Tesla, Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.00 EUR

3.23 B EUR

80.74 B EUR

2.39 B

About Tesla, Inc.

Sector

Industry

CEO

Elon Reeve Musk

Website

Headquarters

Austin

Founded

2003

IPO date

Mar 6, 2013

Identifiers

3

ISIN US88160R1014

Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. It operates through the Automotive and Energy Generation and Storage segments. The Automotive segment includes the design, development, manufacture, sale, and lease of electric vehicles as well as sales of automotive regulatory credits. The Energy Generation and Storage segment is involved in the design, manufacture, installation, sale, and lease of solar energy generation, energy storage products, and related services and sales of solar energy systems incentives. The company was founded by Jeffrey B. Straubel, Elon Reeve Musk, Martin Eberhard, and Marc Tarpenning on July 1, 2003 and is headquartered in Austin, TX.

Related stocks

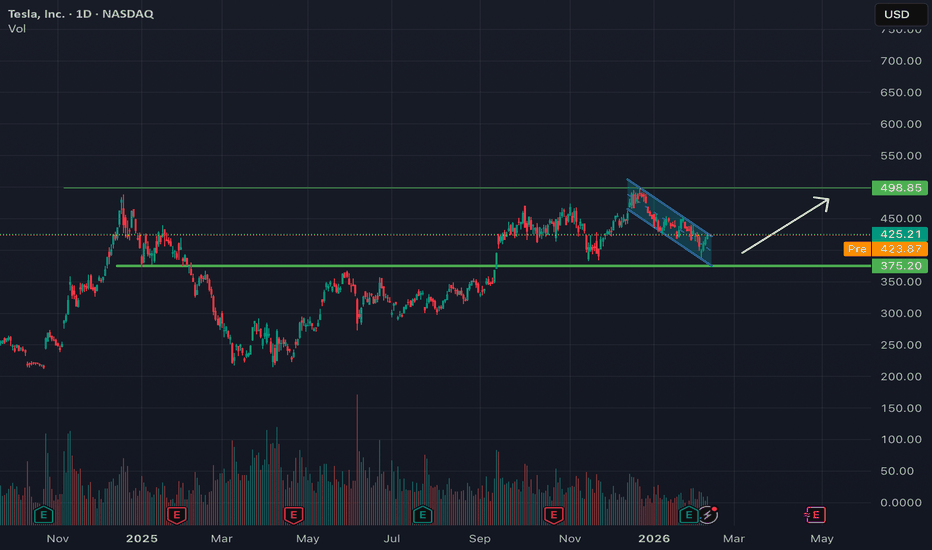

Tesla to potentially retest $500, needs Nasdaq strengthDaily chart showing NASDAQ:TSLA sitting at support inside a downtrend channel, sort of resembling a flag pattern. There is potential that Tesla may bounce off the support, and find its way to breakout of the downtrend channel in a bullish move towards $500.

This is of course is completely depende

TSLA - Not looking greatTSLA idea: trend break + bear flag under MAs (sell-the-rip until proven otherwise)

Tesla lost the major uptrend line and keeps getting rejected under the moving averages — that’s not “dip buy” behavior, that’s overhead supply.

Key map

Pivot / chop shelf: ~420

Line in the sand: 410.9 (LOD)

Downs

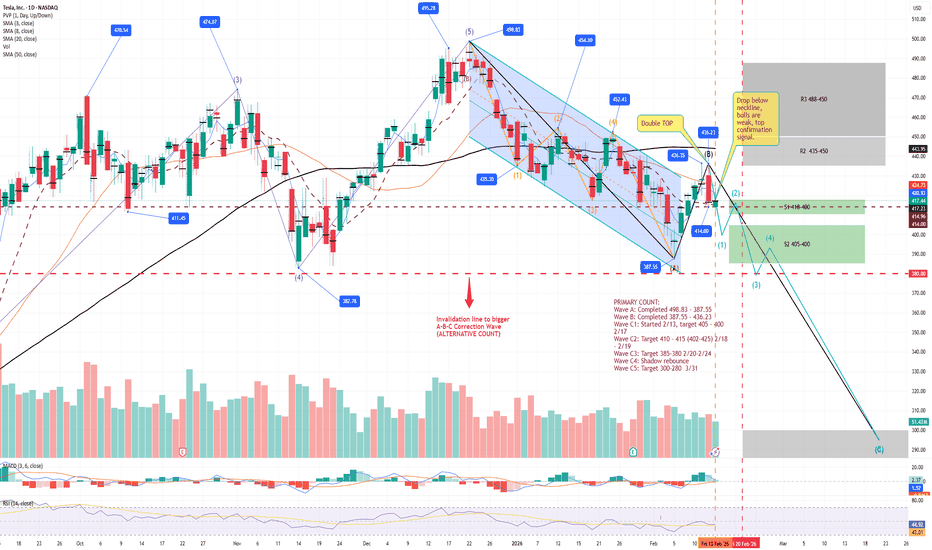

TSLA: DoubleTop Confirmed–BWave Ends 436, CWave target 395-380TSLA from 498 high unfolded a major A-B-C correction.

Primary Count:

- Wave A completed at 387.55. Wave B rallied to 436.35 forming a double top (Feb 11-12).

- Feb 13 CPI day closed with a spinning top, confirming B wave end.

- C wave started from 436, Wave C1 underway.

-- Short-term Wave C1

Tesla: Corrective Dip Before The Next Bullish Leg?Tesla staged an impressive recovery from its April 2025 lows, extending the rally to fresh highs near the 500 level. However, the beginning of 2026 has introduced a notable retracement, raising questions about whether this marks a larger reversal or simply a pause within a broader uptrend.

From an

Tesla: Electrifying the Future – Why TSLA Could Shock the MarketTesla: Electrifying the Future – Why TSLA Could Shock the Market in 2026 ⚡🚀

Section 1: Executive Summary

Tesla stands at a pivotal inflection point in 2026, with its pivot toward AI-driven autonomy and robotics poised to transform the company from an EV manufacturer into a broader technology pla

Tesla at $411 Faces Heavy Resistance as Traders Fade the BounceCurrent Price: 411.11

Direction: SHORT

Confidence level: 58%(Several professional traders highlight repeated resistance near $415 and describe the move as a relief bounce within a downtrend, with consistent downside targets around $400 and the $380s. X sentiment is mixed but leans cautious, keepi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TSLA4317805

Tesla Energy Operations, Inc. 5.45% 17-DEC-2030Yield to maturity

10.02%

Maturity date

Dec 17, 2030

TSLA4296328

Tesla Energy Operations, Inc. 5.45% 16-OCT-2030Yield to maturity

9.28%

Maturity date

Oct 16, 2030

TSLA4290558

Tesla Energy Operations, Inc. 5.45% 01-OCT-2030Yield to maturity

8.99%

Maturity date

Oct 1, 2030

TSLA4286421

Tesla Energy Operations, Inc. 5.45% 17-SEP-2030Yield to maturity

7.89%

Maturity date

Sep 17, 2030

TSLA4231716

Tesla Energy Operations, Inc. 5.45% 23-APR-2030Yield to maturity

7.60%

Maturity date

Apr 23, 2030

TSLA4250220

Tesla Energy Operations, Inc. 5.45% 29-MAY-2030Yield to maturity

7.40%

Maturity date

May 29, 2030

TSLA4313161

Tesla Energy Operations, Inc. 5.45% 03-DEC-2030Yield to maturity

7.15%

Maturity date

Dec 3, 2030

TSLA4260133

Tesla Energy Operations, Inc. 5.45% 25-JUN-2030Yield to maturity

7.02%

Maturity date

Jun 25, 2030

TSLA4247202

Tesla Energy Operations, Inc. 5.45% 21-MAY-2030Yield to maturity

6.97%

Maturity date

May 21, 2030

TSLA4224815

Tesla Energy Operations, Inc. 5.45% 26-MAR-2030Yield to maturity

6.78%

Maturity date

Mar 26, 2030

TSLA4265473

Tesla Energy Operations, Inc. 5.45% 16-JUL-2030Yield to maturity

6.72%

Maturity date

Jul 16, 2030

See all TL0 bonds

Frequently Asked Questions

The current price of TL0 is 353.10 EUR — it has increased by 0.51% in the past 24 hours. Watch Tesla, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Tesla, Inc. stocks are traded under the ticker TL0.

TL0 stock has risen by 0.77% compared to the previous week, the month change is a −7.16% fall, over the last year Tesla, Inc. has showed a 3.08% increase.

We've gathered analysts' opinions on Tesla, Inc. future price: according to them, TL0 price has a max estimate of 505.50 EUR and a min estimate of 36.23 EUR. Watch TL0 chart and read a more detailed Tesla, Inc. stock forecast: see what analysts think of Tesla, Inc. and suggest that you do with its stocks.

TL0 stock is 1.55% volatile and has beta coefficient of 1.14. Track Tesla, Inc. stock price on the chart and check out the list of the most volatile stocks — is Tesla, Inc. there?

Today Tesla, Inc. has the market capitalization of 1.17 T, it has decreased by −1.91% over the last week.

Yes, you can track Tesla, Inc. financials in yearly and quarterly reports right on TradingView.

Tesla, Inc. is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

TL0 earnings for the last quarter are 0.43 EUR per share, whereas the estimation was 0.38 EUR resulting in a 10.81% surprise. The estimated earnings for the next quarter are 0.35 EUR per share. See more details about Tesla, Inc. earnings.

Tesla, Inc. revenue for the last quarter amounts to 21.20 B EUR, despite the estimated figure of 21.06 B EUR. In the next quarter, revenue is expected to reach 19.43 B EUR.

TL0 net income for the last quarter is 715.19 M EUR, while the quarter before that showed 1.17 B EUR of net income which accounts for −38.88% change. Track more Tesla, Inc. financial stats to get the full picture.

No, TL0 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 16, 2026, the company has 134.78 K employees. See our rating of the largest employees — is Tesla, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Tesla, Inc. EBITDA is 9.36 B EUR, and current EBITDA margin is 11.60%. See more stats in Tesla, Inc. financial statements.

Like other stocks, TL0 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Tesla, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Tesla, Inc. technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tesla, Inc. stock shows the buy signal. See more of Tesla, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.