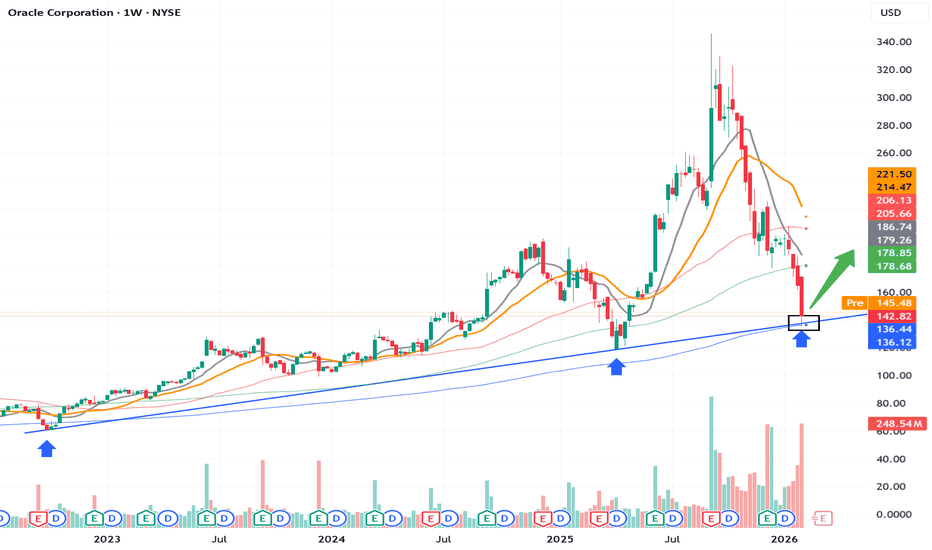

Oracle - The worst drawdown ever!💣Oracle ( NYSE:ORCL ) will ends its bearmarket soon:

🔎Analysis summary:

Over the past five months, Oracle has been correcting more than -60%. And while we can clearly witness a major selloff, Oracle is also approaching a major support area. And if we see bullish confirmation in the near futur

Oracle Corporation

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

5,080 CLP

11.81 T CLP

54.46 T CLP

1.71 B

About Oracle Corporation

Sector

Industry

Website

Headquarters

Austin

Founded

1977

IPO date

Mar 12, 1986

Identifiers

3

ISIN US68389X1054

Oracle Corp. engages in the provision of products and services that address aspects of corporate information technology environments, including applications and infrastructure technologies. It operates through the following business segments: Cloud and License, Hardware, and Services. The Cloud and License segment markets, sells, and delivers enterprise applications and infrastructure technologies through cloud and on-premise deployment models including cloud services and license support offerings. The Hardware segment provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management, and other hardware-related software. The Services segment offers consulting, advanced support, and education services. The company was founded by Lawrence Joseph Ellison, Robert Nimrod Miner, and Edward A. Oates on June 16, 1977 and is headquartered in Austin, TX.

Related stocks

Oracle (ORCL) - "Buy The Dip" Value Area! Oracle (ORCL) is like a huge “digital plumbing” company for businesses. A lot of the world’s biggest companies run their most important data on Oracle. Now AI is making companies need way more computing power + way more data organization, and Oracle is in a strong spot to benefit.

📊 Value Zones o

I bought Oracle ($ORCL) again yesterday at open, three reasons:I bought Oracle ( NYSE:ORCL ) again yesterday at the open.

Three reasons:👇

- A move from $350 to $132 is unsustainable for a $440B company.

- If price re-enters the channel, the opposite side becomes a logical swing target.

- This could also evolve into a broad trading range. In ranges, the only

Oracle Positioned to POP!!!We believe Oracle is well positioned for a bounce from current levels. Since the breakout in March 2020, the stock has traded within a clearly defined ascending channel, consistently respecting both support and resistance.

Following a test of the channel’s upper boundary in September, Oracle experi

Oracle’s Cloud Ascent: Powering the Global AI RevolutionOracle has shed its legacy reputation. It now stands as a central pillar of the artificial intelligence era. Recent stock surges reflect a profound transformation in the company’s core identity. This evolution positions Oracle as a formidable challenger to established cloud giants.

The AI Infrastr

ORCL accumulation stageORCL: my bet is **long-term upside** as long as it holds the **200 EMA (150.76)** and reclaims **156.59**.

**Support:** 150.76, then 135.74 → 119.00

**Major resistance:** 345.72

200 EMA: it’s the stock’s **long-term average price**—above it the trend is usually healthy, below it rallies often stru

ORACALE (ORCL) Rally! Cycle 3 → $400, Eyes on Supercycle $6,000🌀 ORACLE (ORCL) – Elliott Wave Supercycle Analysis | Smart Money & Fibonacci Confluence

🔭 Macro Perspective

Oracle’s long-term chart (NYSE: ORCL) showcases a powerful Supercycle (III) wave in motion — a multi-decade expansion phase fueled by institutional participation, structural growth, an

Oracle - Fifth WaveWe continue to analyze the decline in Oracle stock.

In the previous idea, we reached the first target at 150 , with price moving exactly along the projected path.

Wave 5 doesn’t look complete yet, so we expect further downside.

Before the next leg down, the price may pull back to around 165

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ORCL5995218

Oracle Corporation 6.125% 03-AUG-2065Yield to maturity

6.90%

Maturity date

Aug 3, 2065

ORCL6186140

Oracle Corporation 6.1% 26-SEP-2065Yield to maturity

6.90%

Maturity date

Sep 26, 2065

ORCL6302044

Oracle Corporation 6.85% 04-FEB-2066Yield to maturity

6.90%

Maturity date

Feb 4, 2066

ORCL5500354

Oracle Corporation 6.9% 09-NOV-2052Yield to maturity

6.82%

Maturity date

Nov 9, 2052

ORCL5995192

Oracle Corporation 6.0% 03-AUG-2055Yield to maturity

6.75%

Maturity date

Aug 3, 2055

ORCL5902731

Oracle Corporation 5.375% 27-SEP-2054Yield to maturity

6.74%

Maturity date

Sep 27, 2054

ORCL5536131

Oracle Corporation 5.55% 06-FEB-2053Yield to maturity

6.72%

Maturity date

Feb 6, 2053

ORCH

Oracle Corporation 4.375% 15-MAY-2055Yield to maturity

6.70%

Maturity date

May 15, 2055

ORCL6186139

Oracle Corporation 5.95% 26-SEP-2055Yield to maturity

6.69%

Maturity date

Sep 26, 2055

ORCL6302045

Oracle Corporation 6.7% 04-FEB-2056Yield to maturity

6.69%

Maturity date

Feb 4, 2056

ORCL5902732

Oracle Corporation 5.5% 27-SEP-2064Yield to maturity

6.67%

Maturity date

Sep 27, 2064

See all ORCLCL bonds

Frequently Asked Questions

The current price of ORCLCL is 145,900 CLP — it hasn't changed in the past 24 hours. Watch Oracle Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BCS exchange Oracle Corporation stocks are traded under the ticker ORCLCL.

ORCLCL stock has risen by 13.98% compared to the previous week, the month change is a −14.18% fall, over the last year Oracle Corporation has showed a −17.10% decrease.

We've gathered analysts' opinions on Oracle Corporation future price: according to them, ORCLCL price has a max estimate of 344,530.58 CLP and a min estimate of 133,505.60 CLP. Watch ORCLCL chart and read a more detailed Oracle Corporation stock forecast: see what analysts think of Oracle Corporation and suggest that you do with its stocks.

ORCLCL reached its all-time high on Sep 10, 2025 with the price of 331,020 CLP, and its all-time low was 58,720 CLP and was reached on Oct 3, 2022. View more price dynamics on ORCLCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ORCLCL stock is 9.45% volatile and has beta coefficient of 1.44. Track Oracle Corporation stock price on the chart and check out the list of the most volatile stocks — is Oracle Corporation there?

Today Oracle Corporation has the market capitalization of 396.43 T, it has increased by 0.38% over the last week.

Yes, you can track Oracle Corporation financials in yearly and quarterly reports right on TradingView.

Oracle Corporation is going to release the next earnings report on Mar 9, 2026. Keep track of upcoming events with our Earnings Calendar.

ORCLCL earnings for the last quarter are 2.11 K CLP per share, whereas the estimation was 1.53 K CLP resulting in a 37.80% surprise. The estimated earnings for the next quarter are 1.47 K CLP per share. See more details about Oracle Corporation earnings.

Oracle Corporation revenue for the last quarter amounts to 14.97 T CLP, despite the estimated figure of 15.09 T CLP. In the next quarter, revenue is expected to reach 14.57 T CLP.

ORCLCL net income for the last quarter is 5.72 T CLP, while the quarter before that showed 2.84 T CLP of net income which accounts for 101.40% change. Track more Oracle Corporation financial stats to get the full picture.

Yes, ORCLCL dividends are paid quarterly. The last dividend per share was 448.43 CLP. As of today, Dividend Yield (TTM)% is 1.25%. Tracking Oracle Corporation dividends might help you take more informed decisions.

Oracle Corporation dividend yield was 1.03% in 2024, and payout ratio reached 39.16%. The year before the numbers were 1.37% and 43.15% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 15, 2026, the company has 162 K employees. See our rating of the largest employees — is Oracle Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Oracle Corporation EBITDA is 24.81 T CLP, and current EBITDA margin is 42.21%. See more stats in Oracle Corporation financial statements.

Like other stocks, ORCLCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Oracle Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Oracle Corporation technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Oracle Corporation stock shows the sell signal. See more of Oracle Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.