Indicators, Strategies and Libraries

The " BTC ETF Volume In/Outflows" indicator is designed to analyze and visualize the volume data of various Bitcoin Exchange-Traded Funds (ETFs) across different exchanges. This indicator helps traders and analysts observe the inflows and outflows of trading volume in a structured and comparative manner. Features Multi-Ticker Support: The indicator is capable of...

Bitcoin`s NVT is calculated by dividing the Network Value (market cap) by the USD volume transmitted through the blockchain daily. Note this equivalent of the bitcoin token supply divided by the daily BTC value transmitted through the blockchain, NVT is technically inverse monetary velocity. Credits go to Willy Woo for creating the Network Value Transaction Ratio...

Hello, today I'm going to show you something that shifts our perspective on Bitcoin's value, not just in nominal terms, but adjusted for the real buying power over the years. This Pine Script TAS developed for TradingView does exactly that by taking into account inflation rates from 2009 to the present. As you know, inflation erodes the purchasing power of money....

The script creates a custom indicator titled "BTC Adjusted for Economic Factors. Adjusted BTC Price is plotted in red, making it more prominent. The adjusted price is Bitcoin's historical closing prices adjusted for cumulative inflation over time, based on the Core Consumer Price Index (CPI) annual inflation rates from 2009 onwards. The script calculates the...

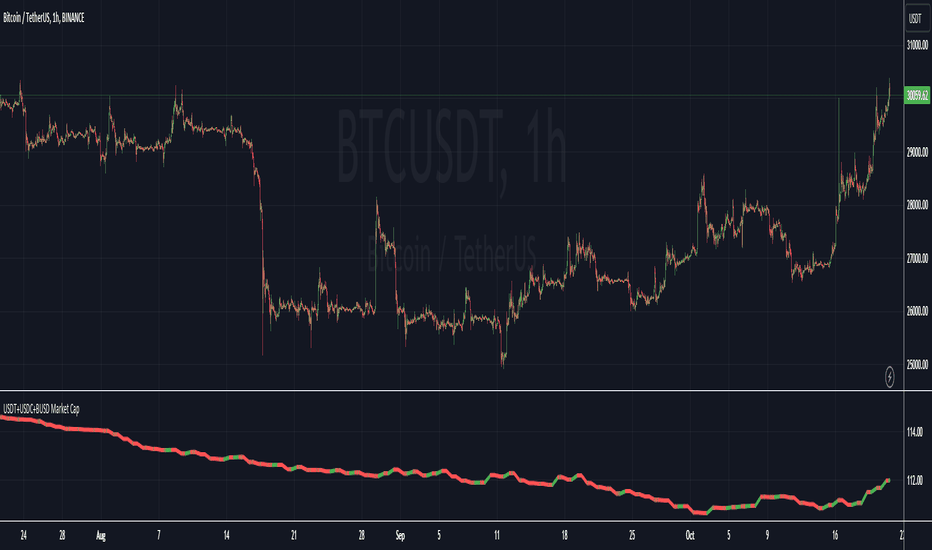

STABLECOINS DEPEG FINDER With this script, you will be able to understand how DePeg in stablecoins USDT, USDC, and FDUSD can influence the TOTAL Market Cap. WHAT IS DEPEG? DePeg occurs when a stablecoin loses its peg. It can't maintain the $1.00 price for a while (or anymore). Traders can use DePeg for high-quality trading both in Crypto and Stablecoins....

The indicator quantifies the relative position of a symbol's current closing price in relation to its historical all-time high (ATH). By evaluating the ratio between the ATH and the present closing price, it provides an analytical framework to estimate the potential gains that could accrue if the symbol were to revert to its ATH from a specified reference point....

The Trend Change Indicator is an all-in-one, user-friendly trend-following tool designed to identify bullish and bearish trends in asset prices. It features adjustable input values and a built-in alert system that promptly notifies investors of potential shifts in both short-term and long-term price trends. This alert system is crucial for helping less active...

This indicator offers a unique analytical perspective by comparing the market capitalization of MicroStrategy (MSTR) with that of Bitcoin (BTC) . Designed for investors and analysts interested in the correlation between MicroStrategy's financial performance and the Bitcoin market, the script calculates and visualizes the ratio of MSTR's market capitalization...

The MVRV ratio was created by Murad Mahmudov & David Puell. It simply compares Market Cap to Realised Cap, presenting a ratio (MVRV = Market Cap / Realised Cap). The MVRV Z-Score is a later version, refining the metric by normalising the peaks and troughs of the data.

This Pine Script indicator visualizes the combined market capitalization of three prominent stablecoins: USDT, USDC, and BUSD, on a daily basis. It fetches the daily closing market caps of these stablecoins and sums them. The resulting line graph is displayed in its own separate pane below the main price chart. The line is color-coded: green on days when the...

// Purpose: -To show High of Week (HoW) day and Low of week (LoW) day frequencies/percentages for an asset. -To further analyze Day of Week (DoW) tendencies based on averaged data from all various custom weeks. Giving a more reliable measure of DoW tendencies ('Meta Averages'). -To backtest day-of-week tendencies: across all asset history or across custom user...

Trend Strategy #1 Indicators: 1. SMA 2. Pivot high/low functions derived from SMA 3. Step lines to plot support and resistance based on the pivot points 4. If the close is over the resistance line, green arrows plot above, and vice versa for red arrows below support. Strategy: 1. Long Only 2. Mutable 2% TP/1.5% SL 3. 0.01% commission 4. When the close is...

NVT Studio is an indicator that aims to find areas of reversal of the Bitcoin price based on the extreme areas of Network Value Transaction. Instructions: - We recommend using it on INDEX:BTCUSD - Use the daily or weekly timeframe The indicator works as an oscillator and offers to visualisation modes. 1) Showing the short term oscillations of NVT showing...

This signal uses information from BITFINEX:BTCUSDLONGS and BITFINEX:BTCUSDSHORTS to forecast tops and bottoms. The idea behind is very simple. We calculate the RSI of the ratio of longs vs shorts and find areas where both the SMA of this RSI and the RSI itself are overextended. You might notice that the win rate is not high but most of the wins provide a...

Dear Tradingview community, I'd like to share one of my staple indicators with you. The volatility depth indicator calculates the volatility over a 7-day period and plots it on your chart. This indicator only works for the DAILY chart on BTC/USD. Colors I've color coded the indicator as follows: - Red: Extreme Volatility - Orange: High Volatility - Yellow:...

Publishing my first indicator on TradingView. Essentially a modification of the Correlation Coefficient indicator, that displays a 2 ticker symbols' correlation coefficient vs, the chart presently loaded.. You can modify the symbols, but the default uses DXY and XAU, which have been displaying strong negative correlation. As with the built-in CC (Correlation...

This algorithm is designed for usage across indices. How it works? The algorithm uses a variation of fractals, momentum, RSI and LRSI to determine a trends direction. The Relative Strength Index (RSI) is a momentum-based oscillator used to measure the speed (velocity) and change (magnitude) of directional price movements. It provides a visual means to monitor...

Before you see this post I want to thank all the TradingView team. Every day that passes I learn better and better to use Pine script and I owe this to all those who publish and to the philosophy of TradingView. Thanks from Amos This trading indicator compares the prices of the S&P 500 Index (SP500), Tesla (TSLA), and Bitcoin (BTC) to find correlations between...

![[MAD] BTC ETF Volume In/Outflow BTCUSD.P: [MAD] BTC ETF Volume In/Outflow](https://s3.tradingview.com/q/qshwBq0g_mid.png)