Trading Journal - January WORST LOSS OF TRADING CAREER

The worst trade i have had in a while, a short position that should have been closed out for a loss turned into a MAJOR loss

Originally shorted

Thesis just like NASDAQ:HYMC => Silver is overextended, minors not working, this miner stock has the worst Relative stren

Key facts today

RBC Capital has raised the price target for Coeur Mining shares to $26.00 from $22.00.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.69 USD

58.90 M USD

1.07 B USD

632.45 M

About Coeur Mining, Inc.

Sector

Industry

CEO

Mitchell J. Krebs

Website

Headquarters

Chicago

Founded

1928

IPO date

Mar 17, 1980

Identifiers

3

ISIN US1921085049

Coeur Mining, Inc. engages in the well-diversified, growing precious metals producer with a focus on generating sustainable, high-quality cash flow and returns from a balanced, prospective asset base in mining-friendly jurisdictions along with commitment to exploration and expansions. It operates through the following segments: Palmarejo, Rochester, Kensington, Wharf and Silvertip. The Palmarejo segment includes a gold-silver complex. The Rochester segment operates an open pit heap leach silver-gold mine in northwestern Nevada. The Kensington segment relates to an underground gold mine located north of Juneau, Alaska. The Wharf segment focuses on an open pit heap leach gold mine located near Lead, South Dakota. The Silvertip segment silver-zinc-lead exploration located in the state of Sonora in northern Mexico. The company was founded in 1928 and is headquartered in Chicago, IL.

Related stocks

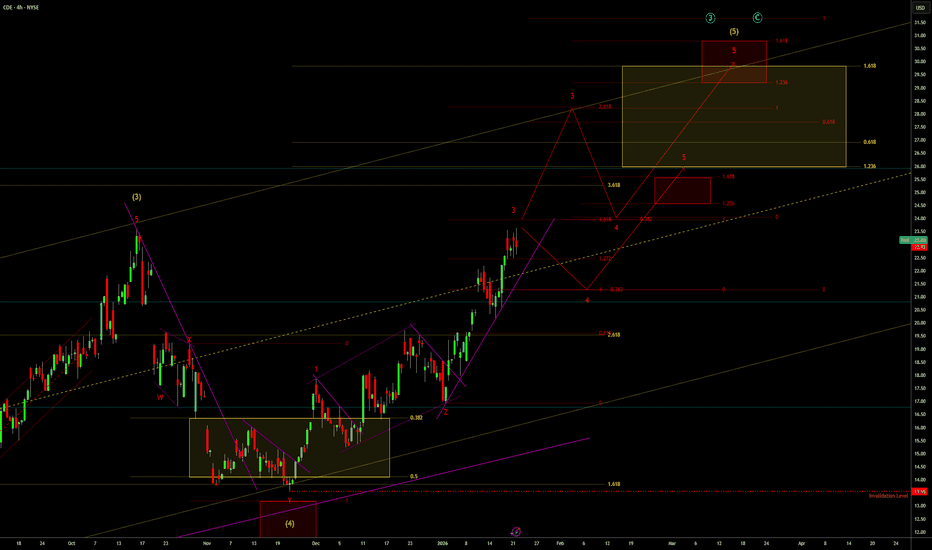

Coeur Mining (CDE) Elliott Wave Outlook - Count 1 Alt1 (4H)This is an alternate outlook which sees that NYSE:CDE is already in the red wave 3 which again is approaching a typical wave 3 target at the 1.618 extension. I prefer the red wave 2 as a running flat on this outlook compared to the expanding leading diagonal count previously used, and with silver

Missed the Silver Run? The Miners Are Finally Waking Up.📝 The Second Chance Setup If you followed our analysis on the WDC AI Vault and the Silver Supercycle , you caught the initial move. But if you missed those entries, don't chase the top. Look for the lag.

The "Catch-Up" Trade ( NYSE:CDE ) While Spot Silver has gone vertical to $80.00 (ATH), the m

Coeur Mining (CDE) Elliott Wave Outlook - Count 1 (4H)Since the previous weekly outlook on NYSE:CDE , price has moved pretty much in line with the expectation, with wave (3) and wave (4) playing out. The pull back in wave (4) was more aggressive and deeper than I would have liked, but wave (2) was fairly flat, so based on the guideline of alternation

$CDE BUll caseE after pulling back from its 52 weeks high $23.62 took support at 13.60-13.75 which has been a previous SR flip level. This zone is also Fib 0618. RSI almost hit oversold terority and bounced -back. Price made a double bottom at this support levlel and broke the neckline, moving avg 9,21 nd 50 has

TRIPLE BOTTOM: COEUR MINING #CDEThe Triple Bottom Pattern is a bullish reversal chart formation defined by three separate troughs occurring at approximately the same price point, succeeding an extended downtrend.

This pattern indicates a possible shift from bearish to bullish sentiment, generally suggesting a robust support leve

Coeur Mining, Inc. (CDE) Rises With Gold and SilverCoeur Mining, Inc. (CDE) is a U.S.-based precious metals producer with operations across North America, focusing on the mining of silver and gold. The company operates several key mines, including Kensington in Alaska and Palmarejo in Mexico. Coeur’s growth is driven by rising gold and silver prices

Coeur Silver Mining, Parabolic Soon.Coeur Mining, a prominent silver and gold mining company, has broken out of its channel, signaling a strong bullish trend fueled by the expected sharp rise in silver mining stocks. The chart highlights the target price.

I’ve previously expressed optimism about the Silver Mining ETF, SILJ. Brace for

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of CDE is 22.42 USD — it has decreased by −9.27% in the past 24 hours. Watch Coeur Mining, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Coeur Mining, Inc. stocks are traded under the ticker CDE.

CDE stock has risen by 5.41% compared to the previous week, the month change is a −4.69% fall, over the last year Coeur Mining, Inc. has showed a 206.28% increase.

We've gathered analysts' opinions on Coeur Mining, Inc. future price: according to them, CDE price has a max estimate of 31.00 USD and a min estimate of 21.00 USD. Watch CDE chart and read a more detailed Coeur Mining, Inc. stock forecast: see what analysts think of Coeur Mining, Inc. and suggest that you do with its stocks.

CDE stock is 7.63% volatile and has beta coefficient of 1.47. Track Coeur Mining, Inc. stock price on the chart and check out the list of the most volatile stocks — is Coeur Mining, Inc. there?

Today Coeur Mining, Inc. has the market capitalization of 13.45 B, it has increased by 8.33% over the last week.

Yes, you can track Coeur Mining, Inc. financials in yearly and quarterly reports right on TradingView.

Coeur Mining, Inc. is going to release the next earnings report on Feb 18, 2026. Keep track of upcoming events with our Earnings Calendar.

CDE earnings for the last quarter are 0.23 USD per share, whereas the estimation was 0.27 USD resulting in a −14.02% surprise. The estimated earnings for the next quarter are 0.38 USD per share. See more details about Coeur Mining, Inc. earnings.

Coeur Mining, Inc. revenue for the last quarter amounts to 554.57 M USD, despite the estimated figure of 533.72 M USD. In the next quarter, revenue is expected to reach 688.24 M USD.

CDE net income for the last quarter is 266.82 M USD, while the quarter before that showed 70.73 M USD of net income which accounts for 277.26% change. Track more Coeur Mining, Inc. financial stats to get the full picture.

No, CDE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 14, 2026, the company has 2.12 K employees. See our rating of the largest employees — is Coeur Mining, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Coeur Mining, Inc. EBITDA is 715.73 M USD, and current EBITDA margin is 32.29%. See more stats in Coeur Mining, Inc. financial statements.

Like other stocks, CDE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Coeur Mining, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Coeur Mining, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Coeur Mining, Inc. stock shows the strong buy signal. See more of Coeur Mining, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.