive the Next MoveGOLD Outlook – Bearish Below 3365, CPI in Focus

Gold is showing bearish momentum while trading below 3365, with a likely move toward 3342.

However, if the price closes a 1H or 4H candle above 3365, it may shift to a bullish trend targeting 3395.

CPI data will be the key factor in determining the next move.

The market expects a print of 2.6%, which would signal no Fed rate cuts this year due to rising tariff pressures.

That said, we expect a 2.7% release, which would likely support a bearish trend for gold.

But if the release is less than 2.6% that will support the bullish trend.

Pivot Line: 3365

Support: 3342 – 3320

Resistance: 3375 – 3395

ORCA/USDT NEW VOLUME ENTERYORCA shows for the first time in long time ago a new volume uptrend, which can get confirmed in the next hours to a new volume.

When there are new confirmations or updates, they will be listed here below.

If there is new confirmations coming, we could see this coin soon to targets

$3.17

$4.20

Best target $5

The trend study shows there is new interest in ORCA

US30 – Bearish Outlook Below 44,500 as CPI Looms US30 – Bearish Outlook Below 44,500 as CPI Looms

US30 rallied and successfully reached our resistance target, as expected in the previous analysis.

However, with today’s CPI release, the market is likely to see increased volatility. As long as the index trades below 44,500–44,570, the bias remains bearish, with downside targets at 44,210 and 43,960.

• If CPI prints below 2.6%, we may see a bullish breakout toward 45,100

• Above or equal to 2.6% supports continuation of the bearish move

However, we expect a 2.7% reading, driven by tariff-related price increases, which would support the bearish scenario.

EURUSD – From Structure to Shift

1H Technical Outlook by MJTrading

EURUSD moved cleanly through a sequence of structural phases:

• Previous Base

• Multi-day Consolidation (potential quiet accumulation)

• Transition into a well-respected Descending Channel

Price has since shown repeated rejections from the upper boundary, including a decisive selloff from the 1.1750 zone, forming what we now label a "Pressure Gap" — a space where aggressive sellers overwhelmed price.

🧭 Key Scenarios Ahead:

🔻 Bearish Continuation:

Breakdown below 1.1700 opens room toward:

• 1.1640 (channel bottom)

• 1.1600 Liquidity Zone

Watch for impulsive sell candles + EMA rejection

🔁 Short-Term Bounce or Trap:

Holding above 1.1700 could spark a rebound toward 1.1750

This may serve as a final test before another leg lower

Only a clean break and hold above 1.1763 flips structure bullish

🔍 Bonus Confluence:

1D Chart shows broader bullish context (inset)

EMAs tightening = expect volatility burst

Well-defined structure gives clear invalidation and targets

Every trend tells a story — from base building to breakout, and now a possible breakdown. Trade the structure, not the prediction.

#EURUSD #Forex #TradingView #TechnicalAnalysis #PriceAction #DescendingChannel #LiquidityZone #SmartMoney #MJTrading

EURUSD Testing Patience – Bearish Trend Not Over YetEURUSD – Overview

EURUSD continues to trade under pressure amid bearish momentum, respecting key technical levels.

The price maintains bearish momentum as long as it trades below 1.1745, with downside targets at 1.1627 and 1.1557.

A retest of 1.1745 is possible and considered normal in this structure. However, if the price stabilizes below 1.1684, it will likely continue dropping toward the support targets.

To shift back to a bullish bias, the pair must break and hold above 1.1745.

Pivot Line: 1.1695

Support Levels: 1.1627 – 1.1557

Resistance Levels: 1.1745 – 1.1810

previous idea: