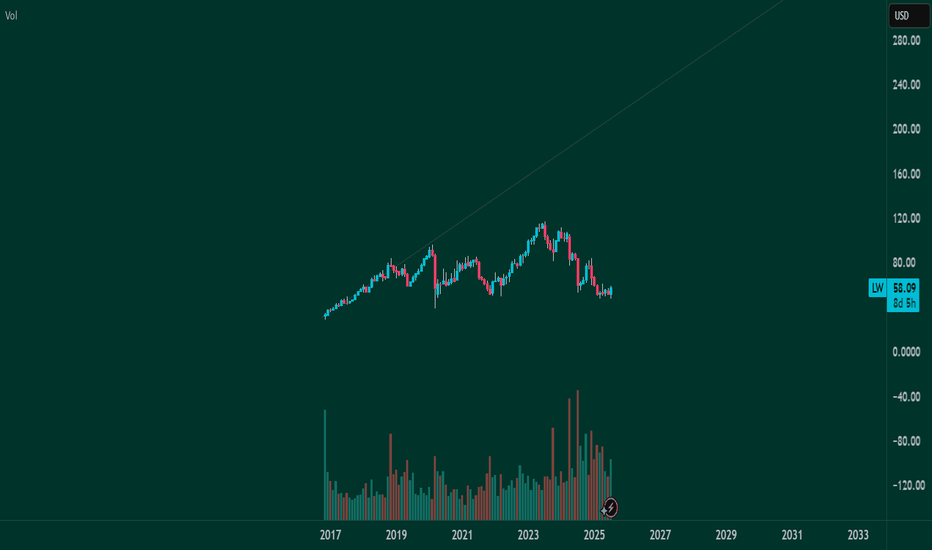

Lamb Weston Holdings | LW | Long at $51.32Lamb Weston Holdings NYSE:LW , the potato / French fry king, has gone through a tremendous downturn since 2023. Yet, earnings are forecast to grow 22% per year into 2027. Debt is quite high at 2.5x and this company, like many others, will significantly benefit from lower interest rates in the futur

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.79 EUR

314.85 M EUR

5.69 B EUR

137.98 M

About Lamb Weston Holdings, Inc.

Sector

Industry

CEO

Michael J. Smith

Website

Headquarters

Eagle

Founded

1950

Identifiers

3

ISINUS5132721045

Lamb Weston Holdings, Inc. engages in the production, distribution, and marketing of value-added frozen potato products. It operates through the North America and International segments. The North America segment includes frozen potato products sold in the United States, Canada, and Mexico to quick service and full-service restaurants and chains, foodservice distributors, non-commercial channels, and retailers. International segment primarily includes frozen potato products sold outside of North America. The company was founded in 1950 and is headquartered in Eagle, ID.

Related stocks

Trading Thesis: Frozen M&A Firestarter– Is LW the Next Takeover 🧠 Trading Thesis: “Frozen M&A Firestarter – Is LW the Next Takeover Pop?”

📉 Ticker: NYSE:LW

🗓️ Timeframe: Daily (1D)

📍 Current Price: $51.32

📈 Fibonacci Extension Target: $136.62 – $170.88

📉 Downside Risk: ~$47.90 if activist push fails

🔭 Time Horizon: 2–6 months

🔍 WaverVanir Thesis

Lamb Weston (

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Short | LW NYSE:LW

Technical Analysis of Lamb Weston Holdings, Inc. (LW)

Key Observations:

Current Price Action:

Price: $82.24

Recent Drop: -0.44 (-0.53%)

Bearish Line: $81.94

Support and Resistance Levels:

Immediate Support: $79.78 (Target Price 1)

Further Support: $76.45 (Target Price 2)

Resistance: Th

Long Lamb Weston $LW

🍟 NYSE:LW is one of the largest producers of frozen 🥔products

🍟 Large supplier to $ NYSE:MCD MCD NYSE:LW

🍟 Stock is bouncing after Jana Partners took a stake and the latest earnings

🍟 Unusual Call Options Activity using @Tradestation shows accumulation

🍟 Upside potential 25% to target

LW Lamb Weston Holdings Options Ahead of EarningsIf you haven`t sold LW before the previous earnings:

Now analyzing the options chain and the chart patterns of LW Lamb Weston Holdings prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximat

Stocks pairs trading: LW vs CLXLet's examine the trade potential for Lamb Weston Holdings (LW) and Clorox (CLX) by analyzing their key financial metrics and recent performance to determine reasons for going long on LW and short on CLX.

Price-to-Earnings (P/E) Ratio:

LW: P/E ratio of 10.50

CLX: P/E ratio of 68.01

LW has a sign

Stocks pairs trading: LW vs WRKLet's examine the trade potential for Lamb Weston Holdings, Inc. (LW) and WestRock Company (WRK) by analyzing their key financial metrics and recent performance to determine reasons for going long on LW and short on WRK.

Price-to-Earnings (P/E) Ratio:

LW: P/E ratio of 10.93

WRK: P/E ratio of 43.2

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LW5284211

Lamb Weston Holdings, Inc. 4.125% 31-JAN-2030Yield to maturity

5.00%

Maturity date

Jan 31, 2030

LW4985743

Lamb Weston Holdings, Inc. 4.875% 15-MAY-2028Yield to maturity

4.93%

Maturity date

May 15, 2028

LW5284213

Lamb Weston Holdings, Inc. 4.375% 31-JAN-2032Yield to maturity

4.79%

Maturity date

Jan 31, 2032

See all 0L5 bonds

Curated watchlists where 0L5 is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Lamb Weston Holdings, Inc. stocks are traded under the ticker 0L5.

We've gathered analysts' opinions on Lamb Weston Holdings, Inc. future price: according to them, 0L5 price has a max estimate of 59.64 EUR and a min estimate of 51.12 EUR. Watch 0L5 chart and read a more detailed Lamb Weston Holdings, Inc. stock forecast: see what analysts think of Lamb Weston Holdings, Inc. and suggest that you do with its stocks.

Yes, you can track Lamb Weston Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

Lamb Weston Holdings, Inc. is going to release the next earnings report on Dec 19, 2025. Keep track of upcoming events with our Earnings Calendar.

0L5 earnings for the last quarter are 0.63 EUR per share, whereas the estimation was 0.47 EUR resulting in a 35.80% surprise. The estimated earnings for the next quarter are 0.56 EUR per share. See more details about Lamb Weston Holdings, Inc. earnings.

Lamb Weston Holdings, Inc. revenue for the last quarter amounts to 1.42 B EUR, despite the estimated figure of 1.38 B EUR. In the next quarter, revenue is expected to reach 1.37 B EUR.

0L5 net income for the last quarter is 55.04 M EUR, while the quarter before that showed 105.69 M EUR of net income which accounts for −47.92% change. Track more Lamb Weston Holdings, Inc. financial stats to get the full picture.

Yes, 0L5 dividends are paid quarterly. The last dividend per share was 0.32 EUR. As of today, Dividend Yield (TTM)% is 2.48%. Tracking Lamb Weston Holdings, Inc. dividends might help you take more informed decisions.

Lamb Weston Holdings, Inc. dividend yield was 2.89% in 2024, and payout ratio reached 58.33%. The year before the numbers were 1.43% and 25.69% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 16, 2025, the company has 10.1 K employees. See our rating of the largest employees — is Lamb Weston Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Lamb Weston Holdings, Inc. EBITDA is 1.05 B EUR, and current EBITDA margin is 19.24%. See more stats in Lamb Weston Holdings, Inc. financial statements.

Like other stocks, 0L5 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Lamb Weston Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.