USD/AUD Outlook: RBA Hawkishness Meets Dollar DebasementThe USD/AUD currency pair is undergoing a significant structural repricing. A convergence of persistent Australian inflation and a politically engineered devaluation of the U.S. Dollar has created a powerful bearish trend for the pair (favoring a stronger Australian Dollar).

Macroeconomics: The Inflation Divergence

The primary economic driver is the divergence in monetary policy lifecycles. Australia’s consumer inflation accelerated to 3.6% in the fourth quarter of 2025, exceeding the RBA’s 2–3% target. Monthly data for December printed at 3.8%, forcing the Reserve Bank of Australia (RBA) to maintain a restrictive "higher for longer" stance.

Conversely, the U.S. macro outlook is dominated by fiscal concerns. With U.S. debt approaching $39 trillion, markets are pricing in a higher risk premium for holding U.S. assets. This fundamental mismatch, an RBA forced to fight sticky inflation versus a U.S. regime tolerating currency weakness, creates a distinct downward pressure on USD/AUD.

Industry Trends: Housing as an Inflation Engine

A sector-specific analysis reveals that housing costs are the engine room of Australian inflation, rising 5.5% in December. This reflects deep supply chain constraints and elevated construction costs.

Unlike transitory price shocks, housing inflation is sticky. It spreads across consumption sectors, including "Recreation and Culture," indicating broad-based demand. This industry trend virtually eliminates the possibility of near-term RBA rate cuts, solidifying the Australian Dollar's yield advantage.

Management and Leadership: Policy Culture Clash

The fluctuation is also a result of conflicting leadership styles.

The RBA (Prudence): Deputy Governor Andrew Hauser and Governor Michele Bullock represent a culture of orthodox central banking. They have explicitly ruled out near-term easing, prioritizing mandate compliance over popular sentiment.

The White House (Disruption): President Trump’s management style involves "verbal intervention." His recent comments that the dollar is "doing great" while it plummeted removed the executive safety net. This signaled to traders that the administration implicitly supports a weaker currency to boost exports.

Geopolitics and Geostrategy: The Debasement Trade

Geostrategically, the U.S. Dollar is facing a crisis of confidence dubbed the "debasement trade." Investors are rotating capital out of the USD and into emerging markets and gold to hedge against fiscal unpredictability.

Trump’s tariff threats and unpredictability have alienated allied capital. The market views this not just as a tactical dip, but as a strategic withdrawal of foreign liquidity from U.S. Treasury markets. This geopolitical friction weakens the USD’s status as the ultimate safe haven, benefiting high-beta currencies like the AUD.

Technology and High-Tech: The Algorithmic Shift

In the domain of financial technology, derivatives markets are flashing warning signals. Data from the Depository Trust and Clearing Corporation shows turnover hitting near-record levels.

Algorithmic trading systems are aggressively pricing "risk reversals," with premiums on short-dated options favoring a weaker dollar. This high-tech market sentiment indicates that institutional machines are programmed to sell USD rallies, exacerbating the downward volatility.

Conclusion: A Structural Downtrend

The USD/AUD pair is caught between a rock and a hard place. Australia’s resilient economy (growing at 2.1%) and sticky inflation demand a strong currency to dampen prices. Simultaneously, the U.S. political apparatus is dismantling the "strong dollar" doctrine.

Unless the RBA pivots unexpectedly or the U.S. fiscal outlook stabilizes, the path of least resistance for USD/AUD remains lower.

Inflation

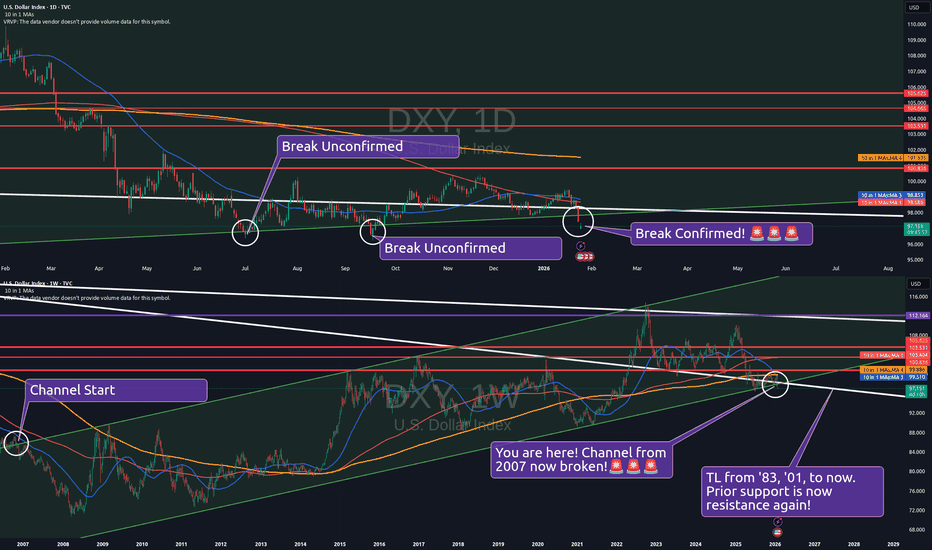

WARNING!!! 19 Year Dollar Channel is Now Broken!Trading Fam,

The title is NOT clickbait. If you’ve been following me for any length of time, you’ll know I have been warning you about this exact moment for some time. We’ve had many signs. Many clues. But the price of gold and silver rising exponentially was our crystal ball. And now, price movement on the U.S. dollar has confirmed to us that the dollar will continue its descent. For the first time in 19 years, the dollar has dropped from its ascending channel. The price of everything is about to increase. Be prepared.

Let’s take a look at our chart.

In the upper rectangle, you’ll see the U.S. dollar on the daily. We have existed inside this channel for 19 years. And for 8 months now, we’ve been consistently hammering away at the bottom of our channel, which has been acting as strong support. 19 years’ worth of strong support. Today, we finally confirmed a break below this support.

Two times in the past, once in July of last year and once in Sept., we did break the bottom of the channel. But we received no confirmation. We were looking for a lower low closing candle, but we never received that, and somehow we escaped back into our “safe” zone, the channel. Today, the break from our channel is looking like it will be confirmed. Yes, we do have to wait and see where our candle will close. But the reason I am confident this is our move is mainly because of that overhead trendline (white) coming all the way from 1983, drawn through a couple of tops in 2001, and extended through today. This will now act as major resistance. And it intersects almost precisely with the bottom of our 19-year channel!

This is not good. It means the price of everything is about to inflate even more than it already has. Any student of monetary history will know that all fiat currency always only ever ends in hyper-inflationary recession/depression. I’m not saying we are at that point yet. But maybe we are? Or is this time different? Whatever the case may be, we can’t cling to hopium to preserve our cash. We must take steps to hedge against this massive deterioration of our dollar that will continue to occur.

So, what do we do? Where do we go from here?

My suggestion is to concentrate on acquiring assets that the FED cannot print! This would include things like physical gold and silver. I have long been a proponent of the 4 “G’s” in investing/hedging strategy. Each “G” is symbolic of a larger class of commodities that will do well to keep one safe in both times of inflationary pressures as well as deflationary pressures. The 4 “G’s” are these:

Gold - anything categorized as precious metals

Ground - real estate providing tangible value and income potential

Guns - again, not literal. So, don’t let this scare you. But to keep the alliteration alive, guns stand for anything physical that can be used to protect your wealth. Usually, this comes in the form of something metal. Whether that be a safe, a tractor, or an iron tool that is hard to get, these tools can be used to protect your property, your precious metals, and anything else that is considered of value. Some may interpret this to be defensive type stocks.

Gas - energy related stocks and investments

How you acquire the above-listed and by what means is entirely up to you. But I don’t think you can go wrong. In the great depression, these categories saved people. In any sort of inflationary recession/depression, they are also most likely to do the same, and they will always hedge against a currency devaluation and an economy that can no longer be controlled.

✌️Stew

Gold at $7,000? The Strategic Case for the Next Historic LeapGold has shattered the psychological glass ceiling. With spot prices piercing the $5,000 mark in January 2026, the yellow metal has entered uncharted territory. While UBS forecasts a consolidation around $5,000, a growing chorus of institutional voices now identifies a credible path to $7,000 per ounce. This trajectory is not merely speculative; it is the mathematical output of a fractured global order. The following analysis dissects the structural drivers propelling gold toward this new paradigm.

Geopolitics: The Chaos Premium

The "fear trade" has evolved into a permanent "chaos premium." Markets are pricing in the unpredictability of the U.S. administration, where foreign policy is increasingly used as a transactional lever. President Trump’s recent threats regarding Greenland’s status and tariffs on European allies have injected unprecedented volatility into the Atlantic alliance. Simultaneously, U.S. military maneuvers involving Venezuela and escalating tensions with Iran have dismantled the traditional assumption that U.S. assets are the ultimate safe haven. Investors are fleeing this geopolitical instability, utilizing gold not just as insurance, but as a non-sovereign store of value immune to sanctions or diplomatic seizure.

Geostrategy: The Sovereign Pivot

A quiet revolution is occurring in central bank vaults. The global monetary architecture is shifting away from a dollar-centric system, driven by the weaponization of finance. Central banks are aggressively diversifying reserves, with official purchases forecast to reach 950 tonnes in 2026. This is a strategic realignment, not a tactical trade. Nations like China and others in the Global South are systematically replacing U.S. Treasuries with gold to inoculate their economies against potential asset freezes. This "sovereign bid" creates a price floor, effectively removing massive quantities of bullion from the circulating supply and tightening the market structure.

Macroeconomics: The Debasement Trade

The most potent catalyst for $7,000 gold lies in the erosion of fiat currency credibility. The "debasement trade" is accelerating as investors confront the reality of U.S. fiscal sustainability. With national debt exceeding $324 trillion globally and U.S. deficits widening, the Federal Reserve faces immense pressure to monetize debt. Real yields are expected to remain subdued or negative, reducing the opportunity cost of holding non-yielding assets. As the Fed potentially moves toward a more dovish stance to support labor markets, the dollar’s purchasing power declines, mathematically necessitating a higher gold price to value the world’s outstanding liabilities.

Industry Trends & Technology: The Scarcity Engine

Physical constraints are colliding with algorithmic demand. Fibonacci extension models used by technical analysts now identify $7,040 as a major target zone, driven by momentum trading and high-frequency algorithms chasing the breakout. On the supply side, the industry faces a geological plateau. New major discoveries are rare, and ore grades are deteriorating, making extraction more expensive and technically challenging. This scarcity is compounded by a structural deficit in silver, which often leads gold in precious metal bull markets. The combination of finite supply and infinite monetary expansion creates a powerful engine for price appreciation.

Conclusion

The ascent to $7,000 is no longer a fringe theory but a plausible outcome of converging crises. Gold has transitioned from a cyclical commodity to a strategic necessity for preserving capital. As faith in political institutions wavers and the global debt burden swells, the market is actively repricing the world’s oldest form of money.

$JPINTR -Japan's Interest Rates (January/2026)ECONOMICS:JPINTR

January/2026 0.75%

source: Bank of Japan

-The Bank of Japan kept its key short-term rate unchanged at 0.75% at its first policy meeting of 2026, leaving borrowing costs at their highest since September 1995.

The widely expected decision was backed by an 8–1 vote.

In its quarterly outlook, the board revised up FY 2025 GDP growth to 0.9% from 0.7% and lifted its core inflation forecast for FY 2026 to 1.9% from 1.8%.

Gold Ending Diagonal: Is the "Blow-Off" Top In? (4888 4965 Zone)The Ending Diagonal structure that has been unfolding since the July lows (3267). The recent spike to 4888 in Wave 5 displays classic "blow-off" behavior—vertical price action often seen right before a trend exhausts itself.

1. The Technical Setup (The "When") While the diagonal is technically valid right here, we are watching two scenarios to time the reversal:

The "One Last Push" (Extension): If Wave 5 isn't finished, its possible to reach a final extension cluster between 4935 – 4965 (where Wave 5 equals Wave 3 length or 0.618x Wave 1).

The Reversal Targets: Once the top confirms, we expect a correction toward these magnetic support zones:

~4270 (38.2% retrace)

~4080 (50% retrace)

~3887 (61.8% retrace) (weak scenario)

2. Reality Check "Why": Fundamentals are flashing warning signs that support our bearish technical view:

The "Yield" Divergence: Gold is hitting records while bond yields are spiking (10Y ~4.29%). This "Gold up, Yields up" correlation is unsustainable; typically, either yields break, or Gold snaps back violently.

Crowded Trade Risks: We are seeing "late-cycle" behavior—ETF inflows are surging (retail FOMO) while institutional positioning is already stretched. This setup (High Specs + High ETFs) often precedes a liquidity flush.

The Trigger: A stabilization in the USD or a continuation of high real yields could be the pin that pricks this momentum bubble.

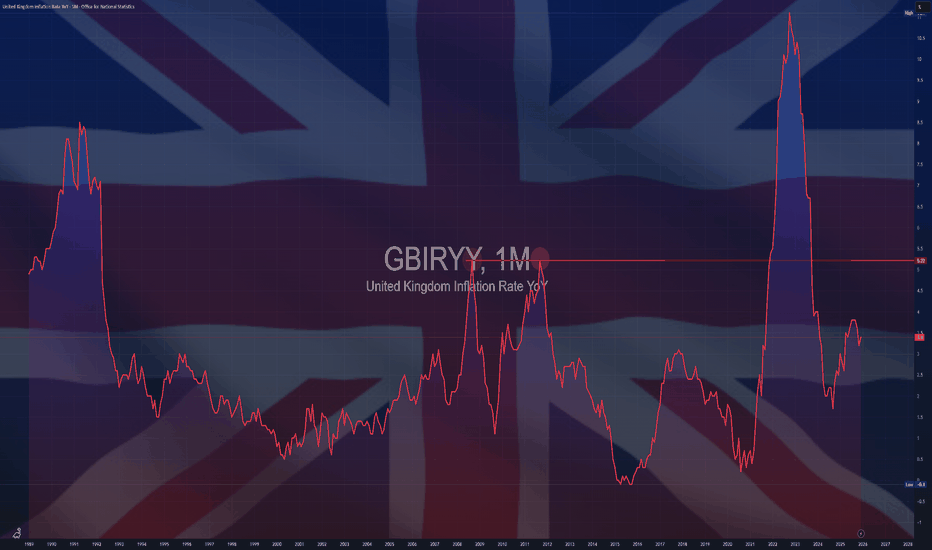

$GBIRYY - U.K CPI (December/2025)ECONOMICS:GBIRYY 3.4%

December/2025 +0.2%

source: Office for National Statistics

- U.K consumer price inflation rose to 3.4% in December 2025, up from November’s eight-month low of 3.2% and slightly above market expectations of 3.3%.

This year-end acceleration, the first since July, could complicate the Bank of England’s efforts to guide inflation back toward its 2% target, though the rise is expected to be temporary thanks to government interventions.

The increase was largely driven by higher prices for alcohol and tobacco, which jumped to 5.2% from 4.0% in November due to the timing of tobacco duty changes, and transport costs, which rose to 4.0% from 3.7% on the back of higher airfares.

Additional upward pressure came from food and non-alcoholic beverages (4.5% vs. 4.2%). Services inflation, a key gauge of domestic price pressures for the BOE, edged up slightly to 4.5% from 4.4%, below expectations.

Core inflation, which excludes volatile items like unprocessed food and energy, remained steady at 3.2%, marking its lowest level since December 2024.

$XAU/USD - Gold's Q1 2026TVC:GOLD remains considerably Bullish until proven otherwise !

- Not only fundamentally speaking by Central Banks heavily accumulating it diversifying away from U.S Treasuries and a Weakening TVC:DXY Dollar ;

to plenty current Geo-Political Risks with unknown and uncertain future scenarios,

to worries of 'Sticky' Inflation and Interest Rates cuts.

This is an Structural Official World-Wide Demand !

Any Pullback seen on charts, will be just another excellent providing support floor to accumulate Gold while cheaper.

Leaving behind 2025 as one of its best performing years throughout history with an amazing rally ;

and entering 2026 on a strong note paired with other precious metals like TVC:SILVER

- TA speaking,

HH's and HL's continue printing, however, concerning for the time being is a bearish wedge pattern forming ,

flirting with the ceiling of 2025 Uprising Channel .

Bearish Wedge not yet confirmed having its measured move putting Gold's TA forecast to as low as 4.380$.

Other strong supports are there to be found as tests before 4.380$ is reached.

Conflicting Supports from PoC of last rally and EMA 50 aiming up and as well the prior week's Gap Break-Out which as not Filled yet.

Note that for the time being, Gold has found support on Previous ATH Level + 20EMA, leaving a Liquidity Wick Zone just below, increasing the probabilities of break-out gap being filled.

Aiming another Higher High creating a New All Time High;

its first test of resistance is the last ATH which can print a Double Top and down it goes to break the bearish wedge pattern confluencing with major news events of United States on 22 of January ;

Breaking ATH and above Uptrend Channel marked on white and Confirming it will Invalidate the Bearish Wedge Pattern.

Probabilities scream for a pullback, however is worth including the Gold's fundamental momentum and anything is to be expected.

NOTE THAT THIS IS NOT FINANCIAL ADVICE .

PLEASE DO YOUR OWN RESEARCH BEFORE PARTAKING ON ANY TRADING ACTIVITIES BASED SOLY ON THIS IDEA

PCE — What the market will see on Thursday (22 January 2026)Introduction

On Thursday, January 22, the Core Personal Consumption Expenditures (PCE) Price Index will be released in the United States. Ahead of the release, we decided to take a deeper dive into macroeconomic theory and revisit what PCE is and how its data influence financial markets.

The PCE (Personal Consumption Expenditures) Price Index is a comprehensive measure of inflation that tracks changes in prices for all goods and services consumed by households within the country, regardless of the source of funding. Its conceptual depth lies in the fact that it reflects the actual cost of consumption across the economy, not merely the out-of-pocket expenses of individual consumers.

The Federal Reserve views PCE as its primary gauge of inflationary pressure due to its deeper analytical structure and methodology, which is largely free from certain statistical distortions and explicitly accounts for behavioral aspects of consumer choice.

CPI vs. PCE

While CPI answers the question:

How much more expensive has life become for the average urban consumer?

PCE addresses a broader one:

How much more expensive has total final consumption in the economy become?

This makes PCE more macroeconomically representative. It includes not only household spending, but also expenditures by non-profit institutions serving households.

The core methodological difference between the two indices lies in how they treat consumer behavior.

CPI assumes relative rigidity in consumption habits:

its basket is updated with a lag

its calculation implies that households continue purchasing the same goods even as prices rise, simply paying the higher cost

PCE, by contrast, incorporates rational behavioral flexibility. The Fisher chain-weighted index used in its calculation reweights components on a quarterly basis, reflecting the natural shift in demand toward relatively more affordable substitutes. This substitution effect not only reduces the indicator’s volatility, but also aligns it more closely with real-world consumer spending dynamics, where price changes are a key driver of budget reallocation.

An important clarification regarding the relationship between CPI and PCE:

the two indicators are highly correlated

PCE typically prints slightly lower readings than CPI

this persistent gap is a structural result of methodological differences in how the indices are constructed

What to Focus on in the Release

When CPI data are released, the most reliable way to assess underlying inflation pressure is to focus on Core CPI.

The same logic applies to PCE.

The headline figure (Headline PCE) carries a significant risk of misinterpretation due to its elevated volatility, which can distort the perception of the underlying price trend. Core PCE, stripped of these destabilizing components, serves as a far more reliable compass, pointing to the deeper inflationary forces in the economy — precisely the forces that shape the long-term path of monetary policy.

With this framework in mind, we can move on to a more precise interpretation of the data.

When the report is released, greater emphasis should be placed on the monthly (m/m) Core PCE reading, as it is more sensitive to short-term changes in inflation. Even if inflation accelerates in the current month (a high MoM print), the year-over-year figure may continue to decline for several months due to base effects — comparisons against elevated readings from the prior year.

It is also important to pay close attention to revisions of the previous month’s data.

The market evaluates releases through the lens of trend, which is often just as important — if not more so — than a single data point.

For example, imagine that the current month’s Core PCE comes in exactly in line with consensus at 0.2%. At first glance, this looks benign. However, if the previous month’s figure is revised upward from 0.3% to 0.5%, the picture changes entirely. Such a revision would be inconsistent with the Fed’s 2% inflation target and would undermine the narrative of a smooth and sustained disinflationary trend.

Market Reaction

Market reaction to inflation data is fundamentally driven by expectations of future Federal Reserve actions. A sustained rise in inflation reinforces a hawkish scenario: the Fed is forced to maintain or tighten monetary policy, which leads to higher interest rates, a stronger dollar, rising Treasury yields, and downward pressure on equities.

Conversely, a consistent decline in inflation signals that the Fed’s measures are working and opens a dovish window for potential easing in the future. This implies the prospect of rate cuts, which typically acts as a catalyst for equity markets, while pushing Treasury yields lower and weakening the domestic currency.

However, accurate analysis is impossible without considering the broader macroeconomic context. For instance, if a prevailing trend has already been established by weak labor market data and a soft CPI report, even a neutral PCE release that comes in line with consensus is often interpreted as a confirmation of that trend. In such an environment, the absence of a negative surprise becomes a positive signal in itself, providing additional support for equities.

That said, the key element of analysis remains the probability of a fundamental surprise capable of breaking the existing trend built on earlier releases. Labor market data and CPI set the preliminary direction of expectations, but they do not carry finality. The PCE report, acting as a strategic “closing argument,” carries sufficient weight in the eyes of both the Fed and market participants to trigger a full reassessment of the priced-in scenario. A material deviation from consensus can do more than merely adjust expectations — it can invert the prevailing market logic altogether, leading to a regime shift across currency, bond, and equity markets.

Conclusion

Ultimately, market dynamics are a complex fusion of countless factors whose interactions often defy linear logic. This is precisely why outcomes so frequently diverge from even the most well-reasoned forecasts.

The only way—if not to tame, then at least to comprehend this force—is to develop your own analytical judgment. Critical thinking and the ability to construct an independent view of reality are the most valuable tools in a world with no guarantees and no ready-made solutions. Neither the forecasts of research desks nor the opinions of popular commentators can replace your personal ability to interpret data, weigh risks, and connect fragmented facts into a coherent hypothesis. This is the path from following noise to understanding signal.

Enjoy!

How To Make Macroeconomics Work For YouIntroduction

Trading around news releases is a powerful tool in financial markets.

The ability to identify the direction of the economy and understand market behavior is a skill that requires patience and extensive practice. In this post, we break down the theory behind trading macroeconomic releases and systematically explain how to form a structured view of the market.

Actual vs. Consensus

In almost any economic calendar, you will see a consensus / forecast column. To properly understand released macroeconomic data, it is not enough to simply look at the headline number. The key to interpretation lies in comparing the actual result with the consensus forecast.

This deviation — often referred to as a “surprise” — is the primary driver of volatility in financial markets.

The reason is that the market is a forward-discounting machine. By the time a report is released, asset prices already reflect the prevailing consensus expectations. The market has priced in a specific scenario. When the actual data comes in above or below those expectations, an immediate repricing occurs — the market reassesses future growth, inflation, and central bank policy paths, adjusting prices to reflect the new information.

Therefore, at the moment of the release, the market is not reacting to the number itself, but rather correcting a previously held — and potentially incorrect — expectation. It is this collective and instantaneous adjustment that creates the surge in volatility we observe around economic data releases.

Trend

Trend is the alpha and omega of analysis — the foundation upon which most trading systems are built. This principle fully applies to macroeconomics as well: to correctly interpret a single data release, one must clearly understand the trend in which the economy, or a specific sector, currently operates.

Yes, a trend on its own rarely generates the same explosive volatility as an unexpected deviation from consensus. However, its role is far more fundamental: the trend is what shapes the consensus itself. The dynamics of previous months define the baseline for analysts’ forecasts and market expectations.

Without accounting for the trend, an individual macro indicator becomes just a number in a vacuum. It may point to completely opposite scenarios depending on interpretation. Data must be evaluated in context and over time. A sector may be performing below its long-term averages, but consistent improvement over recent quarters can be a clear signal that central bank policy is having a positive effect. Conversely, a peak reading within a broader downtrend is far more likely to be a statistical anomaly than a genuine turning point.

Historical data serves as a compass for central banks. By understanding what is “normal” for a given sector, policymakers can interpret readings that break away from the trend not as noise, but as structural shifts — a “slowdown in growth” or a “fundamental change in trend.” This is the power of trend analysis: it separates signal from noise, transforming raw data into a coherent picture of the economic cycle.

Context

Accurately understanding the macroeconomic landscape and anticipating market reactions is only possible when data is viewed collectively, not in isolation. Financial markets are complex, interconnected systems, where developments in one sector inevitably ripple through others.

Labor market data directly shape inflation expectations. Central bank decisions and forward guidance impose structural constraints, defining not only the current phase of the cycle but also future conditions across the entire spectrum of assets.

Equally important is the global political and geo-economic backdrop. These forces either introduce a risk premium, increasing volatility, or reduce uncertainty, making outcomes more predictable.

Together, all of this forms the context — the interpretive framework in which numbers exist. Without it, even the most significant deviation from forecast is nothing more than a statistical outlier. Context turns fragmented data into a coherent narrative, allowing us to understand what is truly happening in the economy and where capital is flowing.

The ability to identify this context is the core skill that translates the language of macroeconomic statistics into the language of real market movements.

Federal Reserve Policy

We have reached the key element that determines the development of both individual sectors and the financial market as a whole. Central bank policy is the primary force that sets the rhythm of market movements. Most forecasts and trading strategies ultimately boil down to an attempt to anticipate the regulator’s next steps.

When analyzing a new set of data, the first question we ask is:

what does this mean for the Federal Reserve? What actions will the regulator take to stabilize conditions or support positive momentum?

To do this, the central bank has a set of fine-tuning tools at its disposal. By understanding how each of them works, one can form well-reasoned assumptions about the future direction of financial markets. The central bank’s toolkit includes:

• the policy interest rate

• the interest rate on reserves

• forward guidance

• balance sheet operations

• open market operations

• direct lending facilities

All of these are important, but the central role belongs to the policy rate — the Federal Funds Rate (FFR).

The policy rate is the central bank’s main interest rate. It defines the base cost of money in the financial system and serves as the primary benchmark for all other interest rates in the economy. By adjusting it, the central bank directly influences inflation and economic activity.

Accommodative stance (rate cuts):

The central bank lowers borrowing costs for businesses and households. This expands the money supply and stimulates demand, supporting economic growth, but it also creates inflation risks and may put downward pressure on the national currency.

Restrictive stance (rate hikes):

The central bank makes borrowing more expensive. This cools demand, slows economic activity, and restrains inflationary pressure. In such an environment, the cost of money in the economy rises, often leading to a strengthening of the national currency.

Thus, by monitoring the Fed’s rate decisions, we gain insight not only into the current diagnosis of the economy, but also a clear signal of the environment — accommodative or restrictive — in which all markets will operate in the near future.

Which Data Actually Move the Market?

Having mastered the basic principles of macro analysis, we move on to practice. Now, when looking at an economic calendar, we no longer see just a list of events — we understand their meaning and can anticipate market reactions. To do this, indicators must be grouped by the type of information they provide about the state of the economy.

1. Inflation Indicators

CPI (Consumer Price Index) and especially Core CPI are the primary measures of consumer inflation and directly influence central bank decisions.

2. Labor Market Data

• NFP (Nonfarm Payrolls) and the Unemployment Rate (UR) are key indicators of labor market health.

• AHE (Average Hourly Earnings) reflects wage-driven inflationary pressure.

• JOLTS (Job Openings, Quits) are leading indicators of labor demand and worker confidence.

• Jobless Claims provide a weekly “pulse check” of the labor market.

3. Consumer Demand Indicator

Retail Sales are the main barometer of consumers’ willingness to spend and a key component of GDP.

4. Leading Indicators

PMI (Purchasing Managers’ Index) from ISM and S&P Global is the most important monthly leading indicator, capturing sentiment and the pace of change in the real economy (manufacturing and services).

Beyond these indicators, there are many other important metrics (industrial production, consumer confidence, housing data). However, we focus on the primary market movers — the releases that generate the most volatility and most often reshape the market narrative. Understanding these four categories provides the key to decoding the majority of price movements driven by macroeconomic news.

Inflation Indicators (CPI and Core CPI)

These indices track changes in the cost of living. Imagine a basket that contains everything a typical household buys: food, gasoline, housing costs, clothing, and medical services.

The headline Consumer Price Index looks at this entire basket. However, prices for certain items — such as gasoline or vegetables — can swing sharply due to weather conditions or political decisions. These swings create a lot of noise and make it harder to see the underlying trend.

That is why analysts and central banks focus primarily on core inflation. It is the same index, but with the most volatile components — food and energy — removed. What remains are prices that move more slowly but persistently: rent, childcare, repair services, and healthcare.

If core inflation is rising, it means the foundation of everyday life is becoming more expensive. The cause is usually an overheated economy — when consumers have ample money and are willing to pay more, while businesses face rising costs, often driven by higher wages. This type of inflation is sticky and difficult to contain. That is precisely why central banks react to core inflation when deciding whether to raise interest rates.

If, on the other hand, only headline CPI rises due to a temporary spike in gasoline prices while core inflation remains stable, the central bank is unlikely to tighten policy — such moves are usually seen as transitory.

Labor Market Data (NFP, AHE, JOLTS, Jobless Claims)

The labor market is not a collection of isolated numbers, but a living system where some indicators lay the groundwork for others. To understand it, one must see the sequence and the cause-and-effect relationships.

The first warning signal usually comes from weekly jobless claims. When the number of people filing for unemployment benefits begins to rise consistently, it is a direct signal that companies are laying off workers more frequently. This is the earliest indication that, a few weeks later, the main monthly report may deliver unpleasant surprises: weak job growth or even outright job losses, followed by a rise in the unemployment rate.

However, the strength of the labor market is determined not only by the number of jobs, but also by their quality and the balance of power between employers and workers. This is where the JOLTS report on job openings and labor turnover becomes critical. When job openings are abundant and workers are quitting voluntarily in large numbers, it points to a unique situation: employees are confident enough to switch jobs in search of higher pay. This scenario almost inevitably leads to accelerated wage growth, which later shows up in the Average Hourly Earnings (AHE) data.

Wages are where the strongest link to central bank policy lies. Persistent wage growth acts as a powerful engine for inflation in the services sector. Therefore, when the Fed sees low unemployment combined with steadily rising wages, it has little choice but to keep interest rates high in order to cool the economy. Conversely, when job creation slows and wage growth begins to decelerate, it sends the regulator a long-awaited signal that labor-driven inflationary pressure is easing — opening the door to discussions about policy easing.

By closely monitoring weekly jobless claims and vacancy data, one can anticipate the likely outcome of the key monthly labor report and, with a high degree of confidence, predict how the central bank will react.

Consumer Demand Indicator (Retail Sales)

This is the most direct snapshot of household wallets. The index shows how much money consumers spent during the month on goods — in physical stores, online, at car dealerships, and at gas stations.

Its strength lies in its simplicity. It does not attempt to predict the future or measure sentiment — it simply records whether people are actually spending their money. And since household consumption is the main engine of the U.S. economy, this number is closely watched by everyone.

Retail Sales are highly sensitive to two factors: labor market conditions and Federal Reserve policy.

When jobs are plentiful and wages are rising (strong NFP and AHE), consumers spend with confidence — sales increase.

When the Fed raises rates, borrowing costs (including credit cards) rise, large purchases are postponed, and sales slow or decline.

As a result, Retail Sales often serve as the final confirmation — or refutation — of trends suggested by other data. Persistent growth in sales despite high interest rates tells the Fed that the economy remains too hot and that policy is not restrictive enough. A sudden drop, especially against the backdrop of an already weakening labor market, becomes a powerful argument for a pivot toward policy easing.

What to focus on in the data:

• The month-over-month change, with particular attention to the Control Group, which excludes the most volatile components (autos, gasoline, and building materials) and provides a cleaner view of core consumer activity.

Leading Indicator (PMI)

PMI is a leading indicator that captures turning points in the economic cycle.

It does not measure production volumes or revenues. Its purpose is to identify the moment when business activity is accelerating or beginning to contract. The index is based on surveys of executives who make daily decisions about purchasing, hiring, and investment. Their collective assessment of changes is one of the most sensitive barometers of demand dynamics.

The key is not the absolute level of the index, but its direction and internal components. A decline from 55 to 52 still signals expansion, but indicates a loss of momentum. A rise from 48 to 49 still reflects contraction, but points to a slowdown in the pace of decline.

For central banks, two PMI components are particularly critical:

• New Orders — the purest indicator of future demand. A decline here typically precedes reductions in production and investment.

• Prices Paid — a direct signal of inflationary pressure in supply chains and the services sector. Sustained increases in this component can prevent monetary policy easing, even if the headline index is slowing.

PMI functions as an early warning system. A sustained deterioration over several months often precedes slower GDP growth and weakening labor market data. Conversely, resilience at elevated levels — especially when price components are rising — serves as evidence for central banks that the economy is overheating and that a restrictive stance must be maintained.

Conclusion

You now have a solid theoretical foundation for interpreting news releases and the signals they send to the market. To truly understand this framework and apply it effectively in trading, consistent practice is essential. From my own experience, keeping a macro trading journal can be extremely helpful. Record how the market reacts under different conditions and gradually develop your own independent view of each situation.

Be especially cautious of market rumors — more often than not, such opinions are simply attempts to attract attention with sensational headlines rather than provide meaningful insight.

Enjoy!

$USIRYY - U.S CPI (December/2025)ECONOMICS:USIRYY 2.7%

December/2025

source: U.S. Bureau of Labor Statistics

- The annual inflation rate in the U.S remained at 2.7% in December, while the core rate probably edged up to 2.7% from 2.6% in November which was the lowest level since early 2021.

On a month-over-month basis,

headline CPI is expected to have increased by 0.3%, with core CPI also seen rising by 0.3%, driven mainly by higher goods prices.

ZB: 30 Year Treasuries Face a Defining Data Week The Long Bond and the Shifting Inflation Narrative

The ZB thirty year Treasury futures contract represents the long end of the United States Treasury yield curve and is primarily driven by expectations around inflation, growth, fiscal policy, and long term interest rate risk. Because of its long duration, ZB is the most sensitive Treasury product to changes in inflation expectations and shifts in term premium. When markets become concerned about persistent inflation or increased Treasury issuance, ZB tends to underperform. When growth risks rise or inflation pressures ease, ZB often attracts defensive demand.

Within the Treasury complex, ZB sits at the far end of the curve, while ZT two year, ZF five year, and ZN ten year futures reflect progressively shorter duration exposures. ZT is most reactive to Federal Reserve policy expectations, ZN tends to balance policy and growth considerations, and ZB expresses longer term confidence or concern about economic stability and inflation control. Over the past few months, sentiment in ZB has improved as inflation has moderated from prior highs and recession risks have remained present but not fully realized. The narrative since late spring has centered on easing tariff fears, slower but resilient growth, and a market that is gradually reassessing how restrictive policy needs to remain over the long run.

This week, macro data will be a major driver. CPI on January 13th, followed by PPI and retail sales on January 14th, will shape near term direction. A miss in CPI or PPI, particularly on core measures, would likely support ZB as it reinforces the idea that long term inflation pressures are cooling, allowing yields to drift lower. A beat in inflation or strong retail sales would pressure ZB lower, as it would revive concerns that growth and pricing power remain too firm for comfort at the long end of the curve.

What the Market has done

• Since bottoming out at the 109'14 area in May 2025 after tariff fears were alleviated, bids have stepped up and the market has steadily reclaimed the April Trump liberation tariff selloff.

• In September 2025, buyers were able to overcome sellers at 116’00, which was daily level 2 and a four month resistance level where sellers had previously defended.

• Subsequently, buyers were able to defend this level until the end of November, when bids slipped and sellers were able to offer prices down through the September 5, 2025 low value area and single print at 115'20 to 114'20.

• Since December, the market has been consolidating sideways within this zone, filling in and repairing the LVA as balance has developed.

What to expect in the coming week

The key level to watch is 115'25 to 116'00, which represents the previous week’s close, the current consolidation block high, and the over-under zone of daily level 2.

Neutral scenario

• Expect the market to continue consolidating in a tight range, potentially between 115'25 and 115'05, as participants wait for clarity from CPI on January 13th and PPI and retail sales on January 14th.

• In this scenario, rotational and mean reverting behavior should dominate, with responsive buyers and sellers active at range extremes.

Bearish scenario

• If the market is unable to accept above 116'00, expect a rotation back down through the consolidation block toward 114'18, which aligns with the range low and weekly one standard deviation low.

• This bearish scenario is likely to be very choppy and difficult to trade, as the market remains in balance within the broader 116 to 114'20 range.

Bullish scenario

• If the market is able to accept above 116'00, price could move up through offer block 1 toward 117'00, which represents the high of offer block 1 and the weekly one standard deviation high.

• In our opinion, this is the cleaner trade opportunity, as the market would be imbalancing out of the current balanced and composite value area, opening the door for directional follow through.

Conclusion

ZB sits at a critical decision point, balancing between a well repaired value area below and a clearly defined acceptance zone above. With CPI scheduled for January 13th, followed by PPI and retail sales on January 14th, the market is likely to remain patient until these releases provide clarity on inflation persistence and demand strength. A softer inflation print or weaker consumption data would support acceptance higher and reinforce the bullish imbalance scenario, while firmer data could keep ZB capped and pressure price back through the current consolidation. In our opinion, traders should focus on how price responds at 116'00 and 115'25 following the releases, as acceptance or rejection at these levels will likely define the next directional opportunity.

If you found this analysis useful, feel free to give a boost, comment, or share your own levels and scenarios below.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

w - Weekly

VAH - Value Area High

VAL - Value Area Low

VPOC - Volume Point of Control

LVN - Low Value Node

HVN - High Value Node

LVA - Low Value Area

SP - Single print

$EUIRYY - E.U CPI (December/2025) ECONOMICS:EUIRYY

December/2025

source: EUROSTAT

- Euro area consumer price inflation eased to 2.0% in December 2025, down from 2.1% in November, according to a preliminary estimate.

This marks the lowest rate since August, returning to the ECB’s midpoint target and reinforcing expectations that interest rates are likely to remain steady for the foreseeable future.

Core inflation, which excludes energy, food, alcohol, and tobacco, fell to 2.3%, the lowest in four months and just below expectations of 2.4%.

Among Europe’s largest economies, HICP rates eased in Germany (2.0% vs. 2.6%),

France (0.7% vs. 0.8%), and Spain (3.0% vs. 3.2%), while Italy bucked the trend with harmonized inflation rising slightly to 1.2% from 1.1%.

$DXY - Ballads of Dollar (2026)TVC:DXY -Ballads of the Dollar (2026)

TVC:DXY 2026 Outlook

Q1-Q2-Q3-Q4

| Quarter | Expected DXY Trend | Main Drivers |

| ----------| ---------------------------- | ------------------------------------- |

| Q1 | Mild weakness / consolidation | Fed cut expectations, risk flows |

| Q2 | Potential trough & volatility | Yield compression, global optimism |

| Q3 | Stabilization / rebound signals | US economic data surprises |

| Q4 | Mixed; range reset | Geopolitics, positioning, seasonality |

📉 Key Fundamental Drivers for TVC:DXY 2026

🔹 Monetary Policy Divergence

Expected Fed cuts compress yield differentials with ECB, BoE, BoJ, etc., reducing carry benefits for USD.

🔹 Interest Rate & Inflation Trends

Ongoing sticky inflation and resilient labor metrics could delay some cuts, supporting the dollar intermittently.

🔹 Global Growth & Capital Flows

Balanced growth worldwide reduces “safe-haven” dollar flows; global portfolio diversification may cut dollar dominance.

🔹 Reserve Currency Dynamics

Changes in global FX reserve weighting (e.g., China lowering USD share) reflect gradual diversification — a structural headwind.

🔹 Fiscal Policy and U.S. Deficits

High deficits and political disputes over debt and spending may weigh on confidence over time, even if they don’t trigger major sell-offs.

📌 Geo-Political Risk Factors Influencing TVC:DXY

🔹 U.S.–China relations: trade, tech competition, and financial linkage tensions encourage FX diversification outside USD.

🔹 Middle East & Ukraine: ongoing conflicts support cyclical USD strength during spikes in risk aversion.

XAUUSD Structure Update — Daily & Weekly View1D Chart (Daily)

Gold continues to trade above all key EMAs, with the 10 EMA leading and holding steady, reinforcing short-term structural support rather than impulsive momentum.

RSI is taking a brief breather but remains elevated near 68, suggesting momentum is cooling in a controlled manner rather than breaking down.

ATR remains flat, indicating volatility is contained and price is progressing in an orderly fashion rather than expanding aggressively.

Due to the nature of spot gold volume, OBV on the daily timeframe is less informative, and participation signals are better assessed from the higher-timeframe structure.

Overall, the daily chart reflects consolidation within strength, not distribution.

1W Chart (Weekly)

The weekly structure continues to support the broader bullish framework.

Price remains above all major EMAs, with the 10 and 20 EMA rising steadily — not steep, but clearly directional — reinforcing sustainable trend progression rather than late-stage acceleration.

OBV trends higher on the weekly, signaling healthy participation and accumulation beneath the surface.

RSI holds near 75, elevated yet stable, indicating persistent strength without signs of exhaustion.

ATR remains flat, confirming that volatility remains controlled even as price holds elevated levels.

The weekly structure confirms that gold remains constructive and supported, with no technical evidence of breakdown.

⭐ Final Clarity Note ⭐

In structurally strong markets, consolidation often appears before continuation, not after failure.

When price holds above trend EMAs, volatility remains compressed, and participation persists on higher timeframes, it typically reflects positioning rather than speculation.

Gold’s current structure suggests the market is digesting gains, not abandoning them.

GBPUSD | Bearish Structure Below 1.3372 Ahead of CPIGBPUSD | Technical Overview

The price has stabilized below the pivot level at 1.3372, which maintains a bearish outlook for the pair.

As long as GBPUSD trades under this level, the market is expected to move toward 1.3295, and a break below this zone may extend the decline toward 1.3232.

A 4H candle close above 1.3410 is required to reverse the current structure and activate a bullish momentum toward 1.3445.

Today’s U.S. CPI release will significantly impact market direction and volatility.

Pivot Line: 1.3372

Support: 1.3295, 1.3232

Resistance: 1.3410, 1.3445

Timeframe: 4H

Bias: Bearish while below 1.3372

GBP/EUR Outlook: Sterling Plunges on Inflation MissMarket Volatility and Economic Shifts

The British Pound (GBP) crashed violently on Wednesday. Markets reacted instantly to the UK’s surprising inflation data. Headline inflation dropped to 3.2% in November. This figure missed the 3.5% forecast significantly. Core inflation also fell to 3.2%, signaling deep economic cooling. Traders immediately bet on a Bank of England (BoE) rate cut. The sudden drop reshapes the short-term currency landscape completely.

Geostrategy and Monetary Divergence

A clear strategic gap now exists between European powers. The BoE must prioritize growth, forcing a dovish pivot. Officials will likely cut rates to stabilize the economy. In contrast, the European Central Bank (ECB) holds firm. ECB President Lagarde maintains a strict, neutral policy stance. This divergence draws global capital away from London. Investors now favor the stability of the Eurozone.

High-Tech Trading and Cyber Impact

Modern currency moves often stem from automated systems. High-frequency trading algorithms executed massive sell orders on Wednesday. These bots react to data variances in milliseconds. The inflation "miss" triggered pre-programmed selling cascades. This cyber-driven volatility punishes currencies instantly. Human traders struggle to match this algorithmic speed. Such technological dominance defines current market liquidity.

Business Models and Industry Trends

Currency devaluation impacts UK corporate strategy deeply. Importers face immediate cost spikes, squeezing profit margins. Management teams must renegotiate supply chain contracts quickly. Conversely, the high-tech export sector gains a competitive edge. Cheaper Sterling makes UK innovation more attractive abroad. This shift rewards companies with agile, export-oriented business models.

Innovation and Patent Analysis

A lower exchange rate can stimulate scientific investment. UK firms often rely on foreign capital for R&D. A cheaper Pound makes UK assets and patents attractive targets. Foreign investors may acquire undervalued British intellectual property. This trend could accelerate cross-border mergers in biotech and science. However, retaining top talent becomes harder with a weaker currency.

Forecast: The Policy Path Ahead

Attention now locks onto the BoE’s forward guidance. Investors demand a clear roadmap for 2026 interest rates. A confirmed dovish stance will drive Sterling lower. Meanwhile, the Euro stands resilient despite mixed German data. The policy gap between the UK and the EU is widening. This structural divergence points to further GBP/EUR downside.

Can a Currency Rise While Science Dies?Argentina's peso stands at a historic crossroads in 2026, stabilized by unprecedented fiscal discipline yet undermined by the systematic dismantling of its scientific infrastructure. President Javier Milei's administration has achieved what seemed impossible: a fiscal surplus of 1.8% of GDP and inflation falling from 211% to manageable monthly rates around 2%. The peso's transformation from distressed asset to commodity-backed currency relies on the massive Vaca Muerta energy formation and lithium reserves, supported by a US-aligned trade framework that reduces political risk premiums. The launch of new inflation-linked currency bands in January 2026 signals normalization, while energy exports are projected to generate a cumulative total of $300 billion through 2050.

However, this financial renaissance masks a profound intellectual crisis. CONICET, Argentina's premier research council, suffered a 40% real budget cut, resulting in the loss of 1,000 staff members and triggering a brain drain that saw 10% of researchers abandon the system. Salaries collapsed 30% in real terms, forcing scientists into Uber driving and manual labor. Patent filings plummeted to a multi-decade low of 406 annually, while the country ranks a dismal 92nd globally in innovation inputs despite 64th in outputs. The administration views public science as fiscal waste, creating what critics call "scienticide," the systematic destruction of research capacity that took decades to build.

The peso's future hinges on whether geological wealth can compensate for cognitive atrophy. Energy and mining investments under the RIGI regime (offering 30-year fiscal stability) total billions, fundamentally altering the balance of payments. Yet import tariff eliminations on technology threaten 6,000 jobs in Tierra del Fuego's assembly sector, while the gutting of research labs compromises long-term capacity in biotechnology, nuclear energy, and software development. The geopolitical bet on US alignment provides bridge financing through IMF support, but tensions with China, a vital trade partner for soy and beef exports, create vulnerability. Argentina is transforming into a commodity superpower with a deliberately hollowed-out knowledge economy, raising the question: Can a nation prosper long-term by trading brainpower for barrels?

$GBIRYY - U.K CPI (November/2025) ECONOMICS:GBIRYY 3.2%

November/2025 (-0.4%)

source: Office for National Statistics

- The annual inflation rate in the UK slowed to 3.2% in November,

the lowest in eight months, compared to 3.6% in October and forecasts of 3.5%.

The figure is also lower than the BoE's prediction of 3.4%, led by a slowdown in food and non-alcoholic beverages.

Gold (XAU) — Short-Term Bearish Pressure Before Bullish ContinuaGold is showing signs of short-term downside pressure. I expect an initial decline into the 4100–4130 zone. However, if the Federal Reserve does not deliver the expected rate cuts and maintains higher levels for longer, there is a real possibility of an extended drop toward the 3940–4000 area before the market stabilizes.

Despite these short-term risks, the medium- and long-term outlook remains bullish. The current structure still reflects a healthy corrective move within a larger upward trend. Once liquidity is cleared below, I expect strong bullish continuation toward the 4600–4700 zone.

Higher-timeframe momentum still favors buyers, and the overall price behavior aligns more with institutional accumulation than with true trend exhaustion.

Drop your asset in the comments + hit the like button and I’ll prepare a custom analysis for you.

Stay patient and trade with precision.

$SPY & $SPX Scenarios — Wednesday, Dec 3, 2025 🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Dec 3, 2025 🔮

🌍 Market-Moving Headlines

💼 Labor + services-heavy morning: ADP, import prices, services PMIs, and ISM all land before 10 AM — a full macro pulse on jobs, inflation pressure, and service-sector strength.

🧾 Shutdown-delayed September reports continue: Import Prices, Industrial Production, and Capacity Utilization still come from the backlog but remain relevant for inflation and growth trend review.

📈 ISM Services is the star: With manufacturing soft, services remain the market’s key gauge of economic momentum into year end.

📊 Key Data and Events (ET)

⏰ 8 15 AM

• ADP Employment (Nov): 40,000 vs 42,000

⏰ 8 30 AM

• Import Price Index (Sept, delayed): 0.1 percent vs 0.3

• Import Prices ex Fuel (Sept, delayed): 0.4 percent

⏰ 9 15 AM

• Industrial Production (Sept, delayed): 0.1 percent

• Capacity Utilization (Sept): 77.3 percent

⏰ 9 45 AM

• S and P Final United States Services PMI (Nov): 55.0

⏰ 10 00 AM

• ISM Services (Nov): 52.5 percent

⚠️ Disclaimer: Educational and informational only — not financial advice.

📌 #SPY #SPX #trading #macro #ADP #services #ISM #inflation #imports #markets #investing

$EUIRYY- E.U CPI (November/2025)ECONOMICS:EUIRYY 2.2%

November/2025

source: EUROSTAT

- The annual inflation rate in the Eurozone edged up to 2.2% in November from 2.1% in October, slightly above expectations of 2.1%.

Prices grew faster in the services sector, while energy costs continued to decline but at a slower pace.

Meanwhile, core inflation held steady at 2.4%.

Is the EUR/JPY Rebound Real or a Bull Trap?

The EUR/JPY cross climbs near 180.70, but technical barriers and hawkish central banks cloud the horizon.

The EUR/JPY pair has snapped a three-day losing streak, gaining traction during the Asian session on Tuesday. Spot prices currently hover near the 180.70 area, marking a 0.10% intraday increase. The market found solid support near the psychological 180.00 mark, bouncing from a four-day low. Traders are now positioning themselves ahead of crucial Eurozone inflation data, which serves as the primary catalyst for this upward momentum.

Macroeconomic Drivers: The Inflation Paradox

Investors focus intensely on the upcoming Eurozone Harmonized Index of Consumer Prices (HICP) data. Forecasts suggest headline inflation rose 2.1% YoY in November, with core inflation edging up to 2.5%. While France and Spain showed cooling prices, Germany reported unexpectedly high inflation figures. This divergence reinforces the argument for a European Central Bank (ECB) policy hold. A pause in rate cuts acts as a significant tailwind for the Euro.

Geostrategy and Global Risk Sentiment

Geopolitical stability and market optimism currently undermine demand for traditional safe-haven assets like the Japanese Yen (JPY). A positive global risk tone encourages investors to seek higher yields, favoring the Euro over the Yen. Furthermore, global trade policy discussions are prompting capital flows into currencies backed by stable export economies. The Eurozone’s industrial adaptability positions it favorably in this environment, suppressing JPY strength despite potential interventions.

Leadership and Governance: The BoJ Stance

Bank of Japan (BoJ) Governor Kazuo Ueda recently delivered hawkish remarks regarding economic projections. He stated that the probability of meeting growth targets is rising. Concurrently, Finance Minister Satsuki Katayama sees no divergence between the government and the BoJ. However, the market has temporarily priced in these warnings. The immediate focus remains on the ECB’s reluctance to cut rates, which overpowers the BoJ’s normalization narrative in the short term.

Industry Trends and Innovation Economics

European currency strength draws support from resilient industrial sectors. High-tech manufacturing and advanced engineering firms in the Eurozone continue to drive wage growth. This economic activity contributes directly to the sticky services inflation observed in the region. Unlike Japan’s deflationary history, Europe’s innovation ecosystem maintains price pressures that prevent the ECB from adopting a dovish stance too quickly.

Technical Outlook and Support Levels

Technically, the pair faces immediate resistance at the 181.75 barrier.

A breach here could open the path toward 182.35. Conversely, failure to maintain momentum may trigger a slide back toward the 179.40 support level. Traders must monitor stochastic indicators, which signaled negativity yesterday but are now neutralizing. The market awaits the HICP release to confirm the next directional breakout.

4 Biggest trading opportunities this week This week presents several key events traders should keep a close eye on:

Korean inflation – Monday 6pm

The last reading for SK CPI came in at +2.4% year‑on‑year in October 2025, above the 2.1% expected by economists. Another surprise uptick might reinforce expectations of a rate pause (or even a re‑tightening), which could boost KRW.

Euro inflation – Tuesday 5am

Inflation data out of the eurozone will shape expectations for the European Central Bank (ECB). If inflation remains sticky or rises, it could bolster ECB hawkishness, strengthening EUR and European bond yields.

Australian GDP Growth – Tuesday 7.30am

Australia’s GDP report will offer a snapshot of the local economic picture. A strong GDP print could support the Australian dollar and lift demand for commodity‑linked assets, given Australia’s status as a major commodity exporter.

US PCE – Friday 10am

The upcoming release of the Personal Consumption Expenditures Price Index (PCE) matters because the Fed views it as its preferred inflation gauge. A hotter‑than‑expected PCE could reaffirm caution on rate cuts and lift USD, bond yields, and potentially weigh on risk assets.