USDCNH

China Yuan Direction & Critical Dollar SupportThe US dollar is still the leading global payment currency, holding a significant share of 49% compared to all other currencies.

However, the Chinese yuan is on the rise. Although it currently accounts for only 3.5%, its growth over the past two years has drawn my attention.

The yuan’s share increased from 2% in 2023 to 3.5% this year, representing a 75% increase in just 2 years.

And for global commerce, the growth is even more striking:

“In trade, 6% of global commerce was financed in RMB last year, up from under 2% in 2023.”

This represents a 200% increase in the use of the yuan for trade in also just 2 years.

If the yuan continues to grow at the same pace — at a 75% increase every 2 years —

it would take roughly 11 to 12 more years to reach 49%, i.e., around the year 2036.

Video version for the statistics:

Offshore Chinese Renminbi Futures and Options

Ticker: CNH

Minimum fluctuation:

Outright:0.0005 per USD increment = 50 CNH

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

China Yuan on the RiseAccording to this report, the yuan’s share increased from 2% in 2023 to 3.5% this year, representing a 75% increase in just 2 years.

And for global commerce, the growth is even more striking:

“In trade, 6% of global commerce was financed in RMB last year, up from under 2% in 2023.”

This represents a 200% increase in the use of the yuan for trade in also just 2 years.

If the yuan continues to grow at the same pace — at a 75% increase every 2 years —

it would take roughly 11 to 12 more years to reach 49%, i.e., around the year 2036.

Offshore Chinese Renminbi Futures and Options

Ticker: CNH

Minimum fluctuation:

Outright:0.0005 per USD increment = 50 CNH

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

USDCNH: Consolidation Could Be Over, Target 8.195Current strength of Chinese yuan vs US dollar could soon lose momentum

USDCNH shows a classic two-leg move with a large consolidation in between.

The first leg unfolded rapidly in 2022, with the pair rocketing more than 1 yuan — from 6.30 to 7.37 — marking a huge depreciation.

That move was followed by a large, three-year consolidation, which now looks close to completing.

If leg two mirrors the distance of leg one, USDCNH could shoot past 8.00 and potentially reach 8.195.

The confirmation trigger is set at 7.224 — the peak of the most recent minor consolidation.

What could trigger such a massive yuan drop?

-New tariffs

-A major clash with the US

-A sharp economic downturn

What’s your take? Drop it in the comments below.

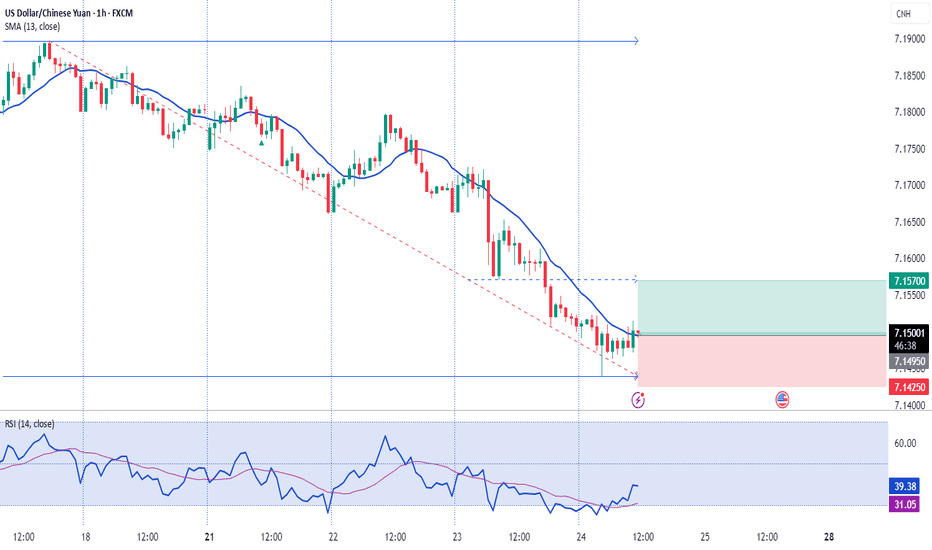

29.06.2025 #USDCNHBUY 7.16250 | STOP 7.14850 | TAKE 7.17950 | The US dollar is likely to rise against the yuan amid political factors and the publication of data on business activity in the non-manufacturing sector (PMI) in China. Technically, the pair has approached and is consolidating around medium-term support levels.

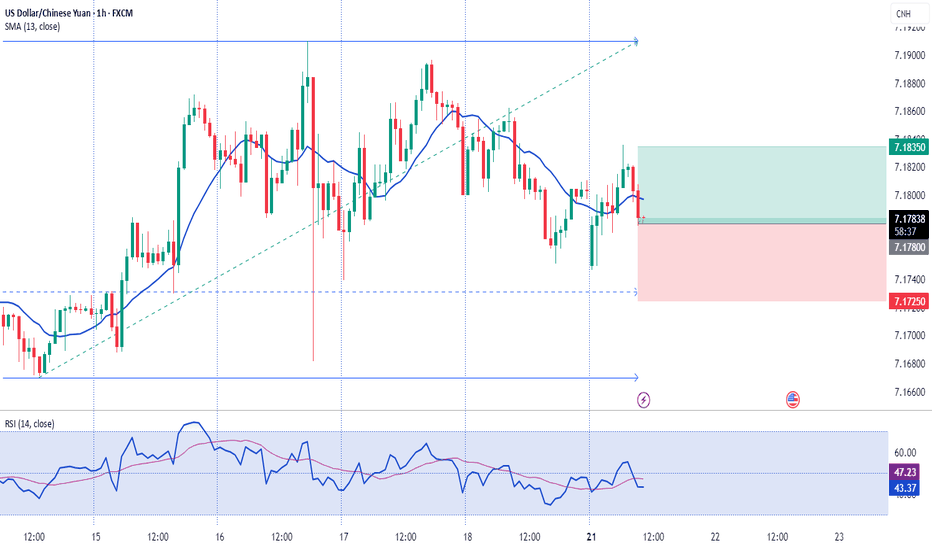

USD/CNH coiling for a breakdown?Over the past several days, the USD/CNH has been coiling inside a tight range, awaiting direction from the oil market. Well oil prices collapsed, and down went the dollar and up went risk assets. The net impact on the yuan was positive. The USD/CNH pair has weakened a little bit more today. If it can take out support at 7.1700 on a daily closing basis then this could potentially pave the way for more technical selling towards 7.1500 initially, ahead of potentially lower levels next. But if risk appetite sours again, or we otherwise see a breakout above the bearish trend line, then in that case all bearish bets would be off the table again.

By Fawad Razaqzada, market analyst with FOREX.com

USDCNH Tests Key Pattern Resistance on PBOC’s Loose Yuan FixThe trade war between China and the U.S. is escalating, and the Chinese yuan is starting to feel the pressure. After the U.S. raised tariffs to a total of 54%, China responded with a 34% increase of its own. Now, Trump has threatened an additional 50% tariff hike if China doesn’t withdraw its retaliation.

It appears unlikely that either side will back down at this stage, and the trade war is set to intensify further.

In addition to retaliating, China is also preparing to defend its economy. According to several news reports, Beijing is planning to frontload stimulus measures aimed at boosting domestic consumption, subsidizing exporters to cushion the blow from reduced U.S. trade, and supporting stock market stability. The People’s Bank of China will likely play a central role in this effort, using tools such as rate adjustments and daily yuan fixings.

The latest yuan fixing came in above 7.20, the highest level since 2023. With this looser fixing and ongoing trade war pressure, USDCNH is pushing higher. The ascending triangle formation which typically breaks to the upside is also supporting bearish bets on the yuan.

If China proceeds with a small and controlled devaluation, as many expect, a breakout from this triangle pattern is likely.

The potential target for the breakout could align with one of the parallel lines of the lower boundary of the formation, which are currently around 7.61 and 7.75, and gradually rising. With time, a move toward 7.80 is well within reach by the end of the year.

Elliott Waves SHows That Gold Is Turning South For Corrective ReGold started the year bullish with a strong extended leg to the upside close to 3k, but the move looks impulsive and may have found a temporary top near 2950. The reversal this week is coming from an ending diagonal, with the price now attempting to break the lower trendline support of the bullish channel. This suggests gold could be entering a corrective wave 4, likely unfolding in three waves. For those looking to join the trend, it’s better to wait for a deeper correction and a retest of lower support in this wave four pullback. Supports are at 2864 and 2789

At the same time, keep an eye on USD/CNH—if it pushes higher now for wave four, to retest its 2022 highs, gold could remain sideways for a while. In such case the new opportunities to rejoin the gold uptrend may come after USD/CNH completes its recovery from the 2024 lows, possibly around 7.40.

GH

USD/CNH Chart Sees Spike in Volatility Due to TariffsUSD/CNH Chart Sees Spike in Volatility Due to Tariffs

In response to the Trump administration's 10% tariff on Chinese goods, Beijing vowed to challenge the decision at the World Trade Organization.

Moreover, Chinese authorities have:

→ imposed retaliatory tariffs of 15% on US coal and liquefied gas, and 10% tariffs on oil and agricultural machinery;

→ launched an investigation into Google for potential anti-competitive practices.

These recent developments have triggered a spike in volatility for the Chinese yuan against the US dollar. As the USD/CNH chart shows today, the ATR indicator is at its highest level since early November, when Trump celebrated his election victory.

On 9 January, in our analysis of the USD/CNH exchange rate, we noted:

→ the importance of the 7.35 level, which had acted as resistance for several months;

→ according to Wang Tao, chief economist at UBS China, the yuan may weaken to 7.6 per dollar by the end of 2025 if the Trump administration imposes higher tariffs.

Today's technical analysis of the USD/CNH chart shows:

→ the rate is supported by the lower boundary of an expanded ascending channel (shown in blue);

→ the 7.35 level continues to act as resistance (as indicated by the red arrow).

Thus, at the beginning of February 2025, we may witness the formation of a narrowing triangle (shown by the black lines), and a breakout could lead to a significant trend movement. How realistic this assumption is largely depends on how the ongoing tariff conflict between the US and China develops.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Why dips appear favourable for AUD/USD bullsTrump's reluctance immediately sign an executive order to implement tariffs on China has allowed the yuan to rise against the US dollar. And where the yuan goes, AUD/USD tends to follow these days. And give AUD/USD has already seen an extended move to the downside, some bullish mean reversion is surely due.

The weekly RSI reached oversold ahead of a false break of the 2022 low, and a bullish divergence also formed on the daily RSI. A higher low has formed on prices, and I suspect AUD/USD is due at least one more leg higher.

Bulls could seek dips towards 0.621 or the 10/20-day EMAs in anticpation of a move up towards the August low, a break above which brings 65c into view near the high-volume node (HVN) from the decline from September to January.

Matt Simpson, Market Analyst at City Index and Forex.com

USD/CNH Near Key Resistance: 2025 OutlookUSD/CNH Near Key Resistance: 2025 Outlook

As shown by today’s USD/CNH chart:

→ the pair is trading around 7.35 yuan per US dollar;

→ historically, this level has acted as resistance, pushing the exchange rate lower in autumn 2022 and autumn 2023, as bulls briefly broke above but failed to sustain gains.

The current approach to this resistance level is partly driven by expectations of US President-elect Donald Trump’s policies, which in 2025 may include imposing trade tariffs and adopting measures likely to strengthen the USD further.

According to Reuters:

→ China holds approximately $3 trillion in foreign exchange reserves, giving it ample power to defend the yuan;

→ Wang Tao, Chief Economist at UBS for China, expects the USD/CNH rate to remain controlled near 7.4 yuan per dollar during the first half of 2025. However, if high tariffs are introduced by Trump’s administration, the yuan could weaken to 7.6 per dollar by the end of 2025.

Technical analysis of the USD/CNH chart reveals:

→ price fluctuations are forming a large contracting triangle, with higher lows in 2023 and 2024 indicating stronger demand;

→ an upward trend structure, highlighted in blue, emerged in late 2024;

→ a grey arrow points to the trend direction calculated using linear regression.

Thus, in early 2025, another attempt at a bullish breakout above 7.35 may occur, though resistance from bears could cause short-term pullbacks towards the lower blue trend line. Given Wang’s bullish outlook and supporting technical signals, it is reasonable to expect bulls to gain control of the 7.35 level during 2025.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

This is why AUD/USD bears need to watch USD/CNHBets are back on for the RBA to cut, with markets having now fully priced in three 25bp cuts beginning in April. Weak GDP was the culprit, which leaves the Aussie susceptible to further weakness should incoming data continue to deteriorate. However, Aussie bears may also need to factor the yuan into the equation.

USDCNH: Triangle Pattern Targets 8.03 Consolidation on the weekly chart has shaped the well-known Triangular pattern (yellow).

Watch the breakout of the upside barrier around 7.3650 for confirmation.

The target is located at the height of the widest part of Triangle added to the upside of the pattern. It's 8.03 CNH/$1

USDCNH - Technical Analysis [Long Setup]🔹 USDCNH Analysis on 1HR chart

- The current Trend is Bearish

- Bullish divergence is present

- If HH is break we will take long position

🔹 Trade Plan

- Entry Level = 7.10808

- Stop Loss = 7.09450

- TP1 = 7.12170

- TP2 = 7.13520

🔹 Risk Management

- First TP is 1:1

- Second TP is 1:2

🔹 How to Take Trade?

- Only risk 2% of your portfolio

- Take 1% risk entry with 1:1 RR

- Take 1% risk entry with 1:2 RR

Like and subscribe to never miss a new idea! ✌🏼

Shorting USDCNH: Seizing the Opportunity Amidst Long Position...🚨 Shorting USDCNH: Seizing the Opportunity Amidst Long Position Surge 🚨

In this video, I explain why I'm shorting USDCNH due to a significant return of large long positions that we haven't seen in a long time. The 60-day bullish run seems to be over, and we're anticipating a potential drop.

Key points covered:

Analysis of the surge in long positions and its implications

Why the recent 60-day bullish trend is likely ending

Insights into the expected drop and its potential speed

Strategic approach to shorting USDCNH in this unique market scenario

While no one, including myself, can predict exactly how long this drop will last, I believe it will be quick. Join me as I break down the current market dynamics and share my strategy for capitalizing on this potential drop.

Don't forget to like, comment, and subscribe for more trading insights and expert analysis. Let's navigate this market opportunity together! 🚀💹 And remember to hit the Boost Button on this video to support our Trading View community!

Disclaimer: Forex trading involves significant risk and is not suitable for every investor. Carefully consider your financial situation and risk tolerance before entering any trade. Always perform your own research and seek advice from a licensed financial advisor if needed.

Just a quick note on the outlook for Chinese yuan futures...Exploring the "Condor" : A Look at the Chinese Yuan Futures

In the realm of option trading, the term "Condor" refers not to a bird of prey, but to an intricate options strategy known for its non-directional nature. This strategy, aptly named after the wide-winged condor, involves positioning four options at once, aiming to profit from low volatility in the underlying asset. The essence of the Condor strategy lies in its ability to limit both gains and losses, creating a balanced risk-reward scenario for traders who anticipate movement and price consolidation before expiration date in certain market range.

Recently, a significant portfolio was recorded on the CME exchange, with an expiration date set for October 4, 2024. This portfolio is noteworthy not only for its size but also for the expectations of its owner. The belief is that the price of the Chinese yuan futures will hover between 7.25 and 7.45, a range.

The implications of this portfolio are manifold. For one, it reflects a sentiment that could influence other traders' strategies and market expectations. Additionally, it highlights the importance of understanding options strategies like the Condor, which can be pivotal in navigating the Forex market, especially when dealing with currencies like the Chinese yuan.

As we look ahead, we will undoubtedly keep a close eye on this portfolio, analyzing its performance from the yuan's impact. Forex Traders might (better say "should") consider this a bellwether for future movements, making it a focal point for those looking to gauge market sentiment.