Friends,

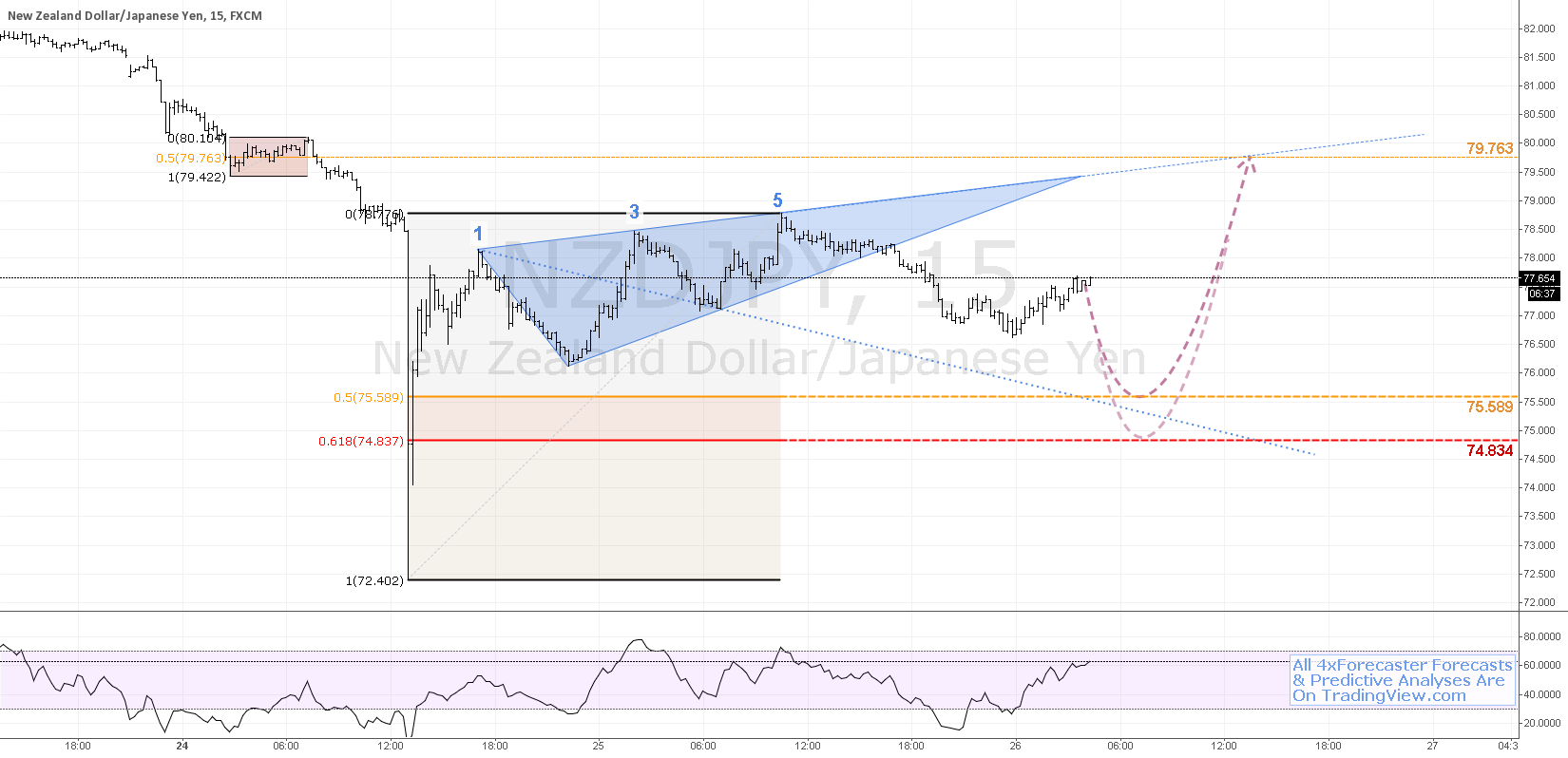

As the $NZDJPY trade is well on its way (although, we are not assuming that it will reach targets, but only that we are moving along with the probability that it would do so - See its analysis and step-by-step developments here: ), we are now turning to another potential short.

Whereas the $NZDJPY was heavier on basic technical conditions (Fibonacci levels), as well as a few occult geometric concepts (nodes, nodules ... Feel free to Google these terms, as well as E.A.G.L.E. if you like to discover these concepts), the case of the $USD vs. $TRY is a bit more involved and complicated, since we are looking at the Geo.

What I would like to do here is to raise a few challenging questions, and after a few minutes, provide a simple and logical answer within the thread, hopefully keeping things as simple, linear and interesting as possible.

I am not interested in being right. I simply follow the rules that I have defined for the Geo, and I stick to the rules that are imposed by the developing Geo. It's that simple. There is no opinion, just objective data which you too can assimilate, ingest and regurgitate. Yum.

Let's start with a BLANK chart of $USDTRY ...

See you below.

David Alcindor

Predictive Analysis & Forecasting

Durango, Colorado - USA

------

Twitter:

@4xForecaster

LinkedIn:

David Alcindor

-----

.

As the $NZDJPY trade is well on its way (although, we are not assuming that it will reach targets, but only that we are moving along with the probability that it would do so - See its analysis and step-by-step developments here: ), we are now turning to another potential short.

Whereas the $NZDJPY was heavier on basic technical conditions (Fibonacci levels), as well as a few occult geometric concepts (nodes, nodules ... Feel free to Google these terms, as well as E.A.G.L.E. if you like to discover these concepts), the case of the $USD vs. $TRY is a bit more involved and complicated, since we are looking at the Geo.

What I would like to do here is to raise a few challenging questions, and after a few minutes, provide a simple and logical answer within the thread, hopefully keeping things as simple, linear and interesting as possible.

I am not interested in being right. I simply follow the rules that I have defined for the Geo, and I stick to the rules that are imposed by the developing Geo. It's that simple. There is no opinion, just objective data which you too can assimilate, ingest and regurgitate. Yum.

Let's start with a BLANK chart of $USDTRY ...

See you below.

David Alcindor

Predictive Analysis & Forecasting

Durango, Colorado - USA

------

Twitter:

@4xForecaster

LinkedIn:

David Alcindor

-----

.