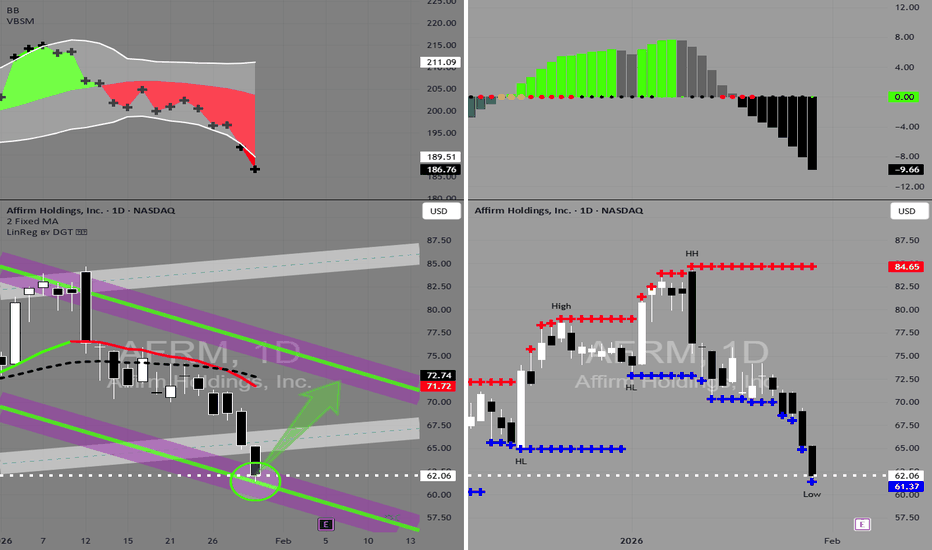

AFRM in BUY ZONEMy trading plan is very simple.

I buy or sell when at either of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow volume spikes beyond it's Bollinger Bands

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom of channe

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.85 USD

52.19 M USD

2.98 B USD

279.22 M

About Affirm Holdings, Inc.

Sector

Industry

CEO

Max R. Levchin

Website

Headquarters

San Francisco

Founded

2012

IPO date

Jan 13, 2021

Identifiers

3

ISIN US00827B1061

Affirm Holdings, Inc. operates a platform for digital and mobile-first commerce. Its platform consists of three core elements: a point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. The company was founded by Max R. Levchin in 2012 and is headquartered in San Francisco, CA.

Related stocks

$AFRM, Where are we going? AFRM stock represents an American financial technology company. The company was founded in 2012 by PayPal co-founder Max Levchin. It is the largest “Buy Now, Pay Later” (BNPL) financing company in the United States. As of 2025, Affirm reports over 24 million users and an annual payment processing vo

AFRM$AFRM. Report Analysis and 3 Key Drivers.

Q1 FY2026 Report ( last report)

Revenue: $933M (+33% YoY) — above expectations.

GMV (merchandise volume): $10.4B (+42% YoY) — accelerating again.

Profit: SECOND consecutive quarter with GAAP operating profit.

Growth Drivers:

1. Affirm Card

The numbers ar

AFRMAFRM Structure Shift Confirmed

AFRM has **broken out of the descending channel** and is now **holding above reclaimed resistance (~$78)**.

* Trend shift: lower highs → **higher low**

* **8/21 EMA support** holding on the pullback

* Breakout followed by a **controlled flag**, not rejection

* Measur

AFRM about to make a move?I should preface this week's idea with an important note: I'm probably not going to take a trade here no matter what.

I'm a little bit scared by what I see in the general market with SPY showing a double top and QQQ starting to form a head and shoulder. I want to see how those things play out befor

Affirm Holdings - Looking to re-affirm further upside?Growing Revenue, chart staggering to the upside...Is NASDAQ:AFRM looking to swing higher?

Our systems have identified a point of potential interest & volatility in AFRM.

If price can hold above $64.12 ... Significant Bullish potential may be unlocked.

If however price falls below $

Fintech charts look extraordinarily appealing.The charts of payment comapnies, particualry the Fintechs are showing enormous promise. Combination of technology, holiday shopping and reduced interest rates might be the reason.

Look to get 30-50% retunrs in next 3 months.

Shift4 Payments 2. Dlocal 3. Affirm Holdings 4. Pays 5. Klarna 6.Sezzle 7

$AFRM can be added to the watchlist for future trade.Setting up nicely for a reversal from here. Today we had a good green candle with decent volume. Rsi still below 60, we need a little more push to gain the bullish momentum. Only worry is that right shoulder forming for a potential H&S. If price closes above that green line around $80. I would be mo

AFRM UpdateOne of the few trades I timed right today, lol. Saw it was down over $8 and bought some calls.

Now I'm looking at the chart wondering if it can bust out of the megaphone structure. Problem is, it's usually a continuation pattern but not always. Just like pennants.

It'd be nice if it could at le

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

AFRM6269558

Affirm Holdings, Inc. 0.75% 15-DEC-2029Yield to maturity

—

Maturity date

Dec 15, 2029

AFRM5507481

Affirm Holdings, Inc. 0.0% 15-NOV-2026Yield to maturity

—

Maturity date

Nov 15, 2026

See all AFRM bonds

Frequently Asked Questions

The current price of AFRM is 49.81 USD — it has increased by 0.10% in the past 24 hours. Watch Affirm Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Affirm Holdings, Inc. stocks are traded under the ticker AFRM.

AFRM stock has fallen by −17.91% compared to the previous week, the month change is a −34.03% fall, over the last year Affirm Holdings, Inc. has showed a −34.99% decrease.

We've gathered analysts' opinions on Affirm Holdings, Inc. future price: according to them, AFRM price has a max estimate of 110.00 USD and a min estimate of 64.00 USD. Watch AFRM chart and read a more detailed Affirm Holdings, Inc. stock forecast: see what analysts think of Affirm Holdings, Inc. and suggest that you do with its stocks.

AFRM reached its all-time high on Nov 8, 2021 with the price of 176.65 USD, and its all-time low was 8.62 USD and was reached on Dec 22, 2022. View more price dynamics on AFRM chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AFRM stock is 5.21% volatile and has beta coefficient of 2.83. Track Affirm Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is Affirm Holdings, Inc. there?

Today Affirm Holdings, Inc. has the market capitalization of 16.59 B, it has decreased by −6.02% over the last week.

Yes, you can track Affirm Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

Affirm Holdings, Inc. is going to release the next earnings report on May 7, 2026. Keep track of upcoming events with our Earnings Calendar.

AFRM earnings for the last quarter are 0.37 USD per share, whereas the estimation was 0.27 USD resulting in a 38.37% surprise. The estimated earnings for the next quarter are 0.18 USD per share. See more details about Affirm Holdings, Inc. earnings.

Affirm Holdings, Inc. revenue for the last quarter amounts to 1.12 B USD, despite the estimated figure of 1.06 B USD. In the next quarter, revenue is expected to reach 996.82 M USD.

AFRM net income for the last quarter is 129.59 M USD, while the quarter before that showed 80.69 M USD of net income which accounts for 60.59% change. Track more Affirm Holdings, Inc. financial stats to get the full picture.

No, AFRM doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 16, 2026, the company has 2.21 K employees. See our rating of the largest employees — is Affirm Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Affirm Holdings, Inc. EBITDA is 1.61 B USD, and current EBITDA margin is 39.71%. See more stats in Affirm Holdings, Inc. financial statements.

Like other stocks, AFRM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Affirm Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Affirm Holdings, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Affirm Holdings, Inc. stock shows the sell signal. See more of Affirm Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.