$AAVE - Logarithmic Idea #AAVELog Chart of AAVE, with curved/parabola trend lines and potential paths.

The fib levels indicate points of resistance.

Current Strong Resistance: 0.236 Fib, EMA20, EMA50 - wow!

Support from EMA 100 - pretty cool to see this all line up.

Breaking through this resistance area could rocket the price up to previous highs, possibly further.

We also have the RSI, Stoch RSI and MFI. All of which are in oversold/neutral territory meaning, risk-vs-reward on this trade is well balanced, if indeed the bull market ensures and bitcoin dominance drops.

My personal opinion is that bitcoin chops sideways for 3-12 days and alts have a mini rally.

LOGARITHMIC

BTC Cup and Handle (in Progress) - Not Exactly TextbookWe have a new high above the rim and a handle in process.

We are are above the Axis of the Logarithmic Channel that describes BTC's Bull Run from Hell.

We are above the Support of the price with the most volume during this Cup formation.

The only thing is we have ATH as a resistance above.

Otherwise there is nothing stopping BTC reaching the Textbook target of 73k described by the previous Cup formation that Musk and his tweet pumps ensured closure.

Top traders on Binance are 3 to 1 account heavy long and Open Interest isn't showing signs of decease.

Shorting at this point could prove expensive.

Good luck

BTC Unstoppable Parabolic Bull RunNote:

Logarithmic Scale

BTCUSDT Perp Futures

BTC plain to see has been going parabolic within a log channel. New high cup rims to new scallop ATHs. Temp shorting is the only recommendation and only for pros. A long heavy account is what the top traders are running and it is wise you do the same !

Ride the whales to economic freedom

Go BTC go you good thing !

Bitcoin Long Term Price PredictionsMany have plotted similar log charts but I think this is the most accurate representation. I believe the middle trendline is important and we have already had the retest below so I lean towards the next large 40% pullback coming from much higher up.

My Initial price range estimates are between $200-$280K but my lowest conservative estimates are $150-$200K, just simply based on the info in this chart and the current macro environment, assuming nothing major changes.

Date range of May to October, more likely June to October &

bitcoin Btc daily outlookThese are the monthly camarilla pivot points. and the white lines are btc logametric growth curves. At first glance on the pivots it looks like 80k 70k or 80k might be next. However I do want to pount out this daily channel which has been respected for some time. As well as we have a daily pivot developing tomorrow 2k+ lower and a weekly pivot developing 4k lower and those newly developed points are high frequency magnet reversion points. As well as our next log growth level around 64k. So I just want to show this outlook out in the art of staying cautious and level headed.

My Bitcoin Price action Cycle Model Disclaimer : I am not Your financial adviser this is not financial advice ... Never invest more than you are willing to loose ...

Quote: History does not necessarily repeat but at times it sure does like to rime

My intentions : I would like to get exposure for a pattern or perspective I have on Bitcoin and its price action in relation to its halving cycles

Thoughts: 1,2,3,4,5??? If price action plays out like it has 4 times before then the blow off top has price action going up to $900,000 or $600,000

I have coloured the cycles purple blue cyan green yellow orange ...

Credits :

//---- Inspiration ----//

@HBK_INVESTMENT_GROUP : ("JUST GONNA SIT THIS HERE.......... Oct 21, 2020")

//---- color array script ----//

@alexgrover : (A Useful MA Weighting Function For Controlling Lag & Smoothness)

//---- Colors used in script ----//

@midtownsk8rguy : ( Pine Color Magic and Chart Theme Simulator)

//---- Halvings Script Creator ----//

@capriole_charles : (Bitcoin Bull Cycles)

The global Macro environment is also quite good for Bitcoin Money printer go Brrrrrrrrrrrrr rrr rr r

Webster’ American Dictionary of the English Language, published by G&C Merriam Co. in 1864, was the first to formally define inflation as an economic term:

undue expansion or increase, from over-issue; -- said of currency.

Btc is potentially an exit from the Debasement of the fiat currency which is the theft of our time and energy ...

My final thought is that obviously this model is far more bullish than most other Macro price action Bitcoin models

Models like : the stock to flow or the log curves classic staples

Thank you kindly for your time

take care

Updated simple log trend with ceiling at 80 NOK. There are some wild swings in this stock. So far still positive news from the company. Progress is being made, but not as fast as the market want.

Highly speculative Ethereum logarithmic regression curveHere is why Winklevoss brothers estimated high prizes for ethereum in bullrun peak.

Do remember to start taking profits / liquidity as we approach the target bubble.

As Ethereums progression reachhes 2.0 (small steps), things are gonna get excited!

BTC Prize speculation using prize peaks during previous bullrunsConsider taking some profits in the coming summer.. there will be bear year after this run.

Also possible altcoin fluctuation, maybe possible to make gains after bitcoin has reached its peak.

But everything will fall drastically after semester.

Sorry strange english, my native finnish brains make Ralli-finglish sentences.

BTCUSD: Monthly Log Chart A logarithmic look at the evolution of BTC price since its very early days

The following key takeaways:

BTC tends to extend only about 1/5 of its prior impulse move measured in terms of % increase;

BTC tends to react ≈38.20% on a logarithmic scale to form a correctional bear market;

The sub $80k area is a pivotal area to look for supply inflows.

This analysis suggests an earlier-than-expected onset of bull trend maturity stage in the upcoming few months, which might correct this lower to the $20k area.

The long term bull caseI have made a lot of comments about the long term bull case for bitcoin. Really that comes in the form of a number of different angles and analysis, which I might suggest a couple more ways of looking at things.

This one goes on the assumption that the price follows historic price action, which it often doesnt. At these prices retail traders are put off, and institution plays a vital role in propping up prices. Fair value of bitcoin is under greater focus the higher the price, and hands get weaker at tops, until new supports are created. In this run we are yet to find a floor for value. Whilst this chart doesnt show a downward price discovery, one will need to happen at some point.

This simply goes on the assumption that IF price continues to match the pattern, and we assume that percentage increase also matches, the price will top at around $320,000usd per btc.

I should note, although I am personally a longterm permabull (year timeframe), I am short term trading trends and always open to short opportunities as well as long term opportunities. This is one bullish outlook, based on certain hand-picked facts. It is not my only outlook, and I could create an equally bearish chart given the time!

Thoughts on anything in this chart are welcomed

100.000 $ bitcoin in sight?Check this logarithmic monthly view for BTCUSD.

2013

Peak: 1100$

Correction middle of this channel: 300-400$

Bottom: 150-200$

2017

Peak: 19.200$

Correction middle of this channel: 6200$ (monthly EMA 50, 200, and bollinger too there)

Bottom: 3800$

2021 (2022?)

Peak: 100.000$ ?

Correction middle of this channel: 44.000$ ?

Bottom of the channel approx...: 30.000$ ?

Correction cycles around 600-800 days...

Giants like TSLA, JP, Goldman, etc... will make the 20.000$ breakout (2020) as the new 1200$ breakout? (2017) We will never see again that lows???

🔥 Bitcoin Has More Room To Grow: Logarithmic AnalysisIn my previous long term Bitcoin analysis I argued that we had much more room to grow, more than 50% actually. This post is to indicate that the current bull trend is far from over and that we, most likely, will have another couple of weeks of the current market.

Seeing this week's sharp increase, the following couple of weeks will most likely be bullish too until the price reaches the upper resistance on the chart. Around that area, be wary that the price might reverse and start a bearish trend. Do your own due diligence.

Happy trading!

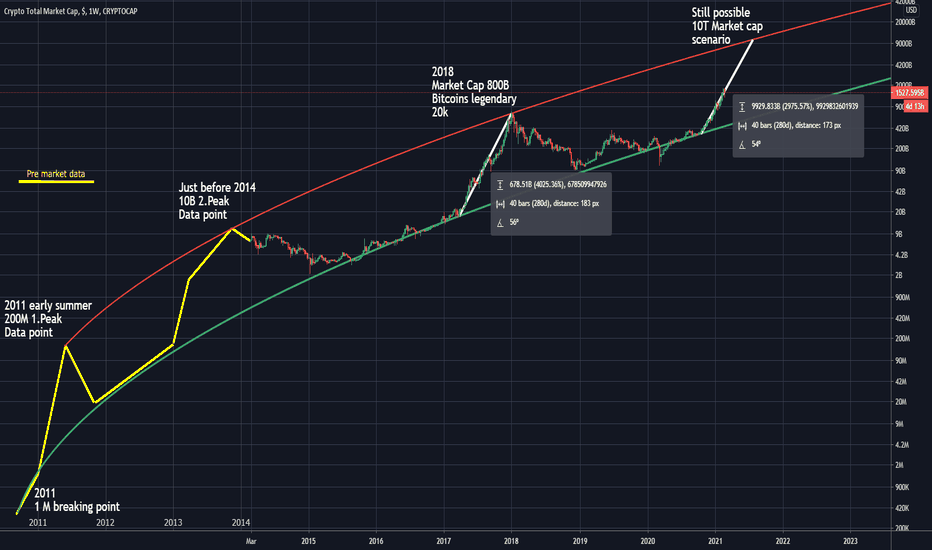

Projection: Crypto Marketcap will hit $83T by Jan 2023The macro of the crypto marketcap is strongly bullish. We broke above the line of resistance that we hit in Dec 2017 that sent us into a multi year bear market and the short term result was a break of $1T. However, we must keep in mind that we may very well come back down to test that line in the mid $700B before we continue our march toward $83T. I expect somewhere around $30T by the end of this year.

BITCOIN might be getting ready for the this cycle's FINAL RUN!!!Guys, I am comparing 2017's bullrun with the current situation using the log growth curves and I've found something interesting:

In 2017, the price corrected just after hitting the center log line. The price then went back to the lower log line and then up directly do the upper one, considering the center line as refference.

NOW, we have just hit the center line and corrected down to the lower one AND the price ran straight to the upper line ONCE AGAIN!

SOOOO, it's very likely we are having one last minor correction now before shooting straight to the moon. IF this happens, this cycle's FINAL TARGET should be around 105.000 USD !

Leave a comment and share this idea if you think it makes sense.

SEE YOU ON THE MOON