What is a breakout? #breakout #Candlestick #TA #Tocademy

Hello. This is Tommy.

The lecture material I prepared today is a concept that must be well informed by TA(Technical Analysis) traders, especially in recent market where untraditional patterns, price actions and trends, as we call ‘scam moves’ occur all the time.

I bet you are familiar seeing retail traders or chart analysts shouting “breakout!”. In order to derive market trends and price action/momentum, we find millions of technical variables such as trendline, channel, Fibonacci retracements, pivot levels, and other indicators, etc. Then we seek for behavior of price action by observing whether these variables are kept valid (not broken) or become invalid as soon as they are broken. Understanding and utilizing this behavior, we make trading decisions by deducting optimal zones to enter position(support/resistance), set stoploss/target price(bottom/top), and statistically giving weights on particular scenarios.

In TA world, breakout means that the price has pierced through certain variables. It is commonly known that when the technical factors are broken, additional price momentum is expected towards the direction of the breakout. As the example above, let’s say that we found a falling trendline that are being formed, meaning that at certain point or area, trendline keeps pushing the price down forming LH(Lower High)s. As soon as the price pierce through the trendline, meaning that the trendline failed rejection, we say “trendline is broken above” and can expect more bullish rally. The direction of the trend would be vice versa when trendline under the price is broken below.

So, we buy when PA is broken above and sell when PA is broken below. That sounds so simple huh?

If it was that easy, everyone would be rich right now. I'm sure most of you reading this post are already aware that it's never easy. Why? It’s simple. In this world, there is no such thing as 100% “breakout”. To put it simply, everything we do based on the technical chart is somewhat relative, abstract, and subjective concept. It’s not like breakout has 100% succeeded, or failed but rather is more like breakout has succeeded in 60~70% chance. In other words, there are more than two possible future cases when we search and utilize breakout behavior.

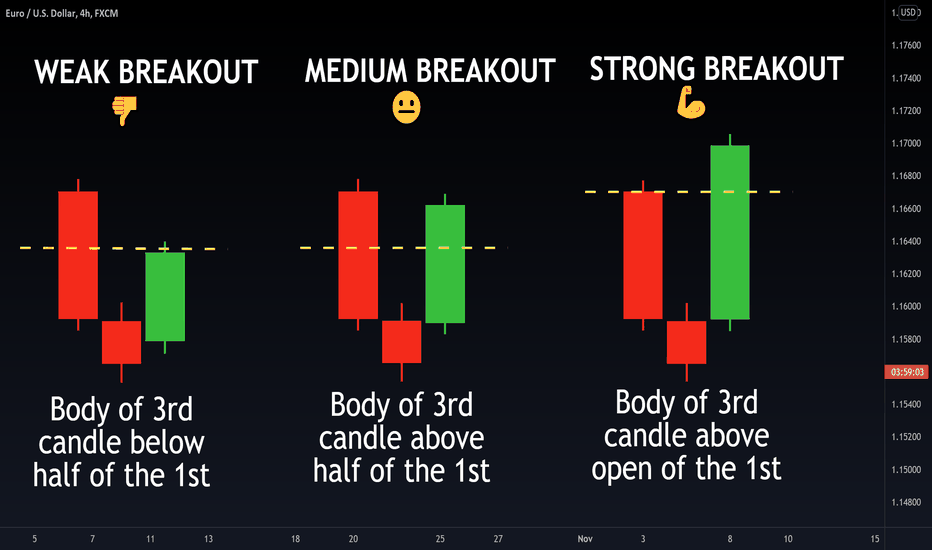

So, we traders need a reliable standard to statistically quantify the ‘degree of breakout’. The most basic way according to the ‘textbook’ is to consider closing price of candlestick firstly crossing the variable. As the price of the candlestick closes above the trendline as case 3, we give a decent weight on breakout scenario.

However, case 2 is the one that confuses us every time. This is when the price did pierce through the trendline but closes below, usually leaving a long tail as a trace which sometimes is interpreted as a whipsaw. As soon as this happens, we have to admit that the chances and reliability is definitely lower than the case 3. It might be regarded as a false breakout or a noise if the trend continues afterwards and it might not actually. It’s a 50:50 call I would say.

When you encounter case 2, to give you a little tip, try waiting a little more to observe next following candles. If the next following candlesticks keep closing prices below, I would raise the probability that the breakout is a false one. In fact, it is best to just not give any meaning on breakout in case 2. It itself is a risk to confirm whether the breakout is successful, not successfully, or false and thus try not take aggressive trades in this very case.

Thank you for reading my posts. Trade Well!

Your likes, comments, and subscriptions are the greatest motivations for me to upload more posts.

Breakout

Angelfish Pattern - BullishWhen a triangle has a saturation of candle touches on its upper narrow side it usually breaks towards that side.

For example if one side has been touched by the candles twice as many times with higher density on the right narrow side, the price action tends to break out of the triangle on that side.

Success rate 80%+

BTCUSDT: Understanding a breakoutHello traders!

This is great advice for you traders and it will make you a profitable trader so read and understand the truth.

I am teaching you guys that breakout never works and to make money you should do the opposite of breakout. I already have posted an education post of the breakout but I am posting one more time.

If there is a bullish breakout go for a sell, if there is a bearish breakout go for the buy.

Trading is a game of probability. The winning probability of selling the bullish breakout is 5 out 6 times. So it's always good to try your luck on a better probability option.

My recent wins on this method were 45 out of 50 trades and my account grew 10 times in a two week using 10x leverage.

People may call it a fakeout but in reality, it's not a fakeout but it's the true nature of the graph.

Ask the questions in the comment section, hit the like button for support and follow to stay connected.

How To: Find Stocks at the START of an UPWARD move.This video will show you a VERY simple way to find stocks that might be at the start of a new upward trend.

Video covers:

1. Change your chart from a line chart to a candlestick chart

2. How to add a Simple Moving Average indicator and customise its settings

3. How to setup and add columns in the TradingView Screener

4. How to find stocks where the price has just crossed above the 20 Day Moving Average

5. How to create a TradingView Watchlist

6. How to add these stocks to the Watchlist and keep track of them over the next few days to see if they are trending up

Tips:

- Don't forget to save your columns (on the left drop down in the screener) and your filters (on the right drop down in the screener)

- I tend to look for stocks where the Moving Average is starting to point up to show that the overall trend is up, and not simply a blip

- I also like to add the RSI to look for stocks where the RSI is pointing up and between 45 and 65.

This is just a very simple example, but the demonstration of how to use some of the tools above might give you some of your own ideas and help you apply them to your own trading style.

Like and subscribe if you found the video or any of the described functionality within useful :)

Father of all strategiesHello traders!

This is a detailed and most importantly a correct analysis of the previous pump and dump.

There is always a reason behind everything and there is also a reason behind this whole formation. There is a complete cycle that forms before this formation and this formation is a reaction of that cycle.

Let's talk about this formation

After a deep search, I have figured out that the market never leaves any Support/Resistance untested and if it happens then we will see this type of formation and when the formation is completed we will see the market will move back to that untested Support/Resistance.

(Tip 1: You can trade every breakout but on the opposite side of breakout because the market always show retracement after the breakout)

At the start of this Formation the time the first pattern we see is a 'J' pattern.

Now, what is the J pattern?

'J' pattern is itself a reversal pattern only if it is formed above the support area but in this case, 'J' pattern is not connected with the support area so it kept pushing up.

The Next pattern after J is a correction/consolidation pattern and in total, we will see 3 consolidation/correction patterns in this formation.

(Tip 2: After every breakout there is a reaction pattern and 5 out of six times market moves back after a breakout so follow tip#1)

After the 'J' pattern the second pattern is an Expanding triangle and if you are aware of this pattern then I must tell you that you were always taught wrong because you must be taught that trade towards the direction of the breakout and it's a wrong way. As I told you 5 out 6 times market moves back after breakout and you can see the charts yourself. So trying your luck on 5 out of 6 probability is better than trying your luck on 1 out of 6 probability.

(Tip # 3 is don't be fooled and follow tip # 1 and always use stop-loss to save yourself from unwanted loss and save your account for new trades)

The third and final pattern is a correction breakout without any reaction pattern and this is a pattern that pushed the Bitcoin back to the pavilion.

Happy new year guys and I hope you will make millions in the year 2022.

Don't forget to hit the like button and follow to stay connected.

supports and resistances and how they convert ✔First of all lets start with the brief technical explanation and after that go through the analyse DOGE ✔

1 support( an imaginary line, level or area )

👍one of the most simplest technical tool that use for indicating the proper point for buyers to enter or purchase one stock

for using support line

we need more than tow price points that an asset doesn't fall below more than those points and using line to connect them

2 resistance ( an imaginary line, level or area )

👍unlike support line investors use it to figure out the place for exit or selling one stock

and for using resistance

exactly like support line we need more than tow price points and one line to connect them but we should pay attention to this point that asset doesn't ascend above those points

⏲how support and resistance line convert to each other ⏲

👍support and resistance can easily change to each others in simple word when acceptable penetration of the price happen in one line for next price hit (be touched by the price ) this line act as an opposite function

for example we have strong support area if the price stand below this line and stay away for awhile for next time when the price become close to this area it will works as a resistance for the price

3 breakout

👍usually indicates new trend

when the acceptable penetration happens by the price to one support or resistance in indirect way

for example we have strong support line and the price start to stands below the line and continue its movement here we have breakout

you can use horizontal line at the left corner of your charts at trading view for indicating your supports and resistances.

or using other tools like Rectangle or Ellipse and indicate support or resistance zone instead of simple line.

🚀🚀analyse of idea🚀🚀

here we have important daily trend line and strong support area 💣

so

If the price breaks this trend line and price stay above this line we expect gain for the price

and

our noticeable resistance line and our next target are located on the chart.

This is not financial advice, always do your own research.

🐳MAD WHALE🐋

Breakout Trading | 7 Steps to Follow 📝

Hey traders,

Breakout trading is one of the most popular trading strategies.

Being quite simple in theory, it remains quite complex and complicated in practice.

In this post, we will discuss 7 steps every breakout trader must follow.

💬And just in brief about a breakout trading itself:

this method aims to spot a key level (it might be horizontal support/resistance or a trend line) and then to trade its occasional breakout assuming that it will trigger an impulsive move.

1️⃣No surprise, the first task of a breakout trader is the identification of key levels. Preferably these levels should be spotted on weekly/daily time frames.

2️⃣Once key levels are spotted, a breakout trader should patiently wait for the test of one of those. His goal is to wait for a breakout.

In that step, many traders fail. The problem is that in order to confirm the breakout, one should have strict & reliable rules to follow. The rules that describe a confirmed breakout.

*I apply the following rule: the breakout of a level will be considered to be confirmed once the candle closes above/below the structure on the highest time frame where the structure is recognizable.

3️⃣Once the breakout is confirmed, the next step is to wait for a retest of a broken level. Why retest? Simply because a retest gives a better risk to reward ratio for the trade. And even though there is no guarantee that the price will retest the broken level and because of that some trading opportunities will be missed, in the long run, retest trading produces higher gains.

4️⃣Opening a trade on a retest one should know the exact target levels. The levels where the profits will be taken. Again, newbies traders make a lot of mistakes on that step. Remember that your targets must be realistic, they must be based on closest strong structure levels, not on your desired returns.

5️⃣Also, a breakout trader should set a stop loss. And again, a stop-loss level must be safe, it must be set at least below/above a previous minor structure to protect you from stop-hunting.

Stop-loss reflects the point where the trader becomes wrong in his predictions and where the trading setup becomes invalid.

6️⃣Once the trading position is opened and stop-loss & take-profit are set, one should patiently wait. There is no guarantee that the price will start falling/growing sharply after the breakout. The market may start coiling for a quite long period of time before it starts acting.

Breakout trader must be patient not allowing his emotions to intervene.

7️⃣Lastly, one should remember that his exit points are stop-loss/take-profit levels. Stop-loss adjustment in case of a position drawdown, preliminary profit-taking, and target extension are your worst enemies. Be disciplined, don't be greedy, and keep your emotions in check.

Of course, this 7-steps trading plan is not sufficient enough for profitable breakout trading. There are so many nuances on each step of the plan to consider.

However, let this plan be your initial guideline: learn & follow that and with time, keep elaborating its rules until you become a consistently profitable trader.

Are you a breakout trader?

❤️Please, support this idea with like and comment!❤️

Trading Breakouts using Pivot PointsThe pivot points, like conventional Support and Resistance levels, do not last forever. At some point, the price will break out of these ranges. We always purchase at support and sell at resistance in our range strategy. However, there are instances when the market breaks out from these levels.

Trading the Breakout, you can have a starter position (small position) once the breakout occurs and then enter heavily once the price retests the new support. In trading terms, this is called the ‘role reversal’ concept. This concept simply means the turning of ‘resistance into support’ and ‘support into resistance’ For example, when the price breaks below the support level , it is not a ‘support’ anymore; but is now ‘resistance.’

Here for example we've entered LCID once it broke out of the resistance trend line . This means that LCID is starting a trend reversal and has a good chance of starting a strong momentum to the upside.

LCID extremely Bullish

I personally prefer trading breakouts instead of "guessing" when the trade will break out. This helps us in catching strong momentum plays at the right time.

Morning Star Candlestick Pattern: Trading strategy!🌟🕯️

✳️The Morning Star candlestick pattern is a candle formation that can often be seen on price action charts. It has a bullish character and can often determine the main minimum of market fluctuations.

✳️Three candles in a figure are one of the mandatory conditions of the pattern. Nevertheless, it is quite easy to find the morning star on the chart. It's easy to make sure of this – just look at the shape and location of the “Morning Star" figure.

⚠️ The shape of the Morning Star pattern

So, the formation consists of three Japanese candlesticks. Each of them must meet certain requirements.

🔵 The first candle is a bearish one with a rather large body and the absence of wicks or their presence with a very small length (no more than 10% of the body);

🔵The second candle is with a small body or completely without it. The candle should be with small wicks. The color of the second candle does not matter;

🔵The third candle is bullish with a large body. The body of the third candle should cover most of the body of the first candle (or engulf the whole body). Also, the candle should be without shadows (ribose) or with very small shadows;

🔵There should be a gap between the central candle and the other two. But, as practice shows, it is not always a prerequisite.

❗ Location of the candle model "Morning Star" ❗

The morning star is a bullish formation. Therefore, it is located at the end of a downtrend. The central candle is the local minimum of the downtrend. After the formation of this Price Action pattern, you should buy an asset.

❗ Signal amplification of the Morning Star model ❗

🔴If the central candle was formed without a body, then the pattern gives almost 100% about the change of the downtrend to an uptrend. This model is also called the "morning star Doji" or "abandoned baby";

🔴The presence of a gap between the central candle and the other two candles strengthens the trading signal;

🔴The bullish central candle is stronger than the bearish one. But the strongest is bodiless;

The third candle completely covers the first candle;

🔴The presence of a small trading volume at the first candle and a large volume at the third candle strengthens the model.

✅ When to enter into a transaction

We enter into the transaction after the closing of the third candle. It is confirmatory in the "Morning Star" pattern. This is a kind of guarantor of the model.

✅ When not to enter into a transaction

Everything is simple here. If the pattern does not satisfy the main conditions, then we do not enter into the transaction. It will no longer be a morning star model, but something else.

❤️Friends, If you want more of these articles, like comment and subscribe❤️

Regressive VWAP Band Buffer Strategy on GC 10RRequired add-on (free): NEXT Regressive VWAP

Target market: COMEX:GC1! 10R chart

Strategy Overview:

- Long when price crosses upper band (green)

- Short when price crosses lower band (red)

- Do not initiate trades in the buffer zone (between the bands) - that is our filter

Setting Alerts:

Here is how to set price (close) crossing band alerts: open a chart, attach NEXT Regressive VWAP, and right-click on chart -> Add Alert. Condition: Symbol, e.g. ES (representing the close) >> Crossing >> Regressive VWAP >> Upper ( or Lower) Band >> Once Per Bar Close.

Why breakout never worksHello traders!

This is another educational post just to break your false perspective which will benefit you and it will also help you not to fall into the trap of uneducated traders.

I have seen traders who just make a trendline line and put a bullish arrow and say that after the breakout price will go to heaven but in reality breakouts never works and they are very far from reality.

If you buy a breakout blindly then there is only 1 out of 6 chance that you are correct. In other words, you will keep losing again and again with that strategy.

So why breakout never works?

The patterns that we see are illusions, they are not real but the market does react to the trendlines and patterns.

What I mean by the reaction is that after a breakout market forms different kinds of reactive patterns. These patterns help the market to move further up or they push the market back in the trendline and most of the time these pattern pushes the market back in the trend.

If you can figure out what pattern is formed after the breakout then you can predict easily that the breakout will work or it will fail.

Do your research and ask the questions.

Here is the tip: Selling on bullish breakouts is more effective than buying on bullish breakouts.

Volatility Breakout Trading ExplainedIn this post, I'll be taking you through a step by step guide on what the volatility breakout trading strategy is, and how you could incorporate it in your own trading style.

Disclaimer: This is not investment advice. This is for educational and entertainment purposes only. I am not responsible for the profits or loss generated from your investments. Trade and invest at your own risk.

The Volatility Breakout Strategy

- This strategy was designed by Larry Williams, a legendary trader.

- The premise of this strategy is based on trends; what goes up, continues to go up

- Based on this idea, the calculation and strategy is actually quite simple:

Strategy

- The Range can be calculated by subtracting the values of the daily high from the daily low; Range = High - Low

- Base Price, or Entry Price = Previous Day's Candle Close + (Range * K), with K being a constant of 0.6 to represent the noise ratio.

- If today's price exceeds the base price, you enter a position.

- The next day, you sell all your positions at the daily open price.

Example

- The diagram above demonstrates an example case

- We have an asset that had a daily range of $100.

- Calculating the base price, we get $1020.

- This means that if the price exceeds $1020 on the second day, we buy the asset and ride the momentum.

- On the third day, we sell all positions at the market open price.

- If the price of the asset reaches $1100 on the third day, that gives us 7.84% returns.

- If it retraces back to $1000 in its opening price, we have a 1.96% loss.

- This demonstrates that not only is the risk/reward ratio optimal, we have a statistical edge in our position because we're following the trend

Strengths of the Volatility Breakout Strategy

- Because we're trading purely based on volatility, and trading short term by selling all positions the next day, it helps us not to be swayed by market psychology.

- Trends are a reflection of market psychology, and as human traders, we can get swayed by our emotions of greed and fear

- However, through a systematic approach based on precise entry and exit points and strategies, we can ignore the noise from the market.

- Because the trend is our friend, unlike reversal trading strategies, we have a statistical edge in our position, and risk/reward ratio.

Conclusion

Implementing this strategy directly in today's market might not be as effective, but an understanding of how legendary traders approached the market back in the day can certainly help you understand what you need to do to methodically approach the market. Taking your emotions out of the game, and having strict rules and invalidation points are key to becoming a successful trader.

If you like this educational post, please make sure to like, and follow for more quality content!

If you have any questions or comments, feel free to comment below! :)

Learning Parallel Channel TrapsSometimes we can get so caught up in the fear of missing out on the breakout that we forget it could be a trap.

It is always crucial to listen to your intuition when you see these easy setups because more often than not they are more complex than they seem.

In this example, a breakout occurred and buyers put stops below the last structure, a few days later this structure got raided for liquidity.

Once the liquidity was gathered we began to see the true move to the upside.

Do you see this often in the markets?

The Breakthrough StrategyGreetings, traders! Welcome to this short, 7-step strategy lesson.

Are you new to trading? Don't worry: we're dedicated toward providing the most high-quality, easy-to-understand, and straight-to-the-point investing education to the TradingView community. This strategy lesson is beginner-friendly (we have pictures!), as we've inserted helpful links into each and every term, just in case you don't know them yet. Anyways, let's get right into the steps of this effective trading method , which we've named " The Breakthrough Strategy ":

• STEP 1, The Breakthrough:

Identify a breakout (or "breakthrough") at the most recent Support/Resistance (S&R) zone. With the horizontal line tool, if you haven't already, mark the level at which price broke: this will be your potential Entry Point (EP).

• STEP 2, The Turnaround:

Immediately following the breakout, you'll wanna see two or more consecutive candlesticks, going in the same direction of the breakout. After the streak, when you spot the first completely-formed candle, going in the opposite direction, you've found your "turnaround" point! Mark it up with a S&R line: this will be your potential Take Profit (TP) level.

• STEP 3, The Other Side:

Now, identify the most recent S&R zone, on the opposite side of the breakout zone: this will be your potential Stop Loss (SL) level.

• STEP 4, The Average:

Make sure that you have your Exponential Moving Average (EMA, 50) installed on TradingView. Is the end of it between the EP and the SL? Perfect! You're ready for the next step.

• STEP 5, The Order:

Place a Limit Order (TP, SL, and EP levels are mentioned in the previous steps). If, before price hits the Entry Point, things start to get choppy, close the pending order: it is now invalid.

• STEP 6, The Execution:

Did price hit your Entry Point? The order has been triggered —we're in! Good job, good luck, and hope for some profits.

• STEP 7, The Final Step:

"Practice makes perfect," so make sure that you backtest this method, to test it out before using it on the live market. Be sure to follow us, for future lessons which will help you significantly increase the power of this strategy!

We hoped that this helped you! We ask that you pay it forward, and share this lesson with a friend, a fellow trader, or... heck... share it with your grandmother.

“My mission is to help you see forex for what it is: it’s not ‘rocket science,’ but a simple strategy game. Get on the ‘good side’ of probability, develop the proper mindset, and you will prosper.”

— Nio Pomilia, Forex Free Press

Boxes trading strategy example. $ABNB stock.Continuing my tutorials on boxes trading strategy.

This time let's analyze NASDAQ:ABNB stock price movement.

Taking all appropriate steps as described in my first lesson:

1. Identifying long-term trend channel.

2. Finding supply and demand zones.

3. Drawing a box inside which price is moving sideways.

4. Buying demand zone bounces.

5. Watching for breakouts.

There are some curious details in this stock's price movements.

We can see there was an attempt for a breakout from the box on the session opening of July 1st. However, there was not enough volume for the move higher, so the breakout failed.

As expected, the stock reversed to go lower in the followind days.

Even though this stock is in a falling trend channel, it's very news sensitive stock.

For instance, if there are positive news regarding COVID mitigation, we could see a major breakout from the falling trend.

-----------------------------------------------------------------------------------------------------------------

Airbnb has been on my radar for a long time now. Personally, I think it's a great long-term investment and I've been buying the stock on it's way down. I believe it will be a great post-COVID play.

-----------------------------------------------------------------------------------------------------------------

Disclaimer!!!

This is not financial advise.

FCPO Identify Fake Breakout and How to Trade it?When the price is near the SnR it is where get it will get tricky...either the price want to continue the trend or reverse?

The false breakout strategy :

1. Timeframe 15min

2. Identify strong valid SnR

3. Draw the zone by pick the wick and the neck.

4. If price breakout and 2nd CS close inside the zone, it is a false breakout and entry position after 2nd CS close.

5. TP for the false breakout can be the opposite SnR.

Valid breakout strategy: Trend continuation

1. Use 15min and 1min chart for confirmation.

How to approach breakouts - best practiceThis is one of the easiest and simple ways to trade forex pairs.

I tried to describe the approach on the chart, both H1 and M15 timeframes.

ANALYSIS/ PLANNING THE TRADE:

- On the "higher" - H1 - frame we wait for a completion of a sideway move (flag/ consolidation), and note, it took 7 days to complete it, after a strong impulsive move down.

- Price makes a local extreme, may we call it a "key" level, followed by two attempts to break it. Usually, the core entry should be located at the third attempt to break the key level.

- Breakout attempt: at this time price makes a consolidation at the key level (as opposed to strong prior rejections). This consolidation usually takes a form of a simple ABC correction, that should be monitored at a lower time frame (in our case - M15).

- Core target should be at the x2 distance of the width of the H1 consolidation. Therefore the minimum risk to reward is 1:1 with a very high probability of success.

- Nevertheless, I would recommend to improve the R:R by locating a better entry with a tight stop loss.

INITIATING A TRADE

- If you are comfortable with a stop loss above the consolidation as shown on the H1 chart - blue zone - you may trade via a sells stop below the key level.

- I prefer to improve market timing (AND THIS CAN BE DONE IN REALITY) and reduce the risk - and enter with a sell stop below the m15 "flag". (Please, switch to M15 chart and check the orange zone marked at the key level).

MANAGING THE TRADE

Usually, this pattern delivers a strong move and the entry is located easily (NOTE: you have to be very patient - as the consolidation takes a week, and the confirmation is on M15 frame).

- I recommend keeping your stop loss intact for a while and track the dynamics of the Bollinger bands 20.

- taking profit at x2 distance below the larger consolidation with an entry as described above will give you R:R 4x and this should be quite a good deal.

- quite often the potential of such moves is far better then x4, this should be planned and executed within a broader context, I guess. Or by trailing your stop loss and exiting AT OBVIOUS DIVERGENCE (REVERSAL) SIGNALS.

- in the case discussed in this post I also showed the exit at the local reversal - that is the best practice of you trade Elliott wave approach - get a reversal impulse up and close the trade at the pullback in the local wave 2 by 50 or 62%.

I WOULD ASK TO PUSH A LIKE BUTTON IF YOU FIND THIS POST USEFUL.

GOOD LUCK IN YOUR TRADING!

How to use "Auto Trendline and Breakout Alert" IndicatorIn this tutorial, we will learn how to use the "Auto Trendline & Breakout Alert (Linear / Log)" indicator.

Note: You can find it in the scripts section of my profile

Auto Trendline & Breakout Alert(Linear / Log) Full-Version by BobRivera990

Overall Introduction

This indicator is the best tool for breakout traders.

Drawing and evaluating the trend lines of multiple charts in different time frames is a very time-consuming and tedious task. In addition, being aware of breakouts in the shortest possible time requires constant monitoring.

With this tool, you can draw and classify trend lines in a fraction of a second and by placing an alert on any chart, you can receive notifications about breakouts, wherever you are.

The classification of trend lines is done based on the reaction of the price chart to the trend lines and the analysis of the trading volume .

This indicator is designed to reclassify trend lines with each reaction of the price chart. These lines are classified into 6 levels and these levels are distinguished by different colors. Thus, any touching or crossing of the price chart can make a difference.

Features

This indicator is designed for use on both linear and logarithmic scales. It works linearly by default. If you are using a logarithmic chart, enter the settings menu and set the chart scale parameter to “Log”.

The indicator is equipped with the volume status tool to identify and avoid false breakouts. Note that you can't completely avoid false breakouts, but you can minimize risk and loss. I have already published volume status as a separate script.

Several filters are provided to customize alerts. You can limit alerts based on the level and strength of broken trend lines , volume status, and type of breakout (Cross-Over, Cross-Under, or both).

The last breakouts panel gives an overview of the current market situation. You can activate it in the settings menu. the figure below shows the panel:

How to setup

There are many parameters in the settings menu, but two are more important. One is “Chart Scale” and the other is the “Max Operational Range Length".

Set the “chart scale” parameter according to the chart, otherwise the trend lines drawn by the indicator do not match the price chart.

If you are using a linear chart, select the "Linear" option or if you are using a logarithmic chart, select the "Log" option.

Max Operational Range Length Limits the range of the price chart that is processed by the indicator.

By increasing this parameter:

The strength and durability of the trend lines increases.

The number of breakout signals decreases.

The importance of breakout signals increases.

The indicator processing load increases.

The best range for "Max Operational Range" is from 300 to 1200,Change it until you get the best view possible.

Also by changing the "Filter" parameter from 1X to 5X, you can reduce the clutter in the chart.

The following figure shows the results of correct and incorrect settings:

Use it well...

How to identify a successful Breakout?Underlying logic:

1. The price gets rejected from a level repeatedly and forms a major resistance.

2. There is an initial test of supply which absorbs some pending orders

3. The price finds a bottom and some sort of accumulation happens.

4. After the accumulation, the price tries to move back up to retest the resistance level.

5. A bull trap is confirmed when the price pierces through the resistance level but there is no follow-up move.

6. But after every test of the supply, it becomes weaker and weaker due to absorption of pending orders(already discussed in older posts)

7. The price finds a bottom again and then another phase of accumulation starts

8. Finally, the price moves up and tries to breakout above the resistance. This time the price manages to break out since the residual supply gets absorbed and it gives a retest.

9. If the breakout is successful, it will be followed by a bullish move and the volume will expand.

10. The retailers buy after the breakout while the institutions buy during the accumulation phase.

Exhibit 1: Clear breakout and clear retest

Exhibit 2: Clear breakout with NO retest of a horizontal level

Exhibit 3: Breakout with consolidation at the resistance level

Sometimes, the price may start consolidating at the resistance level. This is a positive sign because the price is absorbing all the residual supply and is trying to find the equilibrium.

There can be many more different variations, but the underlying concepts remain the same. You can read and revise this post until you master the concepts. I hope you find this post useful.

Disclaimer: This is NOT investment advice. This post is meant for learning purposes only. Invest your capital at your own risk.

Happy learning. Cheers!

@johntradingwick

How To Trade Breakouts !!Hello everyone , as we all know the market action discounts everything :) I have created this short video to explain How To Trade Breakouts , everything you need to know about this strategy is here.

First we got to understand what is a breakout but before u start using this strategy take your time and understand the information well .

so what is a breakout : a breakout occurs when the price breaks out and closes above a resistance level or below a support level

A support line can be identified by connecting the points of low and the price bouncing back up , the support line needs 2 point to be formed but I think 3 gives a stronger signal and its safer.

the resistance line is the same as the support line but it connects the highs instead of the lows and they act as the ceiling on which the market bounce down after hitting it.

Both the Support & Resistance lines can be horizontal or angled .

so when we combine the support and resistance together we get a trading range which keeps the market price in a certain range until the price makes a break either above or below.

trading ranges are formed form the supply and demand and the market phycology so when the price breaks out of the range it signals a change in the supply and demand and the beginning of an upward or a downward trend

so lets talk about the concept of a breakout

For a breakout to happened you one need a support or a resistance line u don’t need both , but having both will create a trading range which will help you take advantage for breakouts in both directions up or down .

There are several ways to trade breakouts :

1.At the actual breakout (this could be very risky in case it was a Fake breakout)

2.Using a pending order at a higher price then the market range

3.Waiting for the conformation on the breakout.

Now lets talk about fake breakouts , it happens when the price breaks past the support or resistance level and moves back into the trading range as you see here :

waiting for a confirmation is really important as u minimize the risk you are talking , this way u will lose some of the momentum of the trend but u will insure that’s the trend is going the way you want it to go.

Make sure to Follow and Like for more content

If you have any questions please ask

Thank you for reading & watching .

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 5-m time frame chart, you can see the panel of the latest breakouts on it (You can enable the panel in the settings menu):

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ⚠)

Minor volume (potential fake breakout ⚠)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.

Indicator introduction: Auto Trendline & Breakout AlertNote: This indicator will be published soon

In short, this indicator is a tool designed for different purposes:

1) Automatic drawing of trend lines

2) Classification of trend lines based on the reaction of price chart and trading volume

3) Receiving trend lines breakout alerts

4) Analyzing smaller time frames is time consuming and tedious, but this tool makes it easy. The following figure shows 2-H time frame chart, you can see the panel of the latest breakouts on it (You can enable the panel in the settings menu):

How it works?

Trend lines are classified into 6 levels, of which only 3 are enabled by default.

Level 01 (Red Lines) is the strongest level. Therefore, the breakout of these lines is the most important signal of this indicator.

Volume verification helps you avoid fake Breakouts.

As you can see, both the labels and the table show the status of the trading volume when the lines breakout.

Trading volume is classified into 5 levels:

Over volume (confirmed ✅)

High volume (confirmed ✅)

Neutral

Low volume (potential fake breakout ❌)

Minor volume (potential fake breakout ❌)

This indicator can be used on both logarithmic and linear charts. (Scale in the settings menu can be changed from linear to logarithmic)

Finally, this indicator includes a trend line breakout alert and you can be notified wherever you are. you can add alerts to different charts and enter the market in the best conditions.

If you like it, please leave a comment.