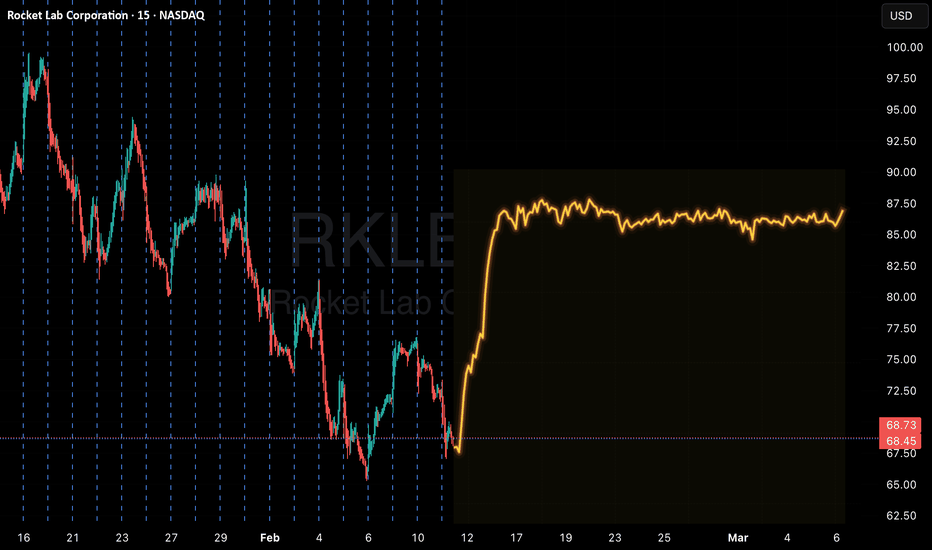

RKLB – Watching This Pullback Closely

NASDAQ:RKLB As you can see on the weekly, the last time an entry label printed it caught both of the big moves, especially the massive run from around $37s up towards almost $100.

Now we’re pulling back into the 0.382–0.5 retracement zone, which is a pretty normal area for price to cool of

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.39 USD

−190.18 M USD

436.21 M USD

487.14 M

About Rocket Lab Corporation

Sector

Industry

CEO

Peter Beck

Website

Headquarters

Long Beach

Identifiers

3

ISIN US7731211089

Rocket Lab Corp. engages in the development of rocket launch and control systems for the space and defense industries. It operates through the Launch Services and Space Systems segments. The Launch Services segment provides launch services to customers on a dedicated mission or ride share basis. The Space Systems segment consists of spacecraft engineering and design services, spacecraft components, spacecraft manufacturing, and on-orbit mission operations. The company is headquartered in Long Beach, CA.

Related stocks

$RKLB , SetupENTRY : CMP

TP1 : 95.25

TP2 : 110.17

TP3 : 148.48

SL : If you wish

My SL is never a SELL, just an alarm to stop adding money and wait for better dca

Follow, Boost, Thank You !!

⚠️ Financial Disclaimer:

This post is not financial advice. I am not your financial advisor, your life coach, or your

RKLB Bounce from 0.618 – Trend Support HoldingHello Everyone, Followers,

Second one for this week is RKLB

Let's drill down:

📊 Technical Overview

After a strong rally, RKLB corrected sharply and found support at the 0.618 Fibonacci level and rising trendline.

Price reacted with strong buying interest, indicating this zone is being defende

Smart Money Loading Calls — RKLB Rebound May Be ImminentRKLB Mean-Reversion Bounce Setup | Quant Signal Targeting 50-Day MA

Ticker: RKLB

Signal: CALLS

Horizon: Weekly (Feb 13 Expiry)

Conviction: Moderate

Alpha Score: 72

🧠 Strategic Thesis

Rocket Lab appears positioned for a high-probability recovery bounce after a short-term liquidity slip. Quant

Rocket Lab Reversal Signal — Quant Models Point HigherRKLB QuantSignals V4 Weekly 2026-02-04

Recent price: about $79–$81 range with intraday highs near $81.61.

Latest close: roughly $81.27.

30-day range: about $71.31–$99.58, showing high volatility.

📊 Analyst Outlook (Bigger Picture)

Average price target around $86.89 (~8.5% upside).

Another cons

RKLB entry 2/5Rocketlab had a great pullback to a strong support at $70. Once the alert popped I began adding shares in blocks of 50. Last year I was able to grab 250 shares at around $40 avg and began releasing them in the 80-90 range. Looking for a similar set up here and anticipating a bounce to $100+. Conside

RKLB plans till June spaceX IPORKlb needs to hold low $40 if not we will head lower in to the $20s

Rocket lab usually runs up around June so it will be inline with SpaceX IPO for a run up

before June neutron might be introduce into the market for a test flight which will explode 100% which will cause the price to tank to low $2

RKLB Weekly Breakdown — Institutions Hedge, Puts Triggere📉 RKLB Weekly Trade (Jan 30 Exp)

Direction: PUT (Bearish)

Reason: Sell-the-news pullback / momentum cooling

Trade Setup

Option: $87 PUT

Expiry: Jan 30, 2026

Entry: $2.20 – $2.40

💰 Targets

Target 1: $2.95 (+25%) → take 50%

Target 2: $3.80 (+60%+) → runner

🛑 Risk

Stop loss: $1.70 (-25%)

Exi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RKLB is 67.44 USD — it has increased by 2.09% in the past 24 hours. Watch Rocket Lab Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Rocket Lab Corporation stocks are traded under the ticker RKLB.

RKLB stock has fallen by −2.33% compared to the previous week, the month change is a −21.96% fall, over the last year Rocket Lab Corporation has showed a 140.17% increase.

We've gathered analysts' opinions on Rocket Lab Corporation future price: according to them, RKLB price has a max estimate of 120.00 USD and a min estimate of 55.00 USD. Watch RKLB chart and read a more detailed Rocket Lab Corporation stock forecast: see what analysts think of Rocket Lab Corporation and suggest that you do with its stocks.

RKLB reached its all-time high on Jan 16, 2026 with the price of 99.58 USD, and its all-time low was 3.47 USD and was reached on Apr 16, 2024. View more price dynamics on RKLB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RKLB stock is 6.26% volatile and has beta coefficient of 2.22. Track Rocket Lab Corporation stock price on the chart and check out the list of the most volatile stocks — is Rocket Lab Corporation there?

Today Rocket Lab Corporation has the market capitalization of 35.26 B, it has decreased by −6.68% over the last week.

Yes, you can track Rocket Lab Corporation financials in yearly and quarterly reports right on TradingView.

Rocket Lab Corporation is going to release the next earnings report on Feb 26, 2026. Keep track of upcoming events with our Earnings Calendar.

RKLB earnings for the last quarter are −0.03 USD per share, whereas the estimation was −0.10 USD resulting in a 69.64% surprise. The estimated earnings for the next quarter are −0.10 USD per share. See more details about Rocket Lab Corporation earnings.

Rocket Lab Corporation revenue for the last quarter amounts to 155.00 M USD, despite the estimated figure of 151.80 M USD. In the next quarter, revenue is expected to reach 176.83 M USD.

RKLB net income for the last quarter is −18.26 M USD, while the quarter before that showed −66.41 M USD of net income which accounts for 72.51% change. Track more Rocket Lab Corporation financial stats to get the full picture.

No, RKLB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 14, 2026, the company has 2.1 K employees. See our rating of the largest employees — is Rocket Lab Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rocket Lab Corporation EBITDA is −191.84 M USD, and current EBITDA margin is −36.08%. See more stats in Rocket Lab Corporation financial statements.

Like other stocks, RKLB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rocket Lab Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rocket Lab Corporation technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rocket Lab Corporation stock shows the buy signal. See more of Rocket Lab Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.