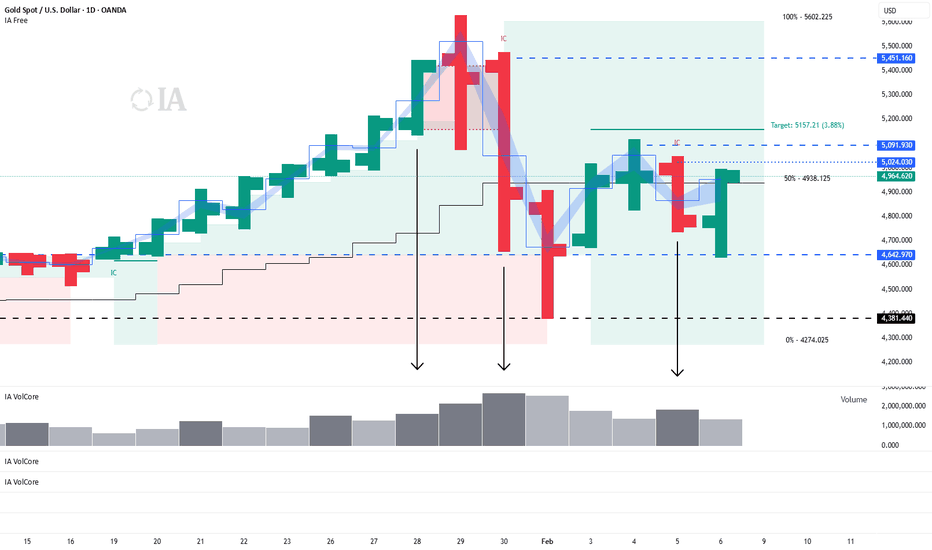

Gold: New sell zones after a volume spikeH1: False Breakout of 4943 in Question.

H4: Range and Key Levels for Seller Continuation

Hi traders and investors!

Daily timeframe

On the daily timeframe, on Thursday, we saw a seller continuation on increased volume.

On Friday, buyers became active from the 4679 level — this level is clearly visible on the 4H timeframe (explained below).

The main sell zones were outlined in the previous review.

In addition, considering the strong seller candle on Thursday, new areas have emerged where it makes sense to look for shorts on H1 and H4.

Hourly timeframe (H1)

A scenario is possible where a false breakout pattern forms at the upper boundary of the most recent seller initiative.

Upper boundary of the initiative: 4943.

There is an attack bar at this level with increased volume.

If the seller absorbs the attack and price closes below 4894 (the low of the attack bar), the pattern will be considered confirmed.

The potential downside target for this pattern is 4790 (red target line).

Alternative scenario: if buyers manage to defend the 4921.85 level, upward movement may continue. In that case, it would be more reasonable to look for sell patterns on the 4H timeframe.

4-hour timeframe (H4)

On H4, price is in a sideways range. A seller initiative is active with a target at 4596.

After the 4679 level formed, the market moved into consolidation, and on Friday buyers resumed from this level.

Within the current seller initiative, the candle with the highest volume stands out (marked as IC on the chart) — it is a seller candle.

This candle has already been tested; the test level is 5024.

Accordingly, 5024, as well as the area above 5091, may act as zones where the seller can resume, making them suitable areas to monitor for sell patterns.

If considering long positions, they should be sought only after price interacts with the 4596 level.

An alternative scenario for longs is the formation of buy patterns after interaction with the lower boundary of the range at 4402.

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

Multiple Time Frame Analysis

Intervention Looms Will 160 Hold? Or 1600 Pip Drop?Big day for the Japanese Yen as markets await the outcome of the election.

The USDJPY has been on a sharp rise towards the 160 mark over the last week and ever since the NY Fed rate check 2 weeks ago.

Looking at the charts I am expecting some volatility on the Sunday/Monday market open and I suspect we may get a gap open with a rally up and maybe above 160.

This would most likely be classic timing for the Japan to actually intervene in the market to shore up the Yen as late Friday's and Early Monday sessions has been times they have acted before and around the same levels given low liquidity.

Given these risks I would not be looking to buy into any USDJPY rally at current levels as the risk reward just ain't there, reading forums and retail ideas many are piling in long classic sheep being led to the slaughter behaviour.

Monthly charts clearly show we are in a range between 160 -143 with a MACD crossover confirmed on the Weekly charts which normally you see the initial drop followed by a rally back up before continuing down.

*The Yen futures chart is also confirming this as we have had a MACD crossover to the upside*

How will I play this move??

High chance this weeks open will be a gap up with price moving sharply towards and above 160 I will start building into shorts above 159 positioning for intervention as we have now had every stop towards actual intervention verbal warnings for Months then the actual rate checks that is followed intervention.

The silence from Japan last week even as the Yen was dropping is something to note as could well be the silence before the storm.

If this plays out then a drop back down to the bottom of the Monthly range 143 is highly likely in coming Months as the dust settles.

If no gap open occurs then way may still see 160 tested BUT the only way I would even think about going long this pair is if we get a strong clean break and close above 160 on a weekly/monthly chart followed by retest to 160 on slowing of momentum then go long.

Let me know your thoughts.

us30 week 2 feb 2026 Out Look I see a sell to buy scenerio

from HORC analysis we have Monthly and daily liquidity resting below

but since we are at ATH no sell zone to sponsor its raid From HORC cordinate we also have a weekly missing coordinate which is W+

if W+ raids the current High then we can expect a reversal down

Bitcoin: Key level 74,508Monthly Chart

The price has moved below the lower boundary of the last buyer initiative at 74,508 and also dipped below the low of the November 2024 buyer candle (66,835).

That November candle remains the highest-volume buyer candle from April 2024 through January 2026. It will be important to see what volume forms in February 2026.

The 74,508 level is now a key reference.

Weekly Chart

A sideways range has been forming on the weekly timeframe since January 2025.

The chart shows a nearly symmetrical expansion of this range:

first downward by about 14,700

then upward by 14,200

and now downward again by roughly 14,500.

This symmetry likely points to stabilization within a broad price range of 60,000–126,000.

The volume of the latest weekly candle is notable. While it is still below the volume of the February 24, 2025 candle, the week has not yet closed and may exceed it.

This suggests solid demand for Bitcoin at current price levels.

Key resistance levels are marked on the chart.

Conclusion:

From a conservative perspective, long positions can be considered once buyers reclaim the seller candle on the weekly timeframe — that is, with a close above 79,360.

Until then, it makes sense to focus on local setups on lower timeframes, as the price may consolidate in this area for several weeks.

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

XAUUSD 30-min – High Probability Short Setup (SMC/ICT)🚨 HIGH PROBABILITY SHORT SETUP – XAUUSD 30-min

Entry Zone: 4,985 – 4,995

(Confluence: Order Block + FVG Fill + Previous Resistance)

Stop Loss: 5,010

(Above recent high and FVG)

Target 1: 4,880 (Liquidity Pool)

Target 2: 4,840 (Support Zone)

Target 3: 4,720 (Break of Structure Extension)

✅ WHY THIS SETUP WORKS:

BOS Confirmed – Market structure broken bearish

Order Block Resistance – Strong supply zone at 4,988.85

FVG Above Price – Likely to be filled before continuation down

Liquidity Below – Price drawn to 4,880 liquidity pool

CHoCH Present – Momentum shifted bearish

🎯 EXECUTION PLAN:

Wait for price to fill FVG/Order Block zone (4,985-4,995)

Enter short on bearish 30-min rejection candle

Stop Loss at 5,010 (above structure)

Move to breakeven after hitting 4,940

Take partial profits at 4,880 & 4,840

⚠️ RISK WARNING:

Only trade with confirmed rejection

Avoid if price breaks above 5,010

Monitor lower timeframe for entry timing

BTC To the moon?Bitcoin (BTC/USD) is currently positioned in a critical demand zone, which I believe represents a strong accumulation area for buyers. This zone has historically acted as a support level where significant buying interest emerges, preventing further downside and setting the stage for upward momentum.

From a technical perspective:

The price is consolidating around this demand area, showing signs of reversal with increasing volume and bullish candlestick patterns.

Key support levels in this zone are holding firm, aligning with Fibonacci retracement levels from the previous bull run.

I anticipate a strong bullish impulse from here, targeting $120,000 as the primary upside objective.

This target is derived from measured moves based on prior wave extensions and resistance projections.

Risk management: Place stops below the demand zone to protect against invalidation.

This is not financial advice; always DYOR.

Long trade 📈 EURJPY — Buy-Side Sentiment Analysis (15-Minute)

Observed: Mon 26th Jan 2026

Session: London AM

Time Reference: 6:00 am (NY time)

📌 Trade Details

Entry: 186.241

Take Profit: 187.418 (1.86%)

Stop Loss: 185.954 (0.14%)

Risk–Reward: 12.89R

🟢 Directional Bias

Buy-side reversal → continuation:

Price action indicates a completed sell-side run, followed by institutional absorption and a controlled transition back into bullish order flow.

🧠 Market Sentiment Overview

An extended bearish leg engineered downside liquidity

Sell-side liquidity swept clean into the 182.00 handle

Aggressive rejection from the lows signals sell-side exhaustion

Buyers stepped in decisively → sentiment flipped from risk-off to accumulation.

🧩 Structural Context

Bearish structure completed its objective (equal lows / sell-side pool)

Sharp displacement higher confirms local bullish BOS

The market transitioned from deep discount back toward equilibrium

Structure now supports mean reversion higher, not continuation lower.

📊 Volume Profile & Value

Heavy volume absorption at the lows

Value began migrating higher post-sweep

Acceptance above in the raday value confirms a bullish auction response

🟦 PD Arrays / Fair Value Gaps

Multiple bullish FVGs formed on the impulse from the lows

Entry aligns with discount mitigation inside bullish inefficiency

No clean inefficiencies left below → downside fuel largely removed

⏱️ Session Behaviour

London AM delivered the true low of the move

Classic session profile:

Asia consolidates → London sweeps → expansion follows

NY continuation his ighly probable if the structure holds

🎯 Trade Logic

Sell-side liquidity fully taken

The market showed immediate bullish displacement

Pullbacks are shallow and supported

Buyside liquidity resting above prior highs acts as a magnet

⚠️ Invalidation Criteria

Failure to hold above the reclaimed structure

Bearish displacement back into discount

Acceptance below post-sweep low

Until then, buy-side bias remains valid.

🧾 Summary

EURJPY shows buy-side sentiment following a completed sell-side liquidity sweep and strong bullish displacement. Absorption at the lows and acceptance back above the value support mean reversion toward premium liquidity.

Gold- From weekly to 15m chart. Where are the trades?These days, everyone has an opinion on Gold.

Most of them are bullish.

And to be fair — so am I.

But here is what many traders either don’t understand or simply ignore:

There is a huge difference between having an opinion and having a tradable opinion.

A tradable opinion is one that can actually be executed in the market, with leverage, risk control, and realistic stops — not just a direction on a chart.

This analysis is not about saying “Gold is bullish, it will go to 6k or 7k, I’m a genius if it does.”

It’s about giving traders something they can actually work with.

🔎 Weekly Chart — Big Picture Reality

Three things stand out immediately:

1️⃣ The 5600 → 4400 drop

Yes, it was massive:

- ~12,000 pips

- large in percentage terms

- emotionally shocking

But in long-term trend terms?

👉 Just a correction.

Even if we measure only the 2025 rally, the drop didn’t even reach a 50% retracement.

2️⃣ Technical respect of structure

The decline stopped almost exactly at the October 2025 ATH, which acted as support.

Markets remember levels.

This is not random.

3️⃣ Alignment with congestion

The drop also aligned with:

- the late-December congestion zone

- the starting price of 2026

The first prices of the year often act as major S/R zones.

This is classic market behavior.

✅ Conclusion from Weekly:

Trend is bullish. No debate here.

❌ But tradable?

Not really.

Why?

Because a correct structural stop would be ~8,000 pips away.

With leverage, that’s not trading — that’s praying.

🔎 Daily Chart — Still Bullish, Still Not Tradable

On the daily:

- clean reversal from support

- first impulsive leg up

- pullback forming a higher low

- recent Piercing Line bullish pattern

Again:

✅ Bullish structure

❌ Not tradable structure

A proper stop still sits ~4,000 pips away.

That’s not risk management.

🔎 15-Minute Chart — Where Trading Actually Happens for me lately

Given current volatility, this is what matters these days

Here’s what we see:

- initial rally in a rising wedge

- rejection from resistance

- drop from 5100 → 4650 contained within a bullish flag relative to the impulse

- breakout above flag resistance

- continuation toward 5k

- NY close near highs

Structurally?

👉 Still bullish.

But even here:

❌ Buying blindly at 4965 makes no sense.

We need a dip.

We need structure.

We need asymmetric risk.

📌 The Two Buy Zones That Make Sense

If price offers them:

✅ 4900

✅ 4800

Those are the zones where risk/reward becomes logical.

⚠️ The Reality Most Traders Don’t Want to Hear

Even on a 15M chart:

- stops of 300–500 pips are normal

- targets should be well above 1,000 pips

Let’s be honest:

Bragging about a 100-pip Gold target these days is like bragging about a 2-pip win on a EURUSD trade.

simply not trading...

✅ Final Conclusion

✔️ Gold is bullish

✔️ I will look to buy dips

✔️ But only with structure and discipline

Because in this environment:

- volatility is extreme

- emotions are expensive

- precision matters more than bias

A trader’s job is not to be right.

A trader’s job is to make money.

And those are two very different things. 🚀

P.S.

And yes — if I see a clear reversal structure on the 15-minute chart, I can take a short trade, even if my overall bias on Gold remains bullish.

This does not contradict my opinion.

It simply reflects the reality that:

You can be bullish on the bigger picture and still trade short-term corrections.

Have a nice Saturday!

Mihai Iacob

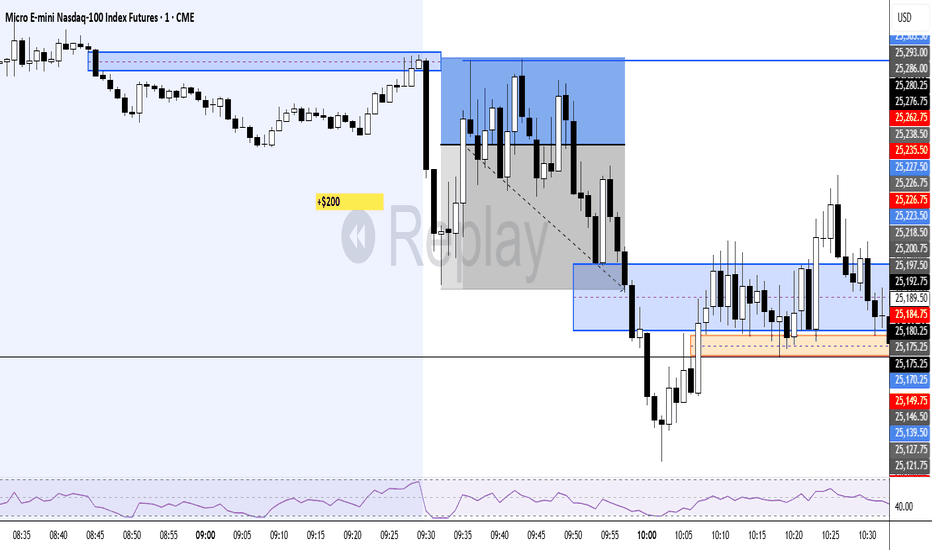

MNQ Analysis & Day Trading - Thursday February 5 2026 part 22-3 so far on the day, +$154. continue the day in part 3.

-------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Thursday February 5 2026 part 12-1 / +$404 so far on the day. Continue this day with part 2 next.

----------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Wednesday February 4 2026 part 3Great day. 4-1 / +$586

---------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Wednesday February 4 2026 part 23-1 / +$498 so far on the day. Remaining day in part 3.

----------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Analysis & Day Trading - Wednesday February 4 2026 part 11-0 / + $200 so far on the day. Remaining day in part 2.

---------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

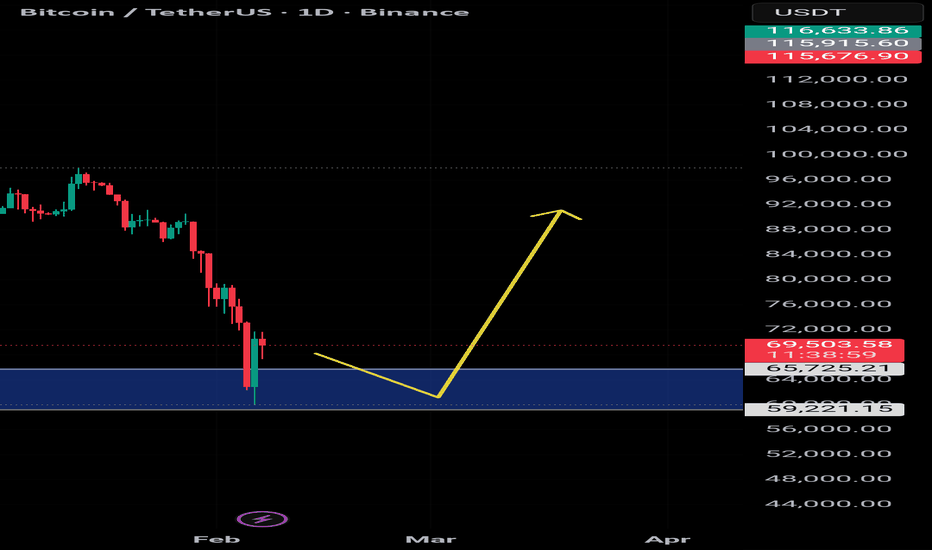

Possible BTC next move. Although most of people are calling a bear market to crypto I keep my bullish sentiment. This end of the week showed a great support around 60k but knowing crypto I know there is a big chance to see a final push back to wipe all the leveraged positions and spread more fear around retail investors. The reaction at 60k is a positive sign but not strong enough to keep the momentum going in my opinion.

AUDCAD (AC) - Bullish | HTF Premium & Cautionary ObservationHigher Time Frame Bias

AUDCAD remains bullish, printing higher highs and higher lows. Price recently confirmed a high by sweeping internal liquidity, validating the HTF bullish structure.

Observation & Midterm Context

• There are two key zones to note:

1. Thin, small orange zone near the inducement sweep → low probability area, risky to take early positions

2. Large, visible orange order block → high probability zone for bullish continuation if price respects market cycle phases

• Currently, price is dancing in premium territory, increasing the chance of distribution and manipulation

• For a clean bullish confirmation, price would need to sweep buy-side liquidity above the highs and show a structural shift, which has not occurred yet

Execution & Mindset

• Focus only on high probability zones (the large orange OB)

• Sit on hands, track footprints, and speculate quietly until alignment

• Avoid early inducements that flush weak participants or counter-trend traders

Patience & Edge

Patience is the key.

Tracking is the edge.

Observe structure, market footprints, and HTF behavior before committing — this discipline preserves the subtle 1% edge in rare market conditions.

Journal LogThis post is created for my own personal trading journal and record keeping. It reflects my own analysis, thoughts, and execution for self-review purposes only. It is not intended to be trading advice, investment advice, or a recommendation for anyone else. Markets involve risk and every trader has different strategies, risk tolerance, and decision-making processes.

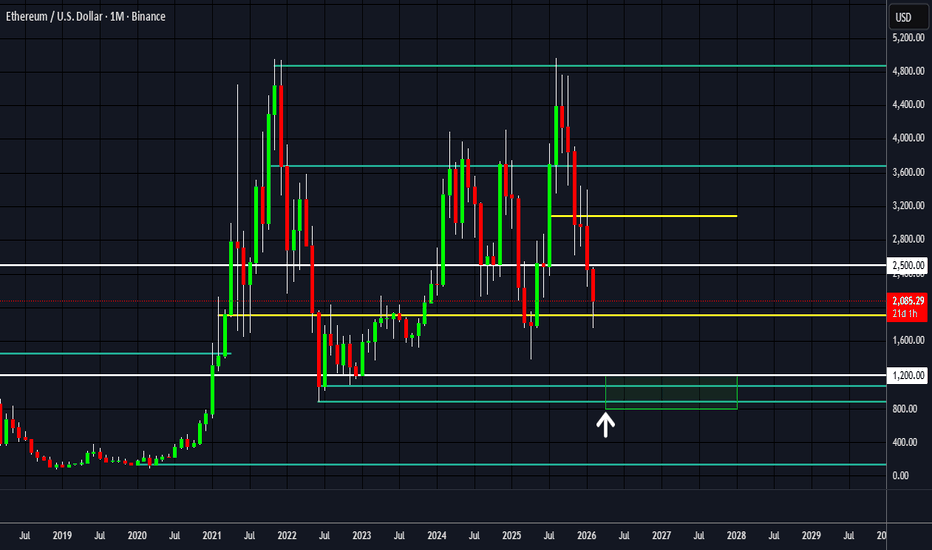

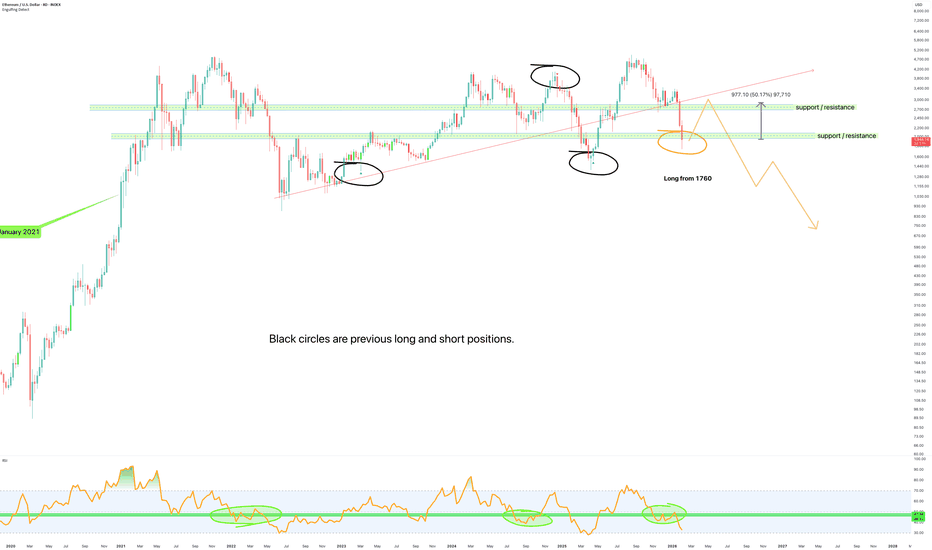

Underwhelming move to $3k for Ethereum - February 2026The most underwhelming move in Ethereum’s history is about to print over the next few months. I say underwhelming because 50% forecast in a market that can drop the same amount in a few hours is.. underwhelming if not depressing. Regardless, they’ll call it a win.

A 50% gain to $3k is where price action was in April 2021. Six years of nothing is not a win, it’s a sad confirmation of an asset no one needs or uses. Do you remember a strong Ethereum run in the past was indication of a strong alt season? The same will be true in reverse. This forecast is not a trading opportunity, it’s an escape hatch to exit a toxic, obsolete, and technological redundant asset class.

The black circles are the last three long and short ideas published by Ww. Click over the little triangles to see the idea, and more amusingly the comments that attempt to denounce the idea. Emotion in liquid form is a valuable commodity to help us understand the validity of an idea.

On the above 8 day chart price action has dropped around 60% since the shared a “mind idea” at 3500 in November past. Had zero bok to publish an idea. And that’s annoying because now there would be 4 little triangles. Auf jeden fall…

Why long now?

Price action, believe it or not, is in an uptrend. A break of the recent upper support was made as price action fell to the next resistance. If a lower high is to print, confirming a larger trend reversal, then the upper support shall confirm resistance, which is around $3k.

Conclusions

In conclusion, the anticipated 50% move to $3,000 represents not a triumph but a failure. It would merely return Ethereum to a price level first seen six years ago, confirming its stagnation and technological redundancy. This forecast bounce is not an opportunity for profit, but a final exit signal, a chance to leave an obsolete asset class before the broader multi year downtrend to lower lows.

Ww

==========================================

Disclaimer

Right, look. Before you get all excited or start crying into your ledger, a quick word. This isn't financial advice. I'm not your dad, I'm not a wizard, and I definitely don't care if you lose your house. I'm just a bloke pointing at a graph, having a giggle.

The idea that Ethereum shuffling back to a price it had when The Queen was still alive is being spun as a "win" is... well, it's clucking tragic, isn't it? It's like celebrating your hairline returning to where it was in 2018. It's not a comeback; it's a confession.

So, if you're one of those sentient beard-strokers who thinks this digital beanbag is the future because it can run a cartoon monkey casino slightly slower than a 1998 Tamagotchi... brilliant. Knock yourself out. Buy it. Mortgage your mum's shed. I genuinely hope it goes to the moon for you, because the resulting documentary when it all goes wrong will be hilarious.

But for the love of God, don't come whinging to me when this supposed "breakout" turns out to be the financial equivalent of a death rattle and you're left holding a bag of obsolete code. You were warned. It's not my fault you thought "decentralised" meant "can't go to zero."

BTC Straight to 50k or Move back To 80K??BTC has been smashing down the last few Months with selling intensifying the last couple of weeks what next ?

Looking at the Monthly chart we have broke the long time Monthly trendline selling off heavy smashing into a key support level which was the previous resistance from 2021 now support and now entering the huge Monthly BUY/DEMAND zone from 50k to 64k.

With a weekly sell zone created up around 80k next likely path is for a move back above 70k towards this zone.

To confirm this move you want to see price stabilize inside the Monthly buy zone possible dead cat bounce out of the zone then a retest with a daily MACD cross over for a move back up to 80k.

Everything is pretty bearish and knowing how crypto can crash I would not be looking to buy until the above signal occurs as the MACD is still pretty open on Monthly, Weekly and daily charts and still has plenty of room to drop towards 50k before any real buyers start accumalating.

Let me know your thoughts

OG Fan Token OG to print 200% upside more to resistanceOn the above 8 day chart price action has corrected 90% since October on this football token.

Resistance is around 200% above current price action with RSI at ridiculously oversold levels for this timeframe. There's many more technical reasons for being bullish, but time is limited for usual waffle.

Is it possible price action falls further? Sure.

Is it probable? No.

Start scaling out after $8 or wait for a probability condition to print.

Ww

==============================================

Disclaimer

This idea is for educational and informational purposes only. It is not financial advice. Cryptocurrency trading carries significant risk of loss and is not suitable for all investors. Always conduct your own research (DYOR) and consider consulting a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

NVDA 1D: Pause before the next chipOn the daily chart NVIDIA has shifted from a strong impulsive advance into a consolidation phase. After printing new local highs, price formed a contracting structure, broke higher, and returned for a retest of the breakout area. Selling pressure remains limited, with no follow-through to the downside, suggesting a pause within trend rather than a reversal.

Structurally, price action reflects consolidation inside a broader uptrend. The 185–190 area remains the key holding zone, where price stabilized after the retest and continues to trade above the 100-day moving average. Higher lows are preserved, keeping the higher timeframe structure intact. MACD holds above the zero line, while ADX continues to decline, confirming compression rather than directional expansion.

The primary reaction level sits near 212, marking the upper boundary of the current consolidation. Acceptance above this level would allow for continuation toward the 230–232 area, aligning with the upper expansion of the range. A failure to hold the 185-190 zone would shift price into a wider neutral structure without confirmation of trend continuation.

Fundamentally, NVIDIA remains strong. Q3 2025 EPS came in at 1.30 USD, with Q4 2025 EPS estimated at 1.52 USD ahead of the February 26, 2026 earnings release. Revenue reached 57.01B USD in Q3, with expectations of 65.56B USD for Q4. Cash flows remain robust, with operating cash flow at 83.16B USD and free cash flow at 77.32B USD. Compute and Networking continues to be the dominant revenue driver.

As long as structure holds, the market remains in digestion mode following the prior impulse.

Price action leads before fundamentals follow.

Is a crash to $56k about to occur for Bitcoin? - November 2025The above chart been brought to my attention by a number of folks asking for an opinion. So here it is.. remember, am just a messenger not target practice.

Price action shown on the above weekly chart has closed under the 50 week SMA, or so I’m told.

“Is that it? The top now in Ww?”

Look left, if you’re using two moving averages:

50 week SMA (blue)

200 week SMA

Then for you, the top is in. It’s over, go home. Congratulate yourself once again for providing exit liquidity for those that entered long positions at $15k. They have your everlasting thanks.

What's the hullabaloo?

Throughout the history of Bitcoin a test of the 200 weekly SMA occurred every time price action closed under the 50 week SMA. That’s not up for debate, it is a chart fact. Today that would be a highly predictable test of $56k, which is also the Fibonacci 0.38.

This forecast is going to upset a lot of people. The influencers promised them tales for fortune and glory. Instead.. they got a lesson in basic economics, but they had to pay $50,000 for it. You don't get refunds for stupidity, do ya?

Is this time different?

It is not possible to tell right now. Many might look at the chart and quit, they’ve had enough. That would be a mistake. Why? Confirmation.

Look left. Always look left. Until Monday 24th, November it is not known if the break of the 50 week is confirmed. Indeed if you take a closer look, price action has not actually closed a weekly candle body under the 50 week SMA, it has closed through it. That’s important.

Today

January 2022 Confirmation

June 2018 Confirmation

August 2014 Confirmation

Conclusions

So here we are again, Bitcoin teetering on the edge, influencers chanting “bull market!” like it’s a religion, and yet… there’s that nasty little blue line.

Price action under the 50-week SMA has never ended well. Not once. Every single time, without exception, it’s been followed by a cozy trip down to the 200-week SMA. Historically, that’s what Bitcoin does, it falls until it hits something red and expensive looking, then everyone acts surprised.

And where’s that level today? About $56k. Right on the Fibonacci 0.38. It’s like gravity with maths. But before you light the torches and start the “Ww’s turned bearish” posts, calm down. The candle hasn’t confirmed yet. That’s right, you’ve got until Monday, November 24th to find out if this is the real deal or just another fake-out designed to make you question every life decision since buying at $110k.

Look left. Every time price closed through the 50-week, the same story played out:

August 2014: crash.

June 2018: crash.

January 2022: crash.

It’s basically Bitcoin’s version of Groundhog Day, but without Bill Murray or the happy ending.

If it confirms below that line, that’s it. The 200-week SMA becomes the magnet.

If not, we’ll bounce, the influencers will return, and everyone will convince themselves they knew all along.

Either way, I’m not saying “doom.” I’m just saying, maths, it works.

Ww

Disclaimer

===============================================================

This isn’t financial advice. Obviously. If you’re taking investment cues from a bloke with a sense of humour about market collapses, you might want to re-evaluate your decision making process.

If you sell here and it pumps that’s on you.

If you hold and it dumps, that's also on you.

If you blame “market manipulation,” congratulations, you’ve just described every loser in crypto since 2017.

I don’t have a crystal ball, just charts and they don’t lie, even if people do. So whether Bitcoin crashes to $56k, or rallies to $160k, or starts taking payments in “Hopium,” I’ll still be here, tea in hand, smirking, watching the comments fill up with “You were wrong!” from people who were never right. Without Worries (Ww)

“Look left, not up.”

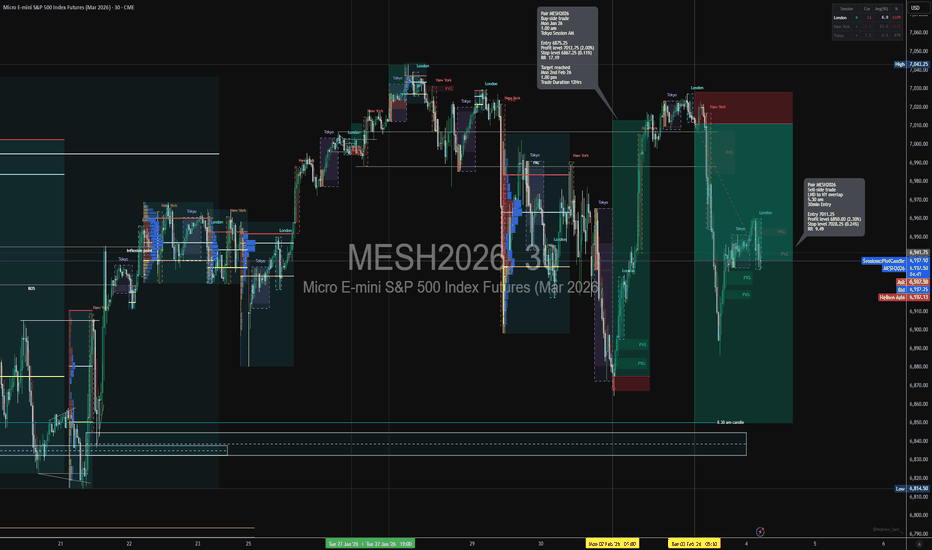

Short trade📊 Market Sentiment & Narrative — MESH2026 (Sell-Side)

Higher-Timeframe Context

Price was trading in premium territory following a sustained upside expansion, with repeated tests into prior highs around the 7,020–7,040 region. Despite the appearance of strength, upside momentum was fading, suggesting distribution rather than continuation.

Liquidity Narrative

During the London → New York overlap (5:30 am), price executed a controlled push into buyside liquidity resting above London highs. This move completed the liquidity grab, attracting late breakout buyers, but crucially failed to gain acceptance above the range.

Orderflow & Delivery

Immediately after the sweep, the price showed clean downside displacement, leaving inefficiencies and unmitigated FVGs below. This behaviour confirmed a sell-side program release, with price repricing lower to rebalance inefficiencies rather than sustain higher levels.

Session Timing Edge

The London–NY overlap is a high-probability window for engineered reversals:

Peak participation and volume

Ideal conditions for stop-runs

Strong alignment with institutional order execution

This reinforced the probability of a false bullish continuation followed by sell-side expansion.

Execution Logic

Entry taken at premium pricing immediately post-buyside sweep

Stop placed tightly above the session high to define risk

Target aligned with sell-side liquidity + higher-timeframe discount zone

Asymmetric structure justified the 9.49 RR

Sentiment Summary

Market sentiment shifted from bullish continuation expectations to risk-off distribution during the overlap. Trapped longs provided the fuel for a measured sell-side expansion toward the 6,850 liquidity pool, where resting sell-side stops and HTF inefficiencies converged.

🧭 Bias Assessment

Bias: Sell-side

Market State: Distribution → Expansion lower

Session: London → New York Overlap (5:30 am)

Liquidity Driver: Buyside sweep → Sell-side release

Confidence: High (HTF + Session + Liquidity confluence)