S&P 500 E-Mini Futures

S&P Futures Trading Day 95 — The 6925 Support Trap & RecoveryEnded the day +$488.00 trading S&P Futures. I started the session on the back foot, forcing a bearish bias that got completely punished when the 6925 level held perfectly. In hindsight, the chart was telling me to stay bullish until that level broke, but I let my bias cloud my judgment early on. Luckily, I was able to reset, trust the algo signals, and scalp my way back from the red to profitability by the end of the day. A solid recovery after a messy start.

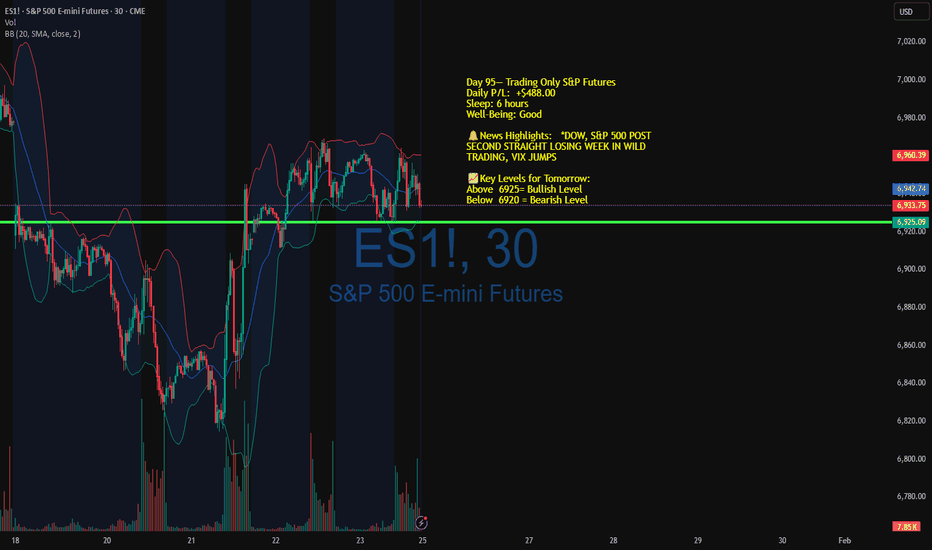

Day 95— Trading Only S&P Futures

Daily P/L: +$488.00

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: *DOW, S&P 500 POST SECOND STRAIGHT LOSING WEEK IN WILD TRADING, VIX JUMPS

📈Key Levels for Tomorrow:

Above 6925= Bullish Level

Below 6920 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

9:00 AM NQ Market flipped bearish on VX Algo X3!

9:36 AM MES Market Structure flipped bullish on VX Algo X3! :check~2:

10:00 AM ES1! Phase Change: Bullish :check~2:

10:00 AM NQ Market flipped bullish on VX Algo X3! :check~2:

11:27 AM VXAlgo ES X1 Overbought/toppy Signal, :check~2:

12:30 PM VXAlgo NQ X1DP Buy Signal :check~2:

12:45 PM ES1! Phase Change: Bearish :check~2:

12:56 PM VXAlgo ES X3 Sell Signal

1:30 PM Market flipped bearish on VX Algo X3! :check~2:

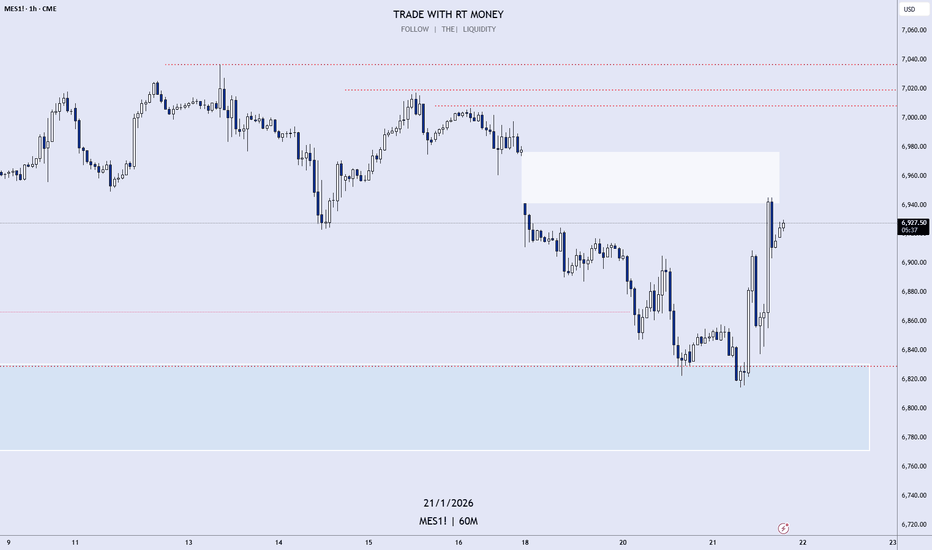

NQ RETESTWith FOMC Wednesday next week and a projected steady rate of 3.5-3.75, if we end up being bearish early next week, I think Monday and Tuesday gives us a good chance of retesting that unfilled 4hr gap and grabbing those 4hr stacked up draws on liquidity for the potential to fill orders up to last weeks highs before the new week opening gap. We will see.

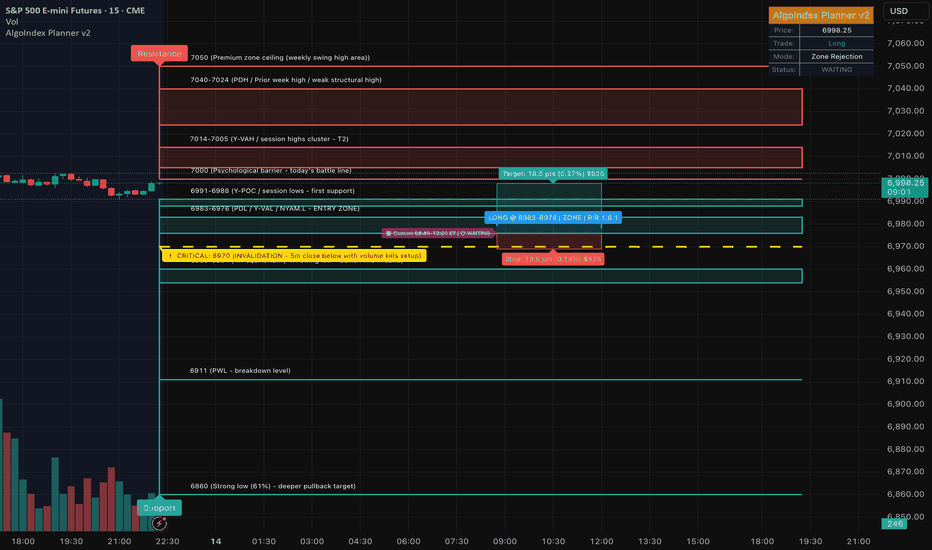

ES (SPX, SPY) Analysis, Key-Zones, Setups for Fri (Jan 23)

Macro sentiment shifted bullish this week. Trump reached "framework deal" with NATO on Greenland at Davos, dropping tariff threats on 8 European nations. Markets rallied on de-escalation.

Breaking overnight: China greenlights tech firms to prep Nvidia H200 orders - major reversal, risk-on for tech sector.

Asian markets hit new highs. MSCI Asia Pacific +0.4%. Gold near $5,000. Dollar plummeted most in a month. Investors rotating out of US assets into emerging markets at record pace.

European PMIs came in better than expected. German Manufacturing 48.7 vs 47.8 forecast. UK Services 54.3 vs 51.7 - strong beat. UK Retail Sales +2.5% vs +1.1% expected.

BOJ held rates at 0.75% as expected. Japan PM Takaichi dissolved parliament, snap election Feb 8th.

TODAY'S ECONOMIC CALENDAR (ET)

9:45 AM - US Manufacturing PMI Flash (Forecast 52.1)

9:45 AM - US Services PMI Flash (Forecast 52.8)

10:00 AM - Michigan Consumer Sentiment Final (Forecast 54.0)

PMIs are the main catalyst today. Services PMI is the bigger market mover.

MULTI-TIMEFRAME STRUCTURE

4H Chart:

Price at Equilibrium ~6940 after recovering from LL at 6825 (Jan 20-21 selloff). CHoCH confirmed mid-January around 6900. Still printing LH structure - needs break above 6964+ for bullish confirmation. Oscillator readings neutral with slight bearish bias.

1H Chart:

HH formed at 6964.5 on Jan 22. Multiple LH prints developing. BOS marked - structure attempting bullish shift. Price sitting at PWL area. Oscillator showing bearish divergence developing.

30M Chart:

Tight consolidation between session levels. Price hovering around VWAP 6948 and Prior Close 6946. Waiting for PMI catalyst to determine direction.

RESISTANCE:

7040-7045 - Prior 4H HH, swing target

7015-7020 - 1H Strong High, 707K volume node

6990-7010 - Major HTF zone. 4H PWH/PQH cluster. 1H PMH. 651K volume node (39%). Premium zone entry.

6958-6970 - Primary resistance cluster. 4H LH 6964.5. 1H HH 6964.5. PDH 6969. ONH 6958.5. Y-VAH 6958.5. NYAM.H 6964.5. AS.H 6960.75. 120K volume zone (7%).

SUPPORT:

6930-6940 - Primary support cluster. 4H Equilibrium 6940. 1H Equilibrium 6940. Y-VAL 6932.5. NYPM.L 6932.5. PWL zone. 38K volume node (2%).

6920-6928 - Secondary support. PDL 6925.5. NYAM.L 6925.5.

6905-6915 - Deep pullback zone. ONL 6911.25. Thursday LO.L 6914.75. 1H HL structure.

6895-6905 - 1H CHoCH+ zone, structure support.

6820-6830 - 4H LL from Jan 20-21. 145K volume shelf (9%).

6795-6810 - HTF liquidity target. 4H PML. Weak Low zone.

SESSION GAME PLAN

Pre-9:45 AM: Expect consolidation 6930-6958. No forced trades. Mark levels and wait.

9:45 AM PMI Release: If PMI beats, look for 6930-6940 buy on any flush. If PMI misses, look for 6958-6970 rejection short. Initial move often fades - don't chase.

10:00 AM Post-Michigan: True directional move typically emerges after initial volatility settles. Best setups at confluence zones with CVD confirmation.

Friday Afternoon: Reduced position sizing after 2 PM. Watch for end-of-week flows. Book profits before weekend.

BIAS

Neutral-to-Bullish. Macro backdrop improved significantly. Technical structure shows recovery from Monday selloff. However 4H/1H still printing LH pattern - needs 6970+ break for bullish confirmation. PMI data is the wild card.

Price sitting exactly at 4H/1H Equilibrium - decision point. Wait for CVD confirmation at the 5-star confluence zones for highest probability entries

Day 94 — Making Money While I Sleep (Overnight Analysis)Ended the day +$143 trading S&P Futures. I started the session in the green thanks to some setups I placed during my nightly analysis. Waking up with profit already locked in gave me the freedom to stay on the sidelines, which was the right call given my worry about a "whippy" session. While the overall range wasn't huge, we saw some violent up and down moves designed to shake players out. With the uncertainty of moving ships toward Iran looming, sitting on my hands and preserving the overnight gains was the best strategy today.

Day 94— Trading Only S&P Futures

Daily P/L: +$143

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: *DOW JUMPS 300 POINTS, VIX TUMBLES AS STOCKS END HIGHER AMID RECEDING GREENLAND TURMOIL

📈Key Levels for Tomorrow:

Above 6925= Bullish Level

Below 6920 = Bearish Level

Reviewing signals for today (9:30am – 2pm EST):

— 9:43 AM MES Market Structure flipped bearish on VX Algo X3!

— 10:00 AM Market flipped bearish on VX Algo X3!

— 10:21 AM VXAlgo ES X7 Sell signal

— 10:50 AM ES1! Phase Change: Neutral

— 11:27 AM MES Market Structure flipped bullish on VX Algo X3!

— 12:00 PM Market flipped bullish on VX Algo X3!

— 12:00 PM VXAlgo ES X1 Overbought/toppy Signal,

— 12:00 PM VXAlgo NQ X1DP Sell Signal

— 2:00 PM ES1! Phase Change: Bearish

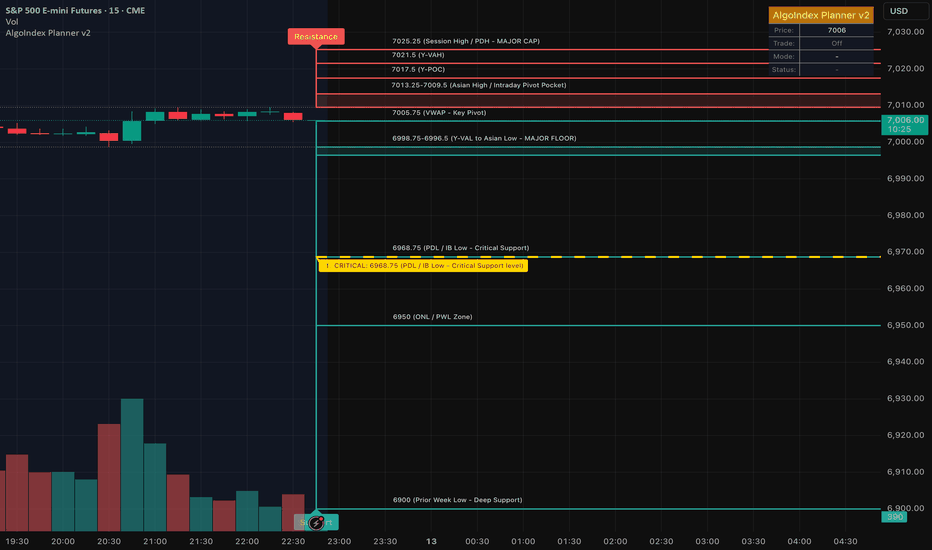

ES (SPX, SPY) Analysis, Key Levels, Setups for Thur, Jan 22

GREENLAND CRISIS DE-ESCALATION

Trump announced "framework of a future deal" with NATO on Greenland/Arctic security. Feb 1 tariffs on 8 European nations CANCELLED. Market rallied immediately on de-escalation - tension that caused Tuesday's -1.3% selloff now reversing. NATO Secretary General Rutte confirmed deal focused on "Arctic security through collective efforts." Denmark welcomed the news, calling it "ending on a better note."

UKRAINE PEACE PROGRESS

US Envoy Witkoff: "We've got it down to ONE issue... I'm actually optimistic." Trump-Zelenskyy meeting TODAY in Davos (7:00 AM ET / 1:00 PM local). Witkoff & Kushner heading to Moscow to meet Putin (around 11:00 AM-12:00 PM ET). Trump floated "tariff-free zone" for Ukraine post-war reconstruction. Major diplomatic progress could spark additional risk appetite.

FED INDEPENDENCE PRESERVED

Supreme Court SKEPTICAL of Trump's attempt to fire Fed Governor Lisa Cook. Justice Kavanaugh: Trump's position "would weaken, if not shatter, Fed independence." Bipartisan pushback from conservative AND liberal justices. Market participants already adjusting Fed outlook - reduced betting odds of Cook removal. This removes a significant tail risk for monetary policy uncertainty. Court expected to rule by June 2026.

AI/TECH MOMENTUM

Nvidia CEO Jensen Huang: AI revolution "would require trillions of dollars." Global chip stocks performing strongly in premarket. Nasdaq 100 futures +0.8% overnight. AI infrastructure plays leading the rally.

WHITE HOUSE ECONOMIC OPTIMISM

WH Sr. Adviser Hassett: "We might get two quarters in a row above 5%"

Hassett: "Recent inflation data may have been very promising"

BEARISH CATALYSTS / RISKS

-------------------------

1. PCE INFLATION DATA (10:00 AM ET) - CRITICAL EVENT

Combined October & November release (unusual - due to prior government shutdown). Consensus: 2.8% YoY for both headline and core. Credit Agricole expects 2.9% YoY (above consensus) which could pare back Fed cut expectations. HOT print = hawkish repricing, potential selloff. COOL print = further rally fuel.

2. GEOPOLITICAL UNCERTAINTY REMAINS

Greenland deal is "framework" only - no concrete details yet. Denmark still says Greenland "not for sale" - fundamental disagreement persists. Ukraine talks down to "one issue" but resolution not guaranteed. Putin-related meetings later today could introduce volatility.

3. EXTENDED RALLY CONCERNS

Small caps outperforming S&P 500 for 13 straight sessions. S&P has yet to fully recover weekly loss. Gold on track for greatest weekly gain since October (flight to safety signal). Bitcoin below $90K showing crypto weakness.

TECHNICAL ANALYSIS

==================

MULTI-TIMEFRAME STRUCTURE

-------------------------

DAILY

Structure: Bullish, recovering from December lows. Recent CHoCH confirmed bullish continuation. Price trading in PREMIUM zone (above 50% fib). PQH resistance cluster near 6,988-7,000. Key Support: PML ~6,780, PQL ~6,600. Fib Extensions (upside targets): 1.272 @ 7,149.75 | 1.618 @ 7,226.75. LuxAlgo Oscillator Matrix: Momentum building but approaching overbought.

4-HOUR

Structure: Bullish swing established after Monday's LL at 6,791. Current position: Testing resistance in 6,940-6,960 zone. Premium Zone: 6,960-7,020 (heavy supply expected). PWL: 6,923.25 (key level to monitor). Fib retracement levels from recent swing: 1.272 @ 6,873.50 | 1.618 @ 6,834.50 | 2.0 @ 6,791.25

1-HOUR

Structure: HH-HL pattern intact. Recent BOS above 6,920 confirms bullish momentum. Premium zone: 6,950-7,050 (overhead supply). Discount zone: 6,830-6,865 (accumulation area). PML: ~6,780. Fib Extensions: 1.272 @ 7,077.50 | 1.618 @ 7,122.75 | 2.0 @ 7,172.75. Volume profile shows strong buying into Wednesday close.

30-MINUTE KEY LEVELS (from stats boxes)

ES Levels:

PDH: 6,904.75

PDL: 6,822.25

ONH: 6,916.50

ONL: 6,846.75

VWAP: 6,865.50

IB High: 6,897.00

IB Low: 6,865.75

Open: 6,886.00

Prior Close: 6,837.50

Y-VAH: 6,904.50

Y-POC: 6,886.00

Y-VAL: 6,841.50

NQ Levels:

PDH: 25,429.75

PDL: 25,098.00

ONH: 25,439.75

ONL: 25,095.25

VWAP: 25,279.00

Prior Close: 25,144.00

KEY ZONES

=========

RESISTANCE (Supply Zones)

-------------------------

6,916-6,920: ONH / Session High - first rejection level, partial profit zone

6,940-6,960: 4H resistance cluster - expect selling pressure

6,988-7,000: Daily PQH + Round Number - major psychological resistance

7,020-7,030: PMH Confluence - strong institutional supply

7,077-7,080: 1.272 Fib Extension - extended target if breakout

7,120-7,150: 1.618 Fib Extension - swing target

SUPPORT (Demand Zones)

----------------------

6,897-6,905: PDH / IB High confluence - first pullback watch zone

6,865-6,875: VWAP + IB Low - high-probability bounce zone

6,846-6,850: ONL - intraday support

6,822-6,830: PDL - critical intraday support

6,780-6,800: PML + Deep Discount - swing support zone

6,790-6,795: Week's LL + 2.0 Fib - invalidation level for bullish thesis

TRADE SETUPS

============

PRIMARY SETUP: LONG ON PULLBACK TO 6,865-6,905

----------------------------------------------

Thesis: Relief rally continuation after Greenland de-escalation and Fed independence preserved. Pullback to VWAP/IB zone provides optimal R:R.

Entry Zone: 6,865-6,905

Stop Loss: 6,818 (below PDL)

Targets:

T1: 6,916 (ONH) - take 50%

T2: 6,955-6,960 (4H resistance) - take 35%

T3: 6,990+ (runner) - trail BE

Confirmation Required:

- CVD divergence at support (selling exhaustion)

- Bid absorption

- Avoid entry if PCE comes hot (>2.9% YoY)

SECONDARY SETUP: BREAKOUT LONG ABOVE 6,920

------------------------------------------

Thesis: Clean break above ONH triggers continuation toward 4H resistance and daily PQH.

Entry: 6,920-6,930 (break and retest)

Stop Loss: 6,895 (below breakout)

Targets:

T1: 6,955-6,960

T2: 6,990-7,000

T3: 7,030

Confirmation Required:

- Volume surge on breakout

- NQ leading/confirming

- No negative headline flow

HEDGE SETUP: SHORT AT PREMIUM REJECTION (6,988-7,000)

-----------------------------------------------------

Thesis: If price spikes into daily PQH without consolidation, fade for mean reversion.

Entry: 6,988-7,000 (rejection candle)

Stop Loss: 7,025

Targets:

T1: 6,955

T2: 6,920

Only valid if:

- Aggressive spike into resistance

- CVD divergence (buying exhaustion)

- PCE already released and digested

- Clear rejection wick on 15m chart

SESSION GAME PLAN

=================

PRE-MARKET (6:00-9:30 AM ET)

- Monitor Trump-Zelenskyy meeting outcome (7:00 AM ET)

- Watch for headline risk from Davos

- Note any pre-PCE positioning in futures

PCE RELEASE (10:00 AM ET)

- Wait 15-30 minutes for initial reaction to settle

- Hot print (>2.9%): Look for short opportunities on failed breakouts

- Cool print (<2.7%): Aggressive long bias, buy dips

REGULAR SESSION

- Primary focus: Pullbacks to 6,865-6,905 for longs

- Take profits at resistance levels (6,916, 6,955)

- If price holds above 6,920, shift to breakout mode

- Late session: Watch for Putin meeting headlines (11:00 AM-12:00 PM ET)

RISK MANAGEMENT NOTES

=====================

1. Position Size: Standard - conditions favor continuation but event risk elevated

2. Max Loss: 10 points per scalp, 25 points per swing position

3. Avoid: Mid-range entries between 6,925-6,950 (no edge zone)

4. Headlines: Greenland/Ukraine headlines can cause instant 10-20 pt swings - use wider stops or reduce size

5. PCE Reaction: Don't fight the initial move; wait for exhaustion signals

SUMMARY & FORECAST

==================

NEAR-TERM (Today): Bullish bias with 65% probability of testing 6,955-6,990 if PCE comes inline or cool. 35% chance of pullback to 6,830-6,865 on hot inflation print.

WEEKLY OUTLOOK: Continuation of recovery rally targeting PQH at 6,988. Break above opens door to 7,050-7,080 (1.272 extension). Failure to hold 6,820 shifts bias back to neutral with potential retest of 6,780-6,800.

KEY LEVELS TO WATCH:

Bullish above: 6,905

Bearish below: 6,820

Breakout trigger: 6,920+

Target zone: 6,955-7,000

S&P Futures Trading Day 93 — +$680 Profit: Expanding Ranges & SiEnded the day +$680.00 trading S&P Futures. I stepped into the market with a strong bullish mindset today, backed by a cluster of early buy signals—including a massive X7 alert on NVDA. The market delivered a huge squeeze, expanding the daily range to over 130 points. While we eventually hit that max range and pulled back, this level of expansion is a warning sign. When volatility gets this wide, the risks increase, so my plan for tomorrow is to size down and proceed with caution.

Day 93— Trading Only S&P Futures

Daily P/L: +$680.00

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: *DOW JUMPS 600 POINTS ON GREENLAND FRAMEWORK DEAL

📈Key Levels for Tomorrow:

Above 6891= Bullish Level

Below 6890 = Bearish Level

S&P500, NASDAQ Update: Found Support! Heading Higher?This is an mid-week UPDATE to the Weekly Forex Forecast for the week of Jan. 19-24th.

In this video, we will analyze the following FX market: ES and NQ

Both of the indices dumped upon the Open Tuesday with Trump tariff threats. Wednesday, the market found support and bounced for a full recovery from Tuesday's drop.

If price breaks through the Volume Imbalance, we could see the market rally to the buy side liquidity highs, as mentioned in the forecast .

We'll soon see...

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

ES (SPX, SPY) Analysis, Key Zones, Setups for Wed, Jan 21

Today was the worst session since April - S&P 500 dropped 2.1%, wiping out 2026 gains. The catalyst? Trump's Greenland tariff escalation ahead of Davos. 10% tariffs on 8 EU countries starting Feb 1, rising to 25% by June 1. Supreme Court declined to rule on tariff authority today, extending uncertainty at least another month.

Critical Event Tomorrow: Trump's Special Address at Davos runs 8:30-9:15 AM ET - directly overlapping cash open. This is the primary catalyst. Any headline could swing markets 50+ points.

ECONOMIC CALENDAR - JAN 21

- 8:30 AM ET: Housing Starts & Building Permits

- 8:30-9:15 AM ET: TRUMP DAVOS SPEECH

- 10:00 AM: Pending Home Sales

Housing data releases simultaneously with Trump's speech - expect it to be overshadowed entirely.

TECHNICAL STRUCTURE

Daily: Price at 6,848.50 holding above 1.618 fib (6,834.50). Premium-to-discount transition in progress after rejection at HH near 7,040.

4H: CHoCH+ triggered at 6,923 confirming bearish shift. Price trading in discount below Equilibrium (6,923.25). Key fibs: 1.272 (6,873.50) | 1.618 (6,834.50) | 2.0 (6,791.25). PWL at ~6,923.25.

1H: Clear LH → LL sequence. PWH at 7,020 (premium trap). BOS confirmed. PML at 6,764.75.

KEY ZONES

RESISTANCE (Shorts):

- 6,865-6,875: VWAP + 1.272 Fib - first rejection zone

- 6,896-6,905: NYAM.H (6,904.75) + Asian resistance

- 6,920-6,935: CHoCH+ origin + Equilibrium - strong supply

- 6,960-6,975: Major liquidity wall (Davos relief rally target)

SUPPORT (Longs):

- 6,834-6,843: 1.618 Fib + AS.H - first bounce zone

- 6,815-6,822: NYPM.L (6,822.25) + 1.272 extension

- 6,791-6,800: 2.0 Fib - psychological confluence

- 6,764-6,780: PML (6,764.75) - STRONG BID expected

SCENARIOS

BEARISH CONTINUATION (60%)

Trump hardlines, no diplomatic progress, EU threatens retaliation.

- Break below 6,834 → 6,791 → 6,764

RELIEF BOUNCE (30%)

"Constructive dialogue" headlines, Feb 1 deadline pushed.

- Squeeze to 6,905-6,920, potential 6,960 extension

CHOP (10%)

Markets await clarity, range 6,820-6,880.

TRADE SETUPS

SHORT @ Premium Rejection

- Entry: 6,896-6,920

- Stop: 6,940

- T1: 6,865 (31-55 pts)

- T2: 6,834 (62-86 pts)

- T3: 6,791 (105-129 pts)

- Confirmation: CVD divergence, absorption failure

LONG @ Discount

- Entry: 6,791-6,800

- Stop: 6,764

- T1: 6,834 (34-43 pts)

- T2: 6,865 (65-74 pts)

- Confirmation: CVD divergence, institutional absorption

RISK NOTES

1. Headline risk EXTREME - size 50-75% of normal

2. Cash open = speech overlap (8:30-9:15 ET)

3. Watch EUR/USD as leading indicator

4. VIX elevated - mean reversion could fuel squeeze

WATCHLIST

- NFLX: Beat earnings, pausing buybacks for Warner deal

- 10Y: 4.29% - above 4.35% = pressure, below 4.20% = relief

- Gold: $4,700+ record - risk-off barometer

- Bitcoin: Cracked $90K

Bearish bias with headline optionality. Structure says lower but Davos = binary risk. Focus 6,920 resistance for shorts, 6,791-6,800 for longs. Let order flow confirm. NOT a session to overtrade.

Good Luck !!!

Day 92 — Hit & Run: Scalping the 1-Min MOBDay 92— Trading Only S&P Futures

Daily P/L: +108.75

Sleep: 8 hours

Well-Being: Good

🔔News Highlights: *DOW TUMBLES 870 POINTS, S&P 500 DROPS 2% ON TRUMP TARIFF THREAT OVER GREENLAND

📈Key Levels for Tomorrow:

Above 6900= Bullish Level

Below 6890 = Bearish Level

💭Today’s Trade thoughts: I slept pretty good today because i know thatt is needed to start the week well.

I stayed patient this morning just watching on the sideline because Today is actually the first major volume day of the week, so i suspect we were going to see unexpected moves. By 10am, I saw that 1 min MOB was very reactive today so i decided to make 3-4 plays on it and made my $100 and ran away from the market. I was also at the max i could make for monday + tuesday due to my profits yesterday so I didn't want to go for more.

There was another high probability play around 6825 zone but I fumble the math and thought it was 6815 and 6800.

📊Reviewing signals for today (9:30am – 2pm EST):

9:10 AM VXAlgo NQ X1DP Buy Signal

9:30 AM MES Market Structure flipped bullish on VX Algo X3!

9:45 AM ES1! Phase Change: Bullish

10:00 AM NQ Market flipped bullish on VX Algo X3!

10:30 AM ES1! Phase Change: Bullish

12:20 PM ES1! Phase Change: Bearish

12:37 PM MES Market Structure flipped bearish on VX Algo X3!

1:00 PM NQ Market flipped bearish on VX Algo X3!

2:00 PM VXAlgo ES X1 Oversold signal

S&P500 vs VIX Is increasing volatility signaling a Bear Cycle?The S&P500 index (SPX) opened considerably lower following the Martin Luther King Jr Day and with that market volatility has started spiking. In fact it's been rising since the week of December 22 2025, approaching levels last seen two months ago in November.

Market volatility is captured by the Volatility Index (VIX) as illustrated on this chart by the black trend-line. We are making a cross asset analysis with S&P500 as such VIX spikes have historically coincided with strong market corrections. Some have just been triggered by shock geopolitical events (such as the Tariff war in February - March 2025 and the March 2020 COVID flash-crash) but most signified proper technical Bear Cycles (2022, 2018, 2015, 2011), occurring harmonically on the market's multi-decade uptrend.

Since we've completed 3 years since the last technical Bear Cycle (2022), the pattern justifies a new one to start this year (2026). The VIX Cycles (red Arcs) come to confirm this as the current VIX rise coincides with roughly the time all previous S&P500 Bear Cycles started.

Interestingly enough, all such corrections tested the 1W MA200 (orange trend-line) and after holding, it initiated the next Bull Cycle. S&P500 hasn't touched its 1W MA200 since October 10 2022. The Feb - March 2025 correction 'only' hit the 1W MA100 (green trend-line) before rebounding. As a result, and based on the 1W MA200 current trajectory, an end-of-2026 test of it could technically take place at 5500 at least.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ES (SPX, SPY) Analysis, Key Levels, Setup for Tue (Jan 20)U.S. cash markets paused on Monday in observance of Martin Luther King Jr. Day, but trading on the Globex platform displayed pronounced volatility amid soaring U.S.-EU trade tensions focused on Greenland. The E-mini S&P 500 (ES) saw a decline of approximately 1.1% from Friday's close, while the Nasdaq-100 (NQ) lagged further, dropping 1.4%. In a shift towards safe-haven assets, gold prices surged to an all-time high of $4,660, driven by a weakening U.S. dollar and strong performance from the Swiss franc.

The catalyst behind the market's movement was President Trump’s announcement of a 10% tariff on eight European NATO allies specifically Denmark, the UK, France, Germany, the Netherlands, Norway, Sweden, and Finland set to take effect on February 1. This tariff is scheduled to escalate to 25% by June 1 unless an agreement regarding Greenland is reached. In response, the EU has activated an emergency protocol and is deliberating potential countermeasures.

Treasury Secretary Bessent, speaking at the World Economic Forum in Davos, expressed optimism about the U.S. economy, stating, “We expect investment to accelerate this year.”

FORECAST

BIAS: Neutral-to-Bearish (Short-Term)

OVERNIGHT THOUGHTS: The Asia and Europe trading sessions are anticipated to test recent overnight lows, with potential for unsuccessful dip-buying efforts at resistance levels.

TUESDAY NY SESSION OUTLOOK: As U.S. traders return to the markets, they will react to the weekend’s accumulated news. An initial attempt at short-covering is expected, likely followed by renewed selling pressure. Failed rallies in the 6920-6935 range may further exacerbate the downward trend.

BULLISH SCENARIO (30% likelihood): A retraction back to 6923 that holds could lead to a gap fill toward the 6950-6960 area.

BEARISH SCENARIO (50% likelihood): A failed rebound at resistance may signal a continuation down to the 6870-6850 discount zone.

CHOPPING SCENARIO (20% likelihood): The market may remain range-bound between 6887-6920 while awaiting clearer catalysts.

INVALIDATION POINT: A sustained break above 6950 would shift the bias towards bullish.

HIGH-IMPACT SCHEDULED ITEMS (ET)

09:30 - US cash equities reopen after MLK Day closure (gap-and-go risk; repricing of Greenland tariff headlines that built up while cash was shut)

10:00 - Supreme Court session begins. Oral arguments scheduled: Wolford v. Lopez (2A), M&K Employee Solutions v. Trustees (pension). Opinions possible but not guaranteed - the tariff case (Learning Resources v. Trump) ruling could drop any session. Court did not pre-commit which decisions will be released. Last courtroom session until Feb 20.

11:30 - Treasury bill auctions (supply event; can jolt front-end yields and spill into ES via rates):

6-week bill auction (announced Thu prior)

4-week/8-week bills settle Tuesday per standard pattern

52-week bill auction possible (every 4 weeks on Tues)

16:01 - Netflix (NFLX) Q4 earnings release - HIGH IMPACT

16:15 - Fed H.10 Foreign Exchange Rates (pushed from holiday)

16:45 - Netflix earnings interview begins

After the close (earnings beta into index futures):

Netflix (NFLX) - major index weight, sentiment driver

United Airlines (UAL)

Interactive Brokers (IBKR)

US Bancorp (USB)

Fifth Third (FITB)

KeyCorp (KEY)

Before the open (also relevant if you trade the open):

3M (MMM)

DR Horton (DHI)

Fastenal (FAST)

WHAT IS NOT ON THE CALENDAR (STILL IMPORTANT)

No top-tier BEA macro prints (GDP/PCE/Income) scheduled for Tue Jan 20 per BEA release schedule

No major BLS releases scheduled for Tue Jan 20 per BLS January schedule

No FOMC meeting - next meeting is Jan 27-28

Fed note: Daily/weekly statistical releases scheduled on the holiday (Mon) are pushed to Tuesday - H.10 at 4:15 PM, H.8 on Thu. Can nudge rates/liquidity expectations.

Trump v. Cook (Fed's Cook firing case) oral arguments are Wednesday Jan 21 - could create Fed-related headline risk heading into that session

WATCH LIST (UNSCHEDULED BUT HIGH PROBABILITY)

EU tariff retaliation announcement - emergency meeting concluded, response expected

Trump/Bessent comments from Davos

Any SCOTUS tariff ruling leak or rel

Good Luck !!!

S&P Futures Trading Day 91 — Why Low Volume Saved This Support LEnded the day +$642.50 trading S&P Futures. I've been eyeing the 6893 level for days as a major zone to watch—it’s our critical 97-minute MOB. When we opened -60 points last night, I realized the probability of dropping into that zone was high, so I set a cluster of orders between 6896 and 6890 to catch the move. My thesis was simple: with it being a holiday, the low volume meant we likely wouldn't have the momentum to break such a key support, setting up a hard bounce. The plan executed perfectly.

Day 91— Trading Only S&P Futures

Daily P/L: +642.50

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: U.S.-EU Tariff War

📈Key Levels for Tomorrow:

Above 6935= Bullish Level

Below 6935 = Bearish Level

S&P500 | NASDAQ: AMD In Action! Wait For Distribution!Welcome back to the Weekly Forex Forecast for the week of Jan. 19-24th.

In this video, we will analyze the following FX market: ES and NQ

Both indices have been moving sideways for over two weeks. Tariff news over this weekend has caused investors to move money to safe havens, like gold and silver, and out of the equity markets.

I believe this is for the short term. Should better heads prevail, Trump will back off his tariff threats to NATO allies. Meanwhile, the injection of volatility by the news shook up the markets again, keeping the air of uncertainty in place.

My plan is to wait for the signature of price to show us that the pullback is over, and the market will resume its upward trend.

Accumulation, Manipulation, Distribution. On a Bank Holiday Monday for the US banks, this is a day when manipulation can catch a lot of traders unawares.

I am waiting for the Distribution part to begin.

No trades for me today. ; )

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

PS Liquidity Zones In-Depth Tutorial XAUUSD, ES, NQ🧭 PS Liquidity Zones In-Depth Tutorial XAUUSD, ES, NQ

📌 This is a practical, trader-style guide for using ProjectSyndicate Liquidity Zones 1.0 on XAUUSD, ES, and NQ, then enhancing entries with confluence using Syndicate Order Block Finder and FVG Finder (NRP).

🧠 You’ll learn how to treat zones as liquidity magnets, how to avoid “touch-trading,” and how to build high-probability confluence setups that combine sweep behavior + structure shift + imbalance/OB retests.

Before we proceed ahead, add the PS Indicators to your ES / NQ / XAU M30 chart

so we are on the same page with the active zones.

Liquidity Zones | NRP | ProjectSyndicate

FVG Finder | NRP | ProjectSyndicate

Order Block Finder | Gold | ProjectSyndicate

________________________________________

💧 1) What Liquidity Zones are really showing

🎯 Liquidity Zones highlight areas where stop-loss orders cluster—usually around obvious highs/lows—making them prime targets for stop runs.

🧲 The core idea is not “zone = entry,” it’s: price is drawn to liquidity first, then it may reverse after it collects stops and shows confirmation.

🟦 Bull Liquidity Zones below price often represent sell-side liquidity being taken stops under lows, followed by potential reversal upward.

🟥 Bear Liquidity Zones above price often represent buy-side liquidity being taken (stops above highs, followed by potential reversal downward.

🔍 Think of zones as areas of interest where you hunt for sweep + reaction, not guaranteed turning points.

________________________________________

🧰 2) Fast TradingView workflow

🧩 Use a simple stacking approach so each tool has a clear job: Liquidity Zones = where, Structure = direction, FVG/OB = entry precision.

🧱 Recommended stack

• 🟦 Liquidity Zones 1.0

• ⚡ FVG Finder (NRP)

• 🧱 Order Block Finder (Gold version on XAUUSD)

⏱️ Timeframes

• 🧭 Context: H1 (and/or M30)

• 🎯 Execution: M15 or M5

• 🧼 Goal: high-quality zones + tight entries without clutter

________________________________________

📈 3) How to trade Liquidity Zones correctly 3 playbooks

🪤 Playbook A — Sweep → Rejection → Go

🏎️ Best for: quick reversals, clean sweeps, scalps.

• 🧲 Price pushes into a zone (ideally wicks through)

• 🕯️ Rejection candle prints (pin/engulf/strong close back out)

• 🎯 Enter on close (or small pullback)

• 🛑 Stop beyond the zone (or 1–2 ATR beyond)

• 🎯 Target next opposite zone or 2R

⚠️ Fails most often on strong trend days where price keeps running stops without reclaiming.

________________________________________

🔥 Playbook B — Sweep → MSS/CHOCH → FVG/OB Retest Entry

🏆 Best for: highest-quality entries on ES/NQ intraday and Gold reversals.

• 🪤 Sweep into zone (stops get taken)

• 📉 MSS/CHOCH shift appears on execution TF (direction changes)

• ⚡ Displacement prints an FVG (imbalance)

• 🧱 Displacement often defines an Order Block

• ✅ Entry triggers on FVG/OB mitigation

• 💎 Best case: FVG overlaps OB inside the Liquidity Zone

🎯 This is the “institutional-style” workflow: liquidity event → direction confirmation → precision entry.

________________________________________

🧲 Playbook C — Zone-to-Zone Targeting

🧘 Best for: range/rotation days, structured intraday conditions.

• 🎯 After sweep + confirmation, target the next opposite liquidity zone

• 🧠 Use zones as logical objectives instead of random exits

________________________________________

🧪 4) Confluence rules how to combine all 3 indicators without clutter

✅ Use a grading system so you only trade the best setups.

• 🟨 Grade 1 (OK): sweep + rejection candle

• 🟧 Grade 2 (Better): sweep + MSS/CHOCH shift

• 🟩 Grade 3 (Best): sweep + MSS/CHOCH + FVG + OB alignment + mitigation entry

🎯 Optional “sniper filters”

• ⏰ Prefer London/NY session sweeps

• 📍 Add PDH/PDL, round numbers, weekly levels

• 🧼 Prefer fresh FVGs (not repeatedly tapped)

________________________________________

⚙️ 5) Instrument-specific notes XAUUSD vs ES vs NQ

🥇 XAUUSD (Gold)

• ⚡ Gold often gives sharp sweeps and fast displacement

• 🧠 Map zones on H1, execute on M15, let price come back to FVG/OB

📈 ES (S&P 500 E-mini)

• 🧘 ES often respects cleaner rotation and structure

• 🧼 Keep fewer zones and prioritize the freshest areas

💻 NQ (Nasdaq 100 E-mini)

• ⚡ NQ is more volatile and “sweepy”

• ✅ Prioritize Playbook B and insist on confirmation

________________________________________

🧾 6) Two examples near current price areas (step-by-step)

📉 Example 1 — XAUUSD short: Buy-side sweep into Bear Liquidity Zone → FVG retest

🧭 Context: XAUUSD around ~4,595, with an overhead Bear Liquidity Zone roughly ~4,620–4,630.

🪤 What you wait for

• 🟥 Price runs into the zone, wicks through, then closes back below

• 📉 M5/M15 prints CHOCH/MSS down (structure shift bearish)

• ⚡ Bearish displacement prints a bearish FVG

🎯 Entry

• 🧲 Price retraces into the bearish FVG (mitigation)

• 🕯️ Short triggers on rejection / reclaim failure at the FVG

• ✅ Extra edge if FVG sits inside/near the Bear Liquidity Zone

🛡️ Risk & targets

• 🛑 Stop above sweep high / zone top

• 🎯 TP1 at nearby swing low / internal level

• 🎯 TP2 at next Bull Liquidity Zone below

________________________________________

📈 Example 2 — NQ long: Sell-side sweep into Bull Liquidity Zone → MSS → bullish FVG retest

🧭 Context: NQ around ~25,700, with a Bull Liquidity Zone below around ~25,590–25,620.

🪤 What you wait for

• 🟦 Price sells into the zone, wicks below, then closes back above

• 📈 M5 prints MSS up (breaks last lower high)

• ⚡ Bullish displacement prints a bullish FVG

🎯 Entry

• 🧲 Price pulls back into the bullish FVG (mitigation)

• 🕯️ Long triggers on reaction candle / reclaim after tapping the FVG

• ✅ Extra edge if OB overlaps the FVG near the zone edge

🛡️ Risk & targets

• 🛑 Stop below sweep low / zone bottom

• 🎯 TP1 at nearest prior high

• 🎯 TP2 at next Bear Liquidity Zone above

________________________________________

✅ 7) Daily checklist

🧭 Step 1 — Map

• 🧱 Mark the freshest 1–2 zones on each side from H1/M30

🧲 Step 2 — Wait

• 🪤 No sweep into a zone = no trade

🕯️ Step 3 — Confirm

• 📉 Take rejection (basic) or MSS/CHOCH (best)

🎯 Step 4 — Enter with precision

• ⚡ Prefer FVG mitigation; 🧱 bonus if OB overlaps

🛡️ Step 5 — Manage

• 🛑 Stops beyond invalidation; 🎯 targets at opposite zone / 2R / structure

Day 90 — Wiping Out 2 Days of ProfitsDay 90— Trading Only S&P Futures

Daily P/L: -495

Sleep: 4 hours

Well-Being: Good

🔔News Highlights: *DOW, S&P 500 END HIGHER IN VOLATILE TRADING, VIX FALLS AS CHIP, BANK STOCKS RALLY

📈Key Levels for Tomorrow:

Above 6984= Bullish Level

Below 6974= Bearish Level

💭Today’s Trade thoughts: Started the day down $200+ due to overnight orders hitting stoploss, so it was a grinding back day from there. However, I was pretty tilted from that loss and due to lack of sleep as well. things got worse, I ended up placing a pretty big order at 5 min MOB as well and it hit end of the day but stopped me out before recovering.

ended up taking a big loss from that at the close of the day and wiping out 2 days of good progress.

📊Reviewing signals for today (9:30am – 2pm EST):

Yesterday at 4:45 PMVXAlgo ES X7 Buy signal

9:00 AM VXAlgo NQ X3DP Buy Signal, :check~2:

9:30 AM VXAlgo ES X1 Overbought/toppy Signal, :check~2:

10:30 AM VXAlgo NQ X1DP Buy Signal :check~2:

10:50 AM ES1! Phase Change: Bearish

10:57 AM VXAlgo ES X3 Sell Signal

11:00 AM Market flipped bearish on VX Algo X3!

12:00 PM Market flipped bullish on VX Algo X3!

12:14 PM VXAlgo ES X1 Overbought/toppy Signal :check~2:

12:25 PM VXAlgo ES X3 Sell Signal :check~2:

1:00 PM ES1! Phase Change: Bearish :check~2:

1:30 PM Market flipped bearish on VX Algo X3! :check~2:

ES (SPX, SPY) Analysis, Key Levels, Setup for Fri (Jan 16)

The S&P 500 futures market is signaling renewed optimism heading into Friday's session, buoyed by a powerful earnings report from Taiwan Semiconductor Manufacturing Co. and resilient labor market data that together have eased concerns about the durability of the artificial intelligence trade.

E-mini S&P 500 futures extended gains for a second consecutive session, settling Thursday near 6994, advancing 12.25 points, or 0.18%, from the prior close of 6981.75.

The catalyst proved to be TSMC's fourth-quarter results, which showed profit growth of 35% and a commitment to capital expenditures of $52 billion to $56 billion in 2026. The guidance dispelled fears that hyperscaler spending on AI infrastructure might be cooling, sending Nvidia Corp. shares up more than 2% and lifting the broader semiconductor complex.

"Taiwan Semi's results today, and more importantly, their capex spending plans, point to reassuring investors that the AI trade is not necessarily a bubble at this point," said Kim Forrest, chief investment officer at Bokeh Capital Partners.

The CBOE Volatility Index fell 5.43% to 15.84, its lowest level in weeks, suggesting options traders see diminished risk of near-term turbulence.

Trade Developments Add Tailwind

Taiwan's Vice Premier confirmed that a bilateral tariff agreement with the United States would be signed within several weeks. The arrangement includes $250 billion in company-led investment alongside $250 billion in credit guarantees a framework the official described as distinct from recent deals struck with Japan and South Korea.

The development carries implications for semiconductor supply chains that remain central to U.S. economic competitiveness. Taiwan emphasized that domestic investment would continue even as companies expand their American footprint, a signal that TSMC's Arizona operations will complement rather than replace its home-island capacity.

Bank earnings provided additional support. Goldman Sachs Group Inc. and Morgan Stanley both exceeded analyst expectations, capitalizing on a resurgence in dealmaking activity. BlackRock Inc. reported record assets under management of $14 trillion.

Labor market data reinforced the constructive tone. Initial jobless claims for the week ending January 10 totaled 198,000, well below the 215,000 economists had forecast—evidence that employment conditions remain firm despite elevated interest rates.

Technical Picture Favors Continuation

From a structural perspective, the daily chart maintains a pattern of higher highs and higher lows, with price holding above a significant volume concentration between 6880 and 6900. Fibonacci extensions derived from the recent swing project potential upside targets at 7149.75, 7226.75, and 7311.75.

The four-hour timeframe shows consolidation between a premium zone near 7025-7050 and equilibrium around 6900. A higher low established at 6923 earlier this week suggests buyers remain willing to defend pullbacks.

On the one-hour chart, a series of bullish momentum signals have confirmed the near-term uptrend. The 6900-6910 zone, representing the prior week's low, now serves as structural support. Overhead, resistance near 7050, where distribution activity would be expected.

Treasury yields present a modest headwind, with the 10-year note at 4.17% as of Thursday's close.

Key Levels

Resistance

7050 → Premium zone, Weak High 39%

7017.25 → PDH (primary target)

7000 → Psychological, PWH area

Pivot

6992.25 → VWAP

6981.75 → Prior Close

Support

6974.75 → PDL (range edge)

6949.50 → ONL

6920-6925 → 1H HL structure

6900-6910 → PWL, critical support

6860 → Strong Low 61%, 1.272 Fib extension

Primary Setup: Long ES at PDL Support

Bias: Bullish above 6992.25 VWAP

Entry Zone: 6974 - 6978 (PDL range edge)

Stop Loss: 6964 (below PDL structure)

Target 1: 6992.25 (VWAP) → Scale 50%

Target 2: 7017.25 (PDH) → Runner at breakeven

Risk: 10-14 points

Confirmation Checklist

- CVD divergence at 6974-6978 (selling exhaustion)

- Bid wall formation / absorption

- Hold above 6970 on retest

- Volume decline into the pullback

Alternative Setups

Long Breakout

Entry: Above 7020 (with retest)

Target: 7040-7050

Stop: Below 7010

Short at Premium

Entry: 7040-7050 (rejection only)

Target: 7020 / 7000

Stop: Above 7060

Long Deep Pullback

Entry: 6920-6925 (1H HL)

Target: 6975 / 7000

Stop: Below 6910

Economic Calendar - Friday Jan 16

8:30 AM ET → Business Leaders Survey (Low)

9:15 AM ET → Industrial Production & Capacity Utilization ⚠️ (High)

11:45 AM ET → NY Fed Staff Nowcast (Low)

Industrial Production is the main event. A beat confirms manufacturing strength and supports continuation toward 7017.25+. A miss could offer pullback opportunity toward structural support.

ES (SPX, SPY) Analysis, Key Levels, Setups for Thur (Jan 15)

The E-mini S&P 500 (ES) closed at 6,961.50, down 40.25 points or 0.57% from the previous day's close of 7,001.75. This marks the second consecutive decline, with the technology sector leading the losses.

Session Highlights:

- Prior Day High (PDH): 6,979.75

- Prior Day Low (PDL): 6,923.25

- Overnight High (ONH): 7,002.50

- Overnight Low (ONL): 6,963.50

- Volume Weighted Average Price (VWAP): 6,947.00

- Value Area High (Y-VAH): 6,957.50

- Point of Control (Y-POC): 6,940.50

- Value Area Low (Y-VAL): 6,927.50

The session featured a cautious tone, opening at 6,972.25 and briefly testing a low at 6,926.50 through New York afternoon hours. Buyers emerged near a critical cluster of support, allowing for a slight recovery ahead of the close, although the overall day ended on a negative note. The market is seeing a risk-off rotation as technology underperforms, whereas energy stocks reached all-time highs and precious metals rallied, with silver increasing by over 6% to above $92.

---

Key News and Catalysts

1. Semiconductor Tariffs (High Impact)

President Trump has implemented a 25% tariff on advanced computing chips including NVDA’s H200 and AMD’s MI325X. Certain exemptions are in place for chips used in data centers, startups, and public sector applications. The White House cautioned that additional tariffs could be imposed soon.

2. CPI/PPI Data (Released January 14)

December's Consumer Price Index (CPI) met expectations, but the Core CPI revealed weaker-than-anticipated results. The Producer Price Index (PPI) rose by 0.2% in line with forecasts. Analysts believe this data will likely lead the Federal Reserve to maintain its current stance through at least March.

3. Retail Sales (Released January 14)

November retail sales data were released post-shutdown, showing a better-than-expected increase of 0.6%, surpassing the predicted growth of 0.5%, thus reinforcing the narrative of consumer strength.

4. Bank Earnings

Bank of America reported earnings exceeding projections (98 cents vs 96 cents expected), while Wells Fargo fell short on revenue targets. The market awaits reports from Goldman Sachs, Morgan Stanley, and BlackRock, which could further influence the financial sector.

5. Geopolitical Developments

- Ongoing discussions regarding Greenland in the White House

- A Supreme Court ruling on tariffs may come soon

- Arguments concerning Federal Reserve independence are scheduled for January 21

---

Economic Calendar for January 15

8:30 AM ET (6 releases):

- Initial Jobless Claims: Expected 215K | Prior 208K

- Empire State Manufacturing Index: Expected +1.1 | Prior -3.9

- Philadelphia Fed Manufacturing Index: Expected -2.9 | Prior -10.2

- Import Prices MoM: Expected 0.0% | Prior +0.1%

- Export Prices MoM

- Continuing Claims

10:00 AM ET:

- Business Inventories: Expected +0.1%

- Existing Home Sales

Note: Future retail sales release dates remain to be determined by the Census Bureau due to ongoing data verification from the shutdown period.

---

Overnight Session Forecast

Asia Session (6:30 PM - 2:00 AM ET)

Bias: Neutral to Slightly Bearish

- Markets in Japan, China, and Hong Kong will react to the chip tariff announcements, while India is closed for local elections. Initial volatility is anticipated with a test of the overnight low at 6,963.50 expected, particularly focusing on Asian semiconductor stocks like TSMC and Samsung.

London Session (2:00 AM - 6:00 AM ET)

Bias: Neutral, Range-Bound

- With several significant UK data releases approaching, including GDP and Industrial Production, market participants should monitor for potential movements in the Euro Stoxx 50, which is at record highs. The anticipated trading range is set between 6,940 and 6,980, pending US data developments.

Pre-Market/NY Open (6:00 AM - 9:30 AM ET)

- Earnings from Goldman Sachs, Morgan Stanley, and BlackRock will influence market sentiment. The upcoming Philly and Empire Fed surveys will offer insights into the manufacturing sector, along with initial jobless claims data expected to provide a gauge on the labor market.

---

Key Resistance Zones

R1: 6,979.75 | PDH

R2: 7,002.50 | ONH + Psychological level at 7K

R3: 7,040 - 7,050 | January Swing High

R4: 7,094.50 | 1.272 Fibonacci (1H)

R5: 7,113.25 | 1.272 Fibonacci (4H)

R6: 7,149.75 | 1.272 Fibonacci (Daily)

R7: 7,161.75 | 1.618 Fibonacci (4H)

Key Support Zones

S1: 6,947 - 6,952.50 | VWAP + Asian Session Low

S2: 6,927.50 - 6,940.50 | Y-VAL to Y-POC cluster

S3: 6,923.25 | PDL / Equilibrium

S4: 6,880 - 6,900 | PWL zone

S5: 6,800 - 6,788 | PML + Major Weekly Support

The 6,923-6,940 range presents a significant confluence of support.

---

Trade Setups for Tomorrow

Primary Setup: Value Area Bounce (Long)

Context: With the bull market intact, the price is positioned within a value area, finding support below.

- Entry Zone: 6,927 - 6,940

- Trigger: Bullish displacement from support

- Stop Loss: Below 6,918

- Targets:

- Target 1: 6,965

- Target 2: 6,979.75

- Target 3: 7,002.50

Risk-Reward Calculation (for an entry at 6,935 and stop at 6,918):

- Risk: 17 points

- Target 1 Reward: 30 points → 1.76:1

- Target 2 Reward: 44.75 points → 2.63:1

- Target 3 Reward: 67.5 points → 3.97:1

Invalidation: A close below 6,918 with follow-through.

Secondary Setup A: ONH Breakout (Long)

- Entry Zone: Above 7,002.50

- Trigger: 15-minute close above ONH with volume

- Stop Loss: Below 6,985

- Targets:

- Target 1: 7,020

- Target 2: 7,040

Note: Target 1 alone presents unfavorable risk-reward; focus on achieving Target 2 with partial at Target 1.

S&P Futures Trading Day 89 — Don't Chase: How I Fixed My Morning🔔News Highlights: *STOCKS END LOWER FOR A SECOND DAY, VIX JUMPS AS BANK OF AMERICA, WELLS FARGO FALL AFTER EARNINGS

📈Key Levels for Tomorrow:

Above 6990= Bullish Level

Below 6980= Bearish Level

💭Today’s Trade thoughts: I started the day bearish because we had x7 market structure bearish signal yesterday and we broke over key levels overnight during EU session.

So when market opened, I was looking for shorts at 1 min MOB but didnt get fill so i made a fomo trade and lost $100.

Eventually we dropped to 30 min MOB and I went long from there and made most of my money there and stepped away for the day.

📊Reviewing signals for today (9:30am – 2pm EST):

9:00 AM MES Market Structure flipped bearish on VX Algo X3! :check~2:

9:30 AM NQ VXAlgo NQ X3DP Sell Signal :check~2:

9:45 AM ES1! Phase Change: Bearish :check~2:

10:50 AM ES1! Phase Change: Bearish :check~2:

12:00 PM VXAlgo NQ X1DP Sell Signal

12:30 PM VXAlgo NQ X3 Buy Signal :check~2:

1:30 PM ES1! Phase Change :check~2:

1:55 PM ES1! Phase Change: Bullish :check~2:

2:30 PM Market flipped bullish on VX Algo X3! :check~2:

S&P Futures Trading Day 88 — Bullish Bias vs. Bearish RealityEnded the day +$12 trading S&P Futures... essentially a scratch. I started the session with a strong bullish bias off the 8:30 AM CPI print, which completely blinded me to the bearish flip at 9:48 AM. I spent the morning on the wrong side of the move, battling back and forth—making money on one trade only to give it back on the next. It was a choppy, frustrating session where the market phases shifted constantly, and I felt disconnected from the flow. In hindsight, the only clean play was trusting the 5-minute and 10-minute MOBs.

🔔News Highlights: *DOW ENDS DOWN 400 POINTS, VIX JUMPS AS JPMORGAN NYSE:JPM SLIDES AFTER WEAK EARNINGS

📈Key Levels for Tomorrow:

Above 6990= Bullish Level

Below 6975= Bearish Level

ES (SPX, SPY) Analysis, PMI, Key Levels, Setups for Wed, Jan 14Overnight-to-NY Session Forecast: Market Consolidation with Bearish Sentiment

In the latest market outlook, a consolidation phase with a bearish tilt is anticipated (60% probability) as prices are expected to remain capped below the resistance levels of 7,000 to 7,014 during the Globex trading hours. This comes amid a risk-off sentiment observed as the market approaches the close. Traders should prepare for a trading range between 6,976 and 7,005 overnight, particularly aware of the potential for false breakouts typical of the thinner trading volumes in the Asian session. Pre-PPI positioning could keep prices compressed around the value area of 6,988 to 6,993 established yesterday.

Should the Producer Price Index (PPI) report come in soft either in-line with expectations or below 0.2% a rally towards the 7,014 to 7,024 range might be seen in the New York morning session. Conversely, if the PPI indicates rising prices, a move below 6,976 could target the equilibrium range of 6,954 to 6,960.

In a bullish scenario (25% probability), a soft PPI reading would bolster the disinflation narrative, potentially triggering a squeeze that pushes through the 7,000 mark, with upward momentum likely aimed at the 7,024 to 7,040 zone. For this to materialize, a sustained bid above the volume-weighted average price (VWAP) of 6,998 and a breach of the overnight high will be crucial. Traders should look for a cumulative volume delta (CVD) divergence as confirmation, where prices make higher lows while the CVD registers higher highs.

On the other hand, the bearish scenario (15% probability) could develop with a hot PPI release or heightened geopolitical tensions, such as a response to Iran’s tariffs. A break below 6,976 would pave the way towards the 6,954 to 6,960 range, with further bearish pressure potentially targeting the 6,911 price level if the equilibrium fails to hold. This scenario may gain traction, especially if the Nasdaq leads the downturn, reflecting the broader tech sector's sensitivities to changing rate expectations.

S&P500 This tight squeeze can trigger a massive 2026 correction.The S&P500 (SPX) made a new All Time High (ATH) touching yet again the Higher Highs trend-line of last October (2025). This is the same chart we first published last week only this time on the 1D time-frame. The reason is that, with the 1D MA100 (green trend-line) rising fast, it creates a tight squeeze with this Higher Highs trend-line.

Whatever level breaks first, that will give the next long-term trend for 2026. The very same pattern in 2021 though, broke the 1D MA100 first, initiating essentially the 2022 Bear Cycle. A strong, long-term correction that only stopped when it found bottom on the 1W MA200 (orange trend-line).

As mentioned last week, the similarities are there. Massive 1W RSI Lower Highs Bearish Divergence against the price's actual Higher Highs, create the same squeeze. If the 1D MA100 breaks, the market may face the reality of triggering a new Bear Cycle for 2026.

If that's the case, the potential long-term Buy Zone will be within 5350 - 5050, which is the expected contact with the 1W MA200 and a projected -27.63% decline, if the 2026 Bear Cycle replicates exactly 2022. Also, when the 1W RSI gets Oversold (30.00 and lower), it is generally a solid level for long-term investors to start buying again. A Higher Lows trend-line as in October 2022, would be the ideal indication of a trend shift to bullish as this time it will be a Bullish Divergence (against market's Lower Lows).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ES (SPX, SPY) Analysis, CPI, Levels for Tue (Jan 13)

CPI Day Setup: Key Levels, Scenarios & Trade Ideas

FUNDAMENTAL BACKDROP

Increasing Pressure on Federal Reserve Independence

The political landscape surrounding the Federal Reserve is growing increasingly turbulent, as recent developments have raised concerns about potential interference in monetary policy. The Department of Justice served Fed Chair Jerome Powell with grand jury subpoenas on Friday, prompting Powell to defend the integrity of the Fed in a video statement, labeling the subpoenas as a "pretext" for a concerted effort to pressure the central bank into lowering interest rates. Senator John Thune has commented on the challenges this investigation poses for any future confirmation of Powell.

In a recent address, Fed President John Williams emphasized a cautious outlook, projecting U.S. economic growth to land between 2.5% and 2.75% for 2026. He noted that inflation is anticipated to peak in the first half of the year at rates between 2.75% and 3.0%, with a return to the 2% target expected by 2027. Williams reassured markets, stating that the Fed is “not under strong pressure to change rates,” and he acknowledged that the current market calm reflects an underlying uncertainty regarding these developments.

Geopolitical Tensions Rising

President Donald Trump has initiated a significant trade move, imposing 25% tariffs on nations conducting business with Iran, effective immediately. In a swift response, Iran’s foreign minister stated that Tehran is prepared for either “war or dialogue,” adding a layer of geopolitical risk that could influence market volatility in overnight trading sessions.

Foreign Exchange and Global Market Insights

In the global currency markets, the Dollar/Yen pair has reached a one-year high, trading at 158.25. Meanwhile, the Chinese Yuan continues to weaken, with the People’s Bank of China’s mid-point rate floating around 6.9734. Additionally, gold prices remain buoyed near record highs, driven by persistent demand for safe-haven assets amidst ongoing political and economic uncertainties.

TUESDAY'S KEY EVENT: CPI REPORT SET FOR 8:30 AM ET

Consensus Expectations:

- Headline CPI MoM is expected at 0.3%, up from the previous 0.2%.

- Headline CPI YoY is anticipated to remain steady at 2.7%.

- Core CPI MoM is projected at 0.3%, an increase from last month’s reading of 0.2%.

- Core CPI YoY is forecasted at 2.7%, slightly up from 2.6% previously reported.

Important Context:

Recent data collection for October and November has been impacted by the government shutdown, leading to some analysts warning of potential upside risks due to a "payback" effect from previous artificially low readings. Shelter inflation continues to be stable at around 3.0% year-over-year. The Core CPI month-over-month figure is expected to be the most immediate market mover, making it a critical focus for investors.

CPI Scenario Matrix:

- Much Lower (<0.2% Core MoM): Potential market rally of 30-50 points.

- Lower (0.2%): Anticipated rally of 15-25 points.

- In-Line (0.3%): Expected to result in market fluctuations of ±10-15 points.

- Higher (0.4-0.5%): Predicted market sell-off of 25-40 points.

- Much Higher (>0.5%): Market "flush" could lead to a drop of 40-60 points.

Technical Structure:

- Daily: Current prices are at a "Strong High 90%," indicating an extended phase while still maintaining trend integrity. Multiple higher high structures are currently showing signs of exhaustion, with a key support level at 6,900.

- 4-Hour: A change in character has been confirmed from the lows of 6,968, resulting in a sequence of higher lows at 6,950, 6,968, and 6,998. A higher low at 6,988 must hold for bullish continuation.

- 1-Hour: Prices are currently in a premium zone above 7,009, with a break of structure confirmed following recovery from the morning lows. Consolidation is forming ahead of the CPI catalyst.

Overnight Market Forecast

In the Base Case scenario, traders are positioned for a consolidation phase within the range of 7,004 to 7,013, driven by thin liquidity and pre-CPI positioning. As market participants reduce risk ahead of key data releases, expect choppy price action.

On the Bullish Case front, there’s a 25% likelihood of probing levels between 7,017 and 7,021, fueled by short covering prior to the CPI announcement. The calming tone from Fed's Williams is supporting risk appetite, but a stall is expected below the 7,025 mark.

Conversely, the Bearish Case carries a 20% probability of a dip to the 6,996 to 6,998 range, influenced by headline risks related to the Fed and tensions in Iran. There is pre-CPI hedging pressure that could lead to a bounce at the Y-VAL.

Post-CPI Scenarios

Scenario A Bullish Acceptance (35% Probability)

- Trigger: A 15-minute close above 7,025.25.

- Targets: 7,040 and then 7,058-7,065.

- Invalidation: Falling back below 7,021.

Scenario B Rejection/Fade (40% Probability)

- Trigger: A sweep above 7,021-7,025 followed by a failure to hold above 7,021.

- Targets: 6,996.50, moving down to 6,968.75.

- Invalidation: Acceptance above 7,025.

Scenario C - Breakdown (25% Probability)

- Trigger: A 15-minute close below 6,996.50.

- Targets: 6,968.75 and then 6,950.00.

- Invalidation: A reclaim and hold above 6,996.50.

BIAS & SUMMARY

Overall Lean: Slight bearish into CPI, but data-dependent

Bull Case: Cool CPI + Williams' calm tone = squeeze to 7,040+

Bear Case: Hot CPI + Fed/Iran headlines = flush to 6,968 or lower

Key Zones to Watch:

7,025 cap - break = bullish continuation

7,005 VWAP - pivot zone

6,996 Y-VAL - break = bearish acceptance

6,968 PDL - critical support

Risk Management Note: CPI releases create significant volatility. IV crush post-print is real if trading options, take profits quickly on directional moves rather than holding for extended targets.