Buy BRL$I have spent a few years in Brazil. I love the place. I have some ties there. I remember I used to get like 2.5/1eur It has massivily devalued over the years. I would find it difficult to spend more than $500 in a month when I was last there. This is looking like a breakout. If you have $ sitting in

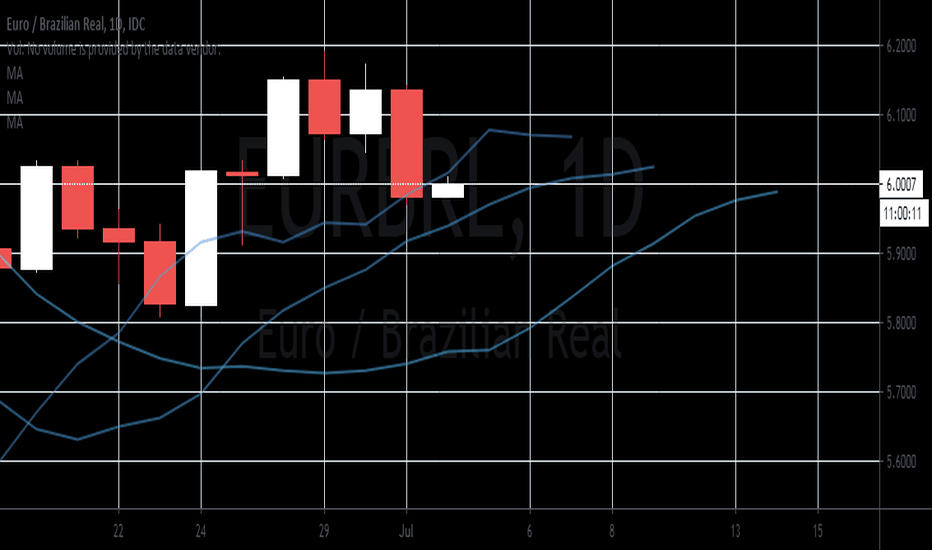

The Brazilian real and the number of coronavirus casesIt’s evident that the Brazilian real’s value continues to plummet against the eurozone’s single currency. The EUR/BRL trading pair has been very bullish in recent days, climbing to record heights. Unfortunately for the Brazilian real, it’s not expected to recover yet although today, prices are seen

Bearish investors are hoping to have their luck against the tideThe euro to the Brazilian real exchange rate has the potential to go down towards its support level as the euro slows down momentarily. Bearish investors are hoping to have their luck against the tides, possibly pulling the prices lower towards their support in the coming days. However, the move wil

Understanding Fair Value of Emerging Market FX RatesWhen making the decision of when to convert currency people tend to have a short-sighted view of what good value exchange rates are. What most people don't take into account are the 4 most important factors when it comes to a currency: Inflation, Interest Rates, Economic Health, Political Risk.

In

The Brazilian real appears that it lost its recovery momentumThe Brazilian real appears that it lost its recovery momentum since early June, not just against the euro, but also against other currencies. The EURBRL’s prices have been flirting with a critical resistance, and yesterday, prices bounced off aggressively from that level. However, the pair is widely

EUR/BRL should go down to its support level this month The exchange rate slightly steadies this Monday, but bears are widely expected to come out triumphant in the coming sessions. The pair should go down to its support level this month as the Brazilian real makes an astonishing come back. The news about the European Central Bank’s decision to expand it

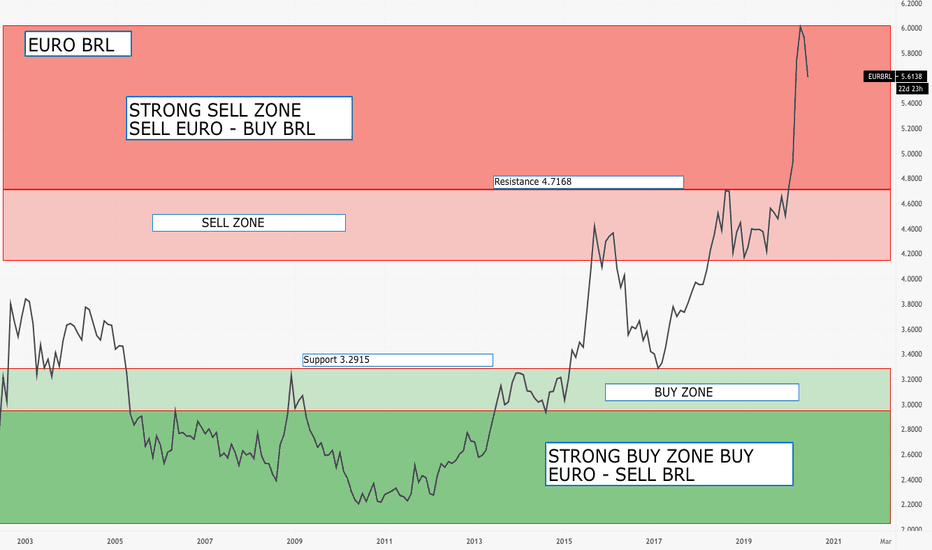

EUR/BRL BUY & SELL ZONESThis chart will show when you should start accumulating a higher percentage of Euros or BRL. It will also show you where strong historic levels of support and resistance. In a Euro BRL portfolio, I would suggest 50-50 in the mid-range 65-35 in the light range and 80-20 to 90-10 in the dark range. It

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.