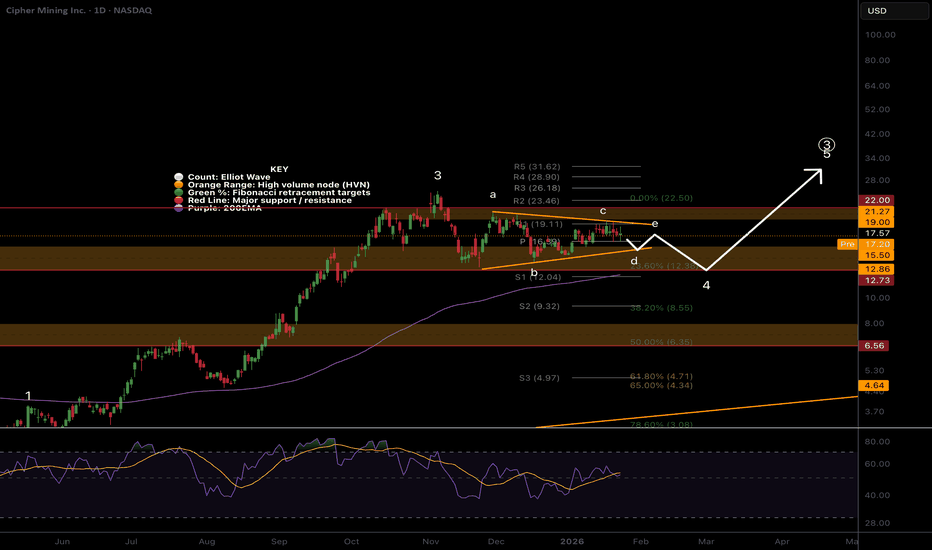

CIFR triangle in wave B has completed, per previousNASDAQ:CIFR has completed the triangle in wave B of 4 with thrust down in wave C, characteristic behaviour of wave Cs.

Triangle are patterns found before a terminal move suggesting we are nearing a bottom at the daily 200EMA, 0.236 Fibonacci retracement.

Safe trading

Key facts today

Cipher Mining's shares increased by 7.7% after Morgan Stanley initiated coverage with an 'overweight' rating.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.19 USD

−44.63 M USD

151.27 M USD

320.00 M

About Cipher Mining Inc.

Sector

Industry

CEO

Tyler Page

Website

Headquarters

New York

Founded

2021

IPO date

Oct 20, 2020

Identifiers

3

ISIN US17253J1060

Cipher Mining, Inc. operates as a Bitcoin mining ecosystem in the United States. The firm is developing a cryptocurrency business. The company was founded in 2021 and is headquartered in New York, NY.

Related stocks

CIFR | DailyNASDAQ:CIFR — Quantum Model Projection

Bullish Alternative 📈

The consolidation phase since early November, forming a Triangle Intermediate Wave (4), may now be complete at $14.92 with its final subdivision—Minor Wave E—unfolding as a three-wave structure near the 0.236 Fibonacci retracement, held

CIFR | DailyNASDAQ:CIFR — Quantum Model Projection

Bullish Alternative📈

CIFR surged +16% in the most recent session.

The correction within Intermediate Wave (4) has evolved into an A – Triangle B – C formation, rather than the prior Triangle, and has not yet reached the 0.382 Fibonacci retracement. Its fina

CIFR: AI Infrastructure Pivot – Mid/Low CheatThe Setup: Cipher is aggressively pivoting to High-Performance Computing (HPC). The market is re-rating them from a "Miner" to an "AI Infrastructure" play. Technically, we see clear Shakeouts within the base followed by a Mid/Low Cheat entry, offering a spot to get in before the main breakout.

Rea

CIFR Triangle path played out nicely..NASDAQ:CIFR triangle in wave B played out, following my path closely, touching the daily 200EMA and major High Volume Node support line, at the 0.236 Fibonacci retracement. This is a highly probable place for wave 4 to end.

Triangle are a penultimate pattern, so that thrust lower last week should

CIFR has reached key resistance zonePrice has reached the key resistance zone outlined in the October updates and is showing signs of at least mid-term topping action.

As long as price remains below 24, I’m watching for continuation to the downside into the 14–10 support zone.

Chart:

Previously:

• On resistance zone (Oct 13):

C

Cipher Mining Inc. (CIFR) added to watch listCipher Mining Inc. seems to be forming w4. the c leg down has a question mark?? is it over or more downside as low as 9.00 - 12.00? since CIFR is bitcoin dependent and BTC seems to be heading lower CIFR should follow. i find asking myself when will the shift from a Bitcoin miner into a major develop

CIFR Short-term analysis | Trading and expectationsNASDAQ:CIFR

🎯 The triangle has flipped to a bearish-looking triangle. This is a penultimate pattern, we can expect price to thrust lower, test the daily 200EMA, end the correction and then makes its way to new highs. l pattern Wave d of the triangle may still be underway, wave e is expected to end

CIFR | DailyNASDAQ:CIFR — Quantum Model Projection

Technical Update

The Triangle within Intermediate Wave (4)—defined by the 0.236 | 0.272 Fibonacci retracement levels—may now be structurally complete, though Minor Wave E remains brief and shallow, suggesting it is not yet fully mature.

The support Q-Struc

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of CIFR is 16.52 USD — it has increased by 10.22% in the past 24 hours. Watch Cipher Mining Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Cipher Mining Inc. stocks are traded under the ticker CIFR.

CIFR stock has risen by 5.15% compared to the previous week, the month change is a −5.34% fall, over the last year Cipher Mining Inc. has showed a 171.69% increase.

We've gathered analysts' opinions on Cipher Mining Inc. future price: according to them, CIFR price has a max estimate of 53.00 USD and a min estimate of 18.00 USD. Watch CIFR chart and read a more detailed Cipher Mining Inc. stock forecast: see what analysts think of Cipher Mining Inc. and suggest that you do with its stocks.

CIFR reached its all-time high on Nov 5, 2025 with the price of 25.52 USD, and its all-time low was 0.38 USD and was reached on Dec 29, 2022. View more price dynamics on CIFR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CIFR stock is 12.93% volatile and has beta coefficient of 3.71. Track Cipher Mining Inc. stock price on the chart and check out the list of the most volatile stocks — is Cipher Mining Inc. there?

Today Cipher Mining Inc. has the market capitalization of 5.82 B, it has decreased by −6.83% over the last week.

Yes, you can track Cipher Mining Inc. financials in yearly and quarterly reports right on TradingView.

Cipher Mining Inc. is going to release the next earnings report on Feb 26, 2026. Keep track of upcoming events with our Earnings Calendar.

CIFR earnings for the last quarter are −0.01 USD per share, whereas the estimation was −0.04 USD resulting in a 75.38% surprise. The estimated earnings for the next quarter are −0.10 USD per share. See more details about Cipher Mining Inc. earnings.

Cipher Mining Inc. revenue for the last quarter amounts to 71.71 M USD, despite the estimated figure of 77.77 M USD. In the next quarter, revenue is expected to reach 86.37 M USD.

CIFR net income for the last quarter is −3.28 M USD, while the quarter before that showed −45.78 M USD of net income which accounts for 92.83% change. Track more Cipher Mining Inc. financial stats to get the full picture.

No, CIFR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 9, 2026, the company has 43 employees. See our rating of the largest employees — is Cipher Mining Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Cipher Mining Inc. EBITDA is 36.23 M USD, and current EBITDA margin is −2.18%. See more stats in Cipher Mining Inc. financial statements.

Like other stocks, CIFR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Cipher Mining Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Cipher Mining Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Cipher Mining Inc. stock shows the buy signal. See more of Cipher Mining Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.