XAU/USD Technical Outlook for the upcoming week In this video I look at the current PA of gold using TPO chart and correlate a plan for where we could see price go in the coming week .

I use a regular chart and TPO chart for this analysis as well as Fibonacci tools .

We are currently in the middle of a range and until that range is broken we plan ahead and seek the best high probability setup via looking at the charts and correlating with the News catalysts.

Fibonacci

BTCUSDT Analysis: Key Drivers beyond Technical Insights Bitcoin is near new all-time highs, and there are three big reasons why. Let's break them down.

1. 📜 Favorable Regulation s

New, more open regulations in the U.S. are boosting investor confidence and creating a stable environment for crypto.

2. 💰 Crypto in 401(k)s

An executive order now allows cryptocurrencies in 401(k)s, integrating crypto into mainstream retirement planning.

3. 📉 Potential Interest Rate Cuts

Anticipation of future interest rate cuts is making riskier assets like Bitcoin more attractive to investors.

All these factors have contributed to sustained confidence among long-term holders.

Technical Insights

1. 1st Retracement: Towards the recent breakout area 118K$ to 120K$

2. 2nd support: Order Block, which is near 113K$ to 115K$

3. For medium-term support, Fibonacci Golden level around 108K$.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

Nasdaq Short Again (nth time): Fibo Extension Level and 5-wavesOver here, I attempt to short Nasdaq again after another failure yesterday. This time, the 5-waves structure is supported by Fibonacci Extension level at 2.618x sub-wave 1 against entire wave 5 structure.

However, take note the circled area where I pointed out 2 imperfections in the wave structure:

1. Wave 4 overlaps Wave 1

2. Sub-wave 4 overlaps Sub-wave 1 (a comparison with S&P500 increases the odds that it may still be a valid count)

Given the imperfections of the wave counts, we still need to set our stop above the all-time-high to protect ourselves.

Good luck!

Nasdaq and S&P500 Short: Completed 5-wave structureIn this video, I explain my analysis of the Nasdaq and S&P 500 chart together with Gold (the risk-off indicator).

I point out 3 main reasons why I labelled the 5-wave structure as W-X-Y-X-Z instead of 1-2-3-4-5:

1. Wave 3 overlaps Wave 1.

2. 5th Wave did not make new peak.

3. Gold structure still supports a 5th Cycle level wave higher.

Regardless of how confident we are, remember to set your stop and respect it.

Good luck!

Bitcoin CME Closing Price: The Key to Next Week’s TrendIn this video I cover the CME closing price and go through a plan which includes a gap to the upside and a short squeeze before gravitating to the downside for lower targets .

I also give a bias for higher prices if the VAH is claimed .

This idea is modelled on the daily time frame and can play out over the course of the following week or more .

I also look at the Eth/Btc pair and the Btc dominance chart and marry whats happening on those charts with this idea .

When looking at BTC I use order flow software to further support my bias and the confluences I present in the chart.

If you have any questions then leave them below .

Support my work with a boost and Safe trading

Nasdaq and S&P500 short: Update on wave counts and trade setupOver here, I update on the wave counts and explain why I think Nasdaq and S&P500 is once again, short opportunities. If you had try out my previous idea on 5th Aug, the maximum profit would be around 250 points on Nasdaq before the price reversed and went higher.

As traders, we are not so much concerned with being right but more on risk-reward and active trade and risk management. So I hope you would have taken your profit on that idea. The general macro and fundamental outlook remains the same as per previous video, which is why my recent ideas had been short ideas. In the near future, I foresee more short ideas too.

Anyway, I believe that the risk-reward is good this time for another short for Nasdaq and S&P500. Good luck!

EURUSDPrice recently plunged into the deep and has now returned for fair value. We are already in a significant area, on a higher time-frame(1D), so any moment from now they can collapse it, much like last week! Be on the look-out like a meerkat!

1.1680 and 1.1720 are institutional price levels and price tends to have strong reactions in these areas. I expect to see that play out tomorrow.

The following reports will be used to trigger this move:

BoE Monetary Policy Report.

Continuing Jobless Claims 4-Week Average.

Initial Jobless Claims.

Unit Labour Costs.

Nonfarm Productivity.

Stay safe!

GBPUSD ANALYSISAfter seeing the previous day close and reject an area of resistance and a break below the trendline area of support on the lower timeframe, but with the daily still bearish the 4hr is pushing to the upside. A break of 4hr structure support could be a clear signal that sellers are now pushing price.

EURJPY ANALYSISAfter seeing the previous weekly candle close bearish and the daily from Monday close below the low of the last bearish candle which is a sign of sellers strength, we could expect further sells to continue but a simple retracement on the 4hr back to an area of interest for a potential LH structure point before further sells

Loss of Momentum Pattern Into StructureSimilar to the OANDA:GBPJPY that I shared, the OANDA:EURAUD has put in a pretty aggressive and direct move into a previous level of structure. However, what makes this opportunity different than "the beast" is that as price approach our level of resistance we started to put in a rising channel which is a loss of momentum pattern along with other clues such as divergence on the RSI.

If you have any questions, comments or want to share your views, please do so below. Also be sure to hit that like button & give me a follow, that way you don't miss my future trading ideas.

Akil

GBPJPY - Catching The Falling Knife... ConservativelyDon't catch the falling knife! This is a common warning in the trading industry. Although i do agree with it (in some circumstances), I think what's more important is for us to perform analysis and be confident on where that knife may find a floor at.

In the case of the OANDA:GBPJPY I think we've seen that floor which may present us with the opportunity to but IF... I say if because simply making that prediction isn't enough. As a trade, what I want to see if some sort of signal from the market (while at that level) that price is more likely to do what I predict, than not.

If you have any questions, comments or want to share your views, please do so below. Also be sure to hit that like button & give me a follow, that way you don't miss my future trading ideas.

Akil

Insiders are selling Roblox ! Heres the levels you need to knowIn this video I lay out a solid plan for a move to the downside for Roblox after a 100% move to the upside since April of this year .

I demonstrate why I believe we will take a 30% retracement and provide confluent evidence to support this theory.

There are some fundamental reasons that I also did include alongside the technical analysis which is not my regular style but important given the context.

Tools used in the video 0.382 Fib , Standard Fib pull, Trend based fib and pivots .

Reddit breaks out for bullish run I have been watching Reddit for a couple of weeks and identified that we had put in the .786 low from the correction since February and then formed a range that was well respected for the past 4 months .

In this video I highlight zones where i expect price to gravitate too and where a nice entry will be if you are looking to long reddit.

Tools used Fib suite , trend based fib , tr pocket , 0.786 + 0.382 and fixed range .

New targets for Reddit RDDT In this video I recap the previous reddit analysis where we looked for the long which is playing out really well .

I also look at the current price action and simulate what I think could be a target for the stock moving forward using Fib expansion tools as well as levels below for price to draw back too.

Welcome any questions below the chart . Thanks for viewing

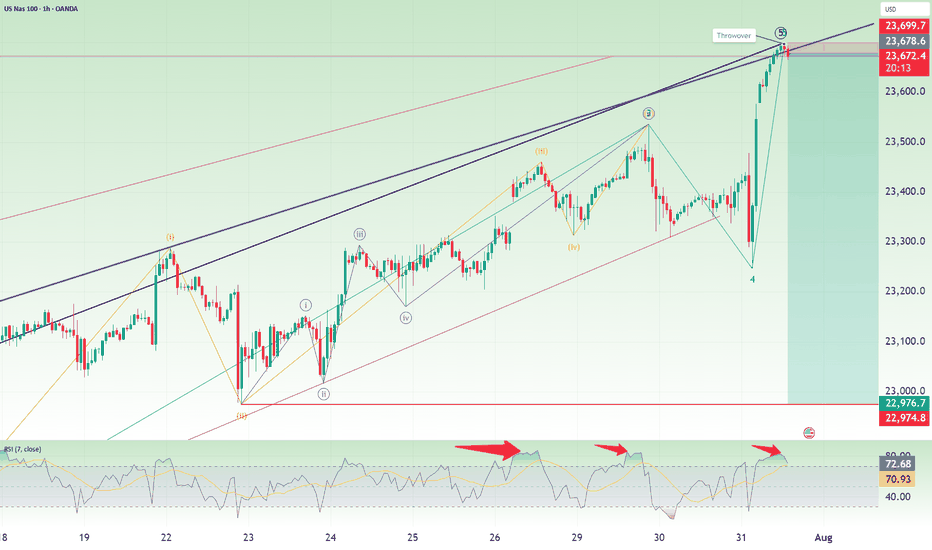

Nasdaq Short: multiple reasonsOver here, I present to you the Nasdaq short idea again. For my previous idea, it was stopped out at 23500. This time, I changed the wave counts again, mainly merging the previous wave 5 into wave 3, allowing for the new high to be a wave 5.

On top of that, here are the few other reasons for the short:

1. Fibonacci extension levels: Wave 5 is slightly more than Wave 1.

2. RSI overbought for the 3rd time on the hourly timeframe.

3. Rising wedge false breakout.

4. Head-and-shoulders on the 1-min timeframe.

As usual, the stop for this idea is slightly above the recent high, around 23700.

Thank you.

Ethereum Long: Using Log Chart to Analyze, Target $6600In this video, I go through the analysis using the log chart for Ethereum and shows the potential of this cryptocurrency where I expect the price to reach new high in the coming days with a longer-term target of $6600.

For shorter-term trading, I recommend placing the stop a distance below recent support on the daily chart, around $3372.

Good luck!