GOOGL Stock Analysis | Pullback Within an Established Uptrend🎯 GOOGL: The Great Heist Setup | Moving Average Pullback Play 💰

📊 Market Intelligence Brief

Asset: GOOGL (Alphabet Inc.) - NASDAQ

Strategy Type: Day/Swing Trade - Bullish Momentum

Risk Profile: Medium | Reward Potential: High 🚀

🔍 THE MASTER PLAN

We're eyeing a classic moving average pullback scenar

Key facts today

Alphabet's Google plans to re-enter the smart glasses market in 2026, partnering with Kering and Warby Parker to develop AI-powered eyewear.

Cognizant has expanded its partnership with Google to boost AI deployment at scale, using Google Workspace and Gemini Enterprise to enhance productivity and employee experience.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.91 USD

132.17 B USD

402.96 B USD

5.05 B

About Alphabet Inc (Google) Class C

Sector

Industry

CEO

Sundar Pichai

Website

Headquarters

Mountain View

Founded

2015

IPO date

Aug 19, 2004

Identifiers

3

ISIN US02079K1079

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. The Other Bets segment consists of businesses such as Access, Calico, CapitalG, GV, Verily, Waymo, and X. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Related stocks

Alphabet - The only surviving stock!🏅Alphabet ( NASDAQ:GOOG ) is clearly not bearish yet:

🔎Analysis summary:

The entire tech sector is currently collapsing. But Alphabet remains totally strong and is sitting close to new all time highs. But considering that current retest of the major resistance trendline, a short term pullback

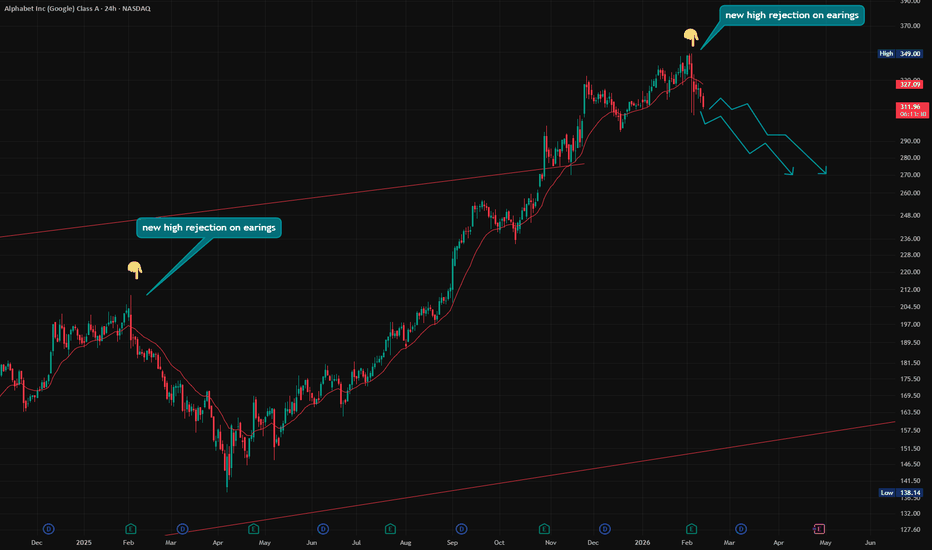

Alphabet ($GOOGL) is likely heading back toward at least $270.Alphabet ( NASDAQ:GOOGL ) is likely heading back toward at least $270.

Four reasons: 👇

- New high rejection on earnings. We saw a similar setup about a year ago — markets often repeat behavior.

- The 2025 trend showed a late-stage acceleration, which historically often precedes a reversal.

- The

GOOG bullback shall be considered as compelling opportunityGiven massive volumes on April tariffs shake-outs, I believe that Google started a new major impulse run.

What I counted with black digits is wave 1 in bigger 5-waves structure.

I will buying around $260-270 as I believe this pullback might end around 38.2 fib of wave 3. However, technically, it

GOOGL Weekly Rebound Setup: Institutional Flow Signals Upside GOOGL QuantSignals V4 — Weekly Bullish Rebound Trade

Signal: BUY CALLS

Conviction: Moderate

Alpha Score: 72

Time Horizon: Weekly (Exp: Friday)

Projected Move: +2.5–3%

👉 Primary Thesis: Smart-money call accumulation + heavy call OI near $325 creates a magnetic effect for price, supporting a ta

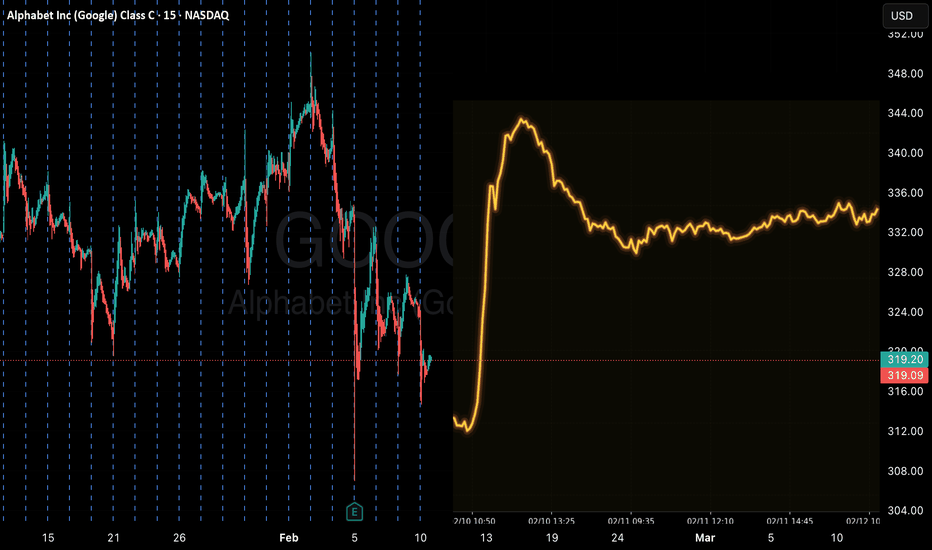

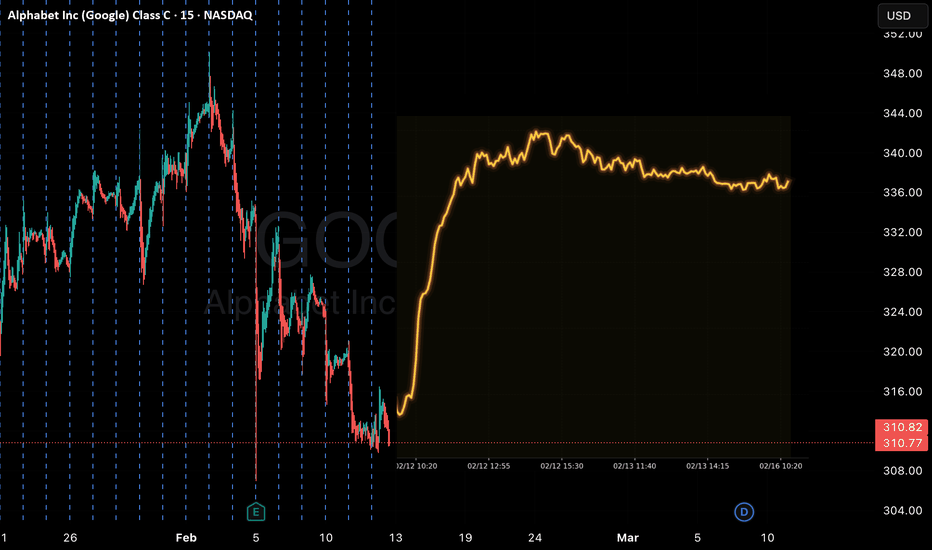

GOOG: Will Buyers Defend the Earnings Low Again?Google Cloud grew ~48% YoY last quarter, outpacing Microsoft’s cloud growth. The market narrative remains clear: Google is viewed as an AI winner, and that perception hasn’t shifted.

After earnings, GOOG opened weak at 312.22 but aggressively reversed intraday to 331.25. That move signaled clear re

GOOGL – Will the Downtrend Continue This Week? (Feb 16–20 )GOOGL is coming into this week still respecting a bearish structure on the 1H timeframe. We’ve seen a clear BOS to the downside, followed by a controlled pullback and compression inside a descending channel. Price is currently hovering around the 305–307 area, which is acting as a decision zone.

GOOGL FEB 2026GOOGL (1D)

Price action:

The 350 high acted as a clean rejection (supply overhead). Price is now pressing into the 310–304 gap zone, which is the immediate pivot: hold/reclaim 310 and the move can re-extend; lose 304 with acceptance and the market likely rotates to the next liquidity shelves below.

GOOGL Weekly Mean-Reversion Call — QS V4 ELITE🔹GOOGL Weekly Trade — QS V4 ELITE

Date: 2026-02-11

Horizon: Weekly (Exp: Feb 20, 2026)

Signal: CALLS

Conviction: Moderate / High

Alpha Score: 84

Regime: Neutral / Recovery

🎯 Core Thesis

Mean reversion toward the 50-Day MA driven by oversold RSI (32).

Positive catalyst: Waymo-Hyundai expansi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS328567504

Alphabet Inc. 6.125% 13-FEB-2126Yield to maturity

6.11%

Maturity date

Feb 13, 2126

XS328556251

Alphabet Inc. 5.875% 13-FEB-2058Yield to maturity

5.94%

Maturity date

Feb 13, 2058

GOOG6224229

Alphabet Inc. 5.7% 15-NOV-2075Yield to maturity

5.72%

Maturity date

Nov 15, 2075

GOOG6308427

Alphabet Inc. 5.75% 15-FEB-2066Yield to maturity

5.64%

Maturity date

Feb 15, 2066

GOOG6065579

Alphabet Inc. 5.3% 15-MAY-2065Yield to maturity

5.63%

Maturity date

May 15, 2065

XS328556227

Alphabet Inc. 5.5% 13-NOV-2041Yield to maturity

5.56%

Maturity date

Nov 13, 2041

GOOG6308428

Alphabet Inc. 5.65% 15-FEB-2056Yield to maturity

5.53%

Maturity date

Feb 15, 2056

GOOG6224228

Alphabet Inc. 5.45% 15-NOV-2055Yield to maturity

5.52%

Maturity date

Nov 15, 2055

GOOG6065578

Alphabet Inc. 5.25% 15-MAY-2055Yield to maturity

5.49%

Maturity date

May 15, 2055

GOOG5025304

Alphabet Inc. 2.05% 15-AUG-2050Yield to maturity

5.37%

Maturity date

Aug 15, 2050

GOOG6308906

Alphabet Inc. 5.5% 15-FEB-2046Yield to maturity

5.35%

Maturity date

Feb 15, 2046

See all GOOG bonds

Frequently Asked Questions

The current price of GOOG is 306.02 USD — it has decreased by −1.08% in the past 24 hours. Watch Alphabet Inc (Google) Class C stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Alphabet Inc (Google) Class C stocks are traded under the ticker GOOG.

GOOG stock has fallen by −6.52% compared to the previous week, the month change is a −8.65% fall, over the last year Alphabet Inc (Google) Class C has showed a 64.59% increase.

We've gathered analysts' opinions on Alphabet Inc (Google) Class C future price: according to them, GOOG price has a max estimate of 443.00 USD and a min estimate of 273.00 USD. Watch GOOG chart and read a more detailed Alphabet Inc (Google) Class C stock forecast: see what analysts think of Alphabet Inc (Google) Class C and suggest that you do with its stocks.

GOOG reached its all-time high on Feb 3, 2026 with the price of 350.15 USD, and its all-time low was 24.31 USD and was reached on Jan 12, 2015. View more price dynamics on GOOG chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GOOG stock is 1.80% volatile and has beta coefficient of 1.15. Track Alphabet Inc (Google) Class C stock price on the chart and check out the list of the most volatile stocks — is Alphabet Inc (Google) Class C there?

Today Alphabet Inc (Google) Class C has the market capitalization of 3.70 T, it has decreased by −4.64% over the last week.

Yes, you can track Alphabet Inc (Google) Class C financials in yearly and quarterly reports right on TradingView.

Alphabet Inc (Google) Class C is going to release the next earnings report on Apr 28, 2026. Keep track of upcoming events with our Earnings Calendar.

GOOG earnings for the last quarter are 2.82 USD per share, whereas the estimation was 2.63 USD resulting in a 7.04% surprise. The estimated earnings for the next quarter are 2.60 USD per share. See more details about Alphabet Inc (Google) Class C earnings.

Alphabet Inc (Google) Class C revenue for the last quarter amounts to 113.83 B USD, despite the estimated figure of 111.32 B USD. In the next quarter, revenue is expected to reach 106.43 B USD.

GOOG net income for the last quarter is 34.45 B USD, while the quarter before that showed 34.98 B USD of net income which accounts for −1.50% change. Track more Alphabet Inc (Google) Class C financial stats to get the full picture.

Yes, GOOG dividends are paid quarterly. The last dividend per share was 0.21 USD. As of today, Dividend Yield (TTM)% is 0.27%. Tracking Alphabet Inc (Google) Class C dividends might help you take more informed decisions.

Alphabet Inc (Google) Class C dividend yield was 0.26% in 2025, and payout ratio reached 7.68%. The year before the numbers were 0.32% and 7.46% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 17, 2026, the company has 190.82 K employees. See our rating of the largest employees — is Alphabet Inc (Google) Class C on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Alphabet Inc (Google) Class C EBITDA is 153.90 B USD, and current EBITDA margin is 38.17%. See more stats in Alphabet Inc (Google) Class C financial statements.

Like other stocks, GOOG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Alphabet Inc (Google) Class C stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Alphabet Inc (Google) Class C technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Alphabet Inc (Google) Class C stock shows the buy signal. See more of Alphabet Inc (Google) Class C technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.