What is happening in the Altcoin universe ? Is Altcoin season in? CRYPTOCAP:ETH and CRYPTOCAP:SOL are the best indicators of the overall sentiment in the Crypto market. Altcoin season usually starts when BINANCE:ETHBTC and CRYPTOCAP:ETH.D both bottoms out. That happened in April. Since then, BINANCE:ETHBTC and CRYPTOCAP:ETH.D have been in an uptrend....

Today we dive deeper into the macroeconomic indicators. People who follow my space know my bias toward TVC:US10Y for market signals. Since months we are following the TVC:US10Y within this downward slopping parallel regression channel. On May 2 we predicted that we might see 3.5% by Dec 2025. TVC:US10Y making new lows. 4% upcoming. 3.5% target low. for...

Where is the Alt season? CRYPTOCAP:TOTAL2 is the best indicator of the Altcoin rally which does not include CRYPTOCAP:BTC and Stablecoins. CRYPTOCAP:TOTAL2 peaked at 1.7 T $ in the last cycle. In this cycle we are very close to our target. But this outperformance can only happen if CRYPTOCAP:ETH breaks out above its previous cycle highs. Please visit my...

NASDAQ:ASML is one of the very few semis cap equipment cos. which have not broken out of their previous ATH. The stock is still at lower bound of the upward slopping channel which we have been following for a few months in this blog. IN this chart below we are following a combination of various technical indicators to see the path of least resistance for the...

Indian equity markets were the investors favorite for many years, and it did perform very well for the last 10 years. At its peak the index has generated 150% return for its investors in the last 5 years beating the S&P500 and even the tech heavy NASDAQ100. But since peaking in Sept 2024 the index has been lower to sideways for almost 12 months. The recent poor...

Within the SPDR Select Sector Retail ETF AMEX:XRT there are very few stocks which consistently outperform the ETF itself let alone the $SPX. We have time and again focused on the momentum name Sprout Farmers within the ETF. NASDAQ:SFM being a momentum stock tend to outperform the SP:SPX and AMEX:XRT on a long-term basis. But recent tariff related issues...

Arista network is a mid-cap semiconductor stock with expertise in Ethernet based network equipment’s and designed for AI workloads. It equipment’s combined with its superior software stack is well designed for this current AI based bull run we are experiencing in the market. During the April 2025 volatility spike the stock suffered a 55% drawdown hitting the 60 $...

Currently the weight loss drugs are having a severe loss of weightage in the corresponding indices. The poster child of weight loss and diabetes drugs XETR:NOV and NYSE:LLY are seeing some of the worst drawdown in their history. Today we look at the worst of the 2 in this space which is $NOV. Novo Nordisk had a lot of missed steps in the current year, and the...

We peaked in CRYPTOCAP:BTC.D chart as we predicted here. CRYPTOCAP:BTC weathering the storm: CRYPTOCAP:BTC.D close to 66%. CRYPTOCAP:BTC to 160K. for BITSTAMP:BTCUSD by RabishankarBiswal — TradingView Since then, Altcoins have shown signs of strength and CRYPTOCAP:ETH.D is bouncing back with BITSTAMP:ETHUSD at 4000 $. Please check my ...

In this space we talk a lot about the market outperformance and how this has resulted in indexes at ATH. The SP:SPX and NASDAQ:NDX and their corresponding ETFs: NASDAQ:QQQ and AMEX:SPY have also made ATHs. But if peel under the surface we can observe that very few sectors have consistently outperformed the S&P 500. The Technology sector represented by ...

First, I have to say its good to be back among friends after a summer break. A lot has happened in the meantime. In the TradFi and Crypto Markets stuffs are making ATH, and we are in a full-fledged bull market which is third year in the making. History is in favor of us. So, let’s look at the stuffs making new highs and the relative performance. Because relative...

In my opinion the most important chart in all Crypto is the $BTC.D. We have been writing and observing CRYPTOCAP:BTC.D for almost 6 months. I predicted here that we will see CRYPTOCAP:BTC dominance @ 66% before the end of this cycle. And we saw CRYPTOCAP:BTC.D touch 65.9% on June 23 as visible from the weekly chart, which is close to our cycle target of 66%....

Recently we have seen some weakness in NSE:NIFTY where it has failed to break out of the upward sloping Fib Retracement level. On June 16 we reflected upon the situation with $NIFTY. I was bullish on NSE:NIFTY due to the $DXY. TVC:DXY weakness and EM markets: NSE:NIFTY more upside? for NSE:NIFTY by RabishankarBiswal — TradingView My prediction was that...

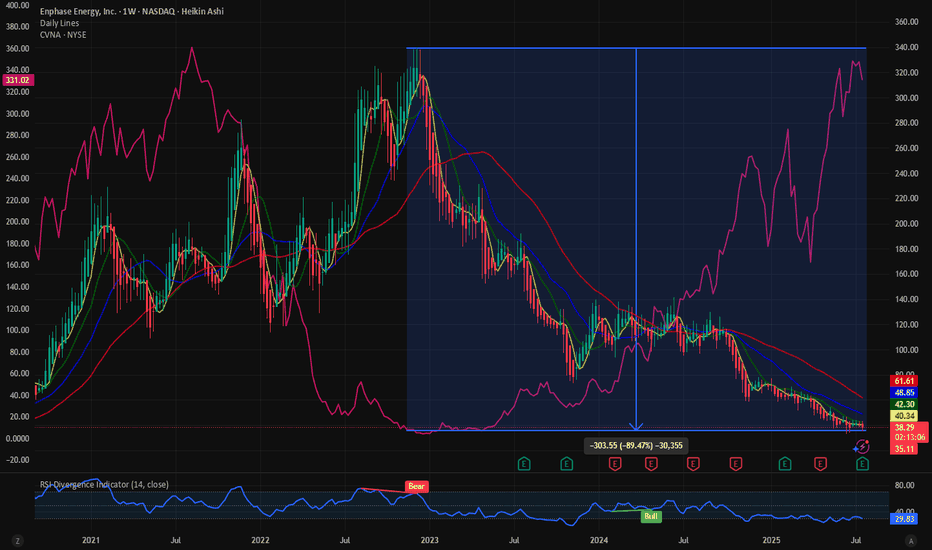

The clean energy stocks are in a serious drawdown. NASDAQ:ENPH has a very messy stock. The stock has seen almost 88% of its value wiped out over the last 2 years. But is it the end of clean energy and stocks? With the new administration in place the clean energy stock has been in a bearish pattern. In terms of the drawdown the stock looks the same as $CVNA. At...

I have been watching the Commodity markets recently keenly to get direction or for market indications. AMEX:GLD , Copper and TVC:USOIL are the big 3 which determines the direction of commodity markets and hence the inflation. Inflation dictates direction of TVC:US10Y , TVC:DXY and hence the Equity markets. So, what are commodity markets telling us? With ...

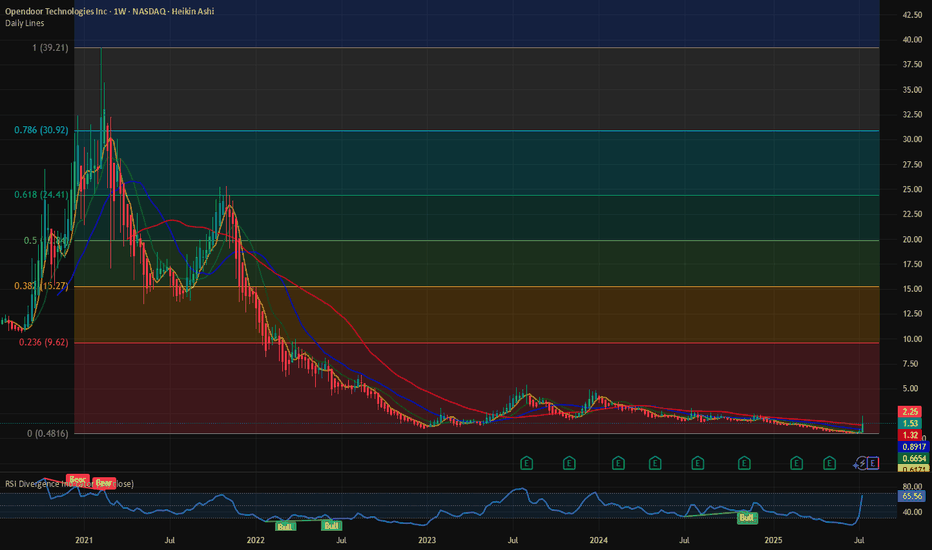

Are these the sign of a mature bull market? Drone cos, Space cos, SPACs, Biotech and Penny stocks are rallying. NASDAQ:OPEN is one such stock which hit the lowest of 0.5 $ last week before rallying more than 200% until July 18, 2025. NASDAQ:OPEN has a high short interest of almost 20% and short interest ratio is only 1.8 days to cover. Which means with 20% of...

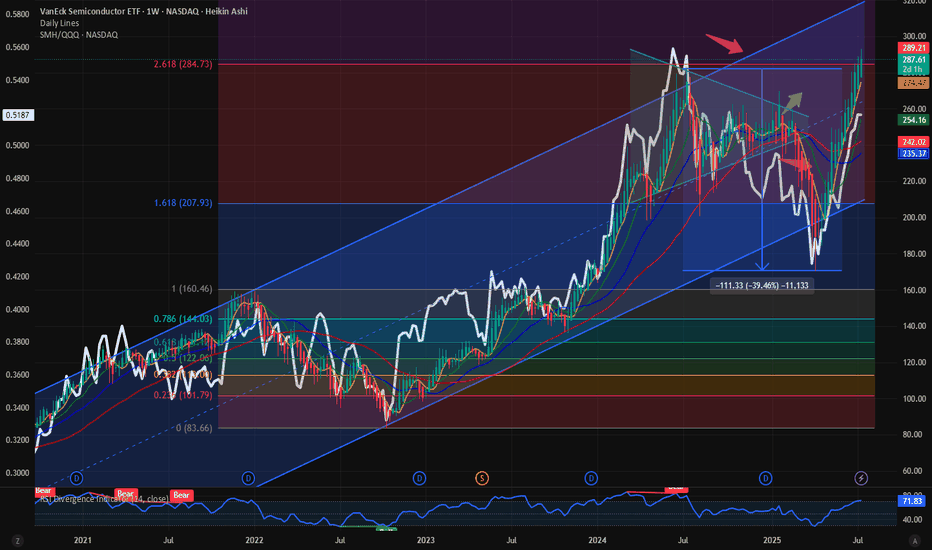

It’s the semis which are the hallmark of a cyclical bull market. It is always the Semis which indicate the start of a bull market and the first to fold over towards the end of a cyclical bull market. Hence the outperformance of Semis as a momentum sector is important from a symbolism perspective and from a market indicator perspective. When the semis outperform...

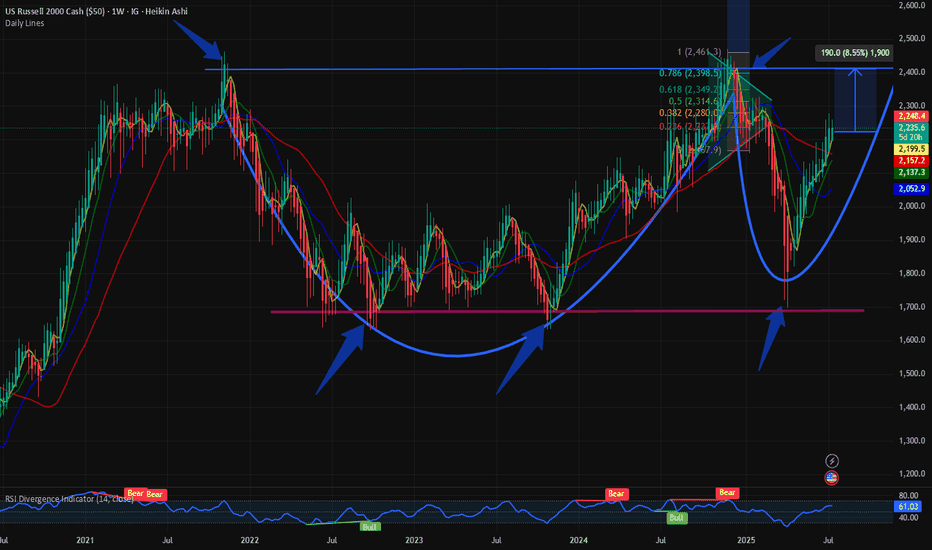

The small cap index $RUSSEL has had a good past couple of months and has bounced back from its lows. We visited the small cap index on May 1st when we identified the trend reversal. The $RUSSEL was in the recovery mode after the Liberation Day capitulation. IG:RUSSELL in a bounce back mode. But upside is capped @ 2400 for IG:RUSSELL by RabishankarBiswal —...