Buy Idea: CPU.ASX – Earnings Momentum PlayEarnings Date: 📅 19 August 2025

📊 Technical Setup

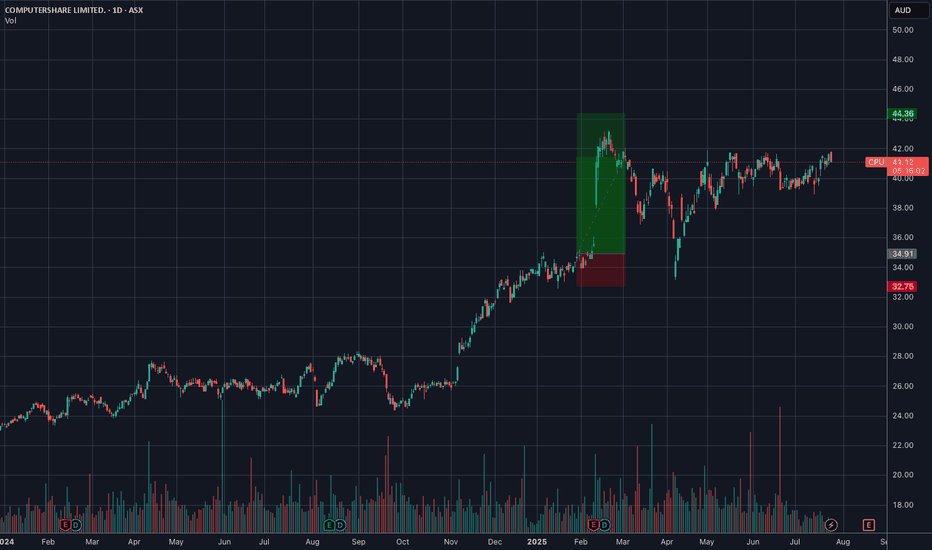

• CPU is forming a tight volatility contraction pattern (VCP) near highs, coiling above the 21EMA and 50MA.

• Strong bounce off support with increasing volume and bullish momentum crossover.

• Setup has clear risk-defined structure and is suppor

Computershare Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.07 USD

616.33 M USD

3.11 B USD

517.25 M

About Computershare Limited

Sector

CEO

Stuart James Irving

Website

Headquarters

Melbourne

Founded

1978

IPO date

May 27, 1994

Identifiers

2

ISIN AU000000CPU5

Computershare Ltd. engages in the provision of investor services, plan services, communication services, business services, stakeholder relationship management services, and technology services. It operates through the following segments: Issuer Services, Global Corporate Trust, Employee Share Plans and Voucher Services, Mortgage Services and Property Rental Services, Communication Services and Utilities, Business Services, and Technology Services and Operations. The Issuer Services segment comprises register maintenance, corporate actions, stakeholder relationship management, corporate governance and related services. The Global Corporate Trust segment refers to the trust and agency services in connection with the administration of debt securities in the US. The Employee Share Plans and Voucher Services segment is involved in the administration and related services for employee share and option plans, together with Childcare Voucher administration in the UK. The Mortgage Services and Property Rental Services segment provides mortgage servicing and related activities, together with tenancy bond protection services in the UK. The Communication Services and Utilities segment focuses on the document composition and printing, intelligent mailing, inbound process automation, scanning, and electronic delivery. The Business Services segment offers bankruptcy, class actions, and corporate trust administration services. The Technology Services and Operations segment includes the provision of software in share registry and financial services. The company was founded by Christopher John Morris in 1978 and is headquartered in Melbourne, Australia.

Related stocks

BUY IDEA: CPU.ASX – VCP Breakout in Motion

💰 Entry: $41 - 42

🛑 Stop: $39.50

🎯 Target: $44.80+ (1.5–2R potential)

⸻

🧠 Setup Thesis

CPU.ASX is breaking out of a textbook Volatility Contraction Pattern (VCP) with clean tightening just above the 21EMA and 50MA. After weeks of base-building with declining volume, today’s breakout comes with:

Trade Idea: ASX:CPU – Long Setup

✅ Technical Setup

• Entry: $40.60

• Stop: $37.80

• Target Zone: $44.80 – $47.00

• R:R Ratio: ~2:1 to 3:1

📊 Chart Notes:

• Price has broken out above 50-day MA, signaling momentum shift

• Formed a solid base between $38–$40 — now showing early signs of trend continuation

• Volume picking up

buying idea CPUCPU has consolidate at top for some time now and looking to make a move! with a stop around 6.5% (32.74) it's a good entry point to see how it will react in coming weeks to earnings.

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to

(XNJ): INDUSTRIALS SECTOR (ASX): CPU - COMPUTERSHARE LIMITED || (XNJ): INDUSTRIALS SECTOR

(XNJ): INDUSTRIALS SECTOR

(ASX): CPU - COMPUTERSHARE LIMITED || March 10, 2024

Master of Elliott Wave Analysis: Shane Hua (CEWA-M).

Bottom line: CPU may continue to rise higher.

(Left chart): The broader context (1D chart) shows that wave 2-red appears to have ended at 22

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of CMSQF is 21.15 USD — it has decreased by −4.26% in the past 24 hours. Watch Computershare Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Computershare Ltd. stocks are traded under the ticker CMSQF.

CMSQF stock has fallen by −6.79% compared to the previous week, the month change is a −6.31% fall, over the last year Computershare Ltd. has showed a −2.87% decrease.

We've gathered analysts' opinions on Computershare Ltd. future price: according to them, CMSQF price has a max estimate of 29.50 USD and a min estimate of 21.33 USD. Watch CMSQF chart and read a more detailed Computershare Ltd. stock forecast: see what analysts think of Computershare Ltd. and suggest that you do with its stocks.

CMSQF reached its all-time high on May 14, 2025 with the price of 27.40 USD, and its all-time low was 1.26 USD and was reached on Jul 31, 2003. View more price dynamics on CMSQF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CMSQF stock is 10.67% volatile and has beta coefficient of 1.41. Track Computershare Ltd. stock price on the chart and check out the list of the most volatile stocks — is Computershare Ltd. there?

Today Computershare Ltd. has the market capitalization of 12.37 B, it has decreased by −1.40% over the last week.

Yes, you can track Computershare Ltd. financials in yearly and quarterly reports right on TradingView.

Computershare Ltd. is going to release the next earnings report on Aug 18, 2026. Keep track of upcoming events with our Earnings Calendar.

CMSQF earnings for the last half-year are 0.68 USD per share, whereas the estimation was 0.68 USD, resulting in a 0.87% surprise. The estimated earnings for the next half-year are 0.77 USD per share. See more details about Computershare Ltd. earnings.

Computershare Ltd. revenue for the last half-year amounts to 1.58 B USD, despite the estimated figure of 1.53 B USD. In the next half-year revenue is expected to reach 1.64 B USD.

CMSQF net income for the last half-year is 285.53 M USD, while the previous report showed 330.92 M USD of net income which accounts for −13.72% change. Track more Computershare Ltd. financial stats to get the full picture.

Computershare Ltd. dividend yield was 2.33% in 2025, and payout ratio reached 58.22%. The year before the numbers were 3.11% and 62.20% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 14, 2026, the company has 12.89 K employees. See our rating of the largest employees — is Computershare Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Computershare Ltd. EBITDA is 1.21 B USD, and current EBITDA margin is 38.82%. See more stats in Computershare Ltd. financial statements.

Like other stocks, CMSQF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Computershare Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Computershare Ltd. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Computershare Ltd. stock shows the buy signal. See more of Computershare Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.