TOL: Luxury Builder Showing High Relative StrengthThe Setup: Toll Brothers is the nation's leading builder of luxury homes, catering to the affluent market which is often more resilient to rate fluctuations. Currently, it is displaying the 2nd best Relative Strength in the entire Homebuilders sector, trailing only behind IBP.

Technically, we have

Key facts today

Toll Brothers will launch Crestmoor Estates in San Bruno, California, offering luxury single-family homes from 2,300 to over 2,800 square feet. Sales start in spring 2026.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

13.66 USD

1.35 B USD

10.97 B USD

93.67 M

About Toll Brothers, Inc.

Sector

Industry

CEO

Douglas C. Yearley

Website

Headquarters

Fort Washington

Founded

1967

IPO date

Jul 16, 1986

Identifiers

3

ISIN US8894781033

Toll Brothers, Inc. engages in the design, building, marketing, and arranging of financing for detached and attached homes in residential communities. It operates through the following geographical segments: North Region, Mid-Atlantic Region, South Region, Mountain Region, and Pacific Region. The company was founded by Robert I. Toll, and Bruce E. Toll in May 1967 and is headquartered in Fort Washington, PA.

Related stocks

Toll Brothers, Inc. (TOL) Builds Luxury U.S. CommunitiesToll Brothers, Inc. (TOL) builds luxury homes across the U.S., focusing on high-end communities with strong design, amenities, and custom features. The company benefits from steady demand among affluent buyers, limited housing supply, and interest in premium living spaces. Growth comes from expandin

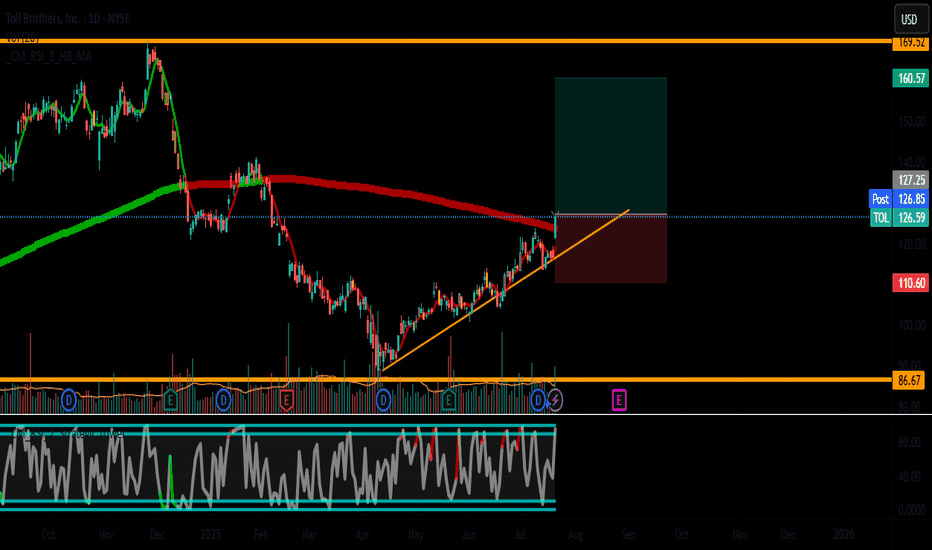

TOL (Toll Brothers) – Bullish Continuation Play🚀 Trade Idea: TOL (Toll Brothers) – Bullish Continuation Play

Entry: $127 | Stop Loss: $110.60 | Take Profit: $160.57

Risk/Reward Ratio: ~1:3

📈 Technical Setup

Trend:

Daily: Strong uptrend, higher highs & higher lows.

4H/1H: Bullish momentum with SMA(20) > SMA(50).

Key Levels:

Support: $121 (r

TOL (Toll Brothers, Inc.) TA & Trade Idea

Short-term Outlook (1–4 Weeks):

• Analysis: Oversold stochastic oscillator showing bullish crossover potential. Price approaching strong historical support near $90–$95. Candlesticks indicate seller exhaustion.

• Trade Direction: Long

• Confidence Score : 75% (Bullish reversal likely)

Medium

Has the TOL been paid?As trading view states, Toll Brothers, Inc. engages in the design, building, marketing, and arranging of financing for detached and attached homes in residential communities. The technicals are neutral and the analysis's naively have given this company a buy rating.

However, among the real estate c

TOLL Brothers #TOL new high vs US single family home priceHomemakers are making money over fist.

Does this confirm that the housing bull market will continue.

It seems like it doesn't it

This ratio highlights the housing bottom in the 90's

this Ratio also topped out in 2005 before the housing bubble popped

#Roaring20's

TOLToll Brothers is a company which designs, builds, markets, sells, and arranges financing for residential and commercial properties in the United States. In 2020, the company was the fifth largest home builder in the United States, based on homebuilding revenue. The company is ranked 411th on the For

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TOL6094657

Toll Brothers Finance Corp. 5.6% 15-JUN-2035Yield to maturity

4.95%

Maturity date

Jun 15, 2035

TOL4882307

Toll Brothers Finance Corp. 3.8% 01-NOV-2029Yield to maturity

4.21%

Maturity date

Nov 1, 2029

TOL4464594

Toll Brothers Finance Corp. 4.875% 15-MAR-2027Yield to maturity

4.15%

Maturity date

Mar 15, 2027

TOL4587598

Toll Brothers Finance Corp. 4.35% 15-FEB-2028Yield to maturity

4.08%

Maturity date

Feb 15, 2028

See all TOL bonds

SDVY.F

First Trust SMID Cap Rising Dividend Achievers ETF Trust Unit -Hedged-Weight

0.67%

Market value

71.57 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of TOL is 152.26 USD — it has decreased by −0.82% in the past 24 hours. Watch Toll Brothers, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Toll Brothers, Inc. stocks are traded under the ticker TOL.

TOL stock has risen by 5.22% compared to the previous week, the month change is a 9.80% rise, over the last year Toll Brothers, Inc. has showed a 15.36% increase.

We've gathered analysts' opinions on Toll Brothers, Inc. future price: according to them, TOL price has a max estimate of 181.00 USD and a min estimate of 110.00 USD. Watch TOL chart and read a more detailed Toll Brothers, Inc. stock forecast: see what analysts think of Toll Brothers, Inc. and suggest that you do with its stocks.

TOL stock is 2.84% volatile and has beta coefficient of 0.76. Track Toll Brothers, Inc. stock price on the chart and check out the list of the most volatile stocks — is Toll Brothers, Inc. there?

Today Toll Brothers, Inc. has the market capitalization of 14.56 B, it has increased by 5.36% over the last week.

Yes, you can track Toll Brothers, Inc. financials in yearly and quarterly reports right on TradingView.

Toll Brothers, Inc. is going to release the next earnings report on Feb 17, 2026. Keep track of upcoming events with our Earnings Calendar.

TOL earnings for the last quarter are 4.58 USD per share, whereas the estimation was 4.88 USD resulting in a −6.18% surprise. The estimated earnings for the next quarter are 2.11 USD per share. See more details about Toll Brothers, Inc. earnings.

Toll Brothers, Inc. revenue for the last quarter amounts to 3.42 B USD, despite the estimated figure of 3.30 B USD. In the next quarter, revenue is expected to reach 1.85 B USD.

TOL net income for the last quarter is 446.72 M USD, while the quarter before that showed 369.62 M USD of net income which accounts for 20.86% change. Track more Toll Brothers, Inc. financial stats to get the full picture.

Yes, TOL dividends are paid quarterly. The last dividend per share was 0.25 USD. As of today, Dividend Yield (TTM)% is 0.65%. Tracking Toll Brothers, Inc. dividends might help you take more informed decisions.

Toll Brothers, Inc. dividend yield was 0.73% in 2025, and payout ratio reached 7.26%. The year before the numbers were 0.61% and 6.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 9, 2026, the company has 4.9 K employees. See our rating of the largest employees — is Toll Brothers, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Toll Brothers, Inc. EBITDA is 1.81 B USD, and current EBITDA margin is 16.31%. See more stats in Toll Brothers, Inc. financial statements.

Like other stocks, TOL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Toll Brothers, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Toll Brothers, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Toll Brothers, Inc. stock shows the strong buy signal. See more of Toll Brothers, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.