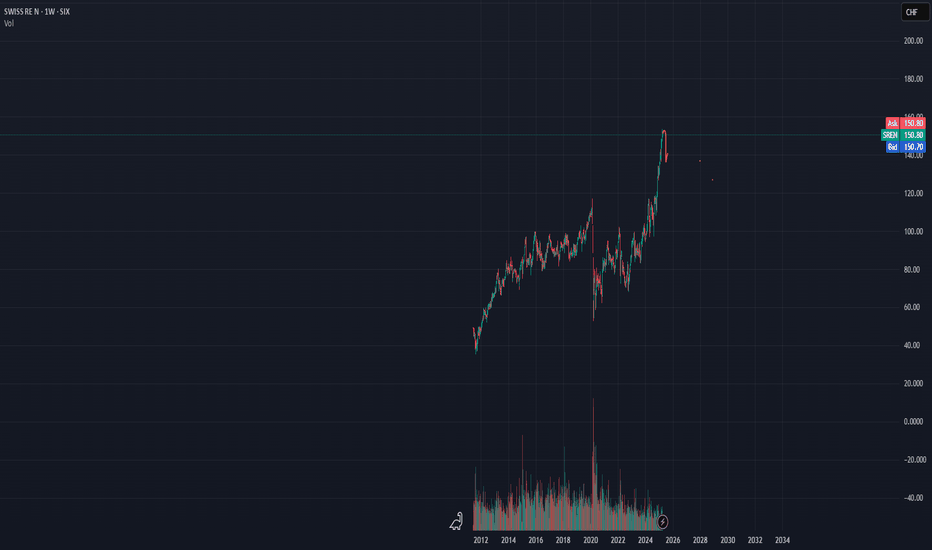

Swiss RE Crash ahead?+low volume

+MACD overbought

+RSI overbought

+increase in dividends

+Divested insurance company stake

+Thailand & Myanmar earthquake uncertainty

+Trump tariff unceartainty

+Most shares are in the hands of baby boomers, who are on the brink of retirement

+I really don't see how the next generation wi

Swiss Re Ltd

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.77 USD

3.08 B USD

48.63 B USD

275.00 M

About Swiss Re AG

Sector

Industry

CEO

Andreas Berger

Website

Headquarters

Zurich

Founded

1863

Identifiers

2

ISIN CH0126881561

Swiss Re AG engages in the provision of reinsurance, insurance and other insurance-based forms of risk transfer. It operates through the following segments: Property and Casualty Reinsurance, Life and Health Reinsurance, Corporate Solutions, Life Capital, and Group Items. The Property and Casualty segment comprises of the business lines property, casualty including motor, and specialty. The Life and Health segment includes property and casualty; and life and health sub-segments. The Corporate Solutions segment offers innovative insurance capacity to mid-sized and large multinational corporations across the globe. The Life Capital segment encompasses the closed and open life and health insurance books, as well as the ReAssure business and the primary life and health insurance business comprising elipsLife and iptiQ. The Group Items segment represents the administrative expenses of the corporate center functions that are not recharged to the operating segments. The company was founded on December 19, 1863 and is headquartered in Zurich, Switzerland.

Related stocks

Swiss Re (SREN.vx) bullish scenario:The technical figure Channel Down can be found in the daily chart in the US company Swiss Re (SREN.vx). Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is one of the world's largest reinsurers, as measured by net premiums written.

Swiss Re AG bullish scenario:We have technical figure Triangle in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Re AG is a reinsurance company based in Zurich, Switzerland. It is the world's largest reinsurer, as measured by net premiums written. The Triangle has broken through the resistance line

SREN.vx bullish scenario:SREN.vx bullish scenario:

We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Found

SREN.vx bullish scenario:We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Founded in 1863, Swiss Re opera

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SSRE3680633

GE Global Insurance Holding Corp. 7.0% 15-FEB-2026Yield to maturity

7.21%

Maturity date

Feb 15, 2026

DEMQ5253921

Argentum Netherlands BV for Swiss Re AG 6.05% 17-FEB-2056Yield to maturity

6.49%

Maturity date

Feb 17, 2056

SSRE3938889

Swiss Re Treasury (US) Corp. 4.25% 06-DEC-2042Yield to maturity

5.42%

Maturity date

Dec 6, 2042

SSRE3680636

GE Global Insurance Holding Corp. 7.75% 15-JUN-2030Yield to maturity

4.36%

Maturity date

Jun 15, 2030

RUK15

Schweizerische Ruckversicherungs-Gesellschaft AG 0.75% 21-JAN-2027Yield to maturity

0.48%

Maturity date

Jan 21, 2027

XS302520780

Swiss Re Subordinated Finance Plc 3.89% 26-MAR-2033Yield to maturity

—

Maturity date

Mar 26, 2033

XS1973748707

Swiss Re Finance (Luxembourg) SA 5.0% 02-APR-2049Yield to maturity

—

Maturity date

Apr 2, 2049

XS218195911

Swiss Re Finance (UK) Plc 2.714% 04-JUN-2052Yield to maturity

—

Maturity date

Jun 4, 2052

US87088QAB05

Swiss Re Subordinated Finance Plc 6.191% 01-APR-2046Yield to maturity

—

Maturity date

Apr 1, 2046

US87088QAA22

Swiss Re Subordinated Finance Plc 5.698% 05-APR-2035Yield to maturity

—

Maturity date

Apr 5, 2035

XS196311696

Swiss Re Finance (Luxembourg) SA 2.534% 30-APR-2050Yield to maturity

—

Maturity date

Apr 30, 2050

See all SSREF bonds

Frequently Asked Questions

The current price of SSREF is 159.51 USD — it has increased by 0.96% in the past 24 hours. Watch Swiss Re Ltd stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Swiss Re Ltd stocks are traded under the ticker SSREF.

SSREF stock has fallen by −2.23% compared to the previous week, the month change is a 0.35% rise, over the last year Swiss Re Ltd has showed a 10.63% increase.

We've gathered analysts' opinions on Swiss Re Ltd future price: according to them, SSREF price has a max estimate of 203.92 USD and a min estimate of 148.57 USD. Watch SSREF chart and read a more detailed Swiss Re Ltd stock forecast: see what analysts think of Swiss Re Ltd and suggest that you do with its stocks.

SSREF reached its all-time high on Oct 7, 2025 with the price of 192.25 USD, and its all-time low was 0.50 USD and was reached on Nov 4, 2015. View more price dynamics on SSREF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SSREF stock is 0.95% volatile and has beta coefficient of 0.44. Track Swiss Re Ltd stock price on the chart and check out the list of the most volatile stocks — is Swiss Re Ltd there?

Today Swiss Re Ltd has the market capitalization of 43.90 B, it has decreased by −3.15% over the last week.

Yes, you can track Swiss Re Ltd financials in yearly and quarterly reports right on TradingView.

Swiss Re Ltd is going to release the next earnings report on Feb 27, 2026. Keep track of upcoming events with our Earnings Calendar.

SSREF net income for the last half-year is 2.79 B USD, while the previous report showed 1.11 B USD of net income which accounts for 151.62% change. Track more Swiss Re Ltd financial stats to get the full picture.

Yes, SSREF dividends are paid annually. The last dividend per share was 7.28 USD. As of today, Dividend Yield (TTM)% is 4.71%. Tracking Swiss Re Ltd dividends might help you take more informed decisions.

Swiss Re Ltd dividend yield was 4.58% in 2024, and payout ratio reached 62.68%. The year before the numbers were 6.57% and 65.90% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jan 15, 2026, the company has 15.02 K employees. See our rating of the largest employees — is Swiss Re Ltd on this list?

Like other stocks, SSREF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Swiss Re Ltd stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Swiss Re Ltd technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Swiss Re Ltd stock shows the buy signal. See more of Swiss Re Ltd technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.