Occidental Petroleum (OXY) — Professional Analyst View | 2026 MaOccidental Petroleum (OXY) — Professional Analyst View | 2026

Market Structure

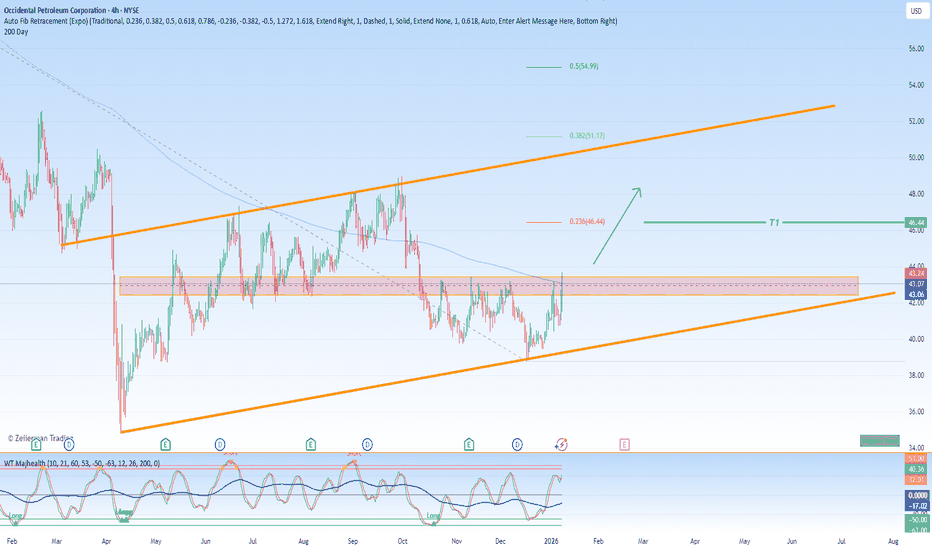

OXY has been in a sustained corrective phase following a long-term expansion. The current price action reflects deceleration of bearish momentum, not continuation. Selling pressure has weakened, and volatility has compres

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.43 USD

3.04 B USD

27.10 B USD

981.74 M

About Occidental Petroleum Corporation

Sector

Industry

CEO

Vicki A. Hollub

Website

Headquarters

Houston

Founded

1920

IPO date

Mar 3, 1964

Identifiers

3

ISIN US6745991058

Occidental Petroleum Corp. engages in the exploration and production of oil and natural gas. It operates through the following segments: Oil and Gas, Chemical, and Midstream and Marketing. The Oil and Gas segment explores for, develops and produces oil and condensate, natural gas liquids, and natural gas. The Chemical segment manufactures and markets basic chemicals and vinyls. The Midstream and Marketing segment purchases, markets, gathers, processes, transports and stores oil, condensate, natural gas liquids, natural gas, carbon dioxide, and power. The company was founded in 1920 and is headquartered in Houston, TX.

Related stocks

OXY (Occidental Petroleum) - Weekly - Accumulation DetectedOXY doesn’t look like a trend right now. It looks like a compressed spring - quiet, coiled, and waiting for release.

1) What Accumulate is showing (free tool only)

On the weekly timeframe, TrendGo Accumulate is detecting a clear accumulation phase .

This tells us the market has entered a zone

Occidental Petroleum Corporation (NYSE: OXY)Based on a technical and fundamental analysis of Occidental Petroleum Corporation (NYSE: OXY), the stock's recent move above its 50-day Simple Moving Average (SMA) signals a potential shift to a near-term bullish trend. This technical strength, combined with key strategic corporate actions, provides

OXY seems ready to jumpOXY seems ready to jump

When we look at the daily chart for NYSE:OXY , we see a classic descending wedge structure. The price has been making lower highs for months, but the volume and price action suggest we are approaching a massive breakout point.

But the key point, a clear resistance has b

Occidental Petroleum's bearish setup points to near-term weaknes

Current Price: $42.43

Direction: SHORT

Confidence Level: 62% (Based on trader consensus leaning bearish, mixed but cautious X sentiment, and recent inability to break key resistance)

Targets:

- T1 = $41.60

- T2 = $40.80

Stop Levels:

- S1 = $43.40

- S2 = $44.20

**Wisdom of Professional Traders

OXY - Strong potential for bullish mean-reversionNYSE:OXY is looking at a potential break to the upside and likely to see strong bullish upside as bullish marobozu is testing the bearish gap resistance zone. Furthermore, the stock has also broken out of the downtrend line. Long-term MACD is back in action as both MACD/signal line is rising steadi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

A

APC3666452

Anadarko Petroleum Corporation 7.73% 15-SEP-2096Yield to maturity

7.40%

Maturity date

Sep 15, 2096

A

APC3666453

Anadarko Petroleum Corporation 7.25% 15-NOV-2096Yield to maturity

7.13%

Maturity date

Nov 15, 2096

APC4875631

Occidental Petroleum Corporation 7.73% 15-SEP-2096Yield to maturity

7.00%

Maturity date

Sep 15, 2096

U

APC.GT

Union Pacific Resources Group, Inc. 7.5% 01-NOV-2096Yield to maturity

6.80%

Maturity date

Nov 1, 2096

APC4876396

Occidental Petroleum Corporation 7.5% 01-NOV-2096Yield to maturity

6.73%

Maturity date

Nov 1, 2096

A

APC3675627

Anadarko Petroleum Corporation 7.95% 15-JUN-2039Yield to maturity

6.66%

Maturity date

Jun 15, 2039

OPCE

Occidental Petroleum Corporation 4.1% 15-FEB-2047Yield to maturity

6.56%

Maturity date

Feb 15, 2047

OPCC

Occidental Petroleum Corporation 4.625% 15-JUN-2045Yield to maturity

6.46%

Maturity date

Jun 15, 2045

APC4869088

Occidental Petroleum Corporation 4.4% 15-AUG-2049Yield to maturity

6.45%

Maturity date

Aug 15, 2049

OPCF

Occidental Petroleum Corporation 4.2% 15-MAR-2048Yield to maturity

6.38%

Maturity date

Mar 15, 2048

APC4875630

Occidental Petroleum Corporation 4.5% 15-JUL-2044Yield to maturity

6.36%

Maturity date

Jul 15, 2044

See all OXY bonds

Frequently Asked Questions

The current price of OXY is 46.31 USD — it has increased by 2.71% in the past 24 hours. Watch Occidental Petroleum Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Occidental Petroleum Corporation stocks are traded under the ticker OXY.

OXY stock has risen by 2.37% compared to the previous week, the month change is a 11.83% rise, over the last year Occidental Petroleum Corporation has showed a −1.47% decrease.

We've gathered analysts' opinions on Occidental Petroleum Corporation future price: according to them, OXY price has a max estimate of 65.00 USD and a min estimate of 38.00 USD. Watch OXY chart and read a more detailed Occidental Petroleum Corporation stock forecast: see what analysts think of Occidental Petroleum Corporation and suggest that you do with its stocks.

OXY stock is 3.46% volatile and has beta coefficient of 0.55. Track Occidental Petroleum Corporation stock price on the chart and check out the list of the most volatile stocks — is Occidental Petroleum Corporation there?

Today Occidental Petroleum Corporation has the market capitalization of 45.63 B, it has decreased by −0.66% over the last week.

Yes, you can track Occidental Petroleum Corporation financials in yearly and quarterly reports right on TradingView.

Occidental Petroleum Corporation is going to release the next earnings report on Feb 18, 2026. Keep track of upcoming events with our Earnings Calendar.

OXY earnings for the last quarter are 0.64 USD per share, whereas the estimation was 0.51 USD resulting in a 24.99% surprise. The estimated earnings for the next quarter are 0.21 USD per share. See more details about Occidental Petroleum Corporation earnings.

Occidental Petroleum Corporation revenue for the last quarter amounts to 6.62 B USD, despite the estimated figure of 6.75 B USD. In the next quarter, revenue is expected to reach 5.57 B USD.

OXY net income for the last quarter is 826.00 M USD, while the quarter before that showed 431.00 M USD of net income which accounts for 91.65% change. Track more Occidental Petroleum Corporation financial stats to get the full picture.

Yes, OXY dividends are paid quarterly. The last dividend per share was 0.24 USD. As of today, Dividend Yield (TTM)% is 2.07%. Tracking Occidental Petroleum Corporation dividends might help you take more informed decisions.

Occidental Petroleum Corporation dividend yield was 1.78% in 2024, and payout ratio reached 36.00%. The year before the numbers were 1.21% and 18.44% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 9, 2026, the company has 13.32 K employees. See our rating of the largest employees — is Occidental Petroleum Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Occidental Petroleum Corporation EBITDA is 12.92 B USD, and current EBITDA margin is 49.61%. See more stats in Occidental Petroleum Corporation financial statements.

Like other stocks, OXY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Occidental Petroleum Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Occidental Petroleum Corporation technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Occidental Petroleum Corporation stock shows the sell signal. See more of Occidental Petroleum Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.