The Trade Desk, Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.89 USD

393.08 M USD

2.44 B USD

437.45 M

About The Trade Desk, Inc.

Sector

Industry

CEO

Jeffrey Terry Green

Website

Headquarters

Ventura

Founded

2009

IPO date

Sep 21, 2016

Identifiers

3

ISIN US88339J1051

The Trade Desk, Inc. engages in the provision of a self-service and cloud-based ad-buying platform. It operates through the United States and International geographical segments. The firm offers omnichannel advertising, audience targeting, solutions for identity, application programming interface (API), custom, and programmatic, measurement and optimization. The company was founded by Jeffrey Terry Green and David Pickles in November 2009 and is headquartered in Ventura, CA.

Related stocks

The Trade Desk (NASDAQ: TTD)The Trade Desk (NASDAQ: TTD) finds itself navigating a period of pronounced turbulence, underscored by a sudden and concerning leadership shuffle at the highest financial level. In a press release issued early Monday, the advertising technology company announced the immediate departure of Chief Fina

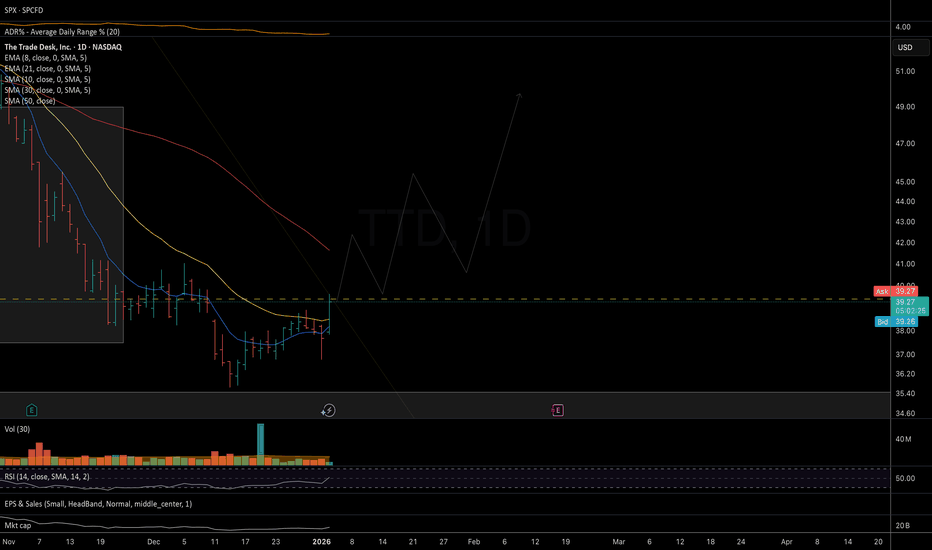

$TTD will the bear market end in 2026?Trade desk is trying to carve out a bottom.

Today we saw a nasty 3 bar surge hitting a final trend line of support.

If this bullish crossover of the 7/20 MA is to hold this is where the bulls need to step in.

Great risk to reward basis on a long.

Great fundamentals and balance sheet.

TTD: might be starting a new uptrend Watching for the start of a new swing uptrend, with scope to at least re-test the Aug/Oct highs and potentially begin a new macro uptrend that could take price above ATHs in the coming years.

Chart:

Monthly view:

Possible risk levels for at least 3-5 days swing trade long:

1. LOD: bel

Bullish Divergence Weekly TTD Trade #00020Bullsh div, V1 trigger, sR coming from oversold, both EFI's coming from < -3 ATR extremes

Montly flipping from red impulse to blue, but factor 3 is already blue.

TP 1: 44,49

TP 2: 49,86

E: 38,4

35,41

R/R: 1:2,2

I plan to enter around 38,4 with 80%, possibly more entries when it goes below

Fast Bounce Setup | Price: 40.05 → Target: 42.05 (+5%)Fast Bounce Setup | Price: 40.05 → Target: 42.05 (+5%) 📈⚡

Fundamentals 📊

TTD maintains strong long-term revenue growth, driven by rising digital ad spending and increasing adoption of programmatic advertising.

Profit forecasts also show healthy growth, strengthening the short-term upside potential.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of TTD is 30.31 USD — it has decreased by −2.29% in the past 24 hours. Watch The Trade Desk, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange The Trade Desk, Inc. stocks are traded under the ticker TTD.

TTD stock has fallen by −15.73% compared to the previous week, the month change is a −19.78% fall, over the last year The Trade Desk, Inc. has showed a −75.56% decrease.

We've gathered analysts' opinions on The Trade Desk, Inc. future price: according to them, TTD price has a max estimate of 98.00 USD and a min estimate of 34.00 USD. Watch TTD chart and read a more detailed The Trade Desk, Inc. stock forecast: see what analysts think of The Trade Desk, Inc. and suggest that you do with its stocks.

TTD stock is 3.40% volatile and has beta coefficient of 1.02. Track The Trade Desk, Inc. stock price on the chart and check out the list of the most volatile stocks — is The Trade Desk, Inc. there?

Today The Trade Desk, Inc. has the market capitalization of 15.11 B, it has decreased by −8.89% over the last week.

Yes, you can track The Trade Desk, Inc. financials in yearly and quarterly reports right on TradingView.

The Trade Desk, Inc. is going to release the next earnings report on Feb 25, 2026. Keep track of upcoming events with our Earnings Calendar.

TTD earnings for the last quarter are 0.23 USD per share, whereas the estimation was 0.20 USD resulting in a 14.45% surprise. The estimated earnings for the next quarter are 0.34 USD per share. See more details about The Trade Desk, Inc. earnings.

The Trade Desk, Inc. revenue for the last quarter amounts to 739.00 M USD, despite the estimated figure of 719.04 M USD. In the next quarter, revenue is expected to reach 841.08 M USD.

TTD net income for the last quarter is 115.55 M USD, while the quarter before that showed 90.13 M USD of net income which accounts for 28.20% change. Track more The Trade Desk, Inc. financial stats to get the full picture.

No, TTD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jan 30, 2026, the company has 3.52 K employees. See our rating of the largest employees — is The Trade Desk, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. The Trade Desk, Inc. EBITDA is 635.69 M USD, and current EBITDA margin is 21.05%. See more stats in The Trade Desk, Inc. financial statements.

Like other stocks, TTD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade The Trade Desk, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So The Trade Desk, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating The Trade Desk, Inc. stock shows the sell signal. See more of The Trade Desk, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.