Key facts today

Enphase Energy's stock surged 30% to $46.20 after reporting Q4 revenue of $343.3 million, exceeding expectations. The stock closed at $51.67, up 38.6%, with 49.9 million shares traded.

Oppenheimer analysts believe Enphase Energy's unique technology will help offset falling residential solar demand after a key tax credit expired, showcasing its power management strengths.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.31 USD

172.13 M USD

1.47 B USD

125.97 M

About Enphase Energy, Inc.

Sector

Industry

CEO

Badrinarayanan Kothandaraman

Website

Headquarters

Fremont

Founded

2006

IPO date

Mar 30, 2012

Identifiers

3

ISIN US29355A1079

Enphase Energy, Inc. is a global energy technology company, which engages in the business of designing, developing, manufacturing, and selling home energy solutions that manage energy generation, energy storage, control, and communications on one intelligent platform. It operates through the following geographical segments: the United States, the Netherlands, and Others. The company was founded by Raghuveer R. Belur and Martin Fornage in March 2006 and is headquartered in Fremont, CA.

Related stocks

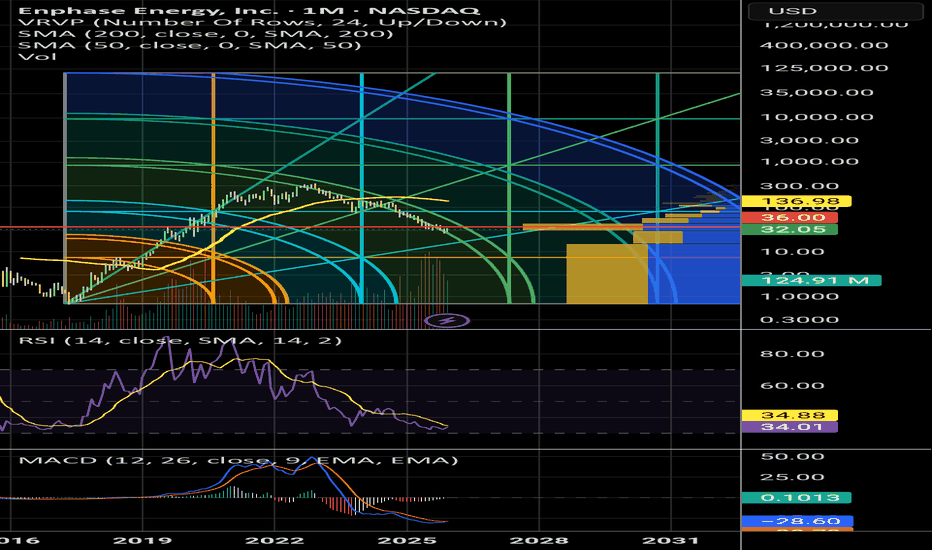

If you are crazy about volume trading U "Must" C Enphase Energy"Volume trading is an analysis method that uses trading volume—the number of units of an asset traded over a specific period—to understand market activity and predict future price movements. By comparing volume to price, traders can gauge the strength of a trend, with high volume confirming a trend

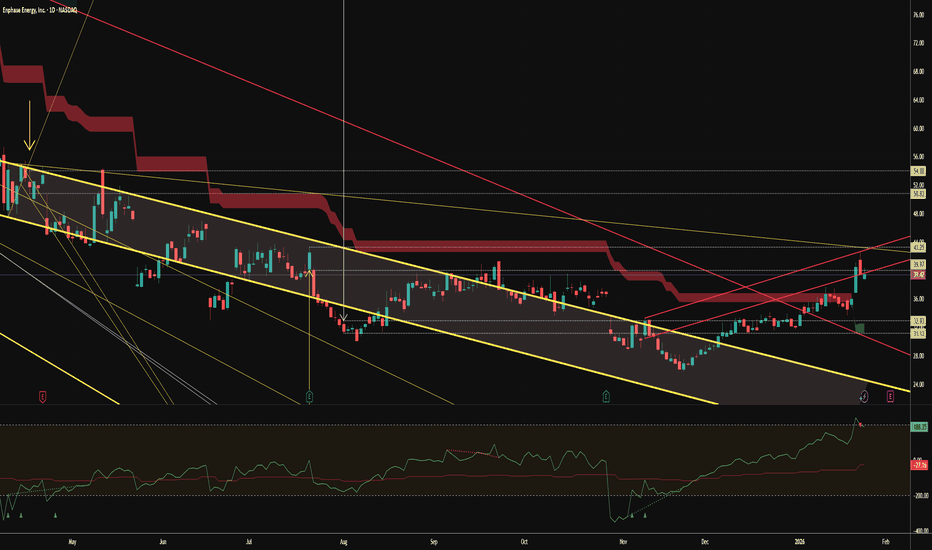

ENPH update swing long.While the previous swing long setup gave a bounce of around 28% price have now retraced back to the entry zone. Few setups to look for here. Liquidity grab of the previous low sitting at 29.89. The HTF negative 618 sitting at 28.5. However for sign of strength ENPH needs to close monthly candle abov

Enphase Energy Chart Fibonacci Analysis 092625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 36.3/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

Enphase potential swing long zoneWe have a little zone of confluence. With the 0.382 macro retracement from ATL/ATL stacking with the 1 to 1 fib trend from ATL coming in around 32. You have have monthly level and the pyschological 30 level. 1 way to approach the long would be to see price go below previous low/key level and look fo

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ENPH5139644

Enphase Energy, Inc. 0.0% 01-MAR-2028Yield to maturity

—

Maturity date

Mar 1, 2028

ENPH5139638

Enphase Energy, Inc. 0.0% 01-MAR-2026Yield to maturity

—

Maturity date

Mar 1, 2026

See all ENPH bonds

INRA

iShares Global Clean Energy Transition UCITS ETF Accum Shs USDWeight

2.89%

Market value

103.80 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of ENPH is 51.67 USD — it has increased by 2.22% in the past 24 hours. Watch Enphase Energy, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Enphase Energy, Inc. stocks are traded under the ticker ENPH.

ENPH stock has fallen by −5.03% compared to the previous week, the month change is a 15.60% rise, over the last year Enphase Energy, Inc. has showed a −20.91% decrease.

We've gathered analysts' opinions on Enphase Energy, Inc. future price: according to them, ENPH price has a max estimate of 68.00 USD and a min estimate of 23.49 USD. Watch ENPH chart and read a more detailed Enphase Energy, Inc. stock forecast: see what analysts think of Enphase Energy, Inc. and suggest that you do with its stocks.

ENPH reached its all-time high on Dec 5, 2022 with the price of 339.92 USD, and its all-time low was 0.65 USD and was reached on May 18, 2017. View more price dynamics on ENPH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ENPH stock is 32.76% volatile and has beta coefficient of 0.53. Track Enphase Energy, Inc. stock price on the chart and check out the list of the most volatile stocks — is Enphase Energy, Inc. there?

Today Enphase Energy, Inc. has the market capitalization of 4.88 B, it has decreased by −3.07% over the last week.

Yes, you can track Enphase Energy, Inc. financials in yearly and quarterly reports right on TradingView.

Enphase Energy, Inc. is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

ENPH earnings for the last quarter are 0.71 USD per share, whereas the estimation was 0.59 USD resulting in a 21.06% surprise. The estimated earnings for the next quarter are 0.45 USD per share. See more details about Enphase Energy, Inc. earnings.

Enphase Energy, Inc. revenue for the last quarter amounts to 343.32 M USD, despite the estimated figure of 338.44 M USD. In the next quarter, revenue is expected to reach 276.85 M USD.

ENPH net income for the last quarter is 38.71 M USD, while the quarter before that showed 66.64 M USD of net income which accounts for −41.91% change. Track more Enphase Energy, Inc. financial stats to get the full picture.

No, ENPH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 5, 2026, the company has 2.78 K employees. See our rating of the largest employees — is Enphase Energy, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Enphase Energy, Inc. EBITDA is 245.30 M USD, and current EBITDA margin is 16.65%. See more stats in Enphase Energy, Inc. financial statements.

Like other stocks, ENPH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Enphase Energy, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Enphase Energy, Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Enphase Energy, Inc. stock shows the neutral signal. See more of Enphase Energy, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.