Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

8.03USD

437.00 MUSD

3.93 BUSD

54.62 M

About Cabot Corporation

Sector

CEO

Sean D. Keohane

Headquarters

Boston

Website

Employees (FY)

4.3 K

Founded

1882

FIGI

BBG000BF3WW4

Cabot Corp. is a global specialty chemicals and performance materials company. Its products include reinforcing and specialty carbons, specialty compounds, conductive additives, carbon nanotubes, fumed metal oxides, inkjet colorants and aerogel. The company operates through the following segments: Reinforcement Materials and Performance Chemicals. The Reinforcement Materials segment involves the rubber blacks and elastomer composites product lines. The Performance Chemicals segment combines the specialty carbons and compounds and inkjet colorants product lines into the specialty carbons and formulations business. The company was founded by Godfrey Lowell Cabot in 1882 and is headquartered in Boston, MA.

Strong outlook for materials science companiesChemical and materials science companies like Cabot are going to be key players over the next decade in providing core resources to manufacturing, infrastructure, food supply chain, and energy independence for the US and other western countries.

Additionally, Cabot looks ripe for a technical breako

ForecastNotes:

Awaiting an earnings Surprise.

About CBT:

"Cabot Corp. is a global specialty chemicals and performance materials company. Its products are rubber and specialty grade carbon blacks, specialty compounds, fumed metal oxides, activated carbons, inkjet colorants, and aerogel. The company operates

Graphene technologyCabot is the leader in carbon black and graphene products development with a significant presence in China where Cabot's characteristics might make it an attractive takeover target. ATHLOS™ carbon nanostructures (CNS) are a unique network of crosslinked carbon nanotubes produced using a proprietary

$CBT with a neutral outlook projected The PEAD projected a neutral outlook for $CBT after a positive under reaction following its earnings release placing the stock in Drift A

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

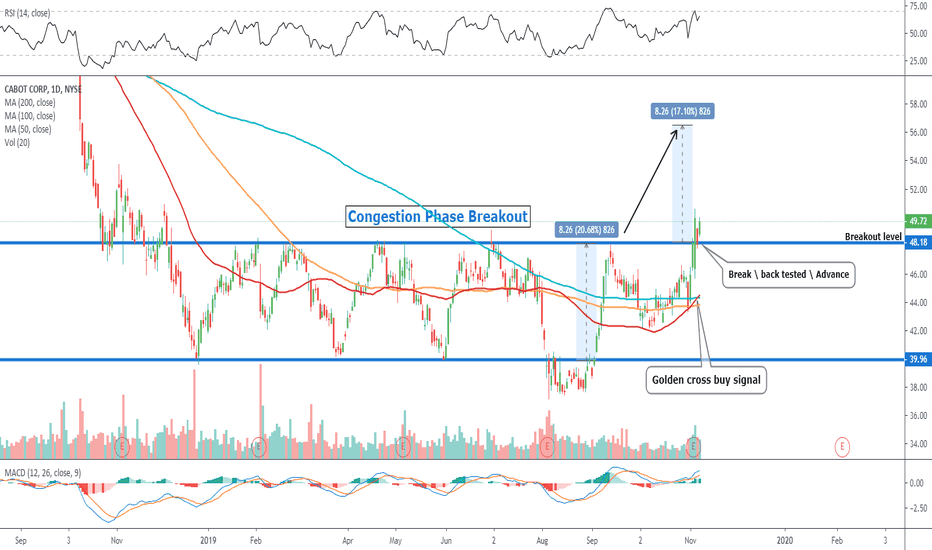

$CBT Golden cross signal in Cabot CorpEntry level $50 = Target price $56

The fundamentals may not be particularly strong but the technical set up is.

The golden cross is a much sought after buy indicator, added to that the stock is breaking out of a 1 year congestion phase, technically the next step higher such replicate that range.

C

CBT, Cabot Corp. - Rectangle ready to BreakoutNYSE:CBT

What would I do when the price comes close on these two clear levels?

I will be on the side where the statistic gives favorable results.

If you are curious soon you will receive information that you can use to learn how to trade in the financial markets.

Trading is not particularly difficu

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of CBT is 101.91 USD — it has increased by 0.08% in the past 24 hours. Watch Cabot Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Cabot Corporation stocks are traded under the ticker CBT.

Cabot Corporation is going to release the next earnings report on Aug 5, 2024. Keep track of upcoming events with our Earnings Calendar.

CBT stock is 1.46% volatile and has beta coefficient of 0.99. Track Cabot Corporation stock price on the chart and check out the list of the most volatile stocks — is Cabot Corporation there?

CBT earnings for the last quarter are 1.78 USD per share, whereas the estimation was 1.66 USD resulting in a 7.19% surprise. The estimated earnings for the next quarter are 1.73 USD per share. See more details about Cabot Corporation earnings.

Cabot Corporation revenue for the last quarter amounts to 1.02 B USD despite the estimated figure of 1.04 B USD. In the next quarter revenue is expected to reach 1.02 B USD.

Yes, you can track Cabot Corporation financials in yearly and quarterly reports right on TradingView.

CBT stock has risen by 6.66% compared to the previous week, the month change is a 5.62% rise, over the last year Cabot Corporation has showed a 50.93% increase.

CBT net income for the last quarter is 84.00 M USD, while the quarter before that showed 50.00 M USD of net income which accounts for 68.00% change. Track more Cabot Corporation financial stats to get the full picture.

Today Cabot Corporation has the market capitalization of 5.64 B, it has increased by 0.71% over the last week.

Yes, CBT dividends are paid quarterly. The last dividend per share was 0.40 USD. As of today, Dividend Yield (TTM)% is 1.57%. Tracking Cabot Corporation dividends might help you take more informed decisions.

Cabot Corporation dividend yield was 2.22% in 2023, and payout ratio reached 19.91%. The year before the numbers were 2.32% and 40.88% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, CBT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Cabot Corporation stock right from TradingView charts — choose your broker and connect to your account.

As of May 10, 2024, the company has 4.30 K employees. See our rating of the largest employees — is Cabot Corporation on this list?

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Cabot Corporation technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Cabot Corporation stock shows the strong buy signal. See more of Cabot Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.

We've gathered analysts' opinions on Cabot Corporation future price: according to them, CBT price has a max estimate of 121.00 USD and a min estimate of 95.00 USD. Watch CBT chart and read a more detailed Cabot Corporation stock forecast: see what analysts think of Cabot Corporation and suggest that you do with its stocks.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Cabot Corporation EBITDA is 735.00 M USD, and current EBITDA margin is 17.12%. See more stats in Cabot Corporation financial statements.