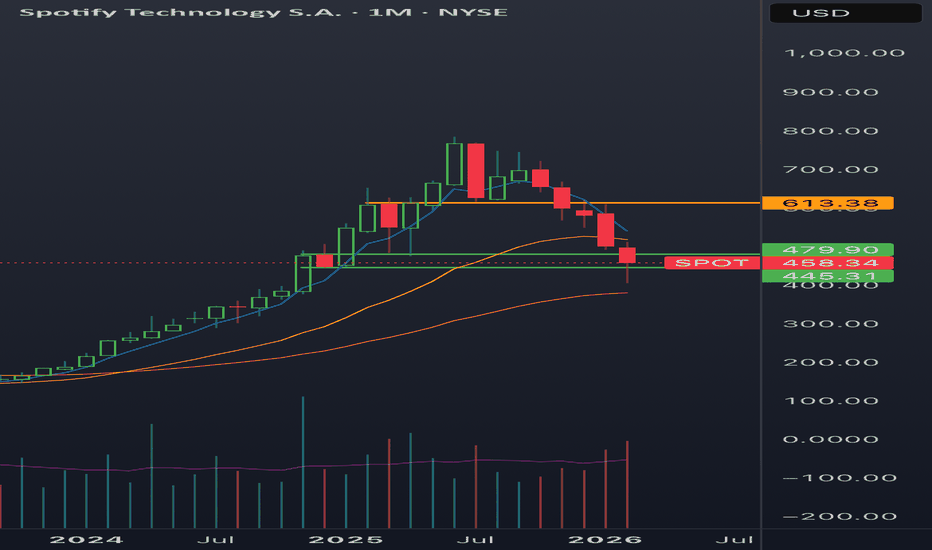

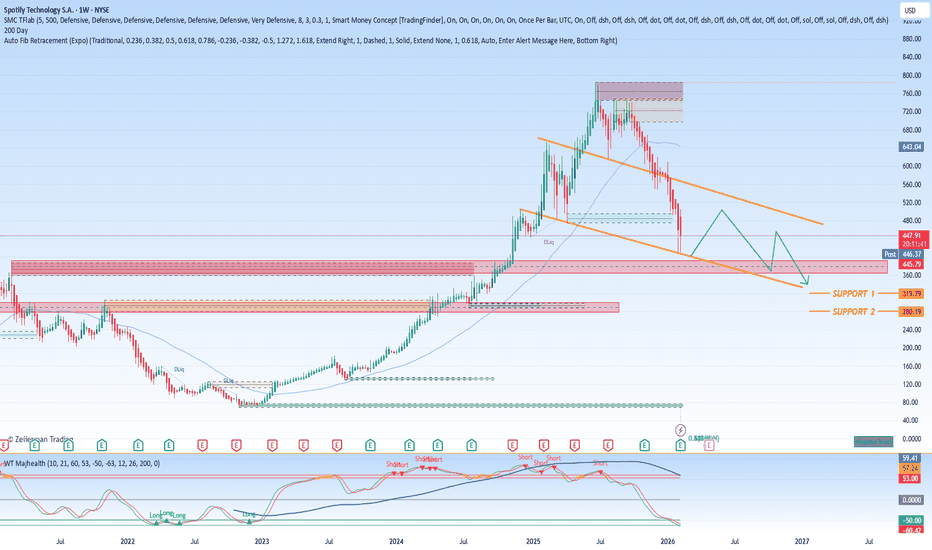

Long spotSpot had a major correction and has landed around the area I was looking for. This is a very clean setup with a pivot looking near based on the strong wick to support. The stock also came very close to the prior cycle swing high which tends to be a pattern I’ve noticed a lot on volatile stocks. They

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.43 USD

2.50 B USD

19.40 B USD

149.77 M

About Spotify Technology S.A.

Sector

Industry

Website

Headquarters

Luxembourg

Founded

2006

IPO date

Apr 3, 2018

Identifiers

2

ISIN LU1778762911

Spotify Technology SA is a digital music service offering music fans instant access to a world of music. The company operates through the following segments: Premium and Ad-Supported. The Premium segment provides subscribers with unlimited online and offline high-quality streaming access of music and podcasts on computers, tablets, and mobile devices, users can connect through speakers, receivers, televisions, cars, game consoles, and smart watches. It also offers a music listening experience without commercial breaks. The Ad-Supported segment provides users with limited on-demand online access of music and unlimited online access of podcasts on their computers, tablets, and compatible mobile devices. It also serves both premium subscriber acquisition channel and a robust option for users who are unable or unwilling to pay a monthly subscription fee but still want to enjoy access to a wide variety of high-quality audio content. The company was founded by Daniel Ek and Martin Lorentzon in April, 2006 and is headquartered in Luxembourg.

Related stocks

Weekly break and retest of SPOT coming soon?!OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

SPOT - A Ticking Time Bomb!SPOT Earnings Yield of 1.3% according to current data — meaning you’re getting about 1.3 cents of profit per dollar invested. LOL!

Better you give me your hard-earned money and I'll give you 2% instead of 1.3%. I like to splurge! :)

The Structural Constraint

Spotify cannot scale margins the way N

$SPOT at nice spotNYSE:SPOT earning next week. this will be wild. currently around the support level. Last time $350-360 was a huge resistance, it took her 3 years base building and then break the res finally in 2024. Now again seems to be coming near resistance area which will be turn into support. any dip near $35

SPOT - Record Profits, Surging Subscribers, and the AI FrontierSpotify’s Era of Abundance: Record Profits, Surging Subscribers, and the AI Frontier

Spotify Technology SA delivered a decisive statement to financial markets this week, proving that its long-awaited profitability is not merely a fleeting anomaly but a durable new operational baseline. Shares reacte

SPOT Loading Zone Detected — Smart Money Watching for Explosive SPOT QuantSignals V4 Swing 2026-02-10

Signal: Bullish Call

Time Horizon: 1–4 Weeks

Risk Grade: MEDIUM

Alpha Score: 62

🎯 Trade Plan

Instrument: $480 CALL (Mar 20, 2026)

Entry Zone: $12.00 – $14.00

Target 1: $18.00 (+40%)

Target 2: $25.00 (+100%)

Stop Loss: $9.00 (-25%)

👉 Execution Trigger:

Critical Macro Signs Seen on SPOT, warrant attentionSpotify has been a fan favorite for the last few years. I mean who wouldn't fall in love with it. It has had roughly 850% gains since Feb 2023.

And so its recent downtrend requires attention. Traders and investors alike are wondering if this is buy the Dip situation with many probably been doing so

Spotify pressing resistance as buyers step back in above $500:Current Price: 513.21 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 62%(based on mixed but slightly bullish trader commentary, supportive technicals, and price holding above key support despite cautious social sentiment)

Targets

Target 1: 525

Target 2: 540

Stop Lev

Why Spotify Stock Is Set to Drop Big TimeI am going to say something that might hurt a few feelings today. If you’re buying Spotify stock right now after this rally… price action is already shaking its head.

This stock just had a strong rally, supply is stepping in, and smart money is doing what smart money always does: selling into stren

SPOT pivot longSPOT looks ready to pivot here as it dips close to a monthly demand zone. This area has 5 months of touch points, and should serve as a strong supportive range. Look at the way the wicks rebound off of the zone. My target is 613$, hard to wait too long on a stock like this, we might not see the gree

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SPOT is 458.34 USD — it has increased by 2.82% in the past 24 hours. Watch Spotify Technology S.A. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Spotify Technology S.A. stocks are traded under the ticker SPOT.

SPOT stock has risen by 8.14% compared to the previous week, the month change is a −14.65% fall, over the last year Spotify Technology S.A. has showed a −29.17% decrease.

We've gathered analysts' opinions on Spotify Technology S.A. future price: according to them, SPOT price has a max estimate of 796.71 USD and a min estimate of 418.27 USD. Watch SPOT chart and read a more detailed Spotify Technology S.A. stock forecast: see what analysts think of Spotify Technology S.A. and suggest that you do with its stocks.

SPOT reached its all-time high on Jun 27, 2025 with the price of 785.00 USD, and its all-time low was 69.29 USD and was reached on Nov 4, 2022. View more price dynamics on SPOT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SPOT stock is 4.22% volatile and has beta coefficient of 1.15. Track Spotify Technology S.A. stock price on the chart and check out the list of the most volatile stocks — is Spotify Technology S.A. there?

Today Spotify Technology S.A. has the market capitalization of 94.37 B, it has decreased by −12.48% over the last week.

Yes, you can track Spotify Technology S.A. financials in yearly and quarterly reports right on TradingView.

Spotify Technology S.A. is going to release the next earnings report on Apr 29, 2026. Keep track of upcoming events with our Earnings Calendar.

SPOT earnings for the last quarter are 5.20 USD per share, whereas the estimation was 3.21 USD resulting in a 61.93% surprise. The estimated earnings for the next quarter are 3.44 USD per share. See more details about Spotify Technology S.A. earnings.

Spotify Technology S.A. revenue for the last quarter amounts to 5.32 B USD, despite the estimated figure of 5.31 B USD. In the next quarter, revenue is expected to reach 5.36 B USD.

SPOT net income for the last quarter is 1.37 B USD, while the quarter before that showed 1.05 B USD of net income which accounts for 30.06% change. Track more Spotify Technology S.A. financial stats to get the full picture.

No, SPOT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 16, 2026, the company has 7.32 K employees. See our rating of the largest employees — is Spotify Technology S.A. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Spotify Technology S.A. EBITDA is 2.61 B USD, and current EBITDA margin is 13.43%. See more stats in Spotify Technology S.A. financial statements.

Like other stocks, SPOT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Spotify Technology S.A. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Spotify Technology S.A. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Spotify Technology S.A. stock shows the sell signal. See more of Spotify Technology S.A. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.