Correlation

Correlation Trading EUR/USD/ DAX/ OIL/ GOLDHey guys,

after a time of inactivity I"m back.

Today I show you how you can trade EUR/USD with the help of correlations.

You can see in the chart positive correlations and negative correlations.

Be careful the arrows on the chart are no trend direction.

If for example Oil change its direction the trend direction is turned.

But be careful with long term-trends and short- therm trend.

Always be aware of your timeframe.

(4h is short therm trading)

Hope I could be informative for you guys

Correlation EURUSD VS. USDCHFHere is my two yestarday´s levels from my Members area. ( Both ended up in profit )

Let me explain my how correlation between EURUSD and USDCHF works and how you can look at the charts.

EURUSD and USDCHF are negatively correlated (correlation almost -100%). If USDCHF falls, then EURUSD should rise. If EURUSD rises, USDCHF should fall.

This means that in similar areas there will be similar levels for trade.

HOW THIS CAN HELP ME IN TRADING?

If you consider some price level for trade make sure that is visible on other pair too... If will be significant area for long on EURUSD, make sure that there is a significant area for short trade on USDCHF too!

If there is, then you will be more likely to have a successful trade.

Happy trading

Dale

Correlation Coefficient + CCIPictured above is a graph of Royal Dutch Shell vs brent crude, the correlation coefficient between them, and the commodity channel index tracking the volume weighted moving average of Shell.

I tested this indicator on a few energy stocks: RDS, MRO, BP and XOM. Negative correlation between brent crude and an energy stock coupled with an overbought CCI seems to give an indication of price reversal. Here we see two overbought CCI readings coupled with negative correlation, both followed by massive drops in the price of BCO and RDS. Likewise we see negative correlation coupled with upward CCI readings pointing to massive price rises in RDS. Seems to work on daily time frame as well but indicator length will need to be tweaked accordingly.

Correlation coefficient going negative is an indication of pricing inefficiency and momentum potential, but does not give us an indication of price direction. The commodity channel index can give us a sense of where price momentum is pointed. Both put together give us a powerful indicator capable of foreshadowing both momentum and direction.

Trading Entry and Exit ChecklistsSELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Trading Entry and Exit checklists

Over the past 18 years of trading, it has been a crucial step in my development to constantly critique myself and my trading strategy. I constantly monitor my performance on a daily, weekly,monthly,quartley and yearly timeframe. Listed below is a small simple example of some of the checklists that i have used in the past prior to entering and exiting a trade.

Entry Rules

1. Is the stop loss placed past the strongest support or resistance line?

2. Am i following my trading rules?

3. The risk/reward is acceptable

4. Have i double checked my entry/stop loss and target position?

5. No news announcements that will affect my trade?

6. Bid/ask spread - Is it in normal range for this pair, this session, this time?

7. AM i risking more then my agreed 1%?

8. Correlation - AM i trading against myself with already open trading trades?

Exit Rules

1. Has the market behaved as predicted? If so stay on track

2. Has the trade reached the support or resistance line?

3. Has the stop been placed too far away? or to close?

4. Am i exiting to early?

5. If unsure of trade exit immediately?

6. If i was impatient and entered trade exit immediately?

7. Is there an upcoming news event that will affect my trade?

8. Is the trade changing directions?

9. Don't take profits to early!! Are you exiting before your target line?

How has yours differed? is it similar?

[DXY] Correlation with other pairsHi guys !

This is an other simple chart to explain the correlation between DXY and other pairs. As you know, the best exemple is with EURUSD. When EURUSD goes up, DXY goes down, and when DXY goes up, EURUSD goes down. This is because in the DXY (Dollar Index), there is more than 50 % EURUSD.

The U.S. Dollar Index is calculated with this formula:

USDX = 50.14348112 × EURUSD ^(-0.576) × USDJPY ^(0.136) × GBPUSD ^(-0.119) × USDCAD ^(0.091) × USDSEK ^(0.042) × USDCHF ^(0.036)

Thanks for your time guys !

Correlation continuesBitcoin and the stock market continues to correlate as news this morning started to cause markets to sell-off, which has resulted so far in a drop in Bitcoin shortly after.

We have to continue to keep an eye on this because they have been following each other closely.

Thanks guys

Gold, GDX & GLD: Correlated Markets Lead To BIG Profits! If you trade Gold, you must know that the GDX and the GLD are both derivative markets of Gold and are closely correlated since they both track aspects of Gold. So when either one of these move, then you must look to the other one's and see what they are doing, going to do or done already. They can give you precious clues as to what the other markets are going to do. In most cases, GDX and GLD are forward indicators of Gold itself.

Why do I point this out? Well, what you see in my charts is my analysis of these 3 markets and you can see that they are all closely mimic each other. Now, I follow the mantra of "Trade what you see. Not what you think". That means I look at each chart by itself and not dependent on what any other chart is doing or projected to do. But when I analyze Gold, I also do look to GDX and GLD as well and see if my independent analysis of those markets agree with what I see in Gold. But VERY IMPORTANT to keep in mind is that NO MARKET correlate 1:1 to any other market. What that means is that Gold can move 100 pips while GDX might only move 25 pts.

In any case, I'm showing you these trades that I took and issued out to my followers to illustrate this point. Just a tip for you the next time you decide to trade in Gold.

Want to know more? Look below to my signature box or PM me.

Bitcoin and S&P500 correlated more than people think! For the longest time, most people always correlated Bitcoin price to Gold price but there was a small subset of people that argued the equity market was the true correlation. As shown in the comparison chart above, we saw that the equities market began selling a few days before the cryptocurrency market given that cryptos are already down over 80-90% but this is more an analysis over global selling.

We can see that October 9th was the day stock broke the triangle and began selling heavily while Bitcoin continued to range for a few days before taking the plunge. After the DOW fell over 800 points yesterday, the crypto market was hesitant to follow suit and waited until the end of the day and into the night before selling off heavily. Some exchanges even saw price break below $6000 as volume picked up massively and volatility re-entered the market. We also got news last night that the Shanghai Composite hit new lows not seen in 4-years last night when that part of the world woke up and saw the carnage of the New York session.

Some rumors were swirling around that the Japanese were selling their crypto to cover the massive losses they were incurring on their equity portfolios, which caused the huge cascading sells in Bitcoin and rippled across the market. Some might say that a bounce in stocks might cause a bounce back in Bitcoin so keeping an eye on this correlation could be profitable if we are in fact correlated.

Thanks guys

DXY and EUR/USD - Quick education!Hey tradomaniacs,

just a chart that shows all what I wanna say. :-)

Just for those who didn`t know.

The Dollar-Index is a currency basket which compares the USD to 6 other currencys.

AS you can see, the EUR/USD has 57,6% (since 1999) of that basket and basically turns that basket into a

USD/EUR currencypair. ;-D

Just check it out :-)

Peace and good trades

Irasor

Study: Crypto Mentality Shift - Potential Bull Market Trigger?Hello and welcome to the revision of my working theory regarding market patterns in cryptocurrencies.

This analysis follows my previous write-up regarding why intra-day traders in cryptomarkets should focus on alt-usd pairs as opposed to BTCUSD, found below:

In this analysis, I focus on the 4-hour timeframe as opposed to the daily timeframe found in the original. This is due to my impression of a change in market mentality, rendered by BTCUSD's most recent upward thrust from 6,750 to 7,350. During this movement, many alt-usd pairs followed BTCUSD, although some lagged in performance. However, in the following days - as BTCUSD consolidated at the 7,300 level following a rejection of the 1.618 Fibonacci level from the previous week's range, many alt-usd pairs retraced the majority of their upward movements that mimicked BTCUSD.

I have been closely watching beta and correlation levels in this scenario, as I believe this is an important signal and should not be discounted by traders in the space.

What we are seeing is a weakening of a long correlation pattern between BTCUSD and alt-usd pairs, with a weakening beta on alts. It was always my belief that this correlation would break, as per the previous study. However, in the current state of the market, we see the correlation break favoring BTCUSD, meaning that BTCUSD is maintaining its new-found value at the expense of alts. Given this developing relationship, a strengthening BTCUSD will attract more alt-traders, while alts will continue to lose strength and therefore value. In addition to this, as the trading volume in BTCUSD has been declining over the majority of the YTD, it is very possible that we will see a large volume breakout on a daily level, which again - will be funded by declining alt coins. Overall, this would give BTCUSD a good push for further uptrend progression.

I believe that BTCUSD has a high possibility of reaching levels between 7,700-7,850 in the near term, but this will be a painful journey for alts, as traders of the previous mindset (high correlations, high betas) will attempt to push alts. I strongly doubt most alts will exceed their local highs, which were developed on BTCUSD's push to 7,350. This is simply because the alt-usd retraces seen during BTCUSD's consolidation are simply too large, which deter the confidence in the alt market. Those who did not take profit on the initial rise will be anxious to get out, keeping the selling pressure on alts strong. See chart below for my BTCUSD targets:

My theory is further reinforced through an analysis of 4-hour betas and correlations on an individual basis between large cap alt-usd pairs on Bitfinex. This collection of low 4-hour betas (SMA-smoothed on a 3-period basis) amongst the entire grouping has not been seen since February/March. If this trend continues, we will begin to see negative betas (negative correlations).

In conclusion, my theory is that a market mentality shift is taking place . Traders are willing to remain bullish in one asset class (BTCUSD or alts-usd) while the other asset class is declining. In our case, this currently favors BTCUSD. While this shift may be painful in the short term for alt-usd pairs, this is a very bullish sign for the market. This means that people are able to maintain their confidence in cryptocurrency as a whole. Previously I noted high correlation and high beta patterns, that implied that sideline money was coming into alts-usd and BTCUSD simultaneously, as well as exiting both markets simultaneously. This change implies that the money will begin to flow in a cycle, from one asset class to another, allowing the market strength to develop and gradually begin a bullish cycle.

tl;dr: Times are changing - we are potentially entering Timespan D.

Thank you :)

Study: Why you should stop trading BTCUSDHello all and welcome to my analysis of trading patterns in crypto markets!

Before we begin, there are several key assumptions we must establish:

The reference data is based on trading prices and volumes on Bitfinex. This is because I believe that Bitfinex is the leading exchange in the cryptocurrency market due to its popularity, despite higher recent BTCUSD volumes on Binance.

Only USD-based pairs are examined

The index is a dollar-volume weighted aggregate of margin-tradeable alt coins on Bitfinex, excluding BTCUSD

The correlation and beta calculations are on a 14-period basis, which are benchmarked against BTCUSD

Given limitations with the data, the index is examined only on a range from October. An second index, consisting of only ETHUSD and LTCUSD will be provided to show the longer timespan

In this snapshot, I have split the frame into three timeframes (A, B, C), which highlight a changing market dynamic over time.

Timespan A captures the peak of bitcoin's 2017 hype. The lowest correlation point is -0.65 which was accompanied by a beta of -1.65, while the highest correlation was 0.80 with an index beta of 3.44. During this span, a relatively volatile correlation (refer to the standard deviation of correlation oscillator) between the altcoin index and BTCUSD can be examined, with similar volatility patterns in the beta. The interesting component here is that, during the price rise, alts would follow BTCUSD when BTCUSD was rising, but experience inflows of money from BTCUSD when the latter was falling. As such, the market mentality was bullish - the money would flow from BTCUSD to alts and then back around. By examining the index beta over this period, you can see how alts outperformed BTCUSD when times were good and when times were bad.

Timespan B begins to paint a different picture, where the volatility in correlation and beta measurements is far less drastic. Over this span, the lowest correlation was 0.28, showing that directional movement between the index of altcoins and BTCUSD remained positive, even when weak. It is important to note the longer duration of high correlations during this period, which were accompanied by similar movements in beta.

Timespan C is where we currently are and, in my opinion, this is a very interesting setting in the market. As the chart shows, the lowest correlation was 0.50, while beta almost consistently remained above 1. The standard deviation of correlation had been only trending downwards from Timespan A , which is reflected in the relatively consistent correlation measurements over the period. The conclusion to be made is that altcoins, in aggregate, have become strongly correlated to BTCUSD, while a beta above 1 indicates higher performance in alts than BTCUSD.

TL;DR: chart BTCUSD and trade altcoins based on BTCUSD momentum. As the statistics show, the market mentality has shifted away from moving money from one crypto to another, but rather buying/selling alts and BTCUSD simultaneously.

Furthermore, we can examine a longer timeframe in the chart below:

In this chart, the correlation and beta, as well as the standard deviation of correlation, are based on a dollar weighted aggregate of ETHUSD and LTCUSD, which were the longest standing altcoins on Bitfinex. The narrative described above remains the same, where the correlations have become far stronger in recent times compared to their historical trends, while the beta has become stronger over time, gaining more ground above a measure of 1 during the high correlation periods.

The final point is an examination of dollar volume in BTCUSD compared against altcoin dollar volume:

As can be seen from the chart, the dollar volume in BTCUSD has been losing ground to the dollar volume in USD-based alt pairs (on Bitfinex)

correlation myths and mysteries, crypto doom of asicsSo back to basics, without any background in economy, financial trading, except experience, logic and an analytical mindset.

by overlaying S&P 500 with btc, you see that both move in similar ways, with S&P slightly leading BTC.

does this mean we can predict btc's direction with S&P 500 as guideline? guess not as they are totally not coupled.

S&P relates to bussiness and the trade in big players in the economy of the world.

BTC has no direct relation to the real world, it is in some sense tied to certain Fiat currencies, as btc is the main value being used in the crypto currencies trading platforms. High activity on the overall crypto market, causes btc to move its needle.

But there are obviously other factors at play too. big holders can move the needle as well. with the majority of BTC hashrate in china, and the fact that the main BTC pools are also in chinese hands, means that they have a leverage that is disproportionate, and they are capable of moving the BTC needle in whatever direction they want.

just an imaginary scenario, say all the big BTC pools dump their holdings in a fell swoop when price rides high.. you evaporate billions of value. which will impact the economy.

would a spread portfolio over multiple crypto currencies help? No it will not, look at the historic graphs overlay btc with any other coin, you will see that they rise and fall with BTC, some magnified, some reduced, but if btc drops to 1$ some day... the rest of the coins will be a fraction of that.

doom scenario .

that is why it is important to support asic resistant coins. XMR did a good attempt, but I am afraid the changes are not big enough to deter the asic builders. asic design used to be very expensive, nowadays its not the case anymore ROI is reasonable if you can have a few months of runtime out of your asics. which typically use low power, combined with high hashrate. ( 10-20x compared to best ( and expensive) GPU's at a fraction of the power)

try to run 10TH/s btc with GPU cards, calculate the power draw including cooling and aquisition cost... system board 100$ GTX1080ti 1000$ * n ( 4GH/s per card : n=2500) =2.5M$ gpu's with around 450 KW of power which also needs cooling. with cheap electricity -> .01 $ / KW -> $4,50 per hour :), this leads to a loss of $4,25 per hour, aka as a yearly loss of $37K with ROI to infinity.

then compare to a antminer of similar performance, look at the power draw including cooling ( running cost) and aquisition cost

example Antminer T9+ 10TH/s -> 1406W... hourly profits : 0,24$ yearly $2075, break even in 201.9 days.

so the question is, has S&P been influenced by BTC manipulations or does the S&P influence btc ( macro economic behaviour)

to be continued

correlation between BTCUSD and USD index?after scaling DXY by quite a bit there is noticeable correlation with BTCUSD - my other chart tries to "decrease" the DXY influence (which in such case may actually be pretty big, for whatever reason) from the BTCUSD chart.

What I'm trying to say in other words is that regardless the fact BTC value expressed in USD has it's own path in time which is pretty volatile and mainly going up for number of years, with the progressing adoption amd new players coming in it may become pretty sensitive to US Dollar strength recent months.

Is there correlation between two economies? The line graph is EUR/USD & Candles USD/CHF

This is a common pair that traders say is inversely correlated...

Is there correlation between economies? Is it because of USD's part?

Will correlation make you the good R/R trades or structure?

Is there a way to trade the correlation (if any) effectively?

Draw your own conclusions & have a good weekend!

Prediction of the S&P500 and NIkkei based on financials and CPIIn the following content i will explain how you can forecast the market with CPI (inflation) and Financials:

If we look at our figure we can say a few things, i will assume them below:

1. ABN AMRO (a dutch Financial) is highly correlated to the NIKKEI225 index.

2. Since nearly May 2016 we can see that the CPI (inflation)-chart has change 5 times. If we look at the Nikkei225 index we can see a few things: when the inflation in the US rose, the Nikkei225 fell 4 out 5 ( a chance of 90% or mathematical: a chance of 0.900). Using maths we know that ABN AMRO has an statistic correlation of 0.70 < r < 0.90 (70% - 90%) to the Nikkei225.

Conclusion: The fInancials are following the NIkkei225, and in turn the Nikkei is following the US CPI (inflation) in a divergence/opposite movement.

3. We can use the inflaton from the US as a staircase for the movement in the S&P500 (on this moment a consolidating market)

Sources: Bloomberg Markets, ING Technical Analyses

NOTE: I don't make any predictions, making decisions based on my reports is at you'r own risk!

Correlation Trading - How to Trade Forex With Little to No Risk!Tonight we did a live stream on YouTube offering an in-depth explanation of correlation trading. You can watch the stream back in its entirety here www.youtube.com

Below will be a written explanation of correlation trading utilizing the AUDJPY vs. NZDJPY as the example:

Correlation trading is an amazing way to add diversification to your trading portfolio and in your trade plan. You can continue your trading plan and strategy but take advantage of correlation trading opportunities as they arise to increase your ability to profit from the forex market. In correlation trading the objective is to find currency pairs that are highly correlated, meaning that when one pair moves in any given direction the other pair also moves in that same direction. A great example of this would be the AUDJPY vs. the NZDJPY. Over the past year the correlation between the two pairs has been very positive, 92% of the time over the past year the two pairs have been moving in sync with one another. This correlation can be confirmed by using the Oanda correlation chart:

Once you have confirmed that you are looking at two pairs that are highly correlated to one another, you will want to then look into the charts and compare the price action over the past year. TradingView makes this very convenient with the ability to overlay charts. When we overlay the NZDJPY chart on the AUDJPY chart (candlesticks=AUDJPY, bars=NZDJPY) we can clearly see the times of the year when the two pairs were moving very much in sync and the times where the correlation cracked a bit and the two pairs moved oddly in opposing directions.

It is during these times when the correlation cracks that provides us with the immensely profitable and essentially risk free trading opportunities. If you notice on the chart throughout the past year you will see highlighted in yellow boxes all of the times when the correlation has cracked and a gap has formed. We can look at these moments and estimate the average maximum gap in correlation and use this information to gauge when to take a correlation trade on this pair.

You will notice every time the correlation has cracked and a gap in price action has formed, price inevitably moved back in correlation narrowing and even closing the gap You will also notice if you look back at the widest portion of the gap from every time there was a crack in correlation that it has been roughly anywhere between 400-500 pips . If we look at the second to most recent gap in correlation that we have labeled on the chart you will notice that at its widest point the gap in price was roughly 600 pips; the high being at 85.500 and the low being at 80.700. If we were watching this occur as it was happening and we noticed the gap in correlation approaching 400 pips and then 500 pips and then 600 pips, forming the widest gap in correlation all year, we could then look to take a correlation trade between these pairs.

In this given example around 3/11/16 we would look to take equal positions of long NZDJPY and short AUDJPY banking on the fact that the gap in correlation should statistically, with 92% likelihood, narrow and potentially even close completely so that the two pairs are moving back in correlation with one another. You will see that if we did this we covered on 3/30/16 we would have netted ourselves a fruitful profit of 300 pips. Our short position in AUDJPY would have been down about 20 pips or so but our long in NZDJPY would have been up about 340 pips.

This profit came with little to no direction risk because as one position goes against you the other statistically should go in your favor and if you are not netting a profit at any given moment your loss should be simnifically reduced as compared to what it would be if you were only holding the losing position.

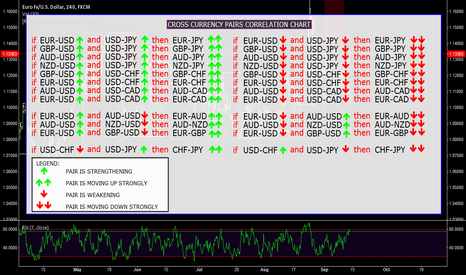

CROSS CURRENCY PAIRS CORRELATION - ADVANCED ANALYSIS Hi all, I wanted to share this chart with you - I am hoping it works when I publish it and the arrows stay inline with the text - something very interesting we all know about currencies moving in tandem with each other to some degree different economic events causing them to stop moving together but eventually they will again.

As a forex trader, if you check several different currency pairs to find the trade setups, you should be aware of the currency pairs correlation, because of two main reasons:

1- You avoid taking the same position with several correlated currency pairs at the same time and so you do not increase your risk. Additionally, you avoid taking opposite positions with the currency pairs that move against each other, at the same time.

2- If you know the currency pairs correlations, it may help you predict the direction and movement of a currency pair, through the signals that you see on the other correlated currency pairs.

If you would like more information describing the affects - reply with a short note and I will paste a URL

Non Charting Tools for Forex TradersI am listing the tools I use daily, during my trading schedule, when I trade the Forex market. I am using general descriptions in this list since I am not endorsing any particular paid service, or website.

Tradingview

A high quality charting platform with all the price charts and many powerful yet intuitive tools. Every single trade I take I chart it here first, marking exact entry, exit and stop loss levels. Some of my potential trades I publish, some I keep to myself. The forex chat is a great “tool” to share views on the market in real time and get other opinions to see if I missed anything.

Execution Platform

I see brokers as a necessary evil and use mine only to execute my trades. I don’t use its charting package, newsfeed, calendar, signals, expert advisors or anything like that. As soon as Tradingview will provide chart trading where we can select a broker of our choosing and execute our trades straight from the charts, this tool can be eliminated.

Economic Calendar

Even if you are a 100% technical trader and don’t take any news into account, at least you would know when major news events are happening (NFP, FOMC rate statement, etc) that could impact your trades, so you might want to stay out of the market. For traders who do take fundamentals into account, it provides you with the previous period and the expectation for the data to be released. It helps to build the picture for how events may move the markets. There are several to be found, find one that suits you.

Premium News Service

This is a feed of headlines that will inform you in real-time on what is happening in the markets. If a pair suddenly moves fifty pips, this news service will tell you why this is happening. The audio feed is the fastest so with urgent news you will not miss out. With un-planned news events this is essential. It’s a paid service and there are several on the market, I am not endorsing any in particular but am using one myself and I am always in the know.

Market Background News Sites

These are websites / financial blogs with markets news, background stories and editorial opinions that differ from the real time premium news services in that the articles are more research based and provide a deeper understanding into fundamental drivers behind the markets and how market players are positioning themselves. I usually read up on them once a day before I start trading. There are several good websites to be found.

Currency Correlation Overview

Pairs don’t move completely independent of each other. Trading highly correlated pairs simultaneously can increase your overall risk or eat your profits. Before entering a potential trade, I crosscheck the currency correlation of that pair with my already open trades (if any) and if its highly correlated (either positively or negatively) to one of them, I do not enter the trade. Since correlation differs per timeframe and changes over time, I use a real time online source.

Position Size Calculator

The difference in pips between entry and stop loss (pips at risk), your equity size and the trade risk you allow as a percentage are what you need to calculate the position size that does not exceed your risk tolerance. You can create a spreadsheet where you calculate this yourself for each trade, you can also find an online position size calculator and some brokers have this feature built into their interface. Regardless how you do it, this will be an essential tool.

Forex Cheat Sheets

I have created cheat sheets with overviews of all candlestick formations, basic and advanced price patterns, key Fibonacci ratios, etc. They help to quickly validate potential trading opportunities. Nowadays I hardly use them anymore, but I still have a hard copy on my desk just in case and they certainly helped me a lot as a beginning trader. I like the feeling that if I need to check a pattern, I have the information easily accessible at my fingertips.

Currency Correlation, Does It Matter?Currency correlation measures the extend in which two individual currency pairs move in the same or in opposite directions. It´s usually expressed as a percentage, from -100% to +100%. Positive correlations (from 0% to 100%) indicate how much two pairs move in the same direction. Negative correlations (from 0% to -100%) indicate how much two pairs move in opposite directions. As a general rule of thumb we can say two pairs are very highly correlated if the correlation is either -80% or lower (highly negatively correlated) or 80% or higher (highly positively correlated).

In my trading plan (see link to this publication under Related Ideas) I take currency correlation into account. I use a fixed fractional money management system and the risk per trade is a stable % of my trading capital. Before entering a potential trade, I crosscheck the currency correlation of that pair with my already open trades (if any) and if its highly correlated (either positively or negatively) to one of them, I do not enter the trade, even if the setup itself is valid. This is a sometimes fiercely debated topic in the forex chat and I have seen members and traders with very different opinions on it.

Some say I am crazy for doing this check, because I deliberately pass on valid trade setups this way and I could make more pips if I would just ignore correlation and always trade an opportunity when it present itself. “Think opportunity!”, they say. Others are even bolder and claim I should deliberately look for highly correlated sister pairs and always trade them both at the same time. “Double your profit in almost any trade!”, they proclaim. And then there are traders who believe I should already exclude a potential trade setup, if it’s moderately correlated (40%) to an open trade. “Anything above that % is too risky!”, they say.

Here is my reasoning:

Highly positively correlated pairs

If I were to buy or sell two highly positively correlated pairs, I would basically be doubling up on my position in one of them, since both pairs move in the same direction. I would not really get two independent chances to win or lose a trade; I would get only 1 due to the very strong correlation. In doing so, I would be doubling my traderisk, which would be a breach of my risk management rule.

Highly negatively correlated pairs

If I were to buy or sell highly negatively correlated pairs, I would basically be hedging against myself (since the two positions would cancel each other out) so the profit of one would be eaten by the loss of the other. The only exception here could be a higher timeframe trade on one of the pairs with a scalp on a lower timeframe on the other, to benefit from both timeframes.

A common misconception is that pairs with the same currency either as the base or as the quote are always highly correlated. Like EURGBP would be highly correlated to EURJPY, since buying those pairs would in both cases mean buying the euro. This is not always the case. Not only the base currency Euro has an effect here, the quote currencies Pound and Yen have an effect as well and those move independently of each other. So correlation is not fixed, it is different per timeframe (correlations on the 1h might not be in line with those on the daily) and it changes over time as well. That is why I use a real-time source to determine the correlation between two pairs on a particular timeframe. There are several sources to be found on the internet, I don’t want to endorse any trading website, but Google is your friend.

Pairs don’t trade completely independent of each other. And trading highly correlated pairs at the same time can increase your overall risk or eat your profits. All in all, I would say currency correlation does matter and its best not to ignore it. It can help you to manage your portfolio.